Quick Answer

- Here are some of the best credit card bill payment apps in India that reward you with cashback and other offers for paying your credit card bill.

- One of the ways to pay your credit card bill is through the mobile app or net banking of the card-issuing bank.

- Under the same, you can get a scratch card worth up to 1 lakh cashback points on bill payments of ₹5000 and more.

Credit cards are a great way to make payments- you get offers and discounts alongside the reward points for every purchase you make. Interestingly, you can also get rewarded for paying your credit card bills by using certain payment apps. Here are some of the best credit card bill payment apps in India that reward you with cashback and other offers for paying your credit card bill.

Related | 5 Ways to Fix Credit/ Debit Card Not Working Online

Best Credit Card Bill Payment Apps in India That Give Cashback

One of the ways to pay your credit card bill is through the mobile app or net banking of the card-issuing bank. The bill gets settled instantly without any hassles. However, it can be tiresome if you hold multiple cards. Plus, you don’t get any rewards in this method.

We now have several new-age payment apps in the market that let you pay credit card bills with ease. You get the convenience of paying and managing bills for all your cards in one place, alongside cashback and other useful offers.

Here are some of India’s best credit card bill payment apps you can use to clear your dues and earn rewards or cashback.

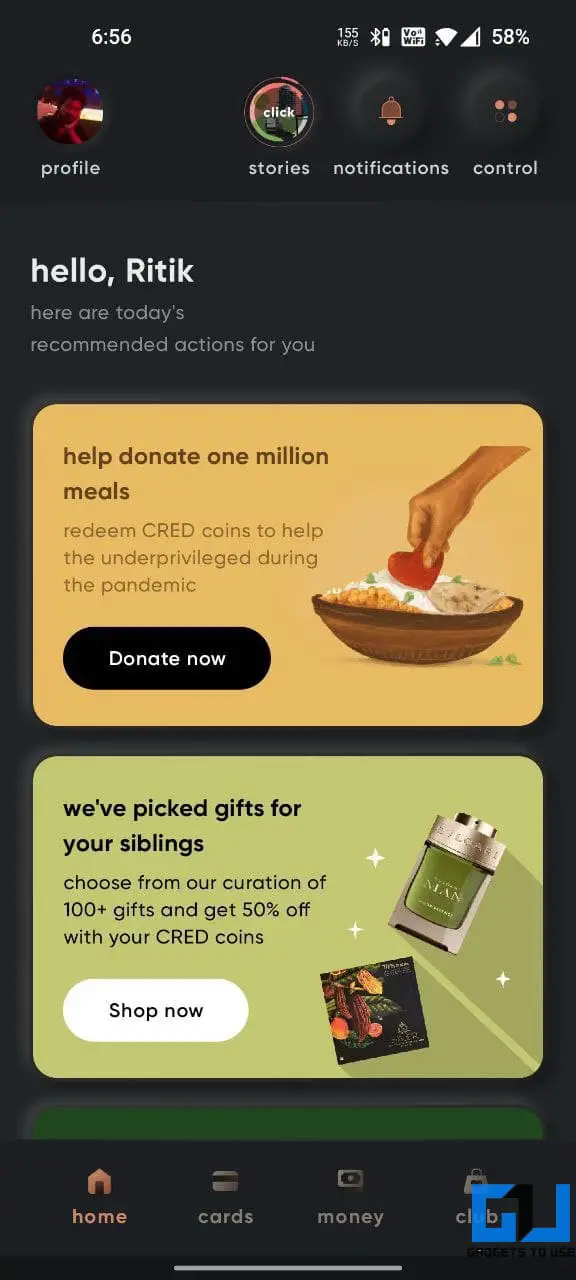

1. CRED

Cred is a top-rated credit card bill payment app in India. Every time you pay a bill, it rewards you with an equivalent number of points called Cred coins. You can then redeem these coins in exchange for offers.

One can claim mystery cashback after clearing a bill of min. ₹1000 to get cash rewards. In the initial days, the app gave good rewards, which are now reduced drastically. So, do not expect huge offers.

| Bill Payment | Earn *Up To* |

| ₹1,000 | ₹1,000 (5 times/ month) |

| ₹5,000 | ₹5,000 |

| ₹20,000 | ₹10,000 |

| ₹50,000 | ₹1,00,000 |

Furthermore, Cred lets you connect your Gmail to auto-grab credit card statements, but it’ll be better to avoid the feature if you have privacy concerns. There’s also a unique referral program with ₹750 cashback on referring friends.

