Quick Answer

- While the scheme is rolling out gradually across the country, here is how you can upload a GST bill and apply for a reward under the Mera Bill Mera Adhikaar Scheme.

- Launched by the Government of India on September 1, 2023, the Mera Bill Mera Adhikaar portal encourages consumers to upload legitimate business-to-consumer (B2C) invoices for purchases of products or services falling under the GST regime by offering prize money of up to ₹1 crore.

- Under the Mera Bill Mera Adhikaar Sheme, the Indian Government will distribute the following rewards to the consumers uploading a qualified bill on the portal.

Launched by the Government of India on September 1, 2023, the Mera Bill Mera Adhikaar portal encourages consumers to upload legitimate business-to-consumer (B2C) invoices for purchases of products or services falling under the GST regime by offering prize money of up to ₹1 crore. Today, in this read, we will guide you through what the scheme is about and how you can apply for the scheme to win rewards.

What Is a Qualifying Bill or Invoice?

As per the Mera Bill Mera Adhikaar scheme, a qualifying bill or invoice to apply for the reward money is of the following characteristics:

- The bill should not be dated earlier than 1 September 2023.

- It must be a business-to-consumer (B2C) transaction.

- Must have supplier’s GSTIN, Invoice Number, Invoice Date, Tax Amount, and Total Value of Invoice.

- The business or seller issuing the invoice must be registered in a state or UT implementing the reward scheme.

What Is the Reward Under the Mera Bill Mera Adhikaar Scheme?

Under the Mera Bill Mera Adhikaar Sheme, the Indian Government will distribute the following rewards to the consumers uploading a qualified bill on the portal.

| Frequency | No. of Prizes | Prize Money |

|

Monthly

|

800 | ₹10,000 |

| 10 | ₹10,00,000 | |

| Quarterly (Bumper Draw) | 2 | ₹1,00,00,000 |

How to Upload GST Bill on Mera Adhikaar Portal?

While the scheme is rolling out gradually across the country, here is how you can upload a GST bill and apply for a reward under the Mera Bill Mera Adhikaar Scheme.

You can upload invoices dated after 1 September 2023 only.

