Quick Answer

- In case you have made a wrong UPI transaction, read our guide to get a refund for the wrong UPI transaction.

- The UPI Lite might sound like a cut-down version of UPI, but it offers a new set of features over UPI.

- You can add balance to this UPI Lite wallet anytime you want, and then use the amount of this wallet to pay for something.

After the success of UPI, the NPCI (National Payments Corporation of India) officially launched UPI Lite on 20th September 2022. UPI Lite’s objective is to reduce the burden on banks, while also speeding up the transaction time, and making it more accessible across the country. Today we will walk through what is UPI Lite, its features, and how to use it. Additionally, you can read how to make offline UPI payments.

What is UPI Lite?

In layman’s terms, you can call UPI Lite a Paytm wallet but for UPI. You can add balance to this UPI Lite wallet anytime you want, and then use the amount of this wallet to pay for something. Such transactions won’t reflect in your bank passbook and help you maintain a healthy account. Trust me, your CA will love this. It is limited to the BHIM app only, but NCPI stated it would be rolled out to Paytm UPI Lite, PhonePe, and Google Pay soon.

Features of UPI Lite

The UPI Lite might sound like a cut-down version of UPI, but it offers a new set of features over UPI. These features will help to add more people to the UPI world and give a boost to the digital payment structure of India.

- Allows to do recurring small payments under INR200.

- It can hold a maximum of INR 2000, with no daily limit of wallet top-up.

- RuPay Credit Cards can be linked to UPI ID.

- No PIN is required for the transaction (only the app PIN is required).

- UPI ID, Phone Number, or QR Code can be used to pay.

- Partially works offline, as the sender can pay without the internet as well.

How to Use UPI Lite?

Now, that we have seen the features UPI Lite offers, let’s check how to activate and use it on your phone. It can be activated from the BHIM app on your Android phone or iPhone. Here’s how:

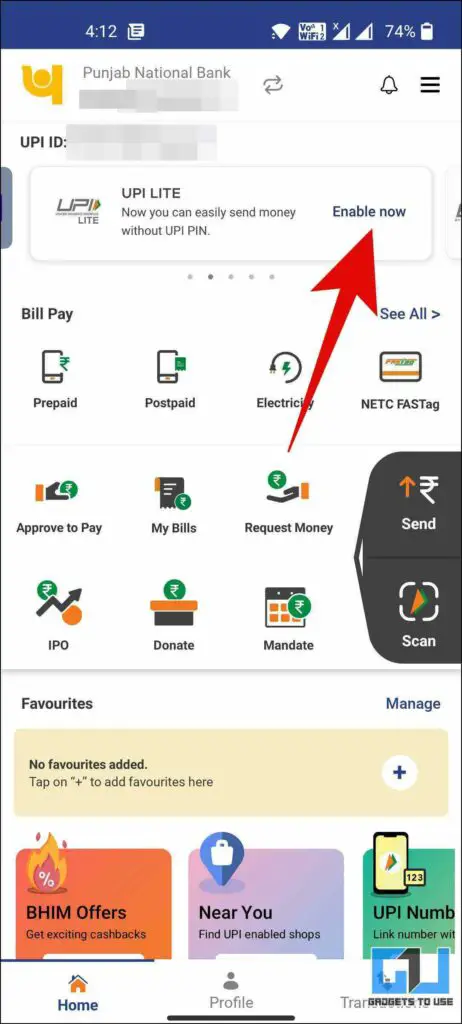

1. Launch the BHIM App (Android, iOS) on your phone.

2. Click the Enable Now, button from the banner at the top. If the banner does not appear for you, make sure to update the app to the latest version, close the app, and re-launch it.

