Quick Answer

- Unfortunately, Groww is plagued with issues, be it the app messing up with my redemptions or the unauthorized switch to a different fund without consent (full story here).

- In addition, you get the option to invest in US stocks and fixed deposits, but these options are limited to the Groww website.

- Kuvera is a personal finance app that can invest in direct mutual funds, fixed deposits, digital gold, India/ US stocks, and ETFs.

Mutual funds are a great way to grow your money over the long term. However, it can get quite confusing to decide which app to use for buying mutual funds. To make things easier for you, here’s our hand-picked list of the best direct mutual fund apps in India with their pros and cons. Besides, we’ll also discuss whether these free apps are safe, how they make money, switching between apps, and more.

Related | Top 7 Useful Apps for Stock Market Investors in India

Best Direct Mutual Fund Apps in India with Pros and Cons

For starters, there is no commission or distribution fee involved in direct mutual funds. This brings down the expense ratio vis-a-vis regular funds. You’re buying straight from the fund house without any commission when you invest via a direct platform.

That being said, below are some of the best apps you can use to invest in direct mutual funds in India. I’ve personally used each app on the list to give you a better idea of its pros and cons. Also, all the apps are SEBI-registered.

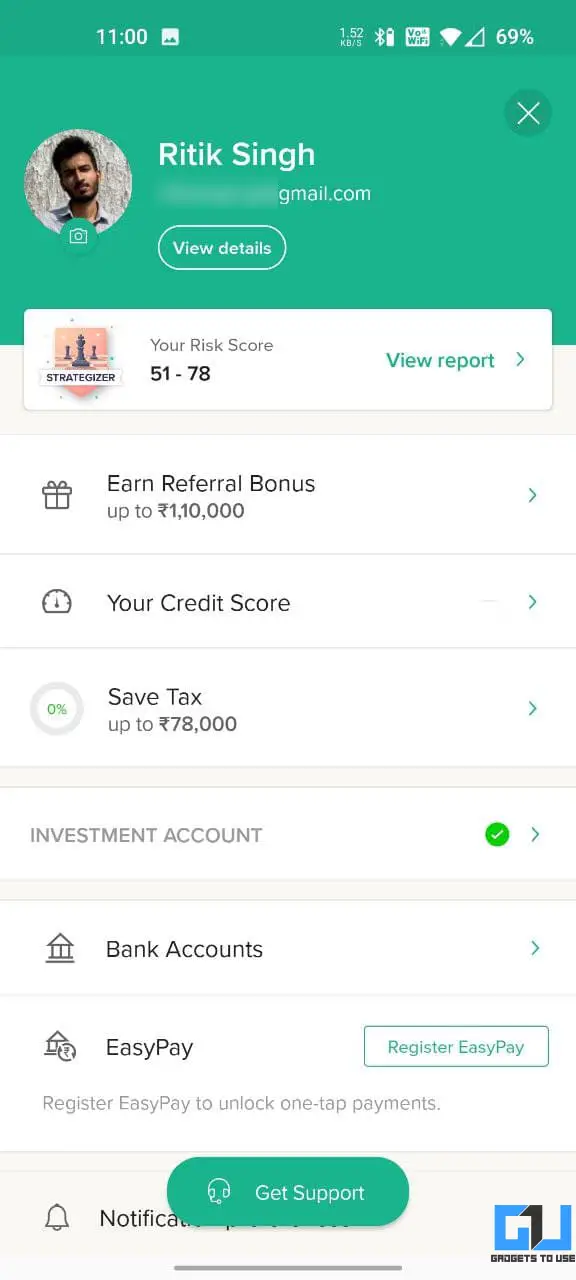

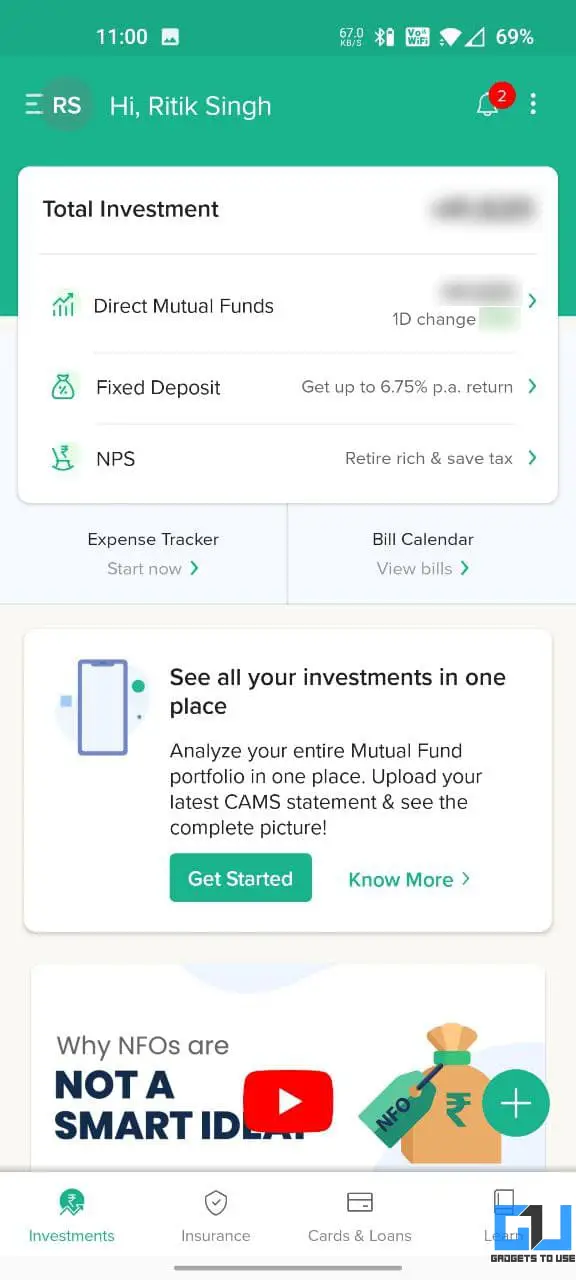

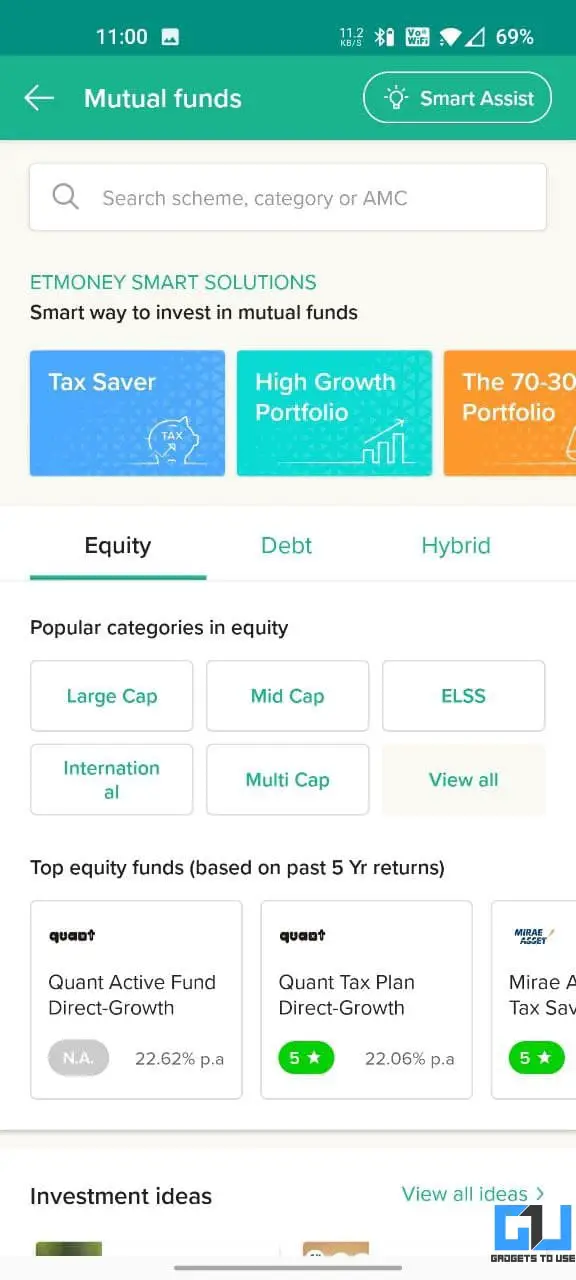

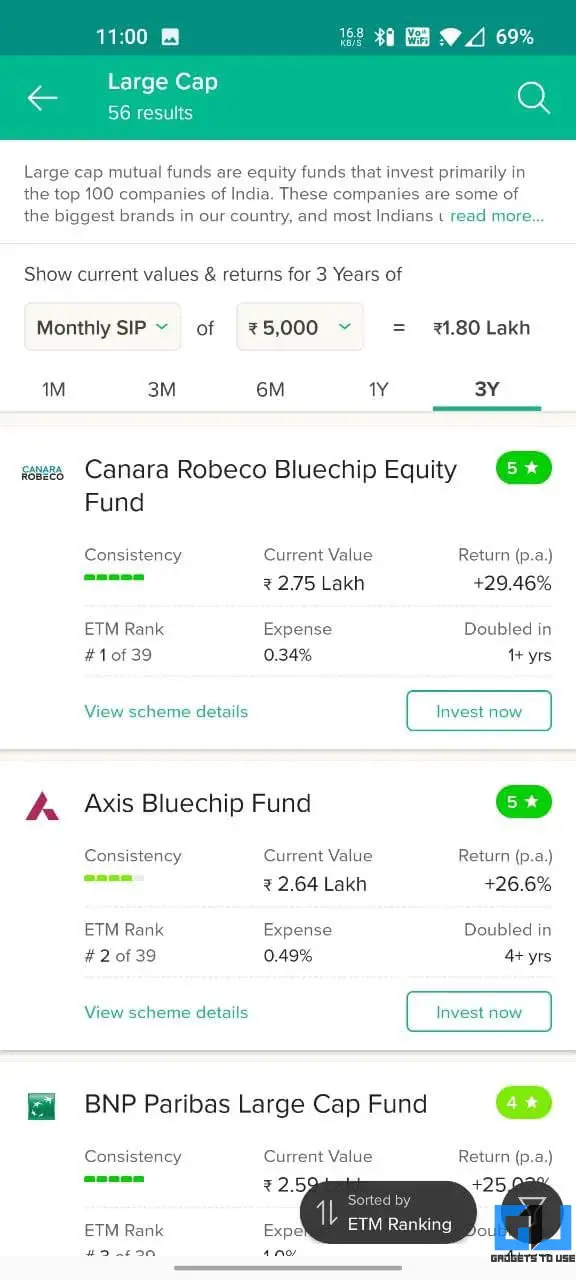

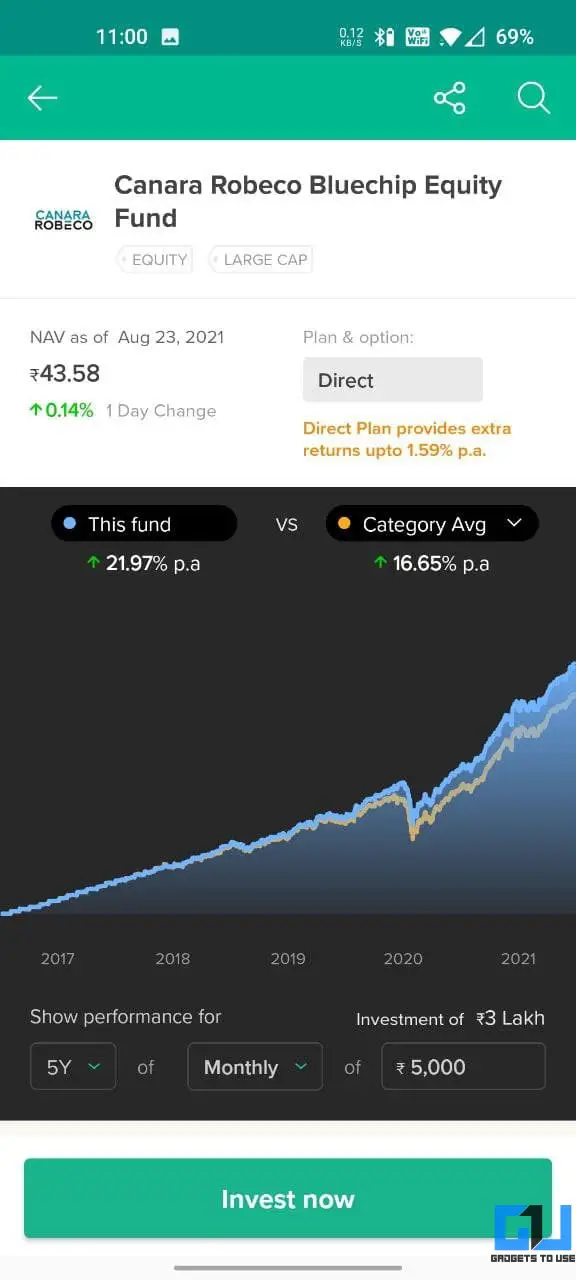

1. ETMoney Mutual Fund App

ETMoney is a full-fledged app that lets you invest in direct mutual funds, track expenses, and get automated bill reminders. Besides, it also provides other financial services like health/ life insurance, fixed deposits, NPS, loans, and tax planning based on your profile.