Note that you need to have a good credit score to register on Cred.

Highlights

- Pay credit card bill via UPI or net banking (min. ₹10)

- Get mystery cashback on bill payments

- Payment reminders, smart statement, free credit score

- Pay rent with your credit card

Steps to Use

- Open Cred, register yourself and add your card.

- Go to the Cards section. Tap Pay now for the card.

- Enter the amount and pay via Cred UPI, other popular UPI apps, or net banking.

- Once successful, claim the mystery cashback if available.

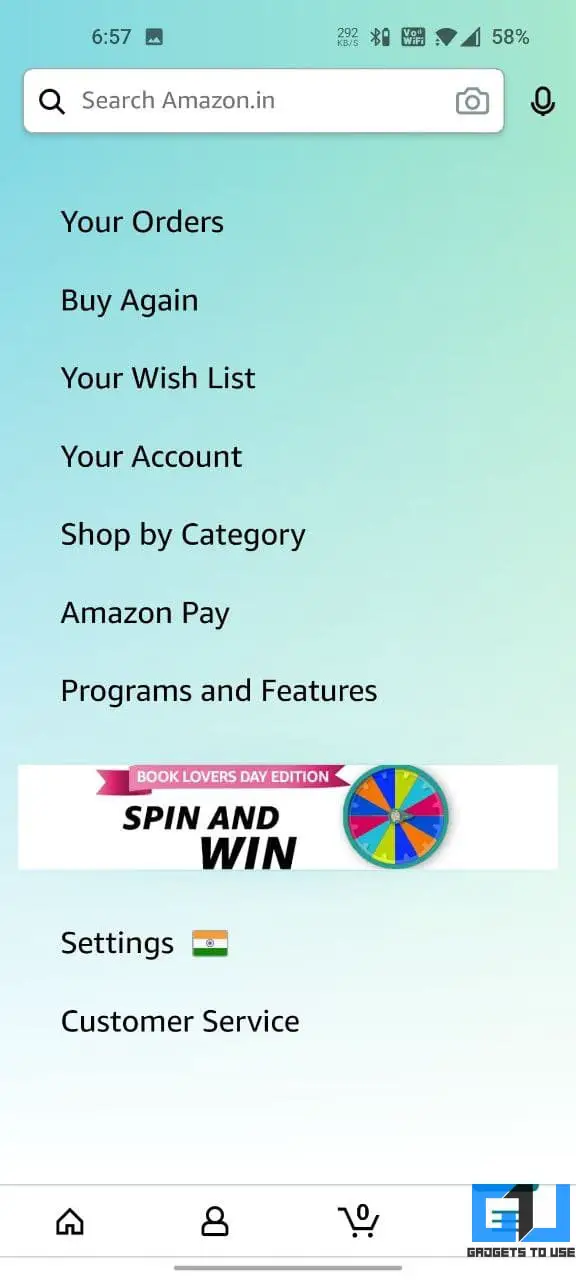

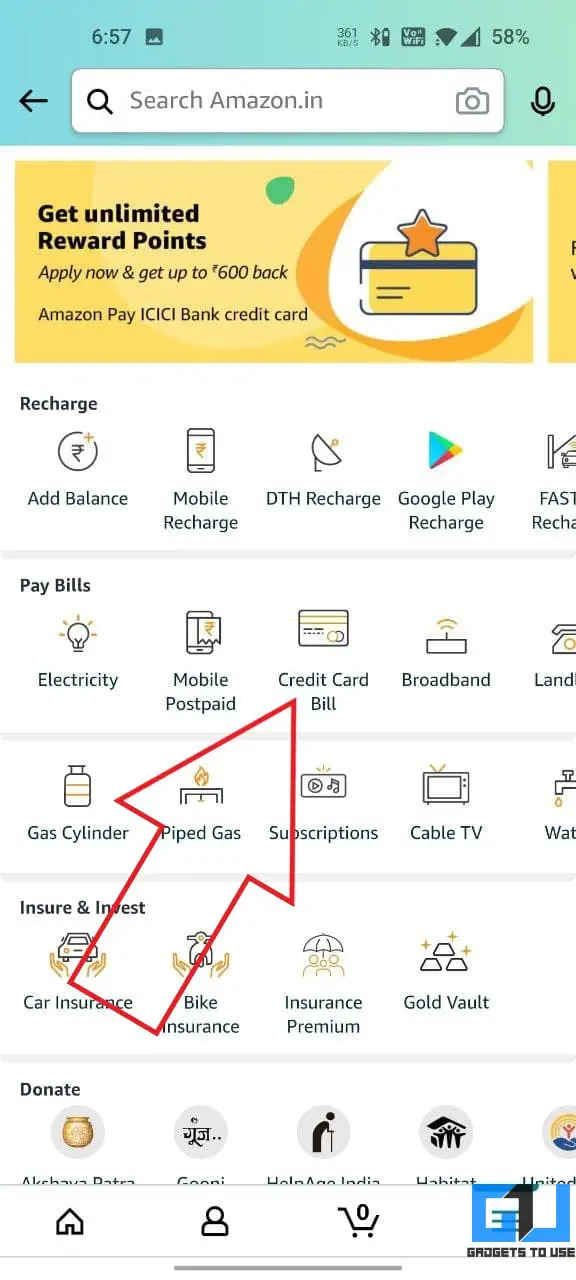

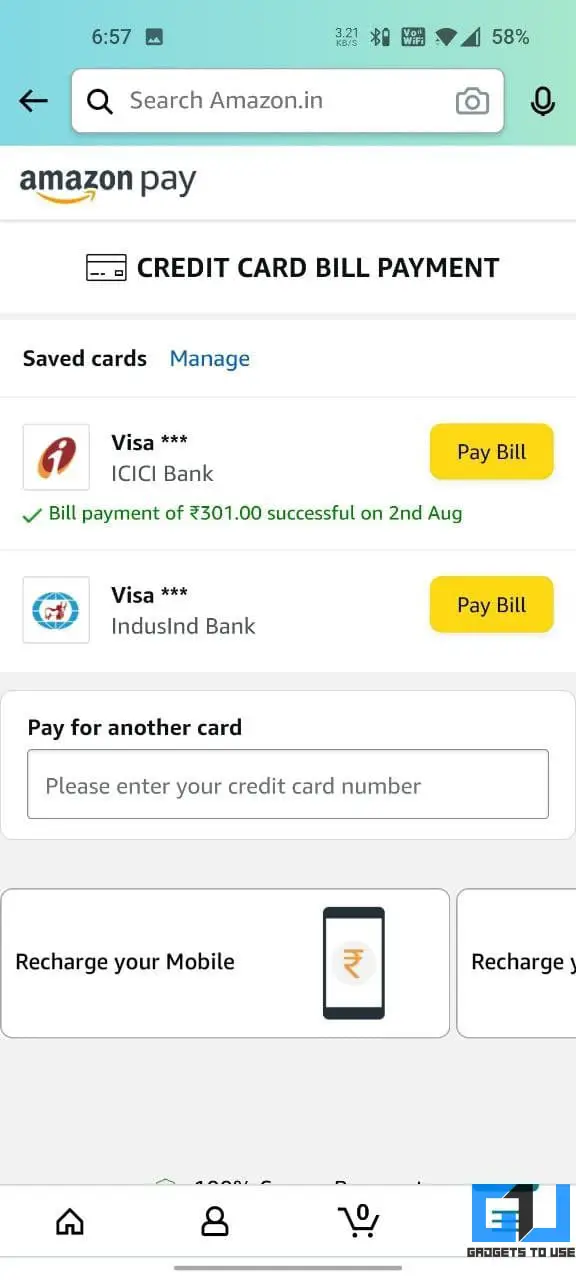

2. Amazon

Besides shopping and paying for mobile and other utility bills, you can also pay your credit card bills through Amazon. Unlike Cred, you don’t get assured cashback. However, you do get occasional offers in the form of rewards.

You can check for offers on credit card bill payments in Amazon Pay > Your rewards. The offers will also show up in Credit Card Bill section. Unfortunately, you can not use Amazon Pay balance to pay credit card bills.

Highlights

- Pay credit card bill via UPI or net banking (min. ₹100)

- Occasional cashback offers on card bill payments

- Free credit score

Steps to Use

- Open the Amazon app on your phone.

- Go to the Amazon Pay section.

- Here, tap on Credit Card Bill.

- Check if you see any offer banners on the bill payment page.

- Add your card and pay the bill via Amazon Pay UPI, any other UPI ID, or net banking.

