Quick Answer

- So if you are a creator whose a large part of the audience is from the US, you should get ready for a few dollars less from the monthly earnings from now on.

- Since India and the US have a tax treaty relationship, this makes the tax rate for Indian YouTubers 15% of the earnings from the views in the US.

- For example, you make a total of 1000$ from YouTube, and out of those 100$ is from the US views, then you’ll have to pay only 15$ if you provide tax info on time.

If you are a YouTuber outside the US then this is something for you. Google will start deducting 24% tax from your YouTube earnings from June 2021 if you do not provide your tax details. Google will deduct taxes on earnings from the US on your video and it will include earnings from ad views, YouTube Premium, Super Chat, and channel memberships, etc. But you know what? You can avoid paying this much tax to Google by providing tax details before May 31, 2021. Here’s more on the YouTube tax policy update.

Also, read | YouTube Channel Got Hacked? Here’s How to Get It Back

YouTube Tax Policy Update

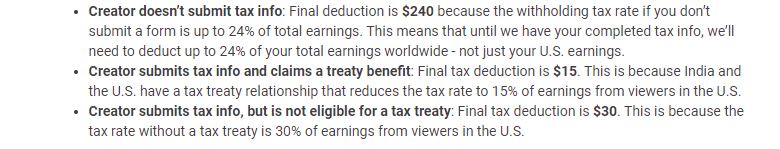

Google has recently sent out notifications to its creators outside the US that they need to provide their tax info by May 31, 2021 otherwise Google will start deducting 24% of your overall earnings. This will not be applicable to creators based in the US.

📣 Attention creators!

If you’re a monetizing creator outside of the U.S., like India, important tax changes are coming later this year that may affect your YPP earnings ⚠️

Find out what’s happening, and what you need to do, below ⬇️

— YT Creators India (@YTCreatorsIndia) March 10, 2021

According to Google’s support page, “all monetizing creators on YouTube, regardless of their location in the world, are required to provide tax info. Please submit your tax info as soon as possible. If your tax info isn’t provided by May 31, 2021, Google may be required to deduct up to 24% of your total earnings worldwide.”

Here are the further details regarding the new YouTube tax policy.

Why is YouTube asking for tax info?

As per Google, Creators based outside the US are subject to US tax withholding because they are earning from the US views. So there should be deductions from their monthly earnings from the US. So Google is asking for tax info from creators worldwide.

To be noted, that you won’t have to pay tax for your earnings from worldwide views. Google will levy taxes only on your money that came from the US views.

What will be deducted after providing tax info?

After providing tax info, creators from outside the US will be liable to a withholding tax rate of 0-30% based on their location from US-based viewers. After you submit your tax information, you can check the exact tax withholding rates that may apply to your earnings under the “United States tax info” section of the Payments.

How much deduction from Indian Youtubers?

Since India and the US have a tax treaty relationship, this makes the tax rate for Indian YouTubers 15% of the earnings from the views in the US. For example, you make a total of 1000$ from YouTube, and out of those 100$ is from the US views, then you’ll have to pay only 15$ if you provide tax info on time.

Also, for other countries, the final tax deduction is 30% of the earnings from US viewers. As without a tax treaty, the tax rate is 30% from the US earnings.

How to provide tax info to Google

Remember to provide your tax info by May 31, 2021 otherwise get ready for the deduction of up to 24% from your total earnings.

You can follow the below steps to submit your U.S. tax info to Google.

- Sign in to your AdSense account.

- Go to Payments and click Manage settings and look for Payments profile.

- Now click on the pencil icon next to “United States tax info” and select Manage tax information.

- Here, you’ll find a guide to fill the appropriate form for your tax info.

Please note that you may have to re-submit tax info every three years. This is due to requirements by the IRS of the US government.

Suggested | Google May Delete Your Google Account After June 1, 2021: How to Stop It

This was all about the YouTube tax policy update. So if you are a creator whose a large part of the audience is from the US, you should get ready for a few dollars less from the monthly earnings from now on.

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.