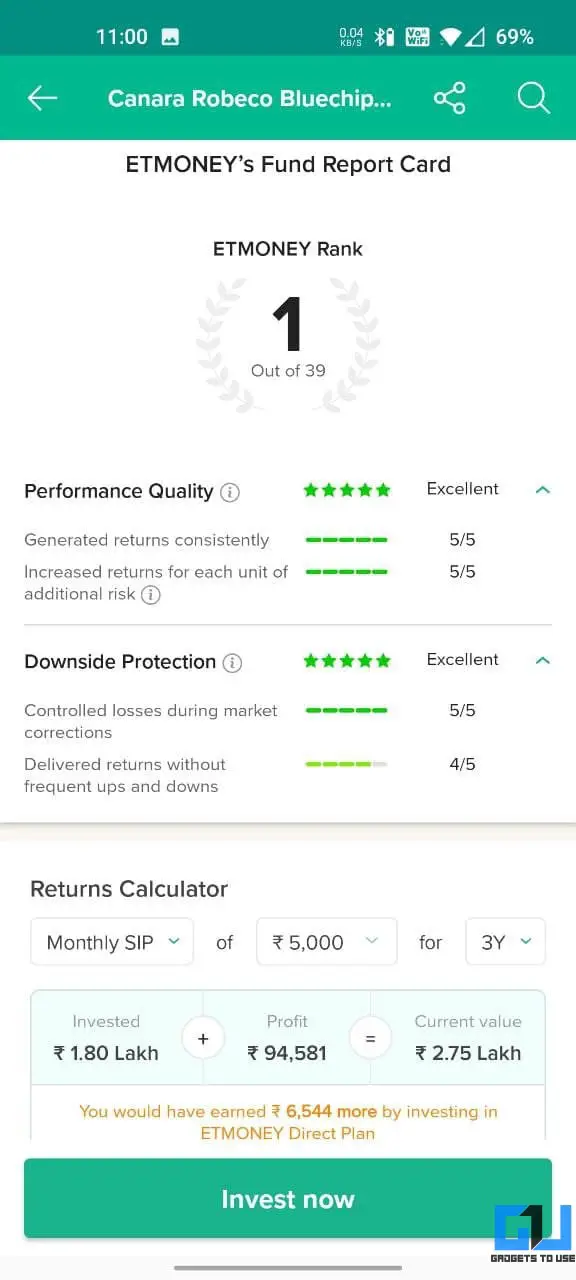

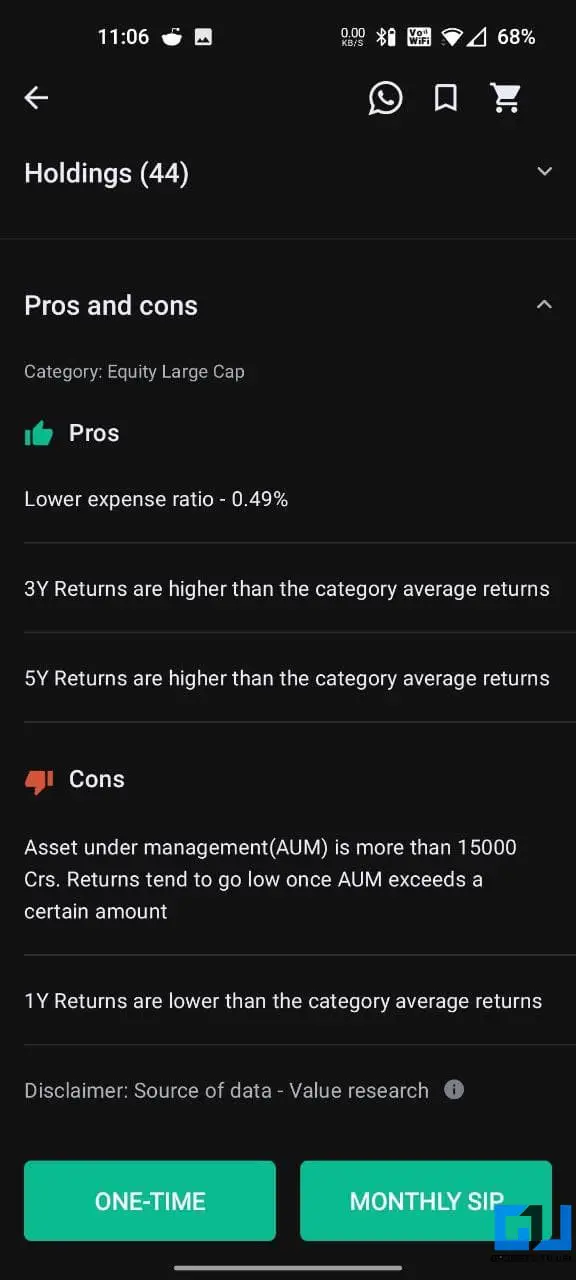

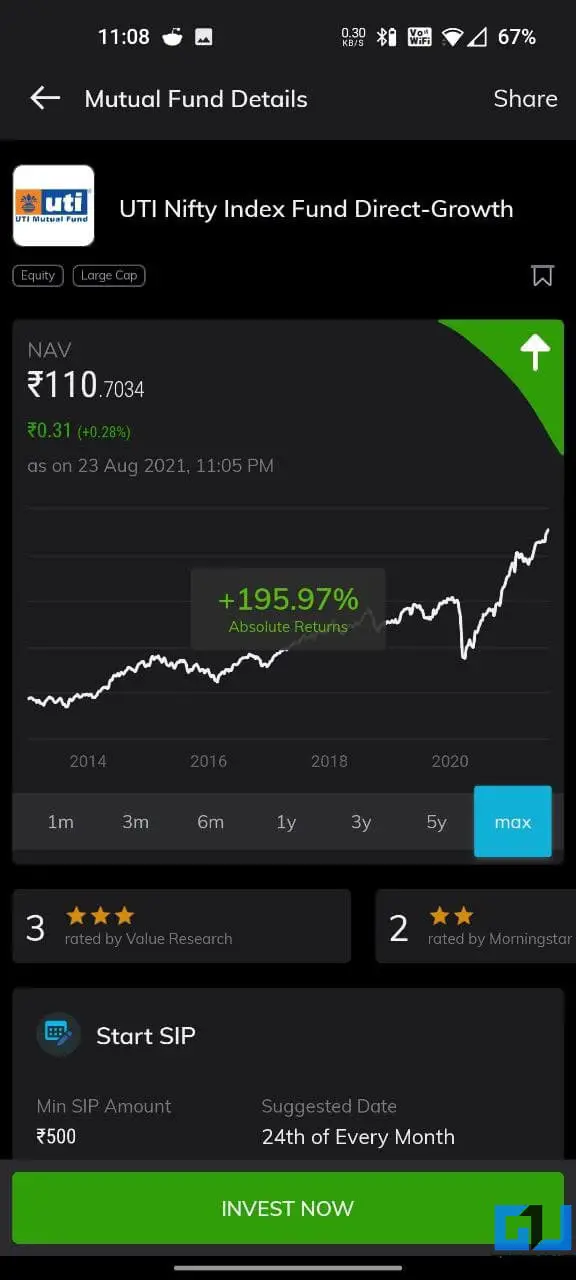

You can explore mutual funds based on investment ideas or by categories. The best part about ETMoney is the fund report card that helps understand a mutual fund’s worthiness w.r.t. return consistency, risk-adjusted returns, downside protection, and stability.

It has recently introduced a new feature to check your “investor personality” by analyzing your behavior. Overall, it has everything one would ask for, making it one of the best mutual fund apps in India.

Key Features

- Invest in direct mutual funds (including ELSS)