3. Paytm

Paytm is the most popular payment app in India. It lets you pay almost all types of bills, including credit card payments. While there’s no permanent cashback structure, it’s currently running a limited-time campaign offer.

Under the same, you can get a scratch card worth up to 1 lakh cashback points on bill payments of ₹5000 and more. Here, 1 lakh cashback points =₹1,000, and you will get a minimum of 1,000 points on every card transaction.

The cashback offers might change over time. So, confirm before making the payment. Paytm also lets you pay bills via debit cards except for VISA and Mastercard.

Highlights

- Pay credit card bill via Paytm balance, UPI, debit cards, or net banking (min. ₹1)

- Occasional rewards on bill payments

- Regular bill reminders

- Pay rent with your credit card

- Free credit score

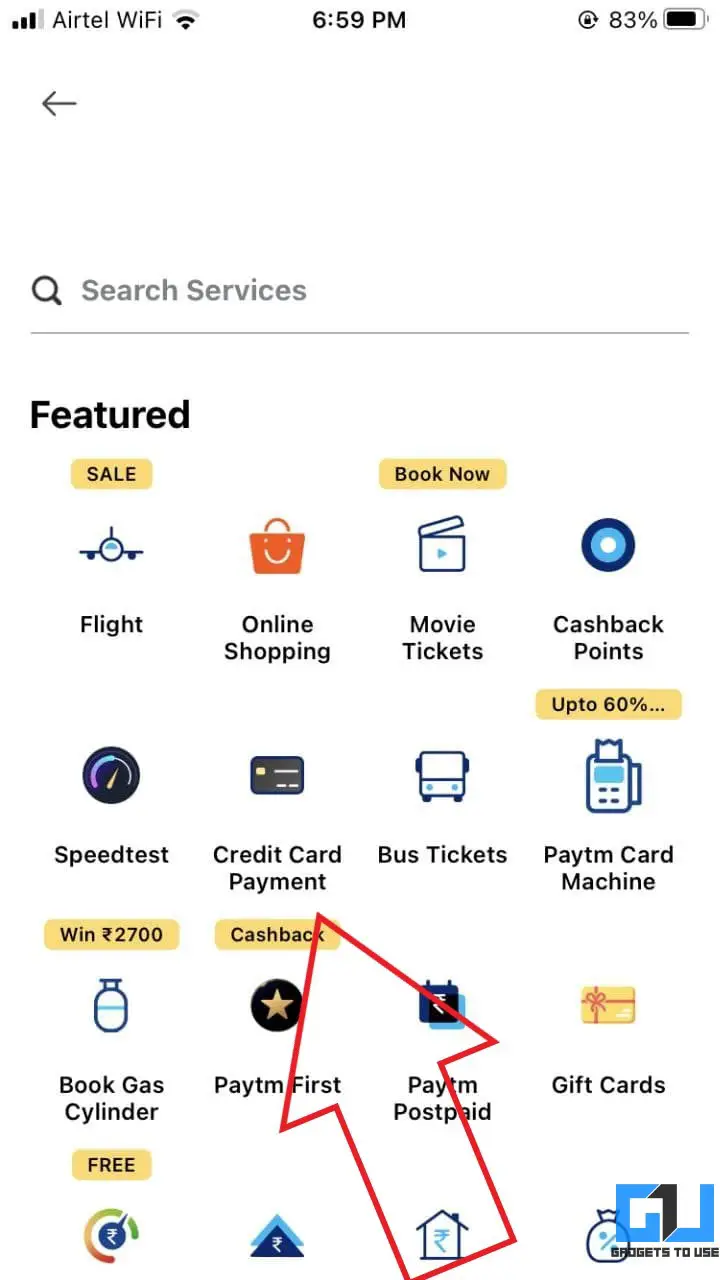

Steps to Use

- Open Paytm and go to Credit Card Bill Payment page.

- Enter your card number if not added already. Also, look for offer banners.

- Enter the bill amount and tap Proceed.

- Make payment via the mode of your choice.

4. Mobikwik

Mobikwik app gives you rewards in the form of Supercash every time you pay your credit card bill. You can use this Supercash later (up to 5% per transaction) while making other payments in the app.

Besides UPI, you can pay the credit card bill using your debit card. This can be useful if you want to complete spending milestones on your debit card, which is a win-win situation. One can also pay via Mobikwik wallet, which attracts a convenience fee of 1.5% + GST.

