Quick Answer

- Like credit cards, the buy now pay later (BNPL) model is all about disbursing small-ticket loans to users in the form of a free credit line.

- For someone who does not have a credit card, buy now pay later services can be a great way to manage the cash flows.

- You can spend up to a certain amount online or offline and then repay it on the set date without any interest charges or fees.

In the last few years, several “buy now pay later” (BNPL) apps have emerged in the Indian market. These apps work similarly to credit cards by providing users with an instant credit line to pay utility bills, food, shopping, and more. This makes up for an easy and convenient way for people to meet their daily expenses without worrying about cash in hand. Here, let’s look at some of the best buy now pay later apps in India for Android and iOS.

Related | 5 Best Mutual Fund Apps with Pros, Cons- Are these Apps Safe?

Best Buy Now Pay Later Apps in India to Get Instant Free Credit Line

Like credit cards, the buy now pay later (BNPL) model is all about disbursing small-ticket loans to users in the form of a free credit line. You can spend up to a certain amount online or offline and then repay it on the set date without any interest charges or fees.

For someone who does not have a credit card, buy now pay later services can be a great way to manage the cash flows. However, given the tons of BNPL apps in the market, it may get difficult for you to decide which one to opt for.

To make things easier, we’ve listed some of the best buy now pay later apps in India below. Read on.

1. LazyPay

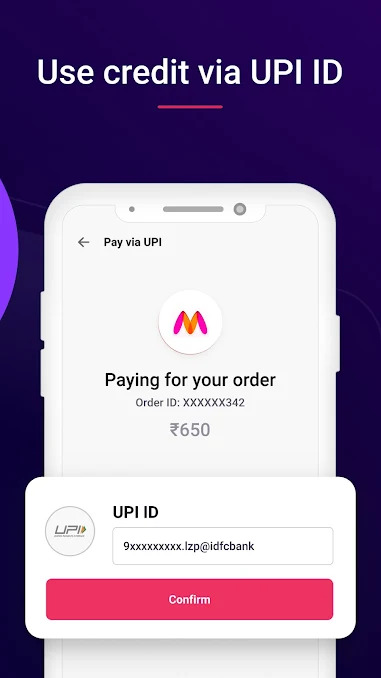

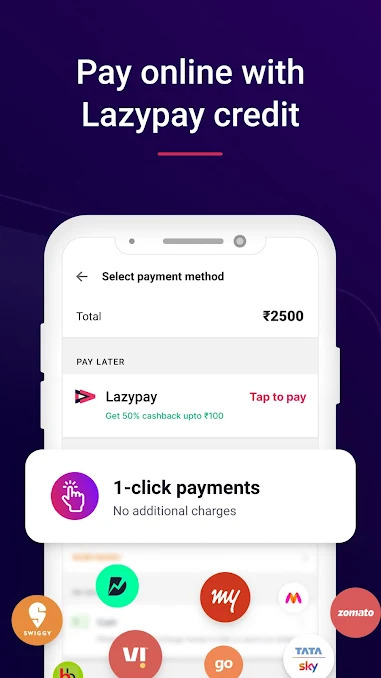

LazyPay is one of the most popular buy now pay later solutions in India. It gives an instant credit line with a paperless KYC process. You can either scan and pay or use your UPI ID to transact with all the merchants who accept UPI.

One can pay at offline merchants and online services like Ola, Uber, Flipkart, Myntra, Zomato, Swiggy, Bookmyshow, and more. If your transaction value is more than ₹10,000, you can choose to convert it into Easy EMI based on available plans.

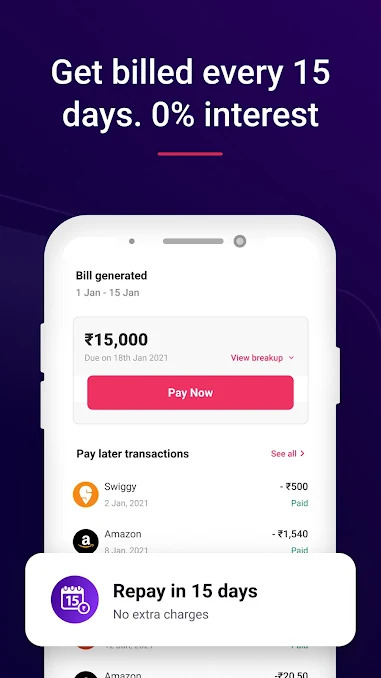

The app gives an interest-free period of 15 days post, which you’ll have to repay and clear the bill (on the 3rd and 18th of each month). You can set up auto-pay or pay manually via UPI, net banking, or debit card.