- Insurance (health, term life, car/ bike), NPS, and fixed deposits

- Credit cards and loans, check credit score

- SmartDeposit liquid fund

- Built-in expense manager, bill reminders

- Track external mutual funds

Pros

- In-depth data to research and choose mutual funds

- EasyPay for one-tap payments

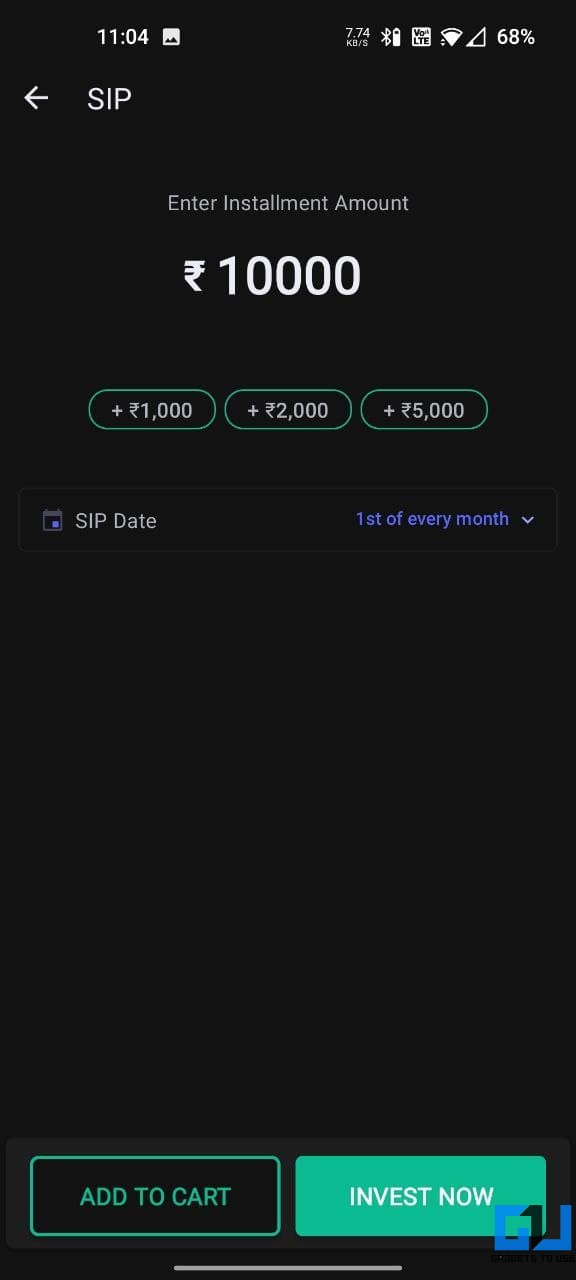

- Skip or edit SIP amount and date

- Know your investor profile

Cons

- No on-call customer support

Offered by: Times Internet Ltd

2. Groww Mutual Fund App

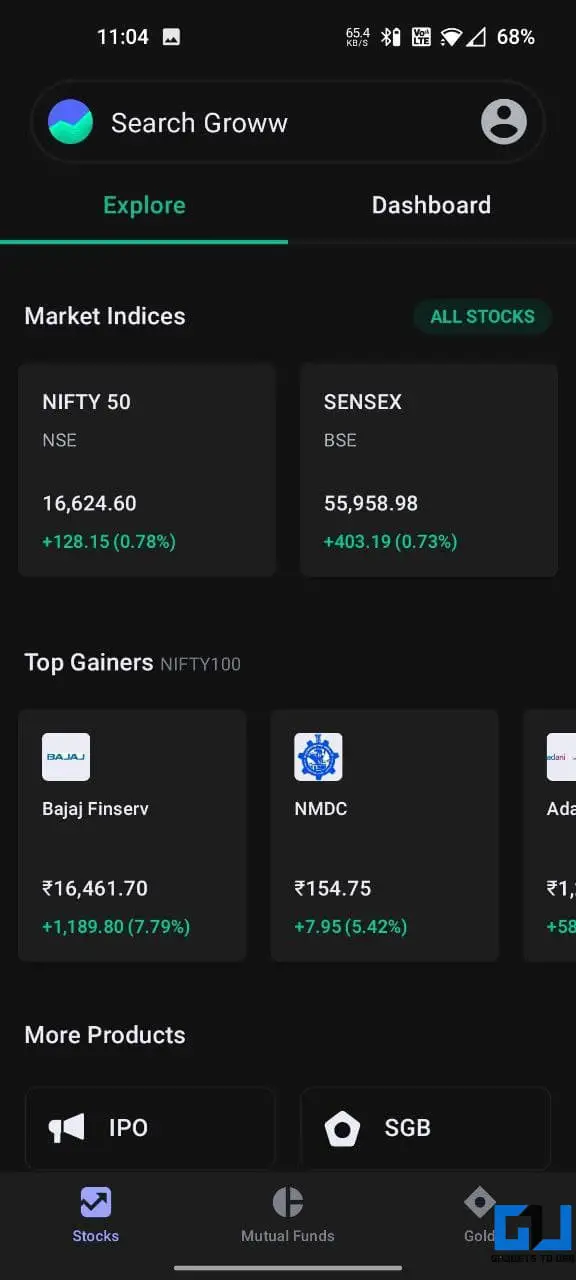

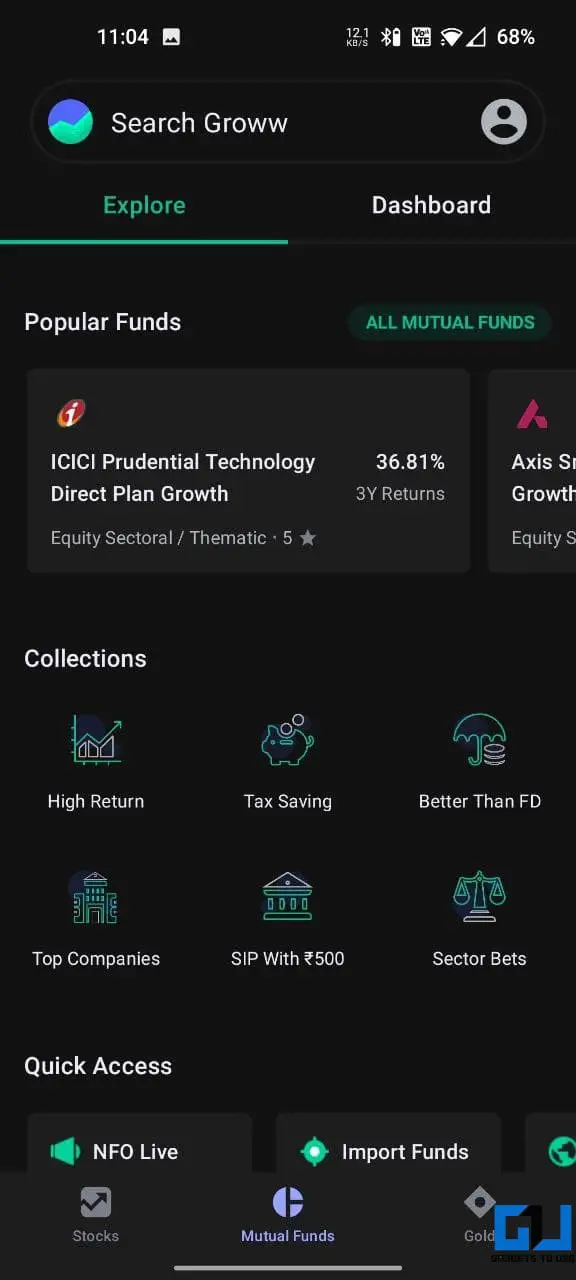

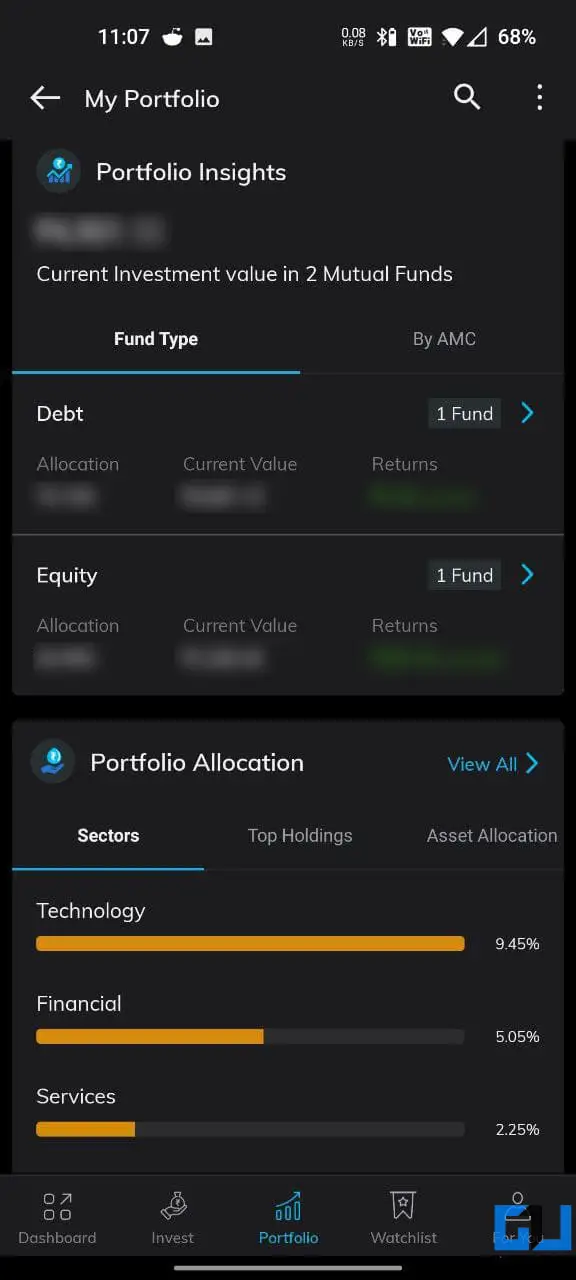

Groww is another very popular app that lets you invest in mutual funds, stocks, and digital gold. The app comes with a very intuitive interface and can be used by anyone with ease. The simplicity is also one of its unique selling points.

In addition, you get the option to invest in US stocks and fixed deposits, but these options are limited to the Groww website. Interestingly, it automatically opens a Demat account when you complete your KYC. However, it is free and has no annual charges.

Another good thing about the platform is its on-call customer support- it takes time to connect but is worth it if you’re stuck in issues.

