Quick Answer

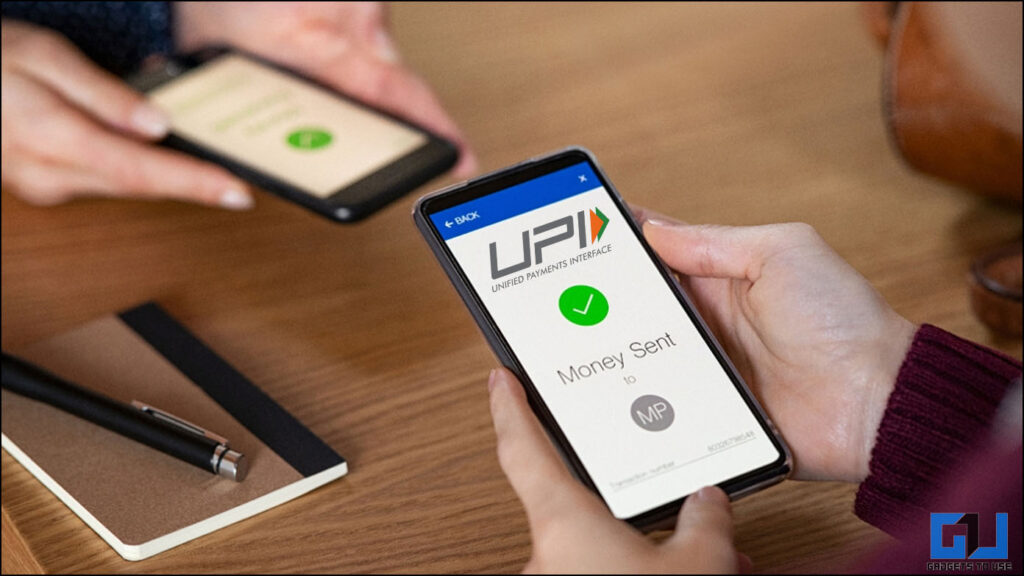

- As we can conveniently pay almost anywhere in the country by either scanning the QR code, paying on the registered number, or even using a tap to pay using an NFC-enabled phone.

- With that said, let’s have a look at the current UPI transaction and amount limit currently in use, in the country by NPC, banks and UPI platforms.

- Back in 2020 NPCI, came up with a directive to impose a 30% UPI transaction share cap, for Third-Party App Providers (TPAP), to prevent concentration risk.

UPI has turned out to be a blessing for digital payments in India. As we can conveniently pay almost anywhere in the country by either scanning the QR code, paying on the registered number, or even using a tap to pay using an NFC-enabled phone. However, this convenience might go away soon as the NPCI along with RBI is planning to introduce a UPI transaction limit soon. Read on to know more.

Why NPCI is Limiting UPI Transactions?

PhonePe, Google Pay, and Paytm collectively hold more than 90% of the UPI payments in India. Back in 2020 NPCI, came up with a directive to impose a 30% UPI transaction share cap, for Third-Party App Providers (TPAP), to prevent concentration risk. However, a two-year extension was given to the limit to comply with the directive.

Now, in November 2022, after the extension period is over, NPCI has again come up with the directive. And in talks with RBI to implement it from December 31, 2022. This might result in PhonePe, Google Pay, Paytm, and BHIM to transaction limits soon. While according to reports, PhonePe has already asked for a minimum three-year extension of the December 31 deadline, and some other platforms want a five-year extension. We should get more clarity about the situation, by end of November or early December.

FAQs

With that said, let’s have a look at the current UPI transaction and amount limit currently in use, in the country by NPC, banks and UPI platforms.

What is the Maximum Amount one can transfer via UPI?

According to the National Payments Corporation of India (NPCI) the body governing all UPI payment platforms. The upper limit per UPI transaction is Rs.2 Lakhs, subject to the limit of the UPI platform and the user’s bank.

What is the Maximum Number of UPI transactions in a day?

Ideally, the maximum number of UPI transactions allowed by NPCI is 20 transactions per day. However, it varies subject to the limit of the UPI platforms like PhonePe, Google Pay, Paytm, and the user’s bank.

What is the UPI Transaction Limit of PhonePe, Google Pay, Paytm, and BHIM?

In the case of the Third Party Applications (TPAPs) the UPI Transaction limit right now is as follows:

- PhonePe – 20 transactions per day.

- Google Pay – 10 transactions per day.

- Paytm – 5 Transactions per hour, and 20 transactions per day.

- BHIM – 10 transactions per day.

What is the UPI Transaction Amount Limit of PhonePe, Google Pay, Paytm, and BHIM?

In the case of the Third Party Applications (TPAPs) the UPI transaction amount limit right now is as follows:

- PhonePe – INR 1,00,000 per day.

- Google Pay – INR 1,00,000 per day, including tap-to-pay.

- Paytm – INR 1,00,000 per day, and INR 20,000 per hour, including tap-to-pay.

- BHIM – INR 1,00,000 per day. While for new users, it is INR 5,000 up to the first 24 hours.

What is the Maximum UPI Amount Limit as per different Banks?

In most cases, the upper limit for UPI transaction value, is INR 1,00,000 per day. However, the maximum amount per transaction might differ based on your bank, you can check this list to get more details or get in touch with your bank.

Can I use Multiple UPI apps on the same mobile if they are linked to different bank accounts?

Yes, one can use more than one UPI application on the same mobile and link both either to the same account or use different bank accounts.

How to Increase the UPI Transaction limit?

It is not possible to increase the UPI transaction limit. Since it is mandated by NPCI, and all UPI platforms like PhonePe, Google Pay, Paytm, and BHIM, along with banks must follow it.

How to Increase the UPI Transaction Amount limit per day?

It is not possible to increase the UPI Transaction amount limit per day. Since it is mandated by NPCI, and all UPI platforms like PhonePe, Google Pay, Paytm, and BHIM, along with banks must follow it.

Wrapping Up

In this read, we discussed why NPCI is limiting UPI transactions, and how it will be implemented. We also discussed the current transactions and transaction value limit, across banks, UPI platforms, and as per NPCI. I hope you found this useful if you did share it with someone who uses UPI on daily basis. Check out other useful tips linked below, and stay tuned to GadgetsToUse for such tech updates, tips, and tricks.

Also, Read:

- What Is UPI Lite? How to Use It on Your Phone?

- Top 4 Best Zero-Balance Neobank Apps in India with Pros & Cons (2022)

- How to Configure or Cancel Autopay in Paytm for Paying Bills

- How to File a Complaint to RBI Ombudsman for Bank Not Refunding Money

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse YouTube Channel.