Key Features:

- Scan and Pay with UPI

- Pay on online merchants like Flipkart, Zomato, and Swiggy

- 15-day zero-interest repayment cycle

- Maximum credit limit of up to ₹1,00,000

- Regular offers on merchants

- Check late repayment fee here

Offered by: PayU India

2. Simpl Pay Later

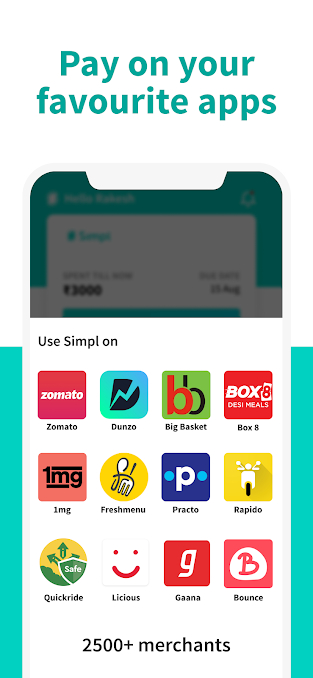

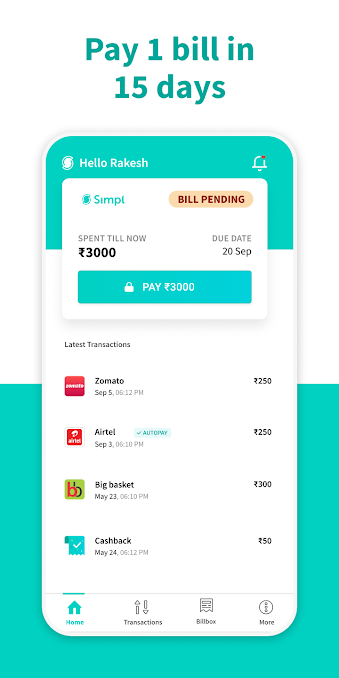

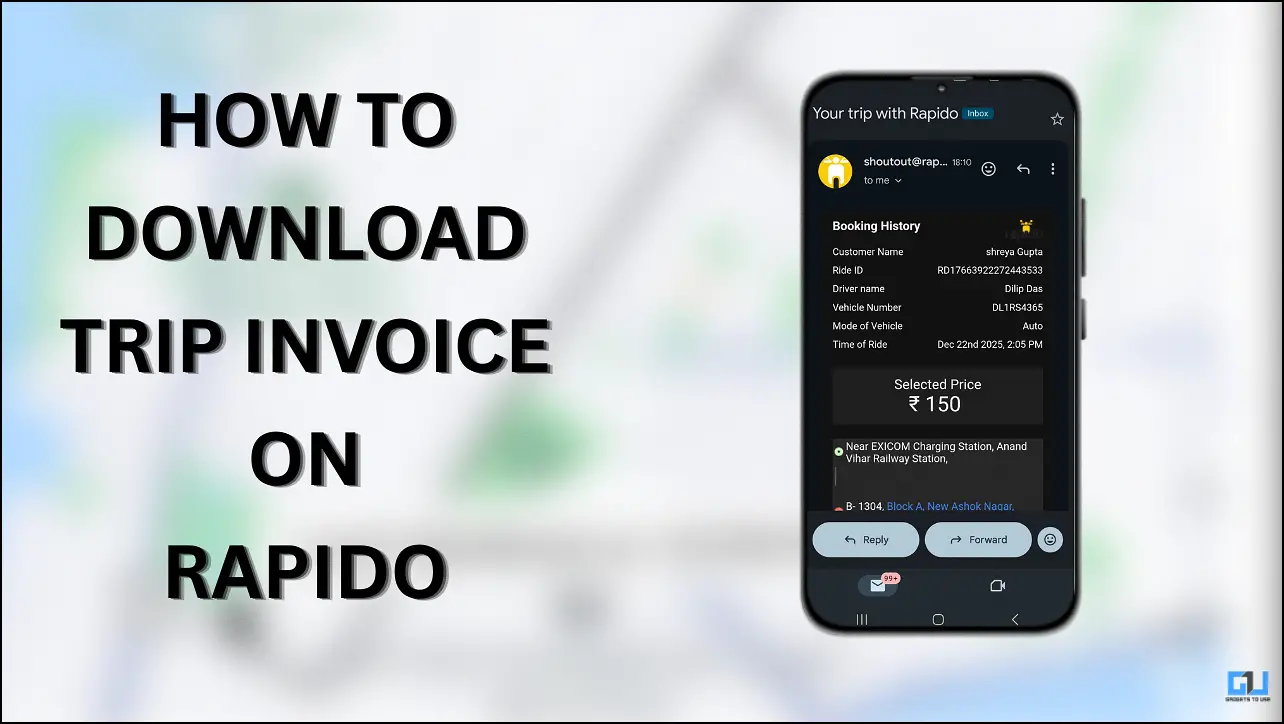

Simpl is another app that offers a one-tap buy now pay later service on Android and iPhone. You can use it to pay directly on online platforms like Zomato, Dunzo, Rapido, Gaana, BigBasket, 1MG, and more.

