Whenever an individual opens a bank account, the particular bank asks for the customer’s details. These details help a bank in identifying the particular person and ensuring that bank services are not misused. This process is termed as KYC and a bank needs to do this periodically to be updated with the latest information of its customers.

RBI updated its regulation in September for KYC and here we are answering some frequently asked questions about the process of KYC.

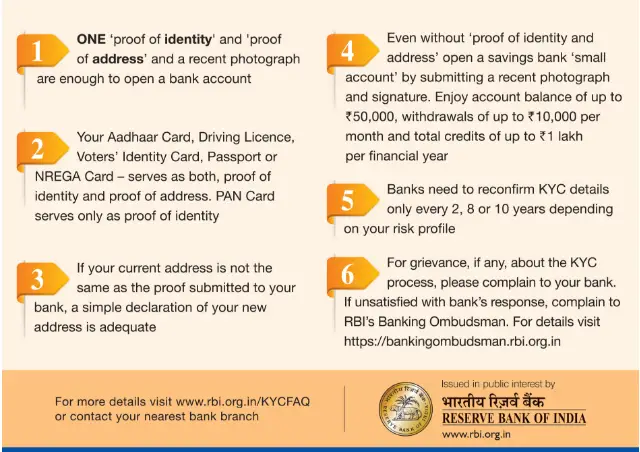

Question: For opening a bank account, what are the KYC requirements?

Answer: An individual needs to submit an identity and address proof to the respective bank with a recent photograph.

Question: What are the documents considered as ‘proof of identity’ and ‘proof of address’?

Answer: According to the Indian government, there are six documents that can be considered as ‘proof of identity’ and ‘proof of address’ which include Passport, Driving Licence, Voters’ Identity Card, PAN Card, Aadhaar Card issued by UIDAI and NREGA Job Card. Usually, these documents consist the individual’s address but, in case it is not mentioned then an additional ‘proof of address’ has to be submitted.

Question: Can anyone open a bank account without submitting the above-mentioned documents?

Answer: Yes, one can open a bank account without submitting the documents mentioned above. The individual needs to submit a recent photograph and put the signature or thumb impression in front of the bank official. Such account will be termed as ‘Small Account’.

Question: What is the difference between ‘small accounts’ and other accounts?

Answer: If you open a ‘small account’ then it will have the following restrictions:

- The balance cannot exceed Rs 50,000 at any point of time

- The total credit within a year cannot exceed Rs 1,00,000

- The total transfers and withdrawal should not exceed Rs 10,000 in a month

- The account cannot accept foreign remittances

The ‘small account’ remains operational for a period of 12 months. If a customer applies for any valid documents within 12 months then this account operational validity increases to next 12 months.

Question: Is it possible to have a bank account which is not under any restriction, without submitting any valid official document?

Answer: Ideally no, for any normal account to be open, an individual need to submit a particular official Proof Of Identity (PoI) or the following documents:

- An identity card issued by Central/State Government Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks and Public Financial Institutions with person’s photograph.

Or

2) A letter issued by a gazetted officer, with person’s photograph with duty attested

For Proof of Address (PoA), an individual can submit either of the following:

- Utility Bill which includes electricity, telephone, postpaid mobile phone, piped gas, and water bill. This bill can be of any service provider and should not be older than 4 months

- Municipal or property tax receipt

- Bank Account or Post Office savings account statement

- Pension or family Pension Payment Orders (PPOs) issued to retired employees by Government

- Letter of allotment of accommodation from employer given by State or Central Government departments, statutory or regulatory bodies, scheduled commercial banks, public sector undertakings, financial institutions and listed companies. Documents provided by Government departments of foreign jurisdictions or letter issued by Foreign Embassy or Mission in India

These documents are not the only way to judge an individual’s eligibility. The final decision is in the hands of the bank to let an individual open the bank.

Question: How can I open an account if my name has been changed and I do not have any OVD with a new name?

Answer: One can submit a copy of marriage certificate issued by the state government or Gazette notification that indicates the changed name. Along with this, a document with previous name has to be presented if a person has a changed name due to marriage or otherwise.

Question: Are customers categorized according to risk assessment done by banks?

Answer: Yes, it is mandatory for banks to classify customers into three categories – low, medium and high risk, depending on their AML risk assessment

Recommended: Locate Nearby ATMs, Here Are Few Ways That Can Help

Question: Do bank notify about risk assessment to the customers?

