WhatsApp Pay has finally launched in India today. The company announced the availability of the feature in India via a Tweet. WhatsApp Pay will join other UPI-based payment apps in India like Paytm, PhonePe, Google Pay among others.

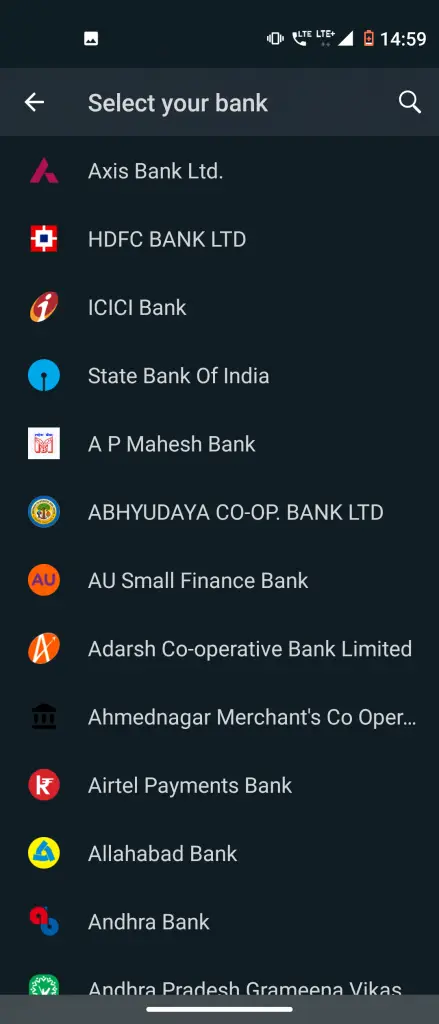

WhatsApp has designed its payments feature in partnership with the NPCI and ICICI Bank using the UPI payment system that also has over 160 supported banks including the leading ones like SBI, HDFC, Axis Bank, etc. People in India can now send and receive money via WhatsApp to anyone who is using UPI.

We are answering some questions about WhatsApp payments here.

WhatsApp Pay FAQs

How to Setup WhatsApp Pay

Q: Is WhatsApp payment available in India?

Starting today, people across India will be able to send money through WhatsApp 💸 This secure payments experience makes transferring money just as easy as sending a message. pic.twitter.com/bM1hMEB7sb

— WhatsApp (@WhatsApp) November 6, 2020

A: Yes, WhatsApp has finally rolled out the WhatsApp Pay feature for all users in India on November 6. However, it may take some time to reach all users.

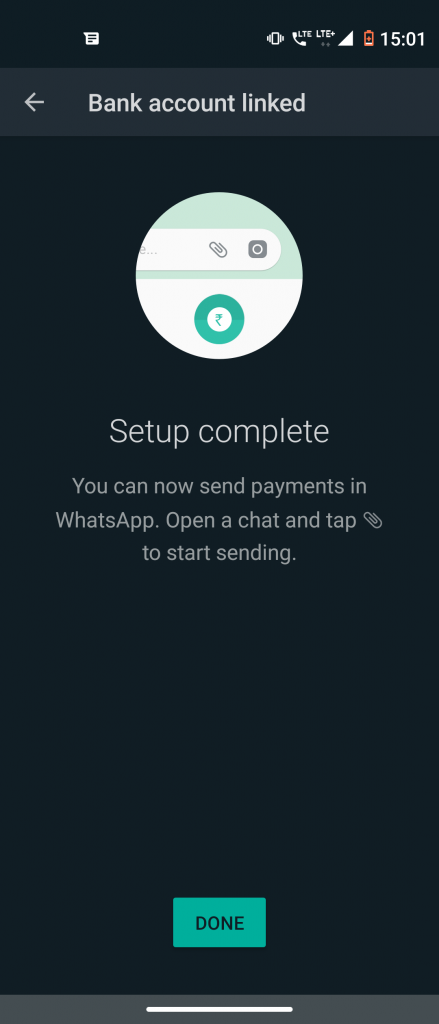

Q: How to setup WhatsApp payments?