Unfortunately, Groww is plagued with issues, be it the app messing up with my redemptions or the unauthorized switch to a different fund without consent (full story here). While it’s still an excellent platform, they need to rectify the backend problems.

Key Features

- Invest in direct mutual funds

- Invest in stocks, apply for IPOs

- Buy digital gold on the platform

- Invest in US Stocks and Fixed Deposits (only on website)

- Track external mutual funds

Pros

- Simple and clutter-free user interface

- Auto-pay SIP via Groww balance (if you don’t enable bank auto-pay)

- On-call customer support

- Skip or edit SIP amount and date

Cons

- Occasional technical issues and glitches

- Automatically opens a Demat account while creating an account- even though it’s free, you don’t get a choice.

Offered by: Nextbillion Technology

3. Kuvera Mutual Fund App

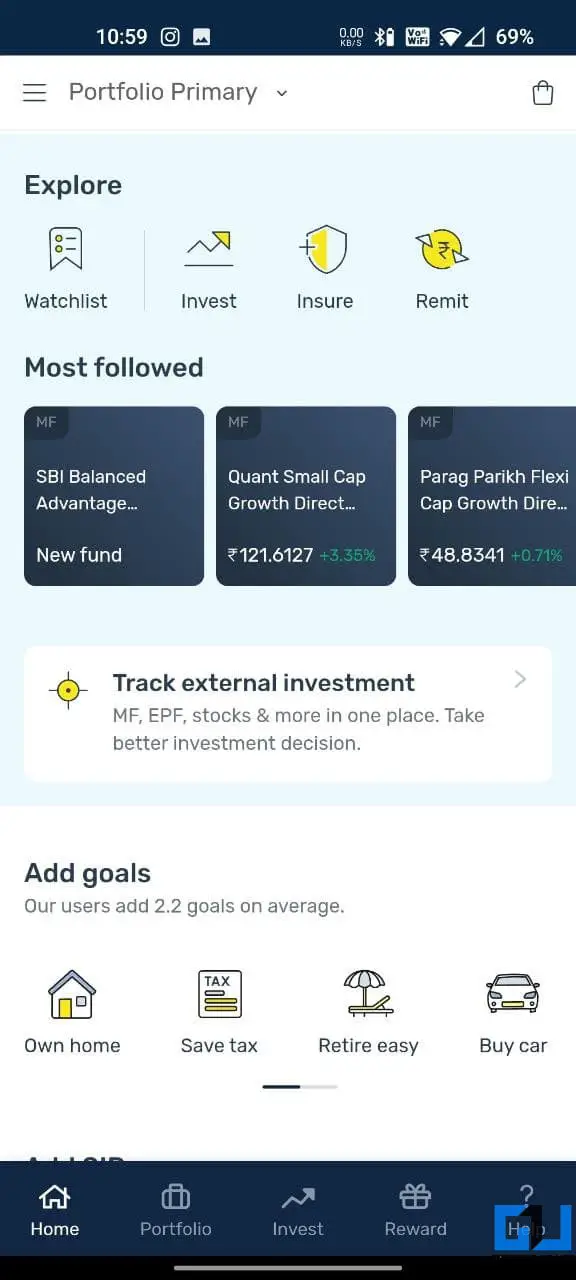

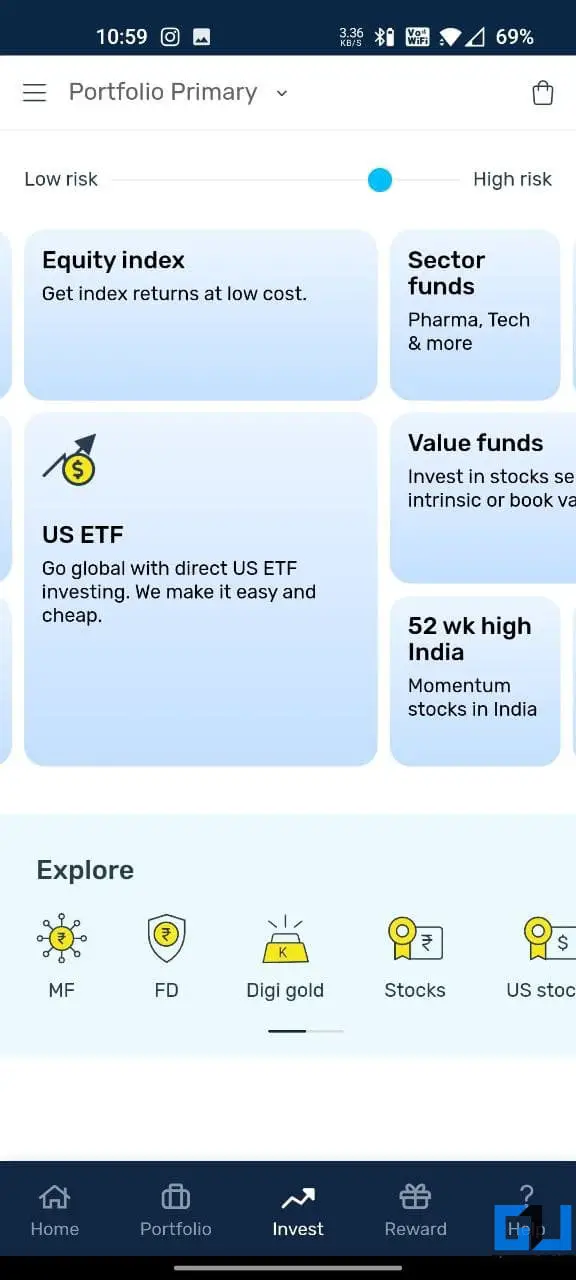

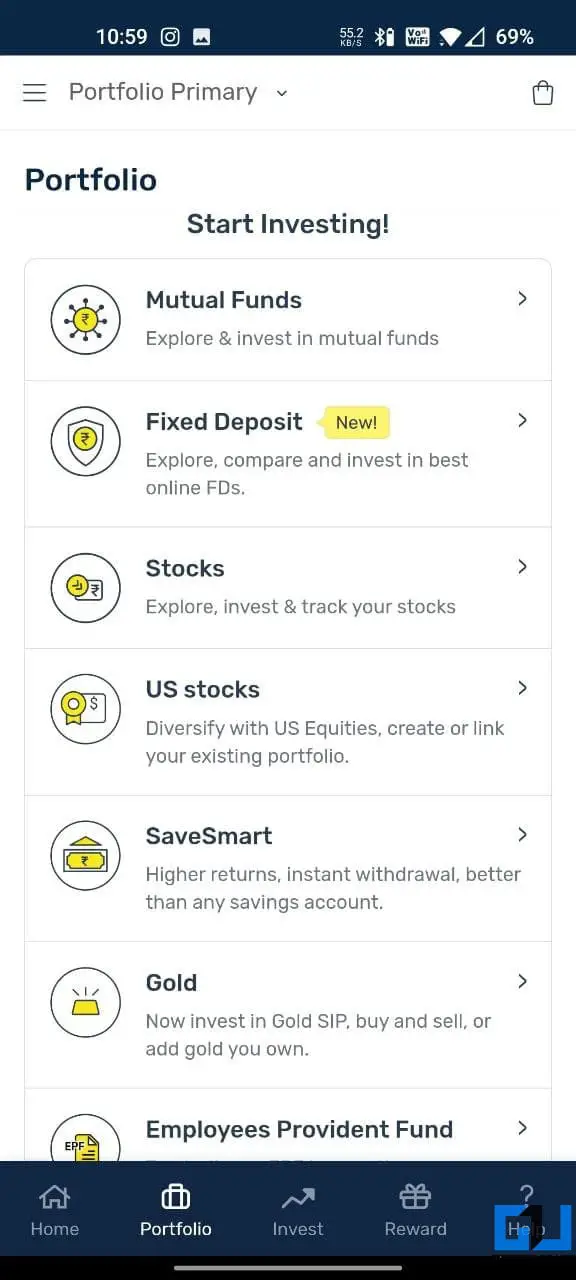

Kuvera is a personal finance app that can invest in direct mutual funds, fixed deposits, digital gold, India/ US stocks, and ETFs. It even supports cryptocurrency, which no other app on the list offers. Plus, you can import and track your EPF.

