Quick Answer

- Once the Payments Bank service is opened to all users, you will have to apply to open a Savings or Current account with Paytm.

- However, at this point, the company has revealed that it will be testing its services with a limited set of users only.

- Paytm Payments Bank services are open on an invite-only basis as of now.

Paytm Payments Bank has finally been launched today. The popular wallet and e-commerce portal has announced that starting today, its Payments Bank services will become operational. However, at this point, the company has revealed that it will be testing its services with a limited set of users only.

How To Apply For Paytm Payments Bank Account?

Paytm Payments Bank services are open on an invite-only basis as of now. You can request for an invite to the service at Paytm.com/bank. Once you get an invite, follow the steps as mentioned in the mail.

Once the Payments Bank service is opened to all users, you will have to apply to open a Savings or Current account with Paytm. Existing wallets will continue to work even after your account is opened.

KYC verification is compulsory for opening an account.

Recommended: Paytm Payments Bank FAQs: Everything You Should Know

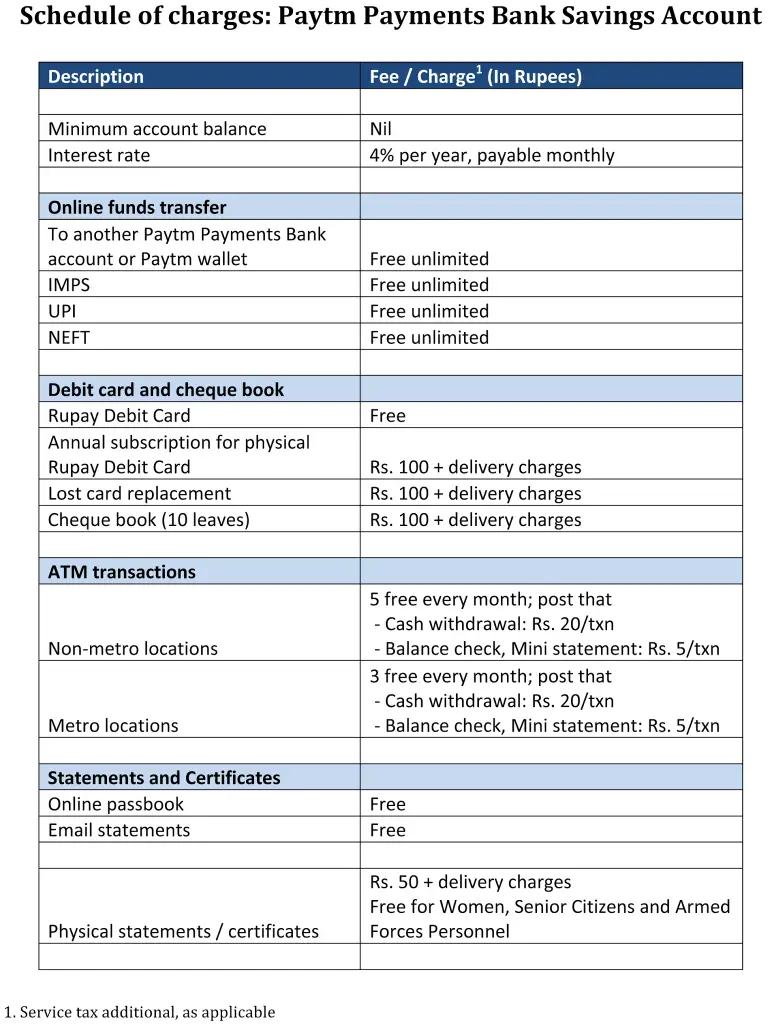

Paytm Payments Bank Schedule Of Charges

Here is the full schedule of charges of Paytm Payments Bank. Main highlights are:

- Zero balance

- 4% interest per annum

- Free virtual Rupay debit card, no issuance or annual charges

- Physical Rupay debit card – Rs. 100 + delivery charges

- Cheque book – Rs. 100 + delivery charges

- Metro locations – 3 free ATM transactions per month, Rs. 20 thereafter for withdrawal, Rs. 5 for balance enquiry

- Non-metro locations – 5 free ATM transactions per month, Rs. 20 thereafter for withdrawal, Rs. 5 for balance enquiry