Method 1 – Use the Mera Bill Mera Adhikaar App

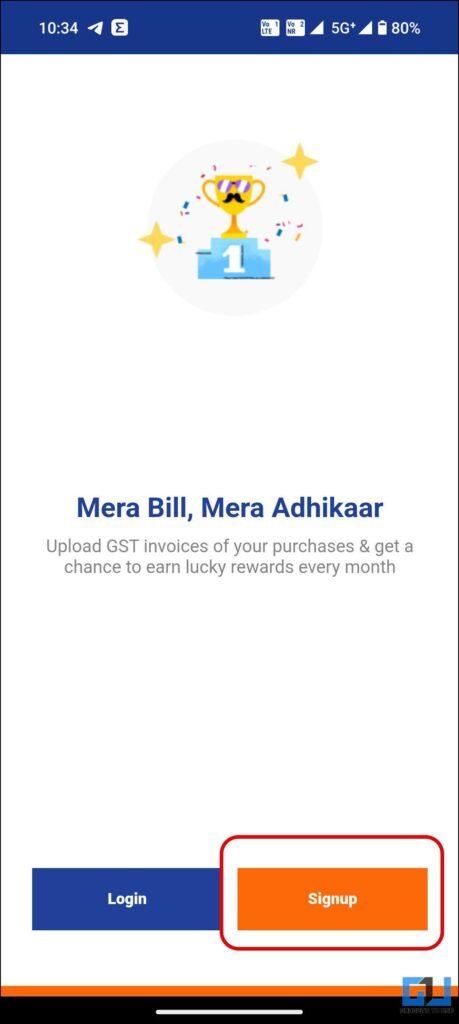

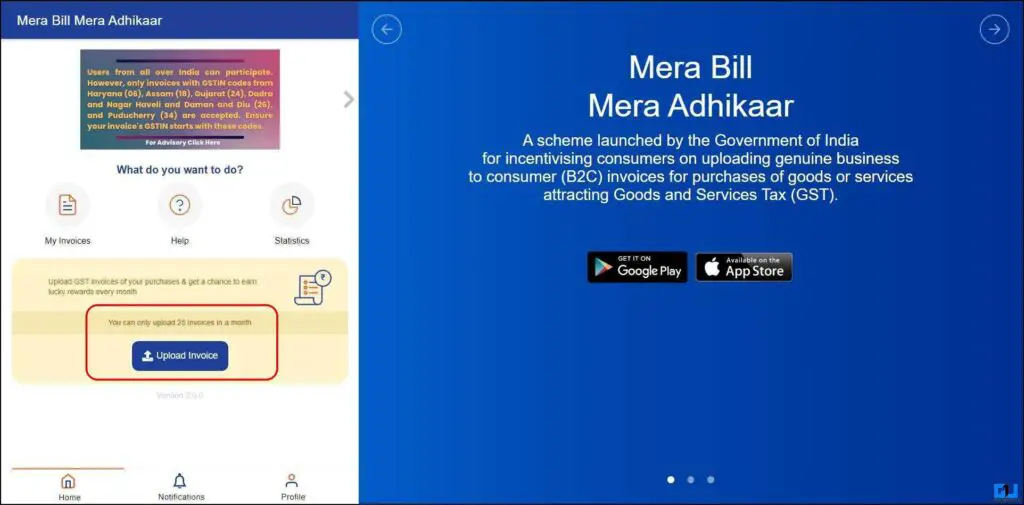

1. Install the Mera Bill Mera Adhikaar app (Android, iOS) on your phone and scroll through the setup screen.

2. Tap Signup to create a new Mera Bill Mera Adhikaar portal account.

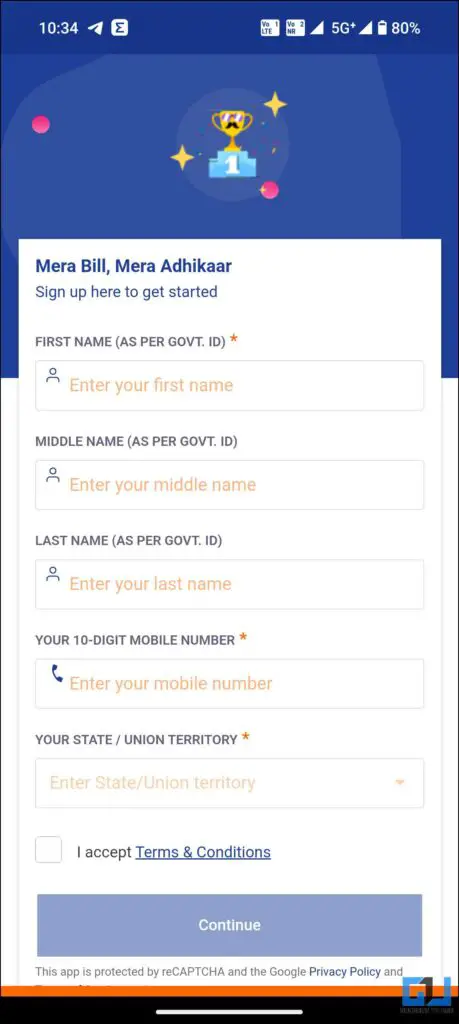

3. Fill in the following details:

- First, middle, and last name as per Government ID,

- Your 10-digit mobile number

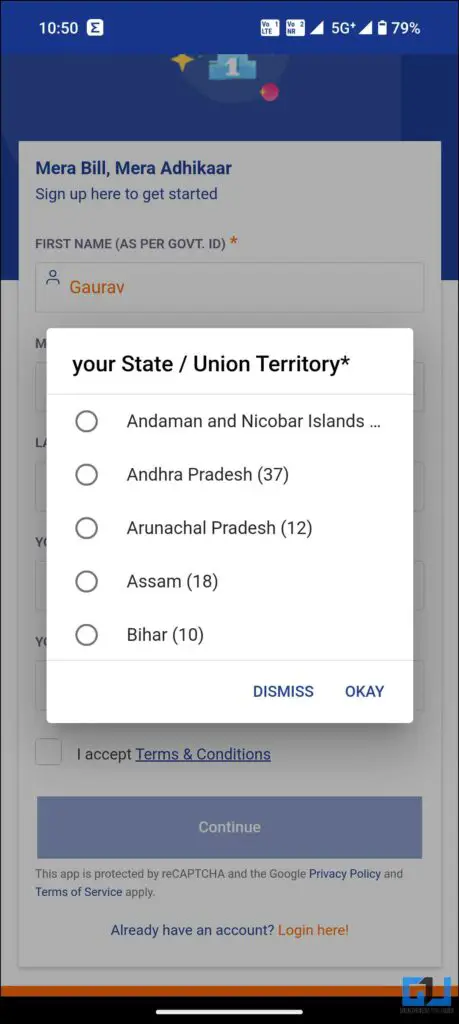