While there are charges for US investing account, investments in mutual funds are completely free. The app gives a good overview of which categories to invest in based on your risk appetite- ranging from FD to mutual funds and stocks.

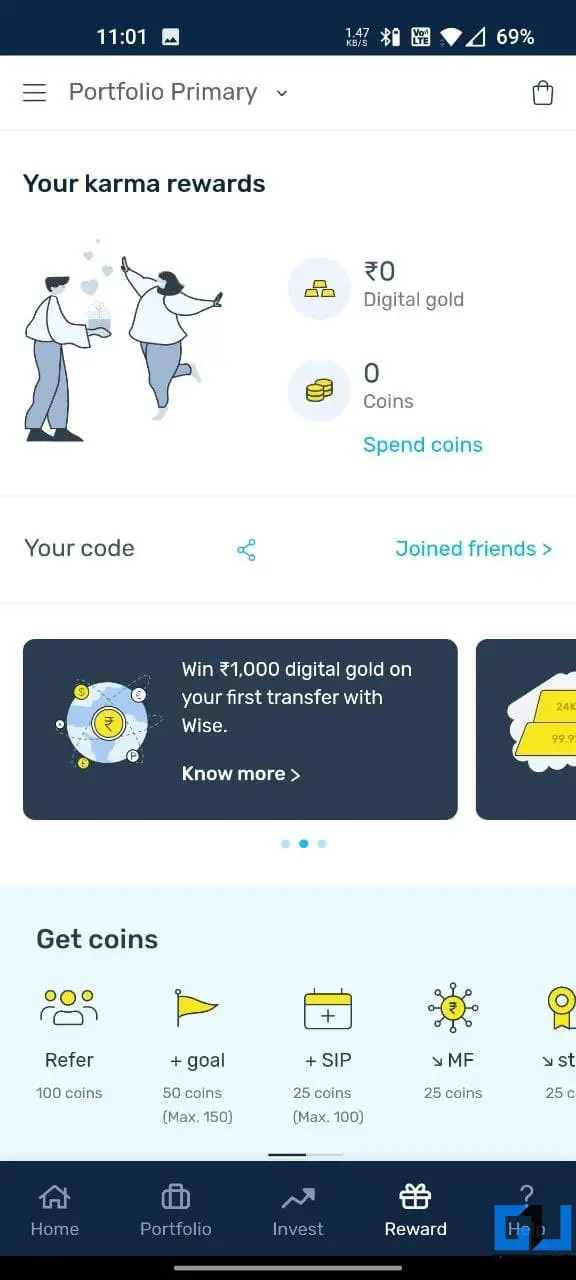

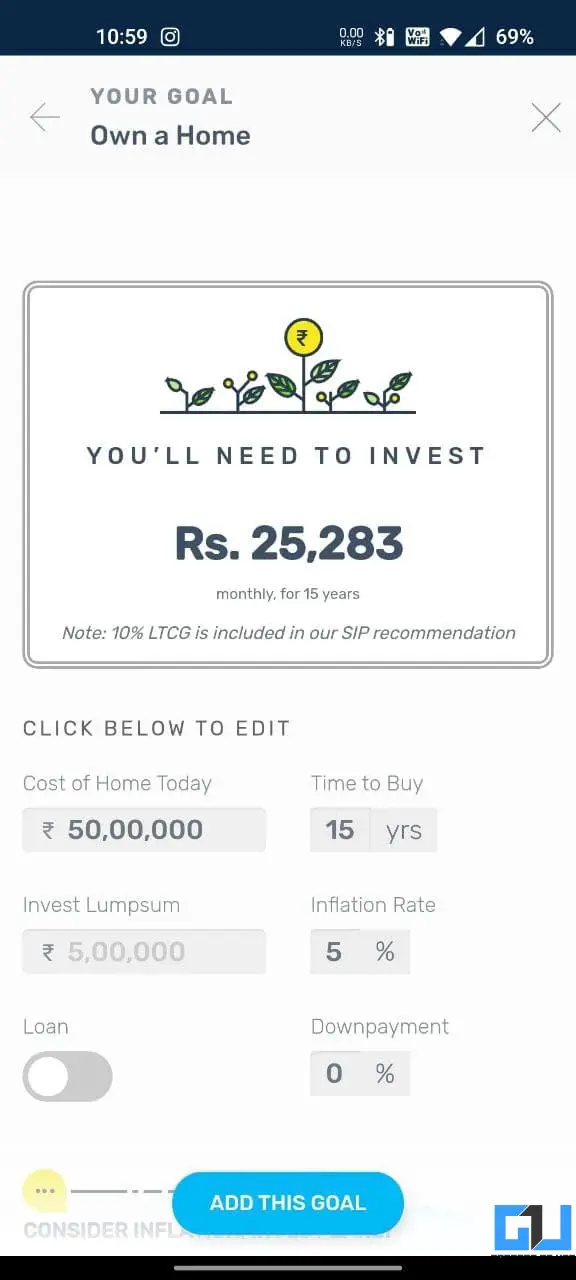

Kuvera helps you plan the SIP and lump sum amount for your long-term goals. Besides, it has a unique feature called Tax Harvesting. Using it, you can manage and save your long-term capital gains taxes every year through smart redemption and re-investment.

Another feature called TradeSmart helps you switch from regular to direct funds gradually with the least expenses. Both the features can be unlocked using coins which you can earn by referral, adding goals, and making investments.

