Quick Answer

- Artos is a privacy-focused investment tracker app that you can use to keep a tab on your net worth over time.

- Besides, it is SEBI-registered and doubles up as a platform for investing in mutual funds, cryptocurrency, FDs, Bonds, and US stocks.

- Below are some handy apps to calculate your net worth and track all your assets and liabilities in one place.

People usually have their wealth spread across different asset classes and platforms. It could be the money in a savings account, fixed deposits, PPF, mutual funds, stocks, real estate, and more. This makes it difficult to keep track of everything in one place. Thankfully, several apps can make wealth tracking easy for you. Here are the three best apps to track your net wealth on Android and iPhone.

Related | How to Send Money From US to India, Singapore Using Google Pay

Best Wealth Tracking Apps to Track Your Net Worth

Your financial net worth is the value of all assets you own minus the liabilities. You may have money scattered across different places and asset classes. Hence, it might be difficult to keep track of them. This is where wealth tracking apps come to the rescue.

Below are some handy apps to calculate your net worth and track all your assets and liabilities in one place.

1. Artos- Investment Tracker

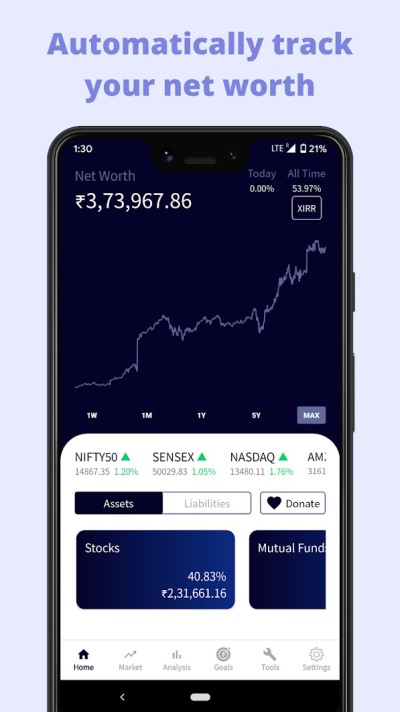

Artos is a privacy-focused investment tracker app that you can use to keep a tab on your net worth over time. It shows graphs over various intervals, rates of returns for individual assets and lets you analyze your asset allocation and view market insights.

Artos is a privacy-focused investment tracker app that you can use to keep a tab on your net worth over time. It shows graphs over various intervals, rates of returns for individual assets and lets you analyze your asset allocation and view market insights.

You can use Artos to track the following assets:

- Cash Accounts

- Fixed and Recurring Deposits

- Stocks (India & US)

- Mutual Funds and ETFs

- Cryptocurrency

- EPF/PPF

- NPS

- Gold

- Dividends

- Loans

You can track stocks by either linking your broker, importing statements, or through manual entry. Similarly, mutual funds and ETFs can be tracked by importing statements or manual entry. There’s also an option to track and manage financial goals.

It’s a completely free, client-side app, meaning no data leaves your device. You can lock the app with biometrics and also enable automatic backups to Google Drive. Additional tools like an EMI calculator and mutual fund overlap checker are given onboard.

Pros:

- Privacy-focused wealth tracker. Your data is stored on your device.

- No phone/ email login is required.

- Very useful insights and analytics.

- Option for manual and automated tracking.

Cons:

- Not available for iOS.