- Your State / Union Territory from the

4. Accept the terms by checking the box and tap Continue.

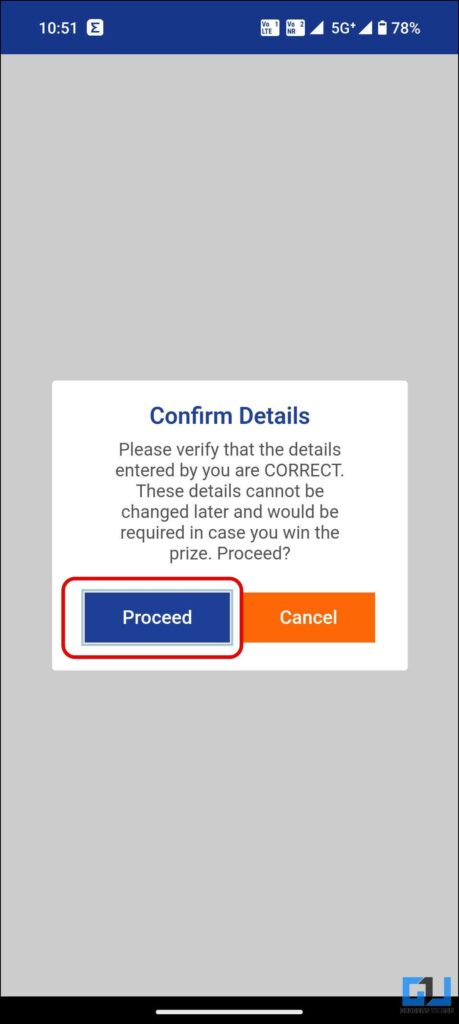

5. When prompted, tap on Proceed to confirm your details.

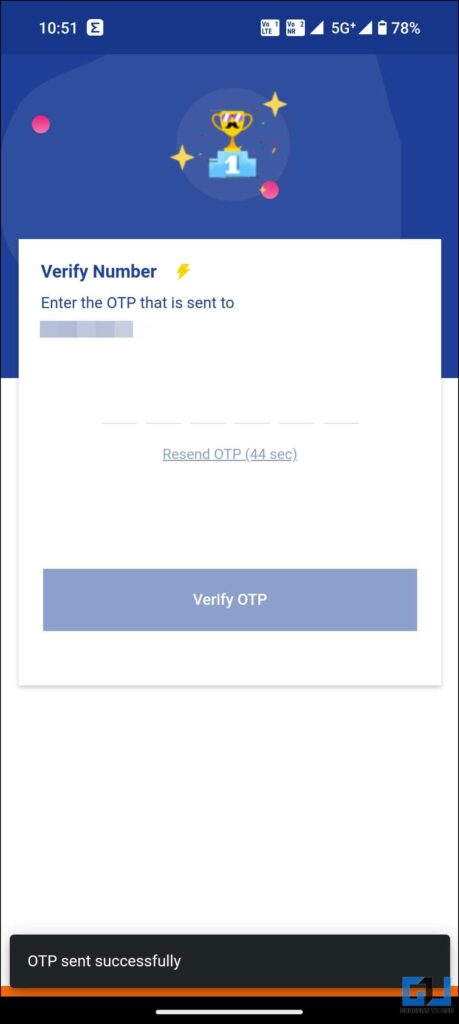

6. Enter the OTP to verify your number.

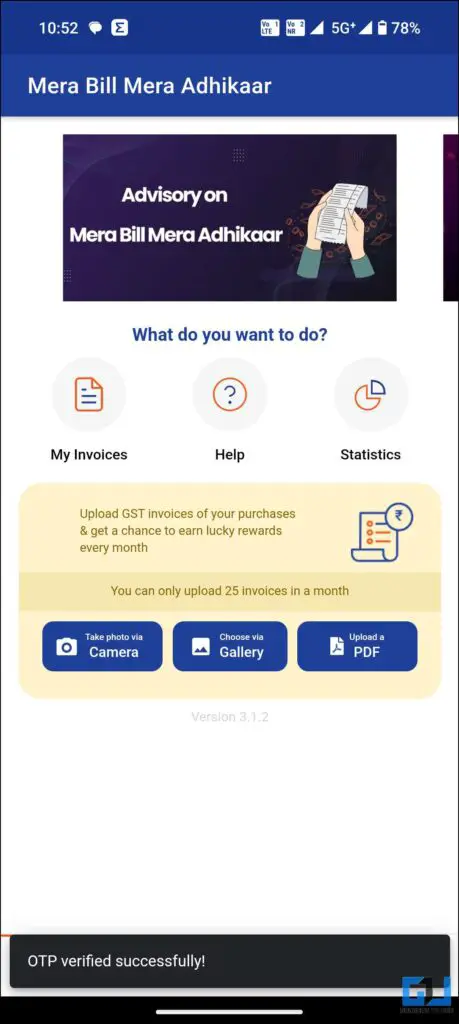

7. Once on the dashboard, you can upload a qualified bill using any of the following means:

- Click a Picture – You can click a picture of a qualifying bill directly from the app. This works for offline purchases for grocery, dairy products, food supplies, cafes or coffee shops, restaurants, etc.

- Upload Image From Gallery – You can upload a picture of the bill from your phone’s gallery. It gives the flexibility of easy uploading and does not require the physical bill receipt to be present at the time of submission.

- Upload PDF – This can be useful for online shopping bill receipts received on registered email or for the digital receipts of a nearby cafe or restaurant.