Key Features

- Invest in direct mutual funds

- India and US stocks, fixed deposits, and gold

- Fund suggestions based on your goal and profile

- Track external mutual funds, stocks, gold, EPF in one place

- SaveSmart liquid fund

- Import and manage your family accounts

Pros

- Save LTCG tax with Tax Harvesting

- Save switching costs with Trade Smart

- Goal-based investment planning

- Skip SIP or edit amount and date

Cons

- No fingerprint unlock

- No on-call customer support

Offered by: Arevuk Advisory Services Pvt. Ltd

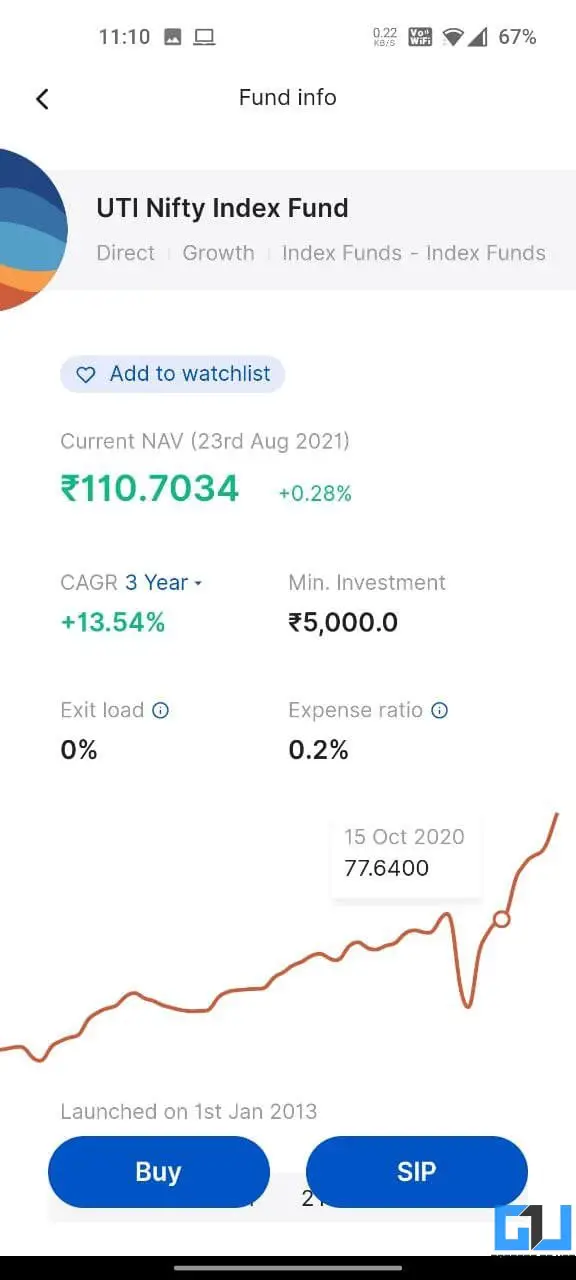

4. Coin by Zerodha Mutual Fund App

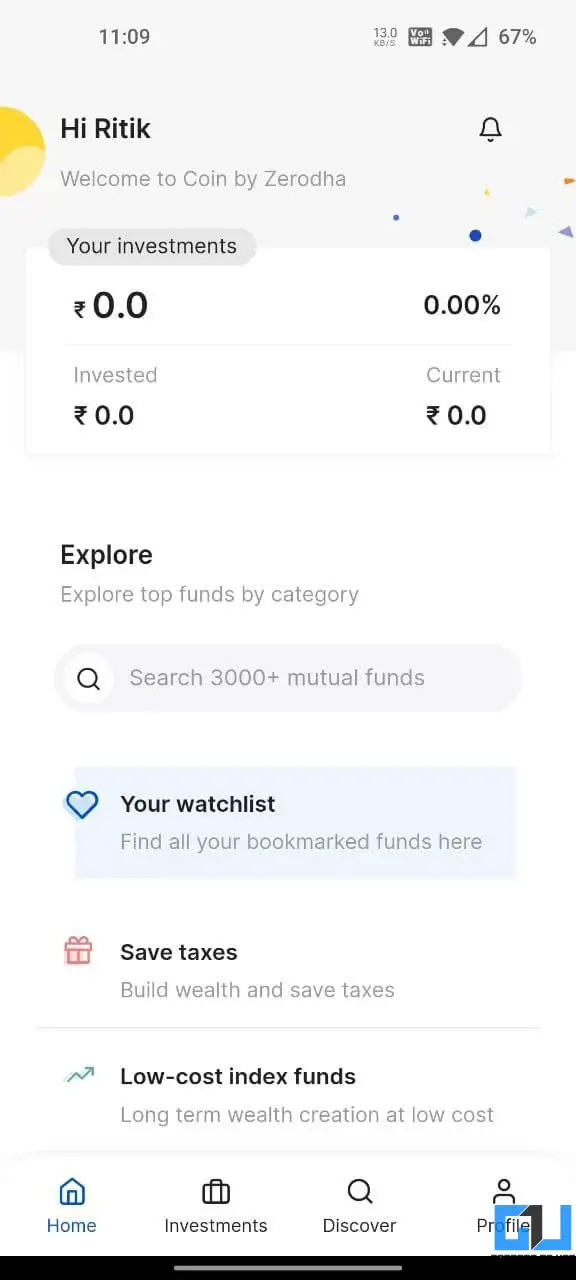

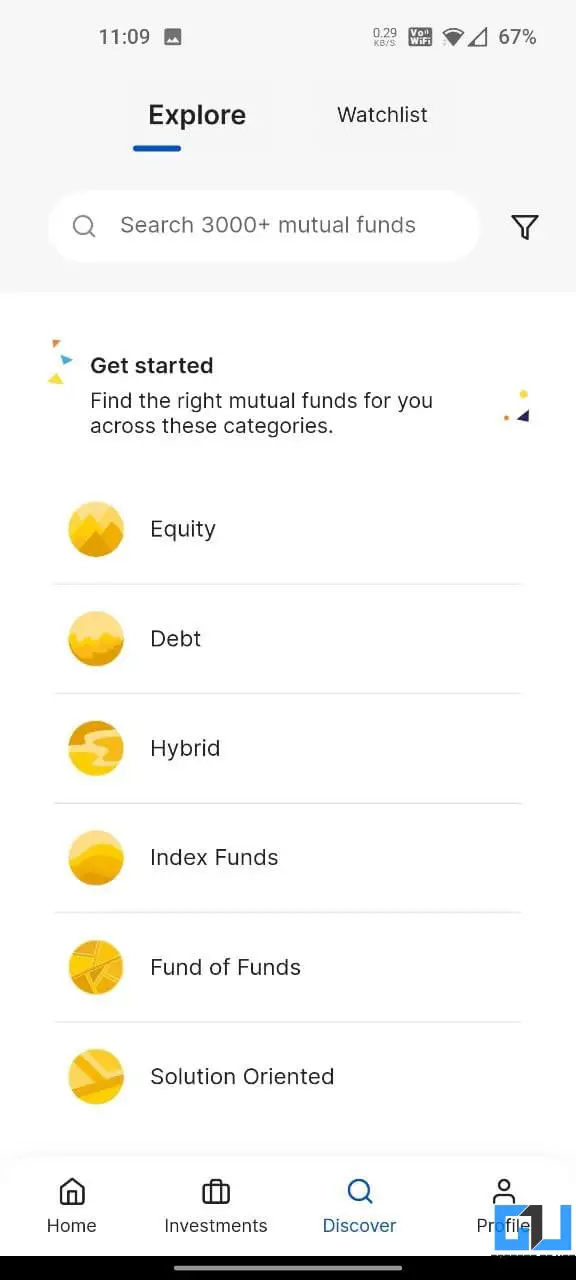

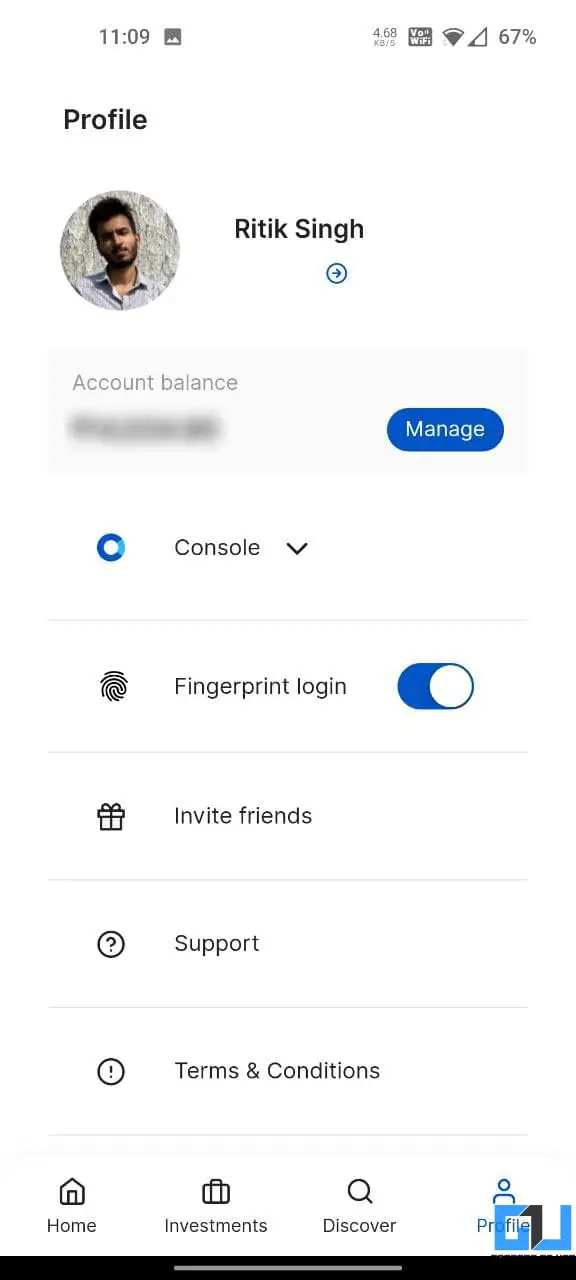

The Coin app comes from the house of India’s largest stockbroker Zerodha, making it a very reputed platform to invest in direct mutual funds. Plus, it comes with a well-polished and clean UI that feels smooth every time you use it.

You can explore funds across different categories, check their holdings, and plan your investments. However, there are two caveats with the app. To begin with, your mutual funds are stored in Demat. Hence, you’ll have to pay for Demat services maintenance.

Storing mutual funds in Demat form makes it easier to pledge as collateral for a loan or margin for trading in derivatives and stocks. Plus, all your stocks and mutual funds are at once place. However, it has its own limitations.

