Quick Answer

- To start using Bharat Interface for Money all you need is a Smartphone, Internet access, an Indian bank account that supports UPI payments and mobile number linked to the bank account.

- Do I need to be a customer of a particular bank to use Bharat Interface for Money.

- Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Catholic Syrian Bank, Central Bank of India, DCB Bank, Dena Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, RBL Bank, South Indian Bank, Standard Chartered Bank, State Bank of India, Syndicate Bank, Union Bank of India, United Bank of India, Vijaya Bank are in the list of supported banks.

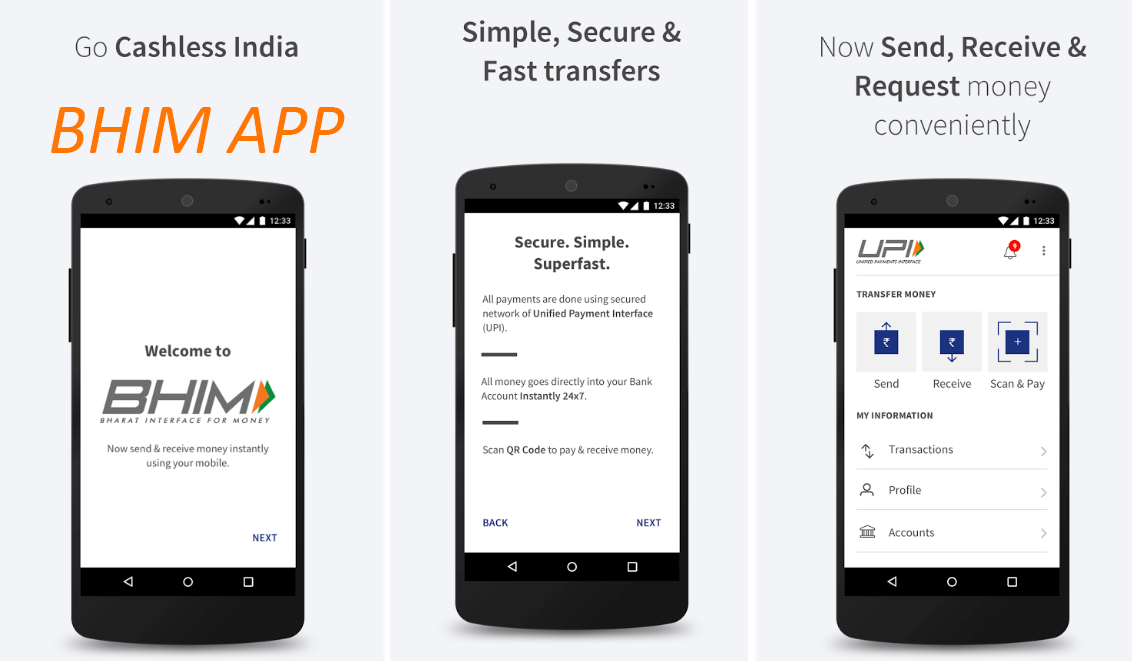

PM Narendra Modi recently introduced a new Aadhaar based mobile payment application called BHIM app for promoting payments through digital medium. BHIM is basically an app that lets you make easy and quick payment and transactions. BHIM (Bharat Interface for Money) application will enable you to have a fast, secure and trustworthy platform to make all the cashless payments through your mobile phones. BHIM is developed by National Payments Corporation of India (NPCI) which gives you a platform where you can link with other Unified Payment Interface (UPI) applications and banks.

Since it’s a new app, everyone has got a lot of questions regarding it. So here we have covered all the possible questions regarding BHIM app. So make sure you go through all the questions before setting up your BHIM account so that you don’t face any kind of trouble or issues

Recommended : 10 Things You Should Know Before You Use BHIM For Sending or Receiving Money

Question: What is BHIM (Bharat Interface for Money)?

Answer: BHIM (Bharat Interface for Money) is an app that lets you make easy and quick payment transactions using UPI. Its easier than Wallets. You will not have to fill-out those tedious bank account details again and again. You can easily make direct bank to bank payments and instantly collect money using just Mobile number or Payment address.

Question: What are the supported banks on BHIM app.

Answer: Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Catholic Syrian Bank, Central Bank of India, DCB Bank, Dena Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, RBL Bank, South Indian Bank, Standard Chartered Bank, State Bank of India, Syndicate Bank, Union Bank of India, United Bank of India, Vijaya Bank are in the list of supported banks.

Also Read: 10 Things You Should Know Before You Use BHIM For Sending or Receiving Money

Question: What is the transaction limit currently ?

Answer: Maximum of Rs. 10,000 per transaction and Rs. 20,000 within 24 hours is the transaction limit as of now.

Question: How fast is a transaction over Bharat Interface for Money ?

Answer: All payments over Bharat Interface for Money are linked to your bank account and transaction can be completed within few seconds.

Question: Are there any charges for using Bharat Interface for Money?

Answer: There are no charges for making transaction through BHIM as of now. However make note that your bank might charge a nominal charge as UPI or IMPS transfer fee. Please check with your bank for more details.

Question: What do I need to start using Bharat Interface for Money?

Answer: To start using Bharat Interface for Money all you need is a Smartphone, Internet access, an Indian bank account that supports UPI payments and mobile number linked to the bank account. Link your bank account to UPI through the app.

Question: Is Bharat Interface for Money app compatible with every Mobile OS?

Answer: BHIM app is currently available on Android (Android 4.4 and above) only. It will be soon coming on other platforms including iOS and Windows.