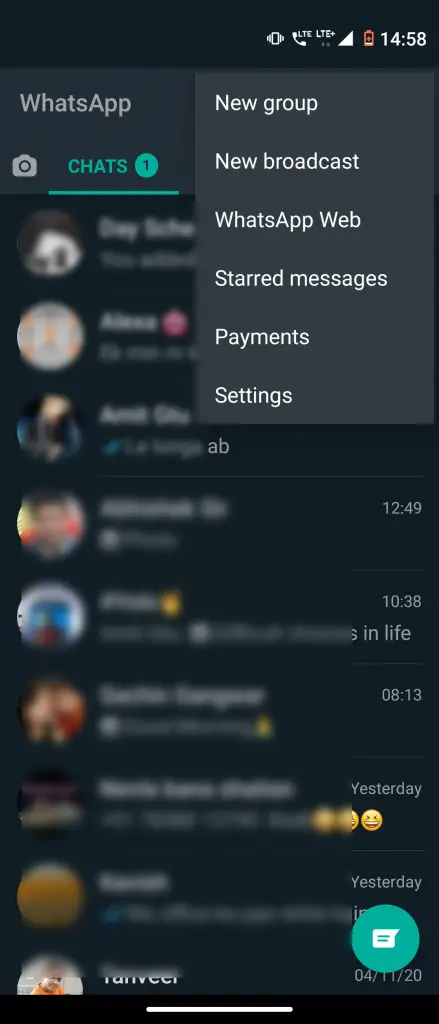

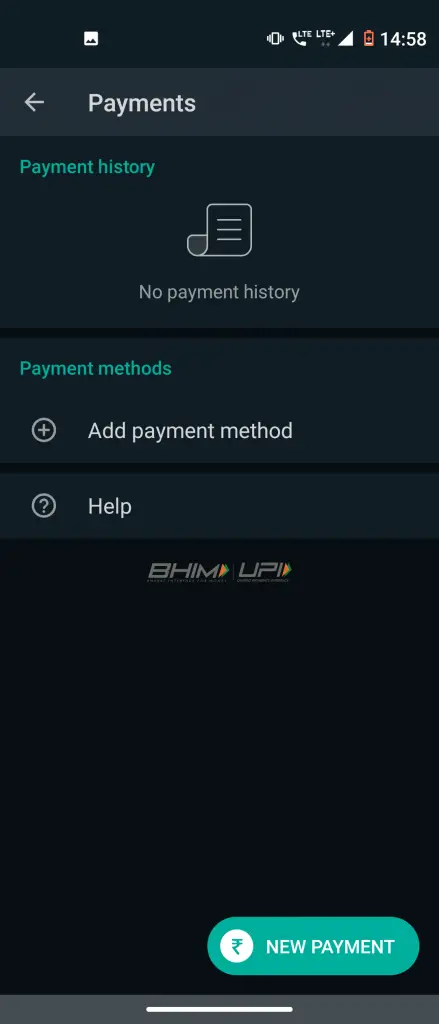

A: To set up WhatsApp payments, launch WhatsApp and tap on the three dots given on the top right, and select Payments. From here, tap on the ‘Add payment method’ and link your bank account and you’ll be good to go.

Read here the detailed guide on how to set up WhatsApp Payments.

Q: How do I activate WhatsApp payment?

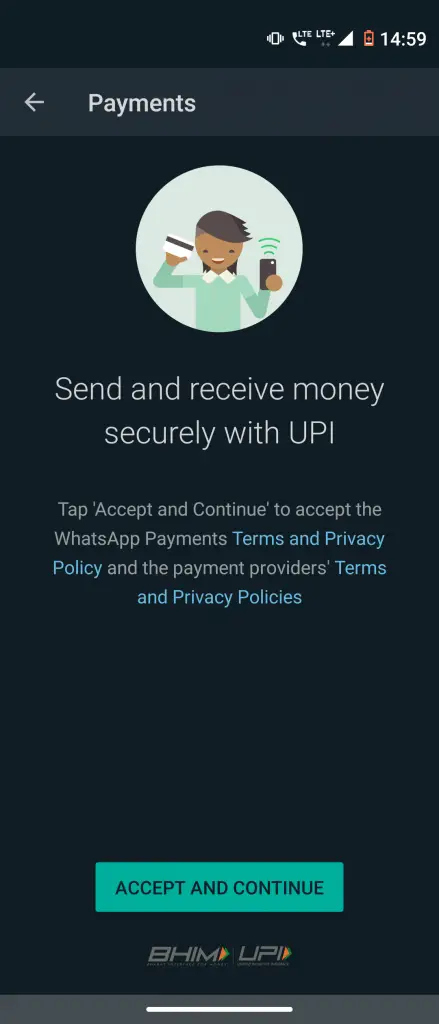

A: You can activate WhatsApp payment on your app by adding your bank account and activating your UPI ID with the registered mobile number.