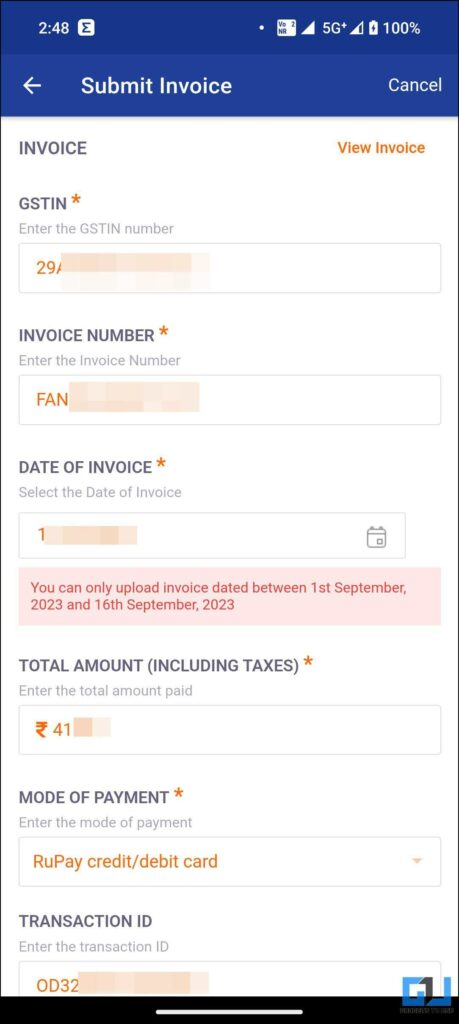

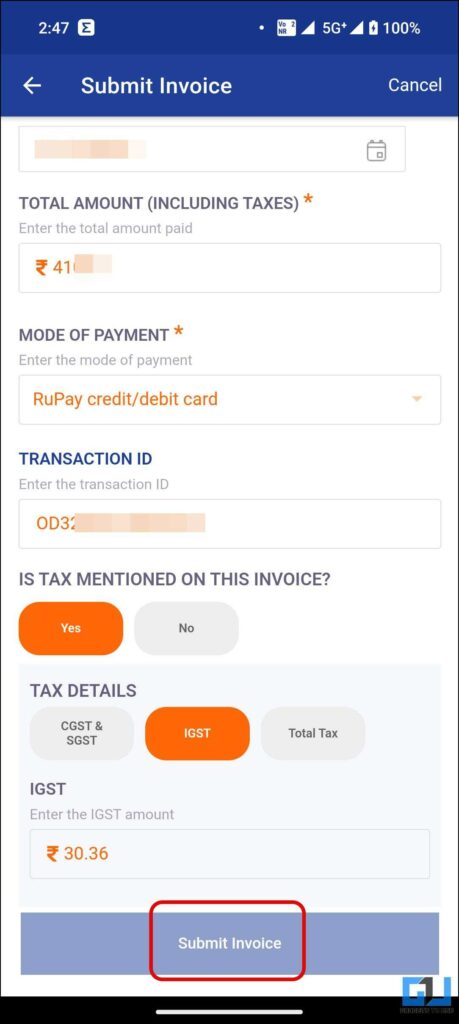

8. Once uploaded, verify and correct the following details of the invoice:

- GSTIN

- Invoice Number

- Date of invoice

- Transaction ID

- Total Amount including Tax

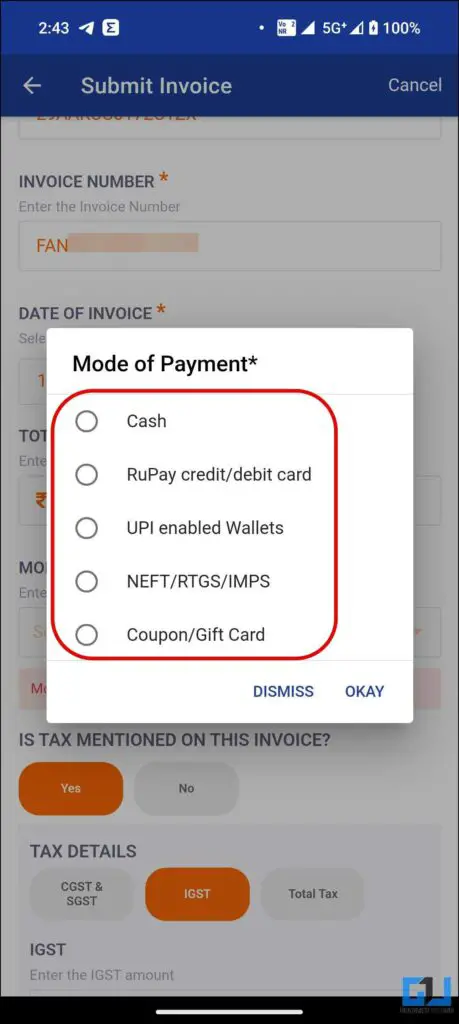

- Mode of Payment and more

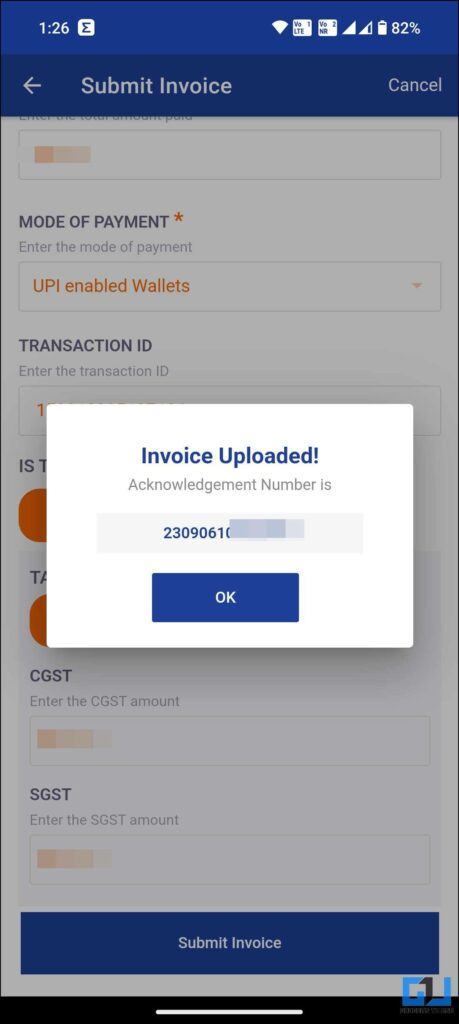

9. Tap the Submit button to file your entry for the claim.

Once the invoice is uploaded, you can see it under the “My Invoices” section of the dashboard. You can upload up to 25 invoices monthly, where the transaction amount must be a minimum of INR 200.