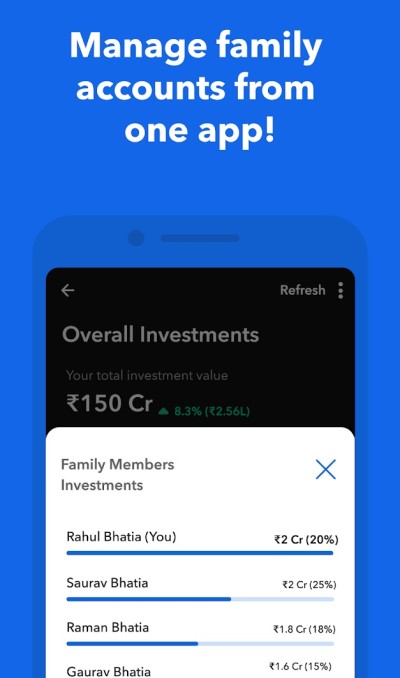

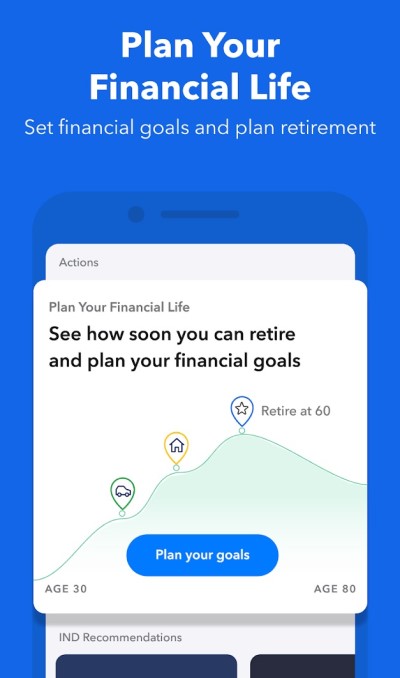

2. INDMoney- Track Assets, Loans, Expenses, Insurance

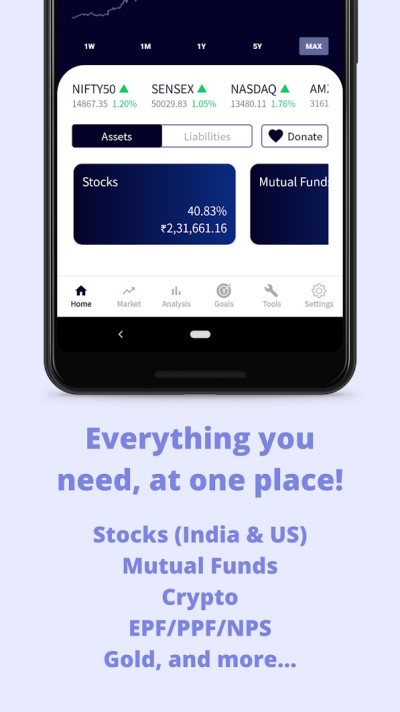

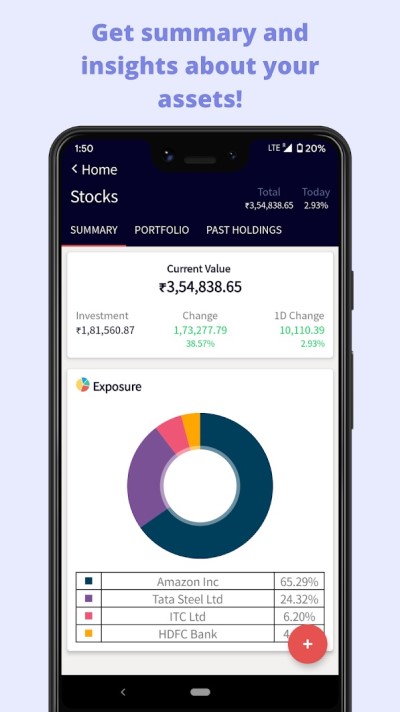

INDMoney is a very popular app that lets you track all your assets in one place. Besides, it is SEBI-registered and doubles up as a platform for investing in mutual funds, cryptocurrency, FDs, Bonds, and US stocks.

INDMoney lets you track and manage the following instruments:

- Fixed Deposits

- Mutual funds

- India and US Stocks

- EPF/ PPF, NPS

- PMS, AIF

- Bonds

- Real Estate

- Life and Health Insurance

Similar to Artos, it tracks all asset classes and has the option to manage financial goals. However, there are few extras like tracking insurance, credit cards, automatic fetching of expenses and savings account balance through SMS, and more.

You can also track your family investments and liabilities in one place. Most options are available for free. However, you need to upgrade for personalized advisory on investments, tax, and stocks from experts.

Pros:

- A full-fledged app for tracking wealth.

- Allows investing in FD, bonds, US stocks, crypto, and mutual funds.

- Tracks your credit score and life and health insurance.

- Free option to manage family member’s assets and liabilities.

Cons:

- If you’re here only track only wealth, you may find it to be cluttered.

- Premium advisory banners can be annoying for some people.