How to Send/Receive Money

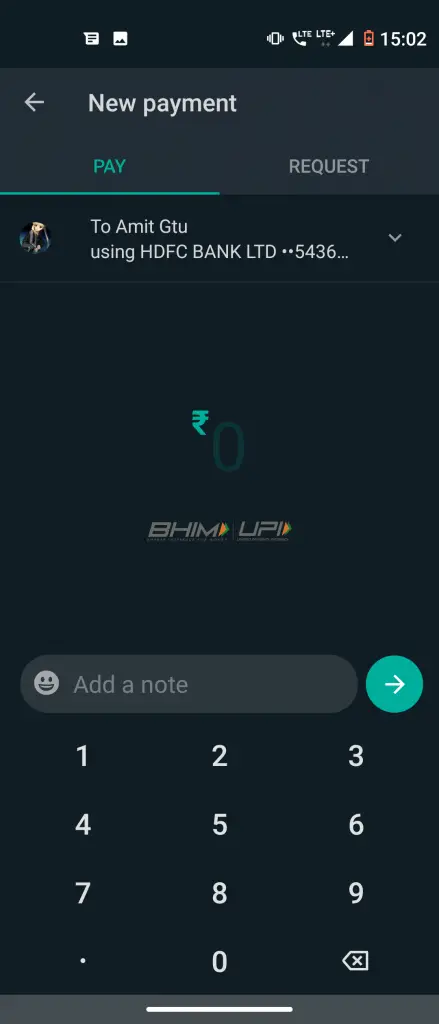

Q: How to send money to someone on WhatsApp?

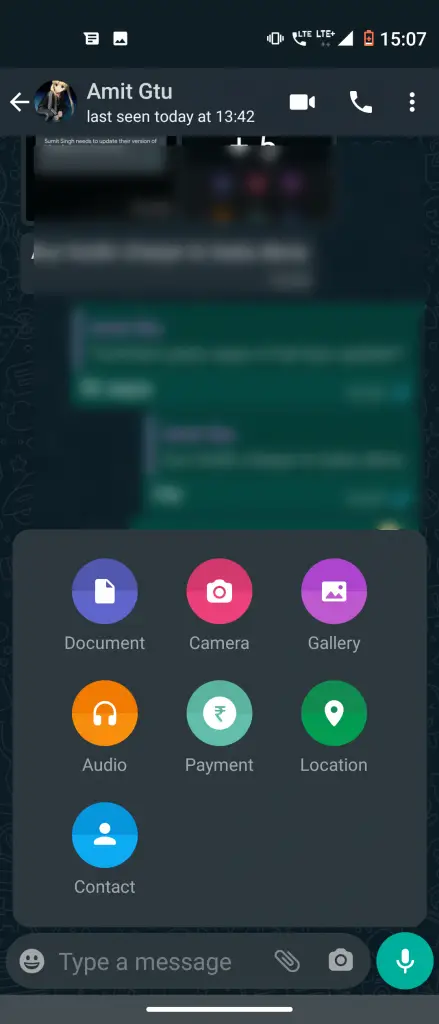

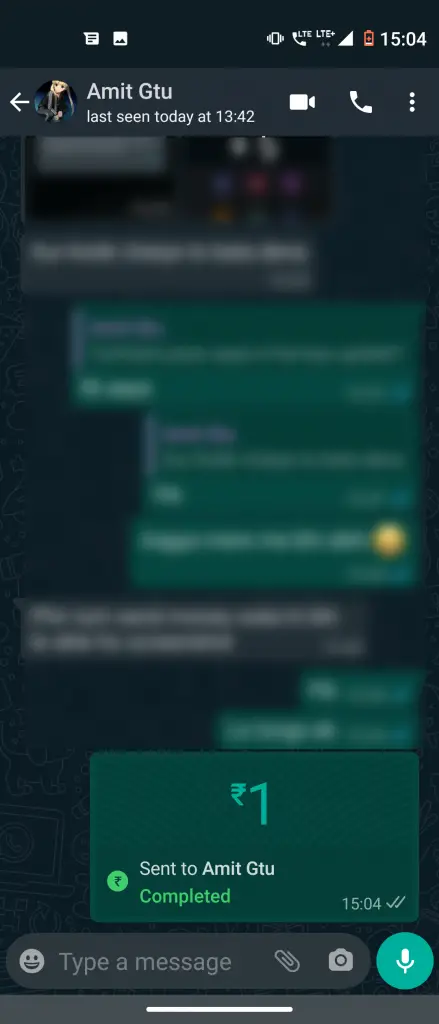

A: In order to send money on WhatsApp, open the chat to whom you want to send the money and tap the attachment icon, and then select payment. Verify your debit card details, enter UPI PIN and money will be sent to that person.

More details here.

Q: How can I use WhatsApp pay in India?

A: To use WhatsApp pay in India, you must update your WhatsApp to the latest version and then check if your app supports the new feature. After that, follow the above-mentioned steps to activate it by adding your bank.

