Quick Answer

- College students and perhaps most youngsters don’t own a credit card and thus there is no way possible for such android users to purchase a paid app from any app store.

- In a nation where most users access internet using smartphones, the App market was also estimated to expand to 2000 crore in 2016 by analyst.

- In spite of this boom in Indian smartphone market, developers might not be able to cash in on fastest growing Asia Pacific smartphone market.

India is a booming smartphone market and all major OEMs, including Chinese Manufacturers are all set to mine gold in 2015. Major OEMs have adapted to providing quality hardware at the lowest possible price and thus, hardware will be well taken care of. In spite of this boom in Indian smartphone market, developers might not be able to cash in on fastest growing Asia Pacific smartphone market.

Not many people have credit cards

In India many people still don’t own a credit card. College students and perhaps most youngsters don’t own a credit card and thus there is no way possible for such android users to purchase a paid app from any app store. Only way such users can reward developers for their effort is by giving them a 5 star rating. Most such users are forced to side load APKs and steal from developers.

Recommended: What’s Wrong and Right with Online Shopping in India

Credit Card Consumption Trend

Number of electronic cards issued has increased many folds in India, but the number of Credit cards have in fact declined post 2008 recession. There are 350 million debit cards and 19 million credit cards in India (27 Million Credit Cards in 2008) and most users use debit cards for ATM withdrawal. Besides, Mastercard claims that 75 percent of all card payments are concentrated in the top 20 cities with Delhi, Mumbai and their suburbs alone accounting for 43%.

Indian App Market

As per study released by Avendus partners, Indian App market was estimated at 150-200 Crore in 2012. In a nation where most users access internet using smartphones, the App market was also estimated to expand to 2000 crore in 2016 by analyst. In 2012 9.6 percent of apps downloaded from Apple App store were paid, while only 0.5 percent of that downloaded from Playstore were paid.

The study also predicts that Indians will be downloading around 8.4 billion apps in 2016 with about 2 percent being paid apps, GooglePlay will gather sky high revenue in 2015. Even though the study was conducted in late 2013, these claims seem even more true as 2016 approaches.

Recommended: Why Default Gallery App on Android Sucks? Which Apps Can Replace it?

Carrier billing will Help

With carrier billing as an option, millions of users can pay via prepaid balance or post paid bills. This will encourage people to shell out money to reward developers for their efforts. The biggest winners will be developers who will now have reach to a much wider audience in emerging markets like India. As credit card consumption won’t increase at the same pace, we can expect carrier billing to be the only savior.

Microsoft has done this

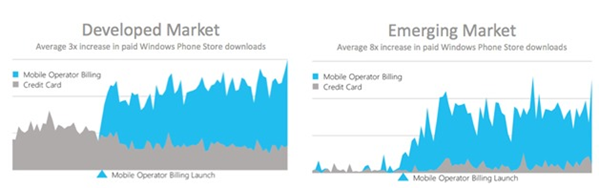

Microsoft has partnered with Idea to offer carrier billing option for Windows Phone users. The company offers 81 mobile operator billing connections in 46 markets with carriers representing 2.5 billion total subscribers. The company claims Microsoft offers operator billing ion 46 other markets and claims 8x increase in revenue in emerging markets and 3x in developed market.

Google understands this and has been trying to offer same facility with Reliance and Uninor, but things failed to materialize.

Recommended: Flipkart is selling Fake Beats by Dr.Dre Pill Wireless Speakers at Low Price

Conclusion

Credit card culture won’t progress at the same rate as Smartphone adoption in India. Most users who own one are reluctant to use them for fear of unwanted deductions. With career billing, users will have a trusted, transparent and more accessible means to pay for Apps they like and the biggest beneficiaries will be developers.