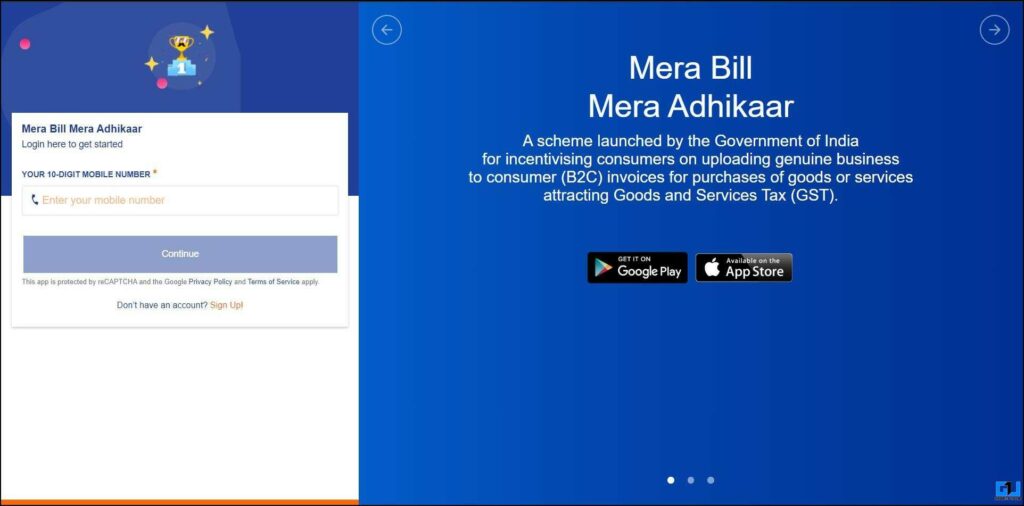

Method 2 – Use the Website

Similar to the app, you can upload a qualifying bill from the Mera Bill Mera Adhikaar web portal from a web browser. Here’s how it can be done.

1. Visit the Mera Bill Mera Adhikaar portal on a web browser and log in with your account using OTP verification.

2. Upload an eligible GST bill following the same process as the app.

The website does not offer an intuitive UI suitable for desktops, so for a better experience, either use the mobile app or your phone’s browser.

FAQs

Q. What Is the Mera Bill Mera Adhikaar Scheme? How Can I Participate in It?

The Government announced the Mera Bill Mera Adhikaar Scheme on September 1, 2023, to promote transparency and GST billing in financial transactions and track malpractices nationwide. Under this scheme, the government is offering lucky draw prizes of up to 1 crore to consumers uploading a valid and qualifying GDT bill on a monthly or quarterly basis. Follow the steps mentioned above to learn the participation process.

Q. What Type of Invoices Can I Upload for the Mera Bill Mera Adhikaar Scheme?

Only Business-to-consumer (B2C) GST invoices are accepted under the scheme. You can upload the following types of GST invoices or bills above INR 200 to apply for the lucky draw:

- LPG Gas Receipt

- School Fee (if it is B2C)

- Shopping bills (both online and offline)

- Groceries bills (both online and offline)

- Food, Drinks, and Restaurant bill

- Any other B2C transaction bill having a GSTIN, Invoice Number, Invoice Date, Tax Amount, and Total Value of Invoice.

Only GST invoices issued by sellers registered in states implementing the reward scheme are eligible.

Note: Petrol, Diesel, and CNG receipts are not included in this scheme, as GST is not levied on fuel in India.

Q. Is the Mera Bill Mera Adhikaar Scheme Available Across the Country?

Currently, the scheme is available in Assam, Gujarat, Haryana, and the Union Territories of Puducherry, Dadar and Nagar Haveli, and Daman and Diu. It will be rolled out to other states and union territories in the coming future.

Q. What Documents Are Required to Claim the Prize Money?

Winners must provide an original identity document, original bill, and any other required government document, as the government prescribes. The winner must preserve the hard copy of the invoice for verification purposes.

Q. How and When Will I Receive the Prize Money?

The winner will be notified through SMS, the Mobile App, and the web portal about his winning amount and other details. The reward will be credited directly to the winners’ bank accounts, and winners must update their PAN and bank details in the app or portal to claim the same.

Q. Do I Have to Pay Tax on the Reward Money Received Under the Mera Bill Mera Adhikaar Scheme?

Yes. As per the Income Tax Act 1961, windfall gains, lottery, and prize money are taxed at a flat rate of 30% and deducted at the source if the amount is above ₹10,000. So, such rewards will be taxed under income tax, and the government will deduct tax at the source, and only 70% of the total amount will be credited to the winner’s bank account.

Wrapping Up

While the scheme is limited to a few states and Union territories, it will expand to other states and union territories in the coming future. This portal not only helps to add a transparent layer to financial transactions across the country but will also act as a mechanism to crack down on unsolicited transactions invading GST. Stay tuned to GadgetsToUse for more such reads, and check the ones linked below.

You might be interested in the following:

- How to Claim Unclaimed Money in Bank Accounts in India Using UDGAM

- Top 4 Fitness Apps That Pay Rewards For Walking, Running in India 2022

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse YouTube Channel.