On the flipside, Mobikwik recently went through a huge data leak. Also, some users have reported delayed credit card payments- so, keep a note of it.

Highlights

- Pay credit card bill via debit card, UPI, and Mobikwik balance (min. ₹1)

- Get Supercash on each bill payment

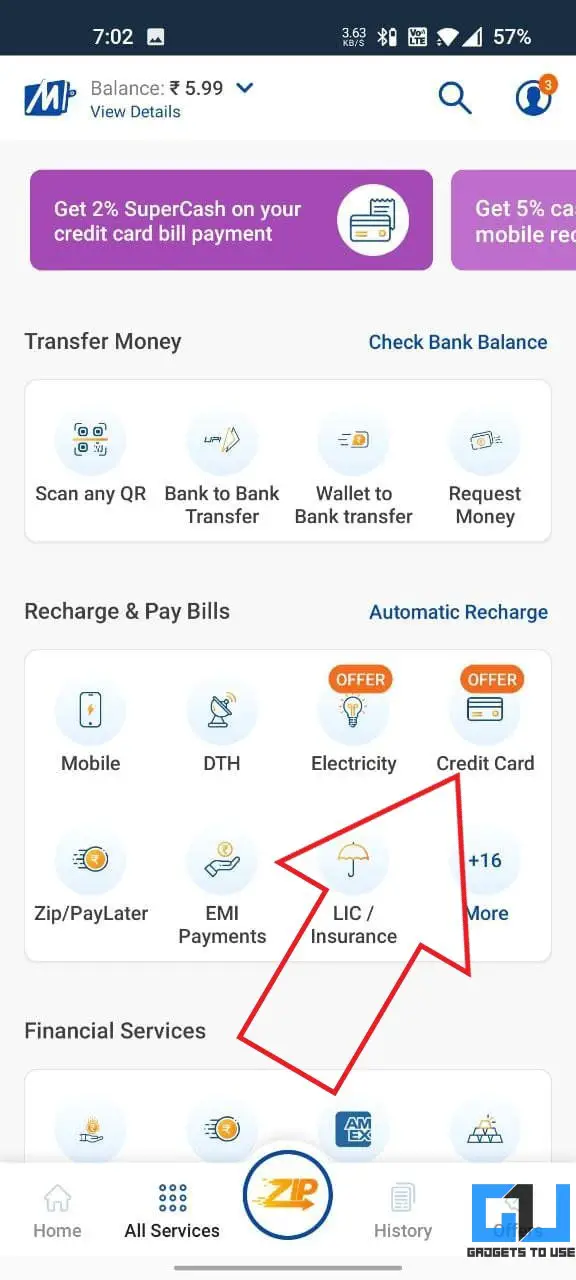

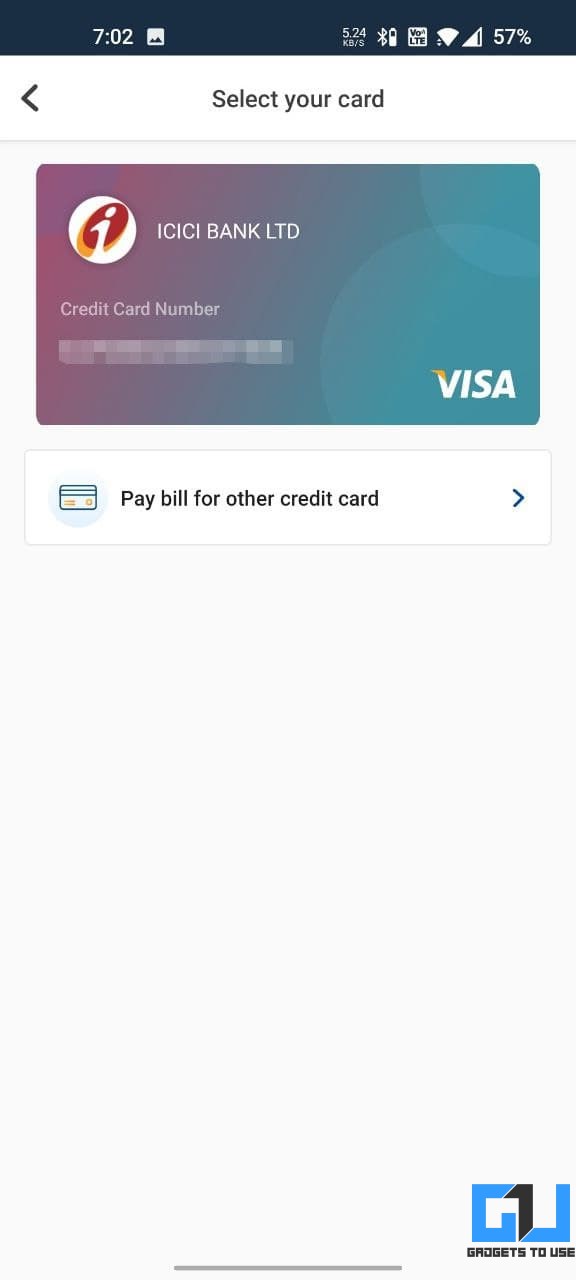

Steps to Use

- Open the Mobikwik app.

- Select All Services and tap Credit Card.

- Enter credit card details if not already.

- Enter the amount and apply a coupon if available.

- Pay via UPI, Mobikwik wallet, or debit card.

5. PhonePe

PhonePe, too, offers the credit card bill payment option. You get scratch cards with up to Rs. 1000 cashback on paying bills, similar to when you pay others or make any other transactions. It’s fairly simple and lets you pay almost all credit card bills using UPI.

Highlights