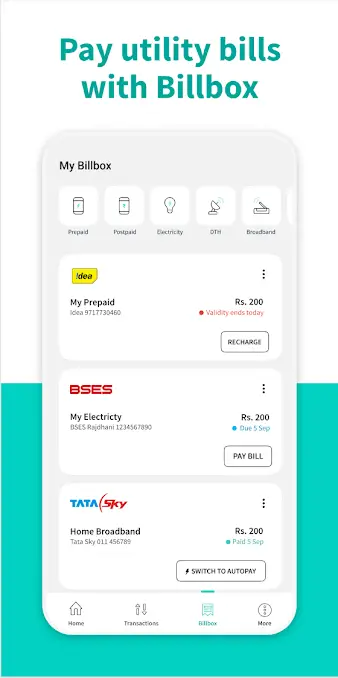

Besides, it also lets you pay utility bills like prepaid and postpaid mobile, electricity, DTH, and broadband from within the app using a given credit limit. Like LazyPay, it provides regular offers and discounts on merchants.

The repayment cycle is 15 days, i.e., the bill is generated twice a month. There are no hidden fees or additional charges provided you make payments on time. Plus, the best part is you do not need KYC documentation to get started with Simpl.

Key Features:

- Pay online on supported merchants

- Pay utility bills with the provided credit line

- 15-day zero-interest repayment cycle

- Discounts and offers on merchants

- No KYC documentation required

- Check late repayment fee here

Offered by: Get Simpl Technologies Pvt. Ltd

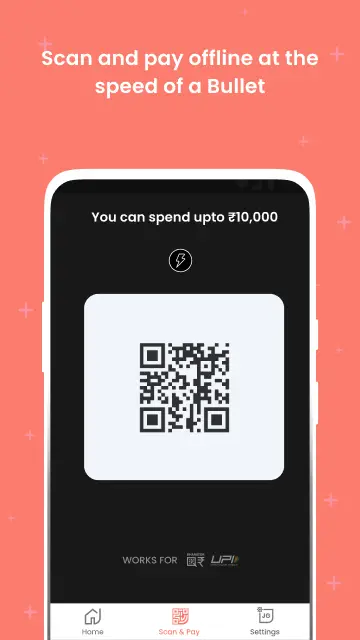

3. Bullet- Pay Later App

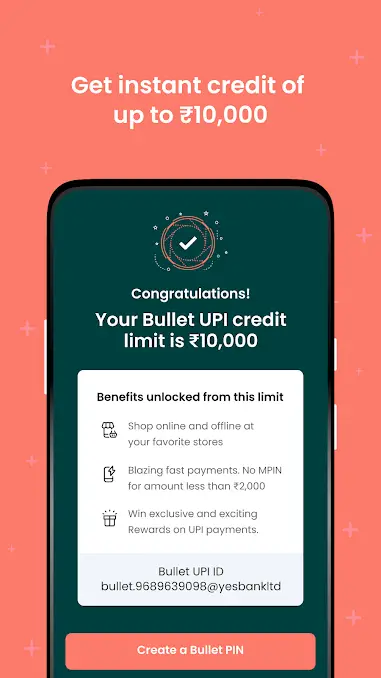

Bullet is a trusted postpaid UPI app from the house of neo banking platform Jupiter. It gives up to ₹10,000 credit for UPI payments at zero interest. You can use this credit limit to pay both online and offline merchants that accept UPI payments.

You can use Bullet to spend on apps like Swiggy, Zomato, Amazon, Myntra, Bigbasket, etc. It also lets you make in-app bill payments. This includes mobile recharge, electricity bill, water bill, gas bill, and more.

Bill is generated twice on the 15th and the last day of every month. You can make the repayment within five days of bill generation. Unfortunately, Bullet seems to have temporarily paused the onboarding of new customers.

Key Features:

- Pay online on apps like Swiggy, Zomato, Amazon

- Pay your mobile recharge and other utility bills

- 15-day zero-interest repayment cycle

- Get a credit limit of up to ₹10,000

- Check late repayment fee here

Offered by: Amica Financial Technologies Private Ltd.