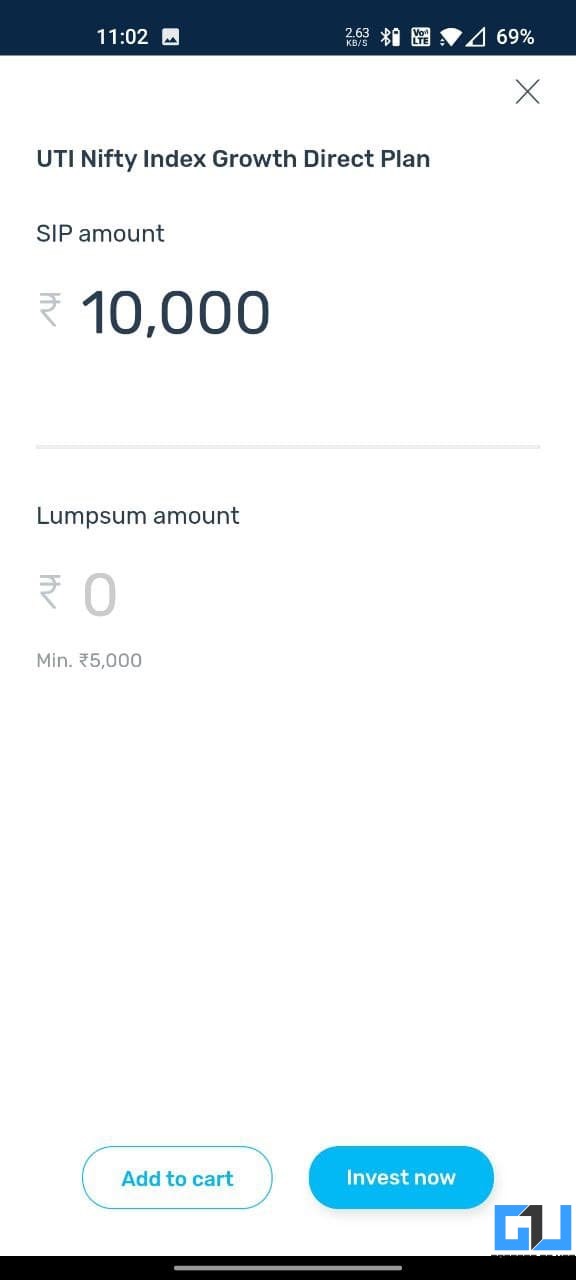

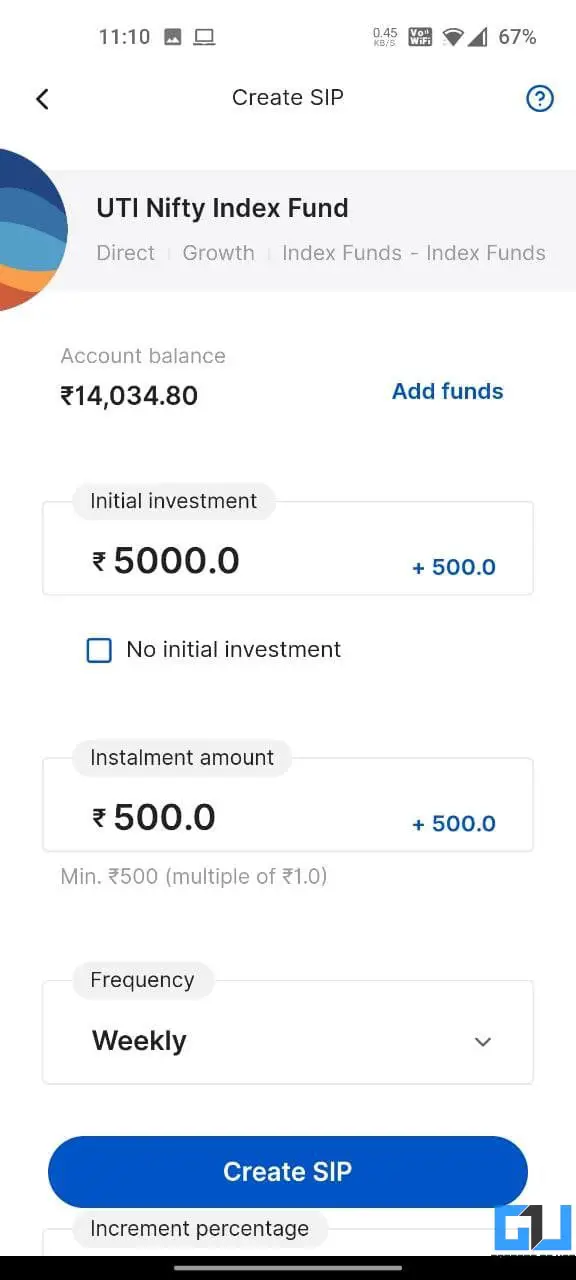

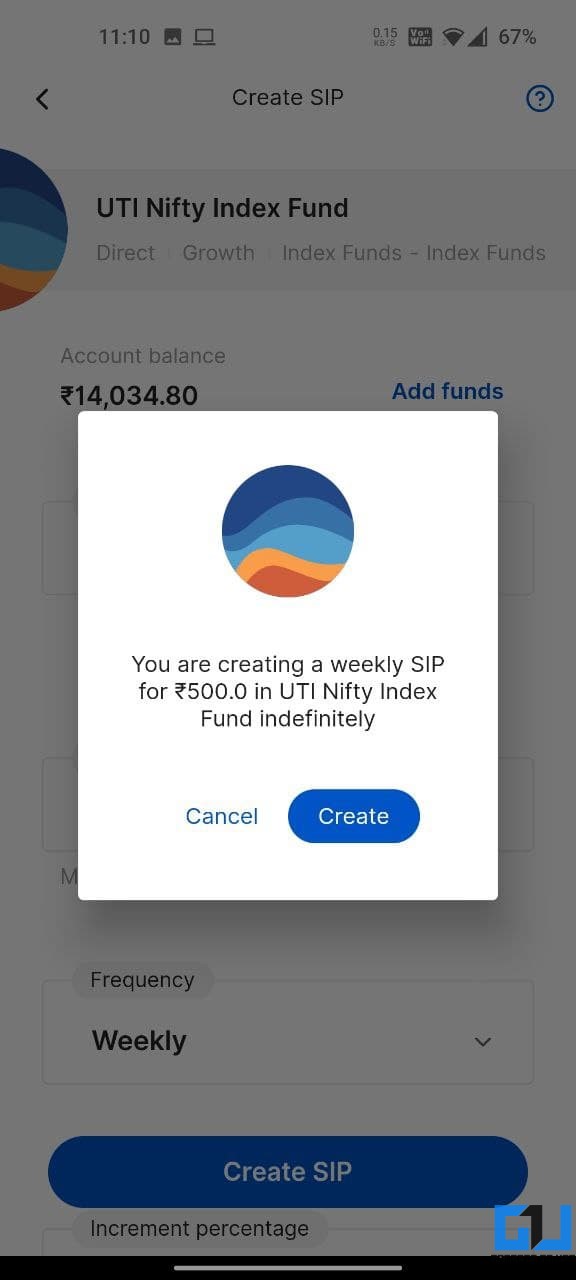

Secondly, most funds on Coin require a minimum initial investment amount of Rs. 5000. If you don’t make the initial investment, it’ll convert to the AMC SIP, and features to edit, pause, or step-up SIP will not be available.

Coin is the only mutual fund app on the list that offers weekly and fortnightly SIP options. If you already use Zerodha for stocks, you can consider using the Coin app.

Key Features

- Invest in direct mutual funds

- Use balance in your trading account for mutual funds

- Explore funds based on categories

Pros

- Smooth and clean UI

- All your stocks and mutual funds in one place

- Pause or edit SIP amount and date

- Weekly, fortnightly SIP options

- On-call customer care

Cons

- Requires Zerodha Demat (account opening charges, annual charges)