- Pay credit card bill via UPI (min. ₹1)

- Get scratchcards on bill payments

- Pay rent with your credit card

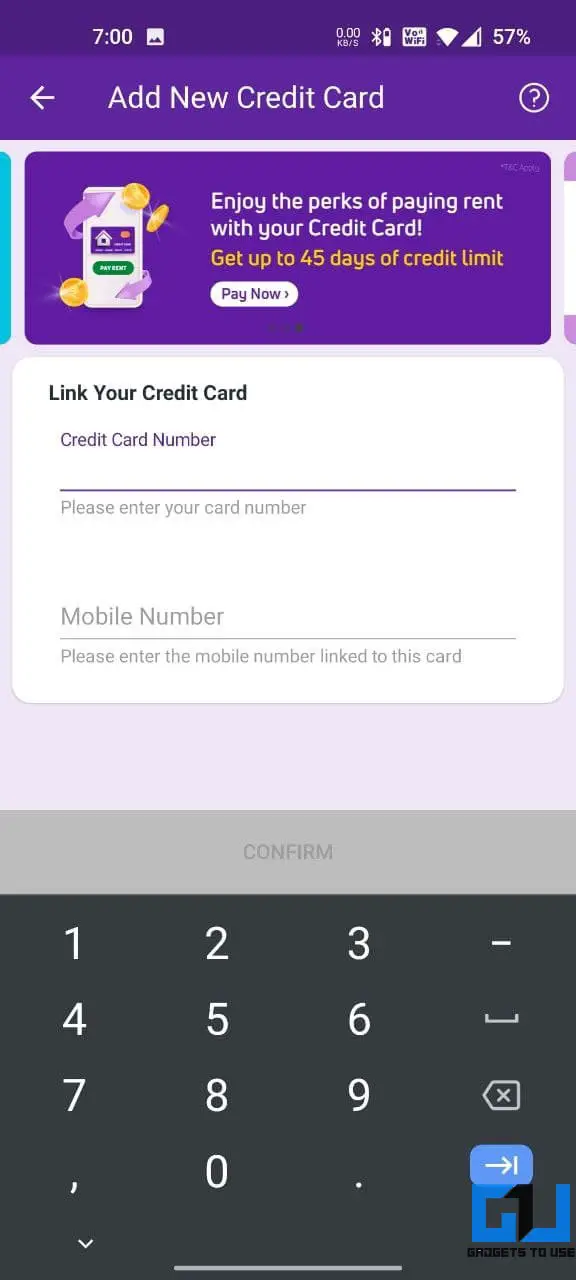

Steps to Use

- Open the PhonePe app.

- Tap Credit Card Bill under Recharge & Pay Bills.

- Enter your credit card number and mobile number.

- Enter the amount and proceed with payment.

Get Rewarded for Paying Your Credit Card Bills

These were the top credit card bill payment apps in India that give you cashback and rewards for paying your card bills. Overall, Cred is still an attractive option, thanks to the features it brings to the table, followed by Amazon with occasional offers.

However, it would be best to check all the given apps for offers and then decide what to go for. Anyways, which one do you prefer? Have any other app to suggest? Let me know in the comments below.

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.