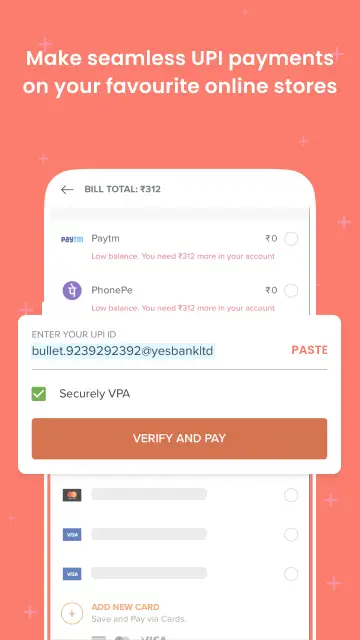

4. Paytm Postpaid

Paytm is one of the most popular payment apps in India. Interestingly, Paytm also offers a pay later service called Paytm Postpaid to its active customers. You can activate it by going to Paytm > All Services > Loan & Credit Card > Paytm Postpaid.

The Postpaid service lets you make payments to partner merchants or for eligible services. You will automatically see Postpaid in payment options whenever applicable. This includes recharges, bill payments, Paytm Mall shopping, and other merchants across India.

The bill is generated once every month. Your Postpaid spend limit is decided based on transaction history, relation with Paytm, and credit history with credit bureaus.

It currently offers three variants- Postpaid MINI, Postpaid LITE, and Postpaid DELITE. DELITE carries no convenience charges while the other two have a convenience charge on the total spend of about 1-3%.

Key Features:

- Pay at Paym merchants & online partners

- Make bill payments or shop on Paytm Mall

- 30-day zero-interest repayment cycle

- Maximum limit of up to ₹60,000

- It helps to build a credit score

- Convenience fee applicable on MINI and LITE

- Check late repayment charges here

Offered by: Paytm (in partnership with Aditya Birla Finance, Clix Finance)

5. Amazon Pay Later

Amazon has its own Pay Later service in India, with IDFC First Bank and Capital Float as its lending partners. The e-commerce giant provides users with a zero-interest credit line based on their credit profile.

You can use Amazon Pay Later to purchase products on Amazon. You can also use the credit amount to pay for water, electricity, mobile bills, or buying groceries.

The amount can be paid by either 5th of next month or over EMIs ranging from 3 to 12 months. However, it requires you to set up auto-repayment, i.e., the amount will automatically deduct from your bank every month.

You can find Pay Later in the Amazon Pay section on the Amazon India app.

Key Features:

- Shop on Amazon with Pay Later

- Pay your mobile, water, electricity bills

- 30-day interest-free repayment cycle

- Maximum limit of up to ₹60,000

- Check detailed terms here

Offered by: Amazon India (in partnership with Capital Float/ IDFC First Bank)

Other Popular Pay Later Services in India

There are several other pay later services in India that can be useful for a lot of people. However, they have their own set of cons which is why we did not include them above.

1. Freecharge Pay Later

- Credit facility up to ₹5,000

- Use for payments on Freecharge or other merchants

- Monthly billing cycle

- Interest is levied on the amount used

- An annual fee of ₹199 is charged by Axis bank

2. Flipkart Pay Later

- It can be used to shop on Flipkart

- Up to 35-days of free credit

- Maximum limit of up to ₹70,000

- Provided in partnership with IDFC First Bank

- A usage fee of ₹10 on bill amounts greater than ₹1,000

3. Mobikwik Zip Pay Later

- Use Pay Later to pay bills and on brands associated with Mobikwik

- 15 days of Interest-free credit

- Get up to ₹30,000 limit

- One-time activation fee of ₹99

4. Pay Later by ICICI Bank

- Only for eligible existing ICICI Bank customers

- Pay bills, make payments to merchants using a UPI ID, or to shop

- Up to 45-day credit duration

- Can be accessed via the iMobile app, net banking, and ICICI Pockets

5. Ola Money Postpaid

- Use Postpaid to pay for Ola Cabs

- Accepted over 300+ apps

- Discounts and offers

- Bill generated every 15 days

- No additional charges

Things to Know Before Using Pay Later Apps

Before using these BNPL apps, keep the following things in mind:

- Buy Now Pay Later should be used only when you can repay in time, not for free money.

- Your eligibility to get a credit line is based on your credit score, relationship with these apps, and other factors.

- Delaying the repayment can cost you a hefty late payment fee and unwanted charges, including an exorbitantly high-interest rate.

- Missing even a single payment can reduce your credit score, impacting your future ability to take loans.

- Most of the pay later services will appear as loans in your credit report. Opening too many of them can impact your credit score.

- Do not fall prey to the shady instant loan or credit line apps online.

Wrapping Up- Enjoy Free Credit Line with Pay Later Apps

These were some of the best buy now pay later (BNPL) apps you can use in India. Out of all, my favorites are Amazon Pay Later and LazyPay. Anyways, which one do you like? Do you prefer credit cards or BNPL services? Let me know in the comments below. Stay tuned for more such articles.

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.