Answer: No, banks do not notify the customers about their risk assessment.

Question: What will happen if I refuse to submit documents for KYC to the bank at the time of account opening?

Answer: In this case, you might not be able to open a bank account.

Question: Is Aadhaar Card valid for opening a bank account?

Answer: Yes, Aadhaar card is now categorised under OVD for both identity and address.

Question: Is Aadhaar Card necessary for opening a bank account?

Answer: No, you can provide any other OVD from the above-mentioned list.

Question: What is e-KYC? How does it work?

Answer: e-KYC is the electronic form of Know Your Customers.

e-KYC can be done for the customers who have Aadhaar numbers. For doing e-KYC service, the customers needs to authorize the Unique Identification Authority of India (UIDAI), by own consent to reveal the identity/address information through biometric authentication to the respective bank branches/business correspondent (BC).

After your confirmation, the UIDAI passes your information including your name, age, gender and photograph electronically to the bank. The information provided through e-KYC is also considered as one of the OVD.

Question: Is it mandatory to give the introduction at the time of opening an account?

Answer: No, it is not necessary.

Question: If I am staying in a Mumbai and my address states address of Jaipur then can I open the bank account in Mumbai?

Answer: Yes, you can open a bank account in Mumbai. You just need to provide a statement of your current residing address for communication purpose.

Question: Is it possible to transfer existing bank account from one place to another? Will I have to do KYC again?

Answer: Yes, you can transfer an account from one branch to another branch of the same bank. KYC is only required if you have changed you current address. If the address on your previously submitted OVD is also changed then KYC is again required.

Question: Do I have to do KYC every time I open a different account within the same bank?

Answer: No, if you have already completed your KYC then you can open other accounts without undergoing the exercise again. But, in the case of opening a bank account in a different bank, you need to do KYC again.

Question: Which banking transactions require PAN number?

Answer: PAN number is required at the time of account opening, and while doing transactions above Rs 50,000.

Question: Is KYC applicable for Credit/Debit cards?

Answer: There is no need for a separate KYC for debit cards, as these are issued after opening an account. For Credit/Smart Cards, KYC is mandatory in case you don’t have a bank account with the respective bank.

Question: Do I need to do KYC exercise if I need to make a remittance and I do not have a bank account?

Answer: Yes, you need to undergo KYC exercise if you want to make domestic remittances of Rs 50,000 or above. For all foreign remittances, you need to undergo KYC.

Question: Can I take a Demand Draft/Payment Order/ Travellers Cheque against cash?

Answer: Yes, demand draft, payment order, traveller’s cheques for below Rs 50,000 can be purchased against cash. For a bigger amount, it can be done by way of debiting the customer’s account or against cheques.

Question: Is KYC necessary while purchasing third-party products?

Answer: Yes, if a customer does not have a bank account then a proof identity and address should be produced. KYC exercise is not necessary for the bank’s own customers for third party products. But, in the case of a transaction above Rs 50,000, PAN number has to be produced. Also, the payment should be made by debit from customers’ accounts or against cheques for remittance of funds/issue of travellers’ cheques, the sale of gold/silver/platinum.

Recommended: Airtel Payments Bank FAQ: Everything You Need To Know

Question: What are the rules of periodic KYC and why my bank insist on doing KYC again after doing it once?

Answer: Banks ask you for KYC for a periodic update. Depending on the risk perception, a bank conducts periodic KYC for the customers. It is required once in two years for high-risk customers. For medium risk customers, it is once in eight years and for low-risk customers, it is once in ten years.

Question: What If I am unable to submit KYC documents at the time of periodic update?

Answer: If it is necessary to provide KYC documents and you are unable to provide them then the bank can close your account. Before closing, the bank may impose ‘partial freezing’. After ‘partial freezing’ you cannot debit from your account while credit will be operational. Later, even credits will be not allowed.

Question: How partial freezing is imposed?

Answer: It can be done in the following ways: –

- A bank will give you three months notice before implementing partial freezing

- A reminder of further three months will be sent to you

- After that partial freezing will be imposed. Allowing credits and disallowing debits with the freedom of closing your account

- If KYC is still not completed after six months of partial freezing then your account will be closed

One can always reopen or open a new bank account by presenting all the valid documents.

If you would like to know anything else, please mention your question in the comment section.