- Higher min. initial investment amount*

Offered by: Zerodha Commodities Pvt. Ltd

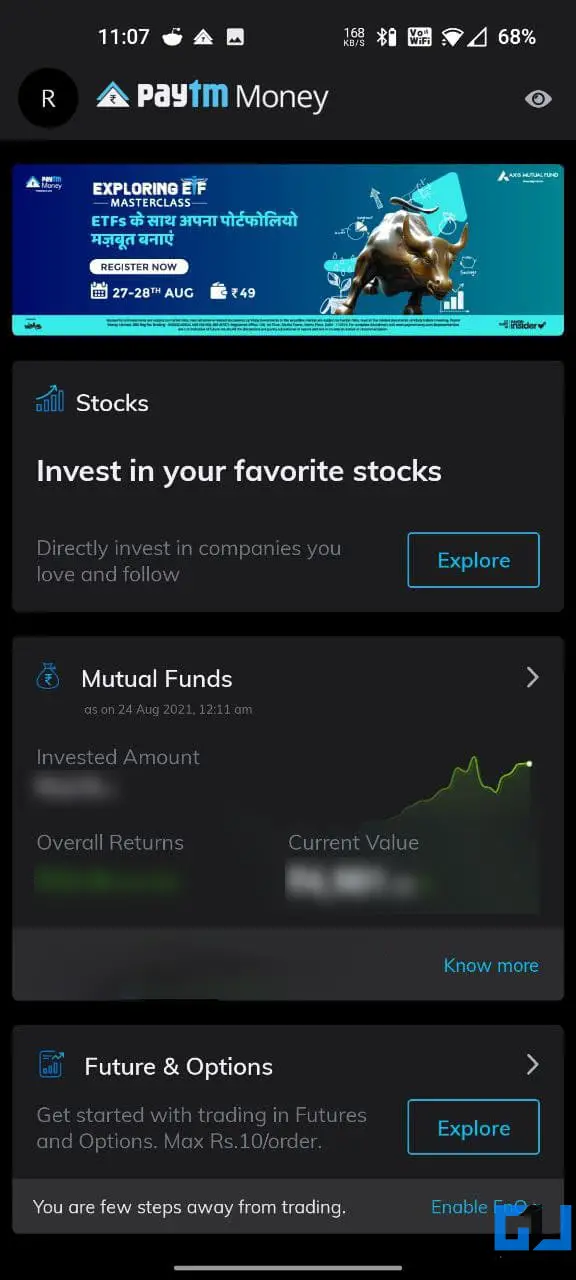

5. Paytm Money Mutual Fund App

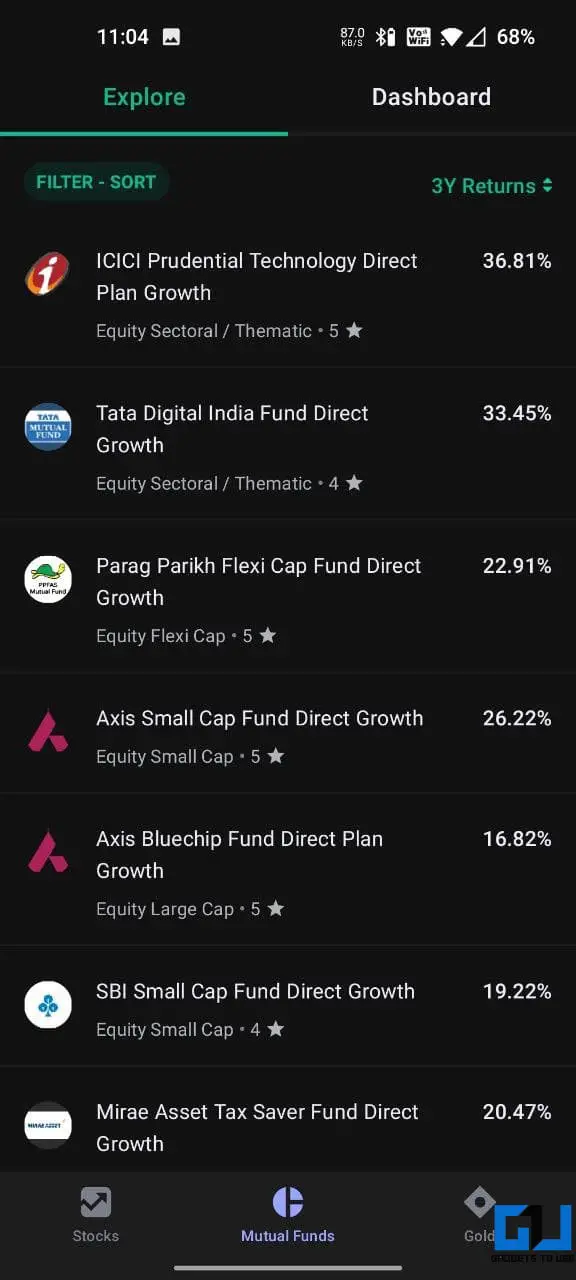

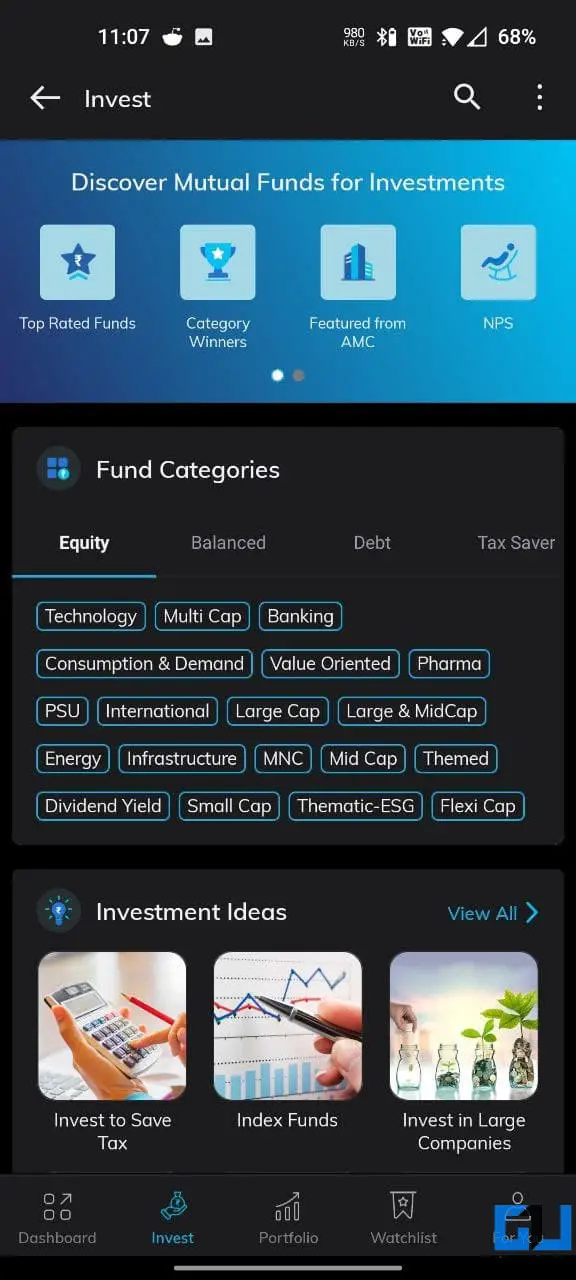

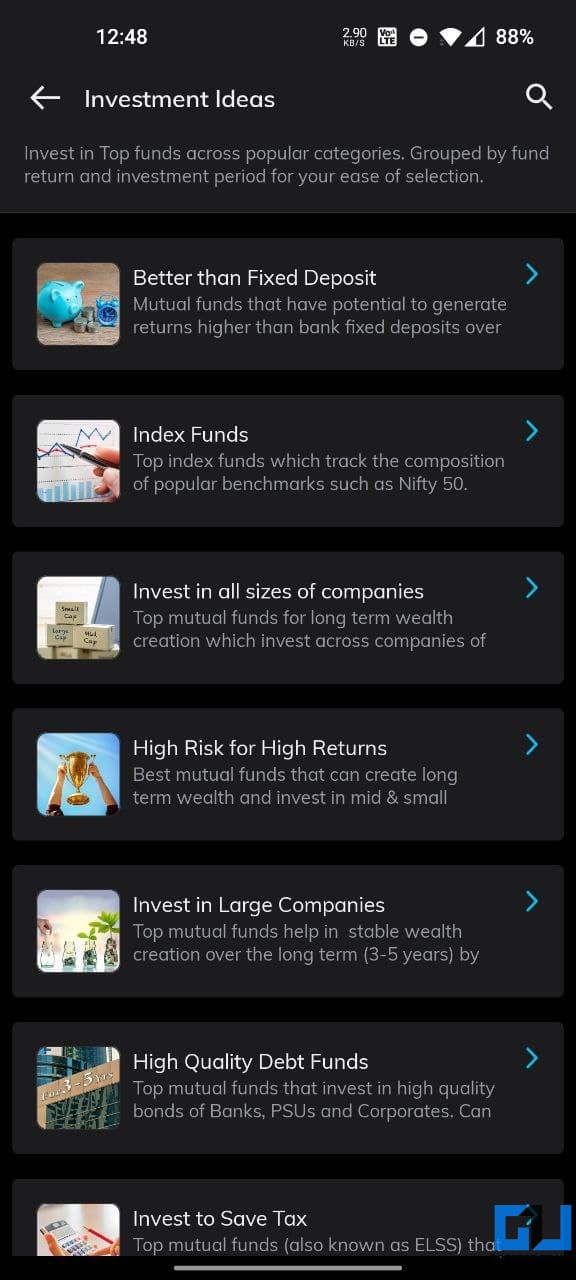

Paytm Money is another popular mutual fund app in India. The app comes with a loaded interface having all options to discover mutual funds based on categories and investment ideas. It shows top funds based on returns, ratings, and category winners.

Besides, Paytm Money also offers digital gold, NPS, and a stocks account. You can create a mutual fund watchlist, set your goals, and manage your SIPs. The good thing is you can top up your portfolio in a single click when you have extra money to invest.

The UI is loaded with details, but some may find it to be cluttered like the original Paytm app. Plus, customer support is not so good, and you can’t change the default bank account yet.

Lately, some users have reported delays in NAV date despite placing the mutual fund order before the cut-off time, which might be a dealbreaker for some. Barring these issues, it’s still one of the best mutual fund apps in India.

Key Features

- Invest in direct mutual funds

- Options to invest in stocks, digital gold, and NPS

- Super Saver liquid fund

- Track external mutual funds

Pros

- Loaded interface

- Pause or edit the SIP amount and date

Cons

- Poor customer support

- Cannot change default bank account in the app

- NAV delay issue

Offered by: One97 Communications Limited

Other Direct Mutual Fund Apps

If you don’t like any of the apps above, you can try the other worthy options below:

- Niyo Money: Formerly Goalwise, goal-based mutual fund app (Android/ iOS)

- Black by ClearTax: Direct mutual funds, tax saver plans, free ITR e-filing(Android/ iOS)

- MyCams: For mutual funds having CAMS as their registrar (Android/ iOS)

- KFinKart: For mutual funds having KFinTech as their registrar (Android/ iOS)

Alternatively, you can use the official fund house app or website for investment. These investments can be tracked in one place with apps that allow external fund tracking.

Mutual Fund Apps FAQ

1. Are These Mutual Fund Apps Safe?

Yes. All the mutual fund apps are safe as the amount you invest goes to the asset management company. Your investments are held with the AMC and not the app- it’s just a mediator.

You can track your investments individually on AMC’s official platform. You’ll also get regular emails and messages from the fund house about your transactions.

2. How Do Direct Mutual Fund Apps Make Money?

Most commission-free mutual fund apps make money by cross-selling other products and services. For example, Groww bundles a Demat account and sells gold and US stocks. Whereas ETMoney provides services like NPS, FD, insurance, cards and loans, and more.

Similarly, Paytm Money, too, offers stockbroking services. Plus, it’s registered as an online point of presence for the NPS- PoPs charge a commission of 0.25% on each contribution to the NPS.

The other way they make money is through market data analytics. The data you provide, like personal details, income range, etc., can be sold to other companies.

Some apps may also tie up with AMCs to push specific funds as recommended or top funds. And hence, you could get biased advice from these apps. So, keep a note of it.

3. Can You Switch from One Mutual Fund App to Other?

You can switch from one mutual fund app to another anytime you want. All you need to do is generate a Consolidated Account Statement (CAS) from CAMS or KFintech website and import them into the new app you wish to use. You can then stop SIPs on the old platform and start fresh on the new one.

All your investments across mutual funds can be tracked in one place using CAS.

4. Do You Need to Pay Any Charges While Redeeming Mutual Funds?

The mutual fund apps don’t levy any specific charges while investing or withdrawing the funds. However, the fund house may charge an exit load for redeeming the amount from the fund.

For instance, Axis Bluechip charges an exit load of 1% for redemption within 12 months. So, make sure you don’t switch or redeem mutual fund investments too frequently.

Wrapping Up

These were some of the best direct mutual fund apps in India with their pros and cons. My personal top picks are ET Money, Kuvera, and Groww. Anyways, do try all the apps and stick with the one that suits you more. Choose your mutual funds after thorough research and avoid investing in too many of them. If you have any other doubts or queries, reach out via the comments below. Stay tuned for more such articles.

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.