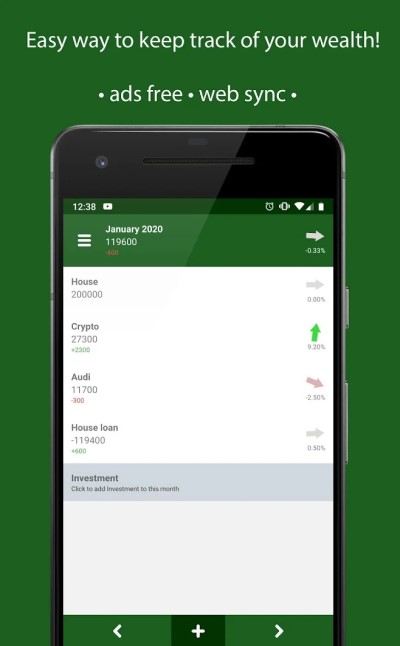

3. Wealth Tracker (Net Worth Tracker)

Wealth Tracker is a rather simple app that works on manual entry. It’s for basic users who just want to keep track of numbers. All you need to do is open the app, manually add each asset class like bank accounts, mutual funds, and enter their corresponding value.

It shows you the percentage change in your net worth compared to the previous month. There’s also a separate month overview section to view addition or deductions from net wealth in each month. You can also visualize your net worth in a graph.

There is an option to sign in with your Google account to save your data. However, if you don’t want to sign in, you can use the traditional Export and Import options to backup and restore your data if you switch your phone.

Pros:

- Very minimal, ad-free, and easy-to-use wealth tracking app.

- No internet required. You can block internet access for the app.

- Monthly overview of net wealth.

Cons:

- Everything needs to be entered manually.

- No fancy features- more like a list of your assets.

- Not available for iOS.

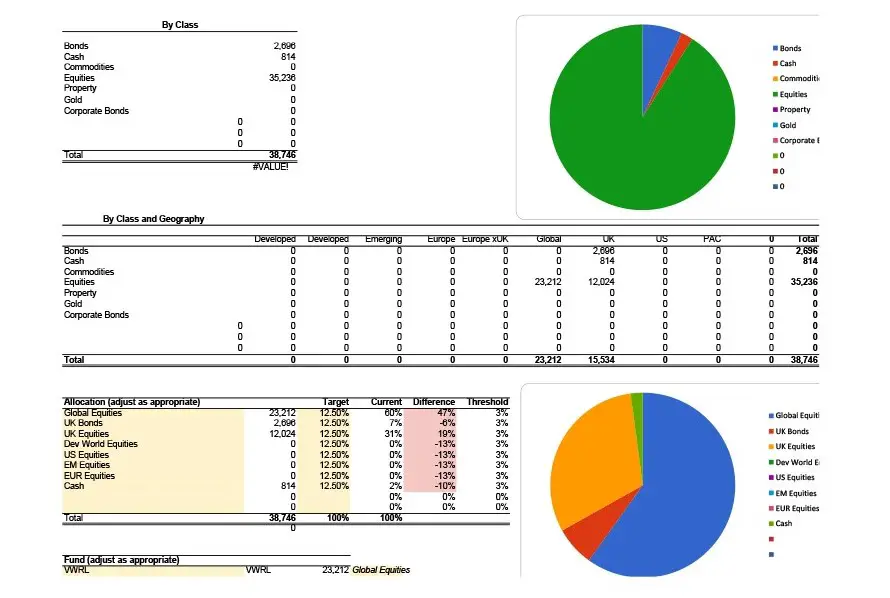

Bonus- Spreadsheets

If you don’t want to rely on an app for tracking your wealth, you can go with spreadsheets. Many people use Google Sheets for keeping records of their assets and liabilities, including savings, investments, and loans.

It gives the comfort of date safety and can be customized as you like it. You can use formulae, create graphs, and use macros to automate tasks. Plus, various readymade templates are available on the web for tracking asset allocation.

However, it can be time-consuming, and the experience won’t be that good on the small screen of phones.

Wrapping Up- Track Your Wealth or Net Worth on Apps

These were three wealth tracking apps you can use to keep track of your assets, loans, and everything in one place. I’ve been personally using all of them for months now and would love to know your experience with them. If you have any other apps to recommend, please let me know in the comment below.

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.