Question: Do I need to enable mobile banking on my bank account to use Bharat Interface for Money?

Answer: Your account need not be enabled for mobile banking to use BHIM. Your mobile number must have to be registered with the Bank.

Question: Do I need to be a customer of a particular bank to use Bharat Interface for Money?

Answer: To enable transfers directly using your bank account, your bank needs to be live on UPI (Unified Payment Interface) platform. All the banks, which are currently live on UPI, have been listed in the Bharat Interface for Money app.

Question: How do I set the UPI-PIN for my bank account from Bharat Interface for Money?

Answer: You can set your UPI PIN by going to Main Menu >Bank Accounts >Set UPI-PIN for the selected account. You will be prompted to enter the last 6 digits of your Debit/ATM card along with the expiry date. You will then receive an OTP which you will enter and set your UPI PIN. Please note that UPI-PIN is not the same as MPIN provided by your bank for mobile banking.

Question: Can I link multiple bank accounts with Bharat Interface for Money?

Answer: Currently, BHIM supports linking of one Bank only. At the time of account set-up, you can link your preferred bank account as the default account. In case you want to link another bank account, you can go to Main menu, choose Bank Accounts and select your default account. Any money that is transferred to you using your mobile number or payment address will be credited into your default account.

Question: Why does my mobile number with Bharat Interface for Money and the one registered with my bank account have to be the same?

Answer: This is a banking network (UPI) requirement. The mobile number which is used to register with BHIM is used to match the bank accounts linked against it.

Question: Do I have to give Bharat Interface for Money my bank a/c details?

Answer: At the time of registration you have to provide Debit card details and with the use your mobile number registered to your bank account, the app will pre-fetch the details from your bank. All the information exchange happens over secure banking networks and it doesn’t get stored so your information is safe.

Question: Can I send money to anyone using Bharat Interface for Money?

Answer: Yes, you can send money using the BHIM app from your UPI enabled bank account. You will need to register and set a UPI PIN using the debit card details linked to the bank account. If your beneficiary’s bank account is also linked to UPI, you can simply use their mobile mobile number or Payment Address to transfer. If not, you can use IFSC code, Bank account or MMID , Mobile number to send money.

Question: Do money transfers happen on Bharat Interface for Money only during banking hours?

Answer: All payments are instant and open for 24×7, regardless of your bank’s working hours.

Question: What if I don’t receive anything even after paying for my transaction.

Answer: Once you complete a transaction, you should see a success status on the Bharat Interface for Money screen and receive an SMS from your bank. In some cases due to operator issues it can take longer time. In case you have not received your confirmation within an hour please contact our customer support at your bank.

Question: How can I view my transaction history?

Answer: Go to BHIM Home Screen >Transaction History. to view all your past and pending transactions.

Question: How do I send money?

Answer: From the BHIM app home screen,

1) Click Send Money Option

2) Enter or select the receiver’s mobile number or Payment Address (you can select from your contact list or enter it) or Aadhaar number

3) Enter the amount you want to send

4) Your default bank a/c gets selected

5) Enter UPI PIN and send

Alternately, you can also scan a QR code and pay via the ‘Scan & Pay’ option.

Question: How to request money?

Answer: From the BHIM app Home screen,

1) Select Request Money

2) Enter or select the receiver’s mobile number or Payment Address (you can select from your contact list or enter it) or Adhaar number

3) Enter the amount you want to request

4) Click Send

This transaction will remain pending until the payment is received. You will be notified when the money is transferred to you. You may also request money by sharing your QR code. Goto Home Screen>Profile>Choose account to get QR code

Question: Can I send money to a friend not on BHIM?

Answer: Yes. Payment can be made via IFSC, Account number, MMID or Mobile number if the person is not registered on BHIM.

Question: What types of transactions can I do using Bharat Interface for Money?

Answer: Through BHIM you can make following type of transaction,

1. Request or Send Money via Payment Address

2. Send Money to Aadhaar Number

3. Request or Send Money to Mobile number

4. Send Money through MMID , Mobile No.

5. Send Money through IFSC code, Account No.

6. In addition, you can use the scan and pay option for Merchant payments.

Question: How will I know if my UPI transaction is successful?

Answer: For any transaction, you will see a status instantly on your screen. If for some reason the transaction is delayed or pending, the result will be posted on your Transaction History page along with a UTR or bank reference number. In addition you will receive an SMS from your bank.

Question: What is UPI?

Answer: Unified Payment Interface(UPI) is an instant payment system developed by the National Payments Corporation of India (NPCI), an RBI regulated entity. UPI is built over the IMPS infrastructure and allows you to instantly transfer money between any two parties bank accounts.

Recommended: Unified Payment Interface (UPI) – FAQ, Recommended Apps

Question: What is an UPI-PIN?

Answer: UPI-PIN (UPI Personal Identification Number) is a 4-6 digit secret code you create/set during first time registration with this App. You have to enter this UPI-PIN to authorize all bank transactions. If you have already set up an UPI-PIN with other UPI Apps you can use the same on Bharat Interface for Money.

Question: Can I change my UPI address?

Answer: Yes, you get an option to create your customized UPI address. By default your UPI address is your registered mobile number. For example if your mobile number is 97381xxxxx, your default UPI address will be 97381xxxxx@upi which can be changed later.

![[Fixed] Cant Open Images and Photos in Windows 11](https://gadgetstouse.com/wp-content/uploads/2024/10/Windows-11-lmages-not-opening-Fixed.png)