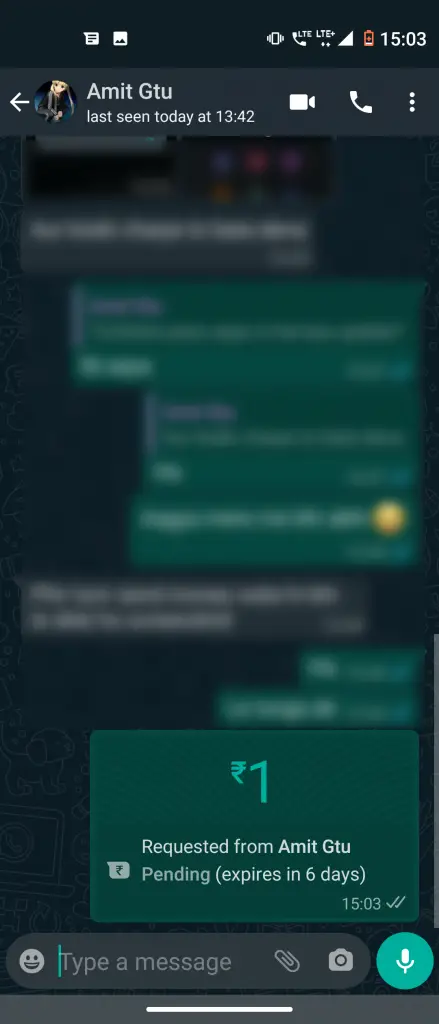

Q: How to receive money on WhatsApp?

A: First of all, you need to update your app to get the WhatsApp payment feature. After that, add your bank account. Now, you are ready to receive the payment.

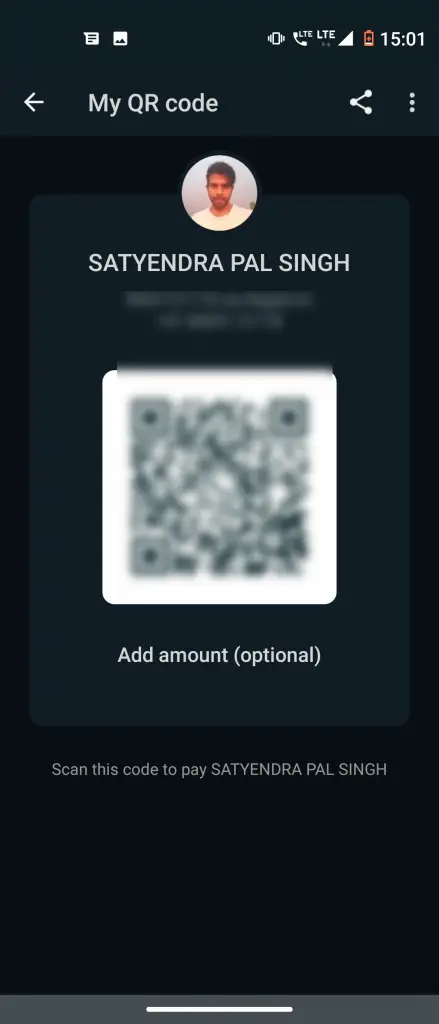

You can request money from anyone by following the same steps as sending money. You can also share your QR Code with someone who wants to send you money.

Q: Whom can I send money to on WhatsApp?

A: You can send money to anyone on WhatsApp who has the latest feature and has added his bank account with it.

Q: Do I need a bank account to send money on WhatsApp?

A: Yes, you need a bank account, and a debit card to set your UPI ID on WhatsApp in order to use WhatsApp pay.

Q: How to add your bank account on WhatsApp?

A: Tap on three-dot and from menu select Payments and from next page select your bank from the list and wait for verification with your registered mobile number. Tap Done and it will be added.

Safety and Other Issues

Q: What to do if someone hasn’t received the WhatsApp payment you sent?

A: If the payment is complete from your end and your contact hasn’t received it, well, it can sometimes take up to 4 business days for the fund transfer to complete.

However, you can still contact WhatsApp support for more information on the status of your payment by tapping on the payment message and then tap on Help.

Q: Is WhatsApp payment safe?

A: Yes, WhatsApp payments are completely safe and the user data is secured with it. Also, sensitive data such as debit card details and UPI PIN are not stored.

Q: Does WhatsApp save any transaction details?

A: WhatsApp doesn’t save any details and it only shares the transaction information to the bank partner and to NPCI, so “they can facilitate” the payment.

If you still have any doubts regarding WhatsApp pay in India, you can ask us in the comments below!