3. Navigate through the welcome screen, and check the box to agree on terms and conditions. Now, tap on Enable Now.

4. Choose your bank, from the list.

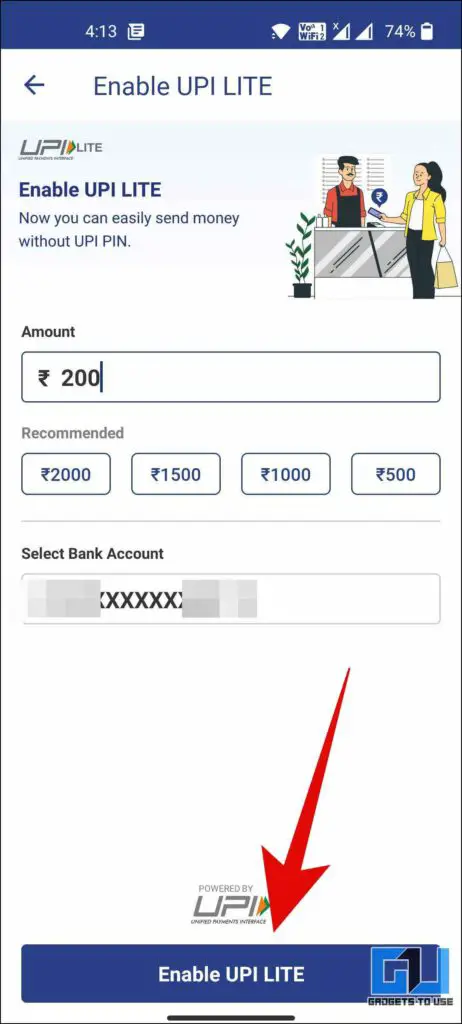

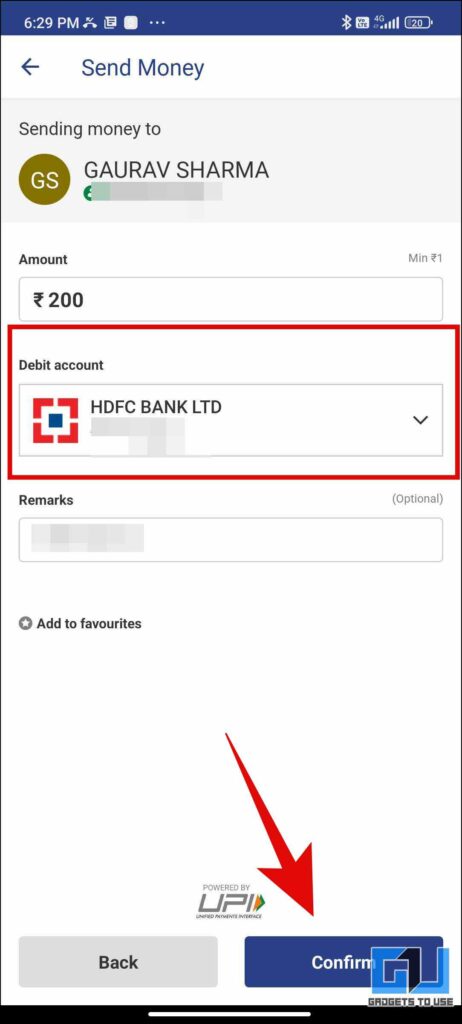

5. Now, choose from the available options to add money to your Wallet. Tap on Enable UPI Lite and enter your UPI PIN.

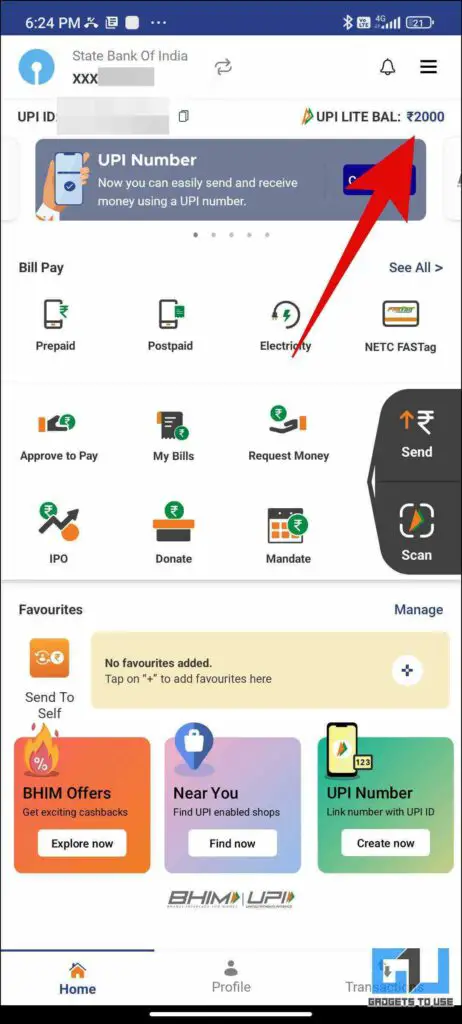

6. Your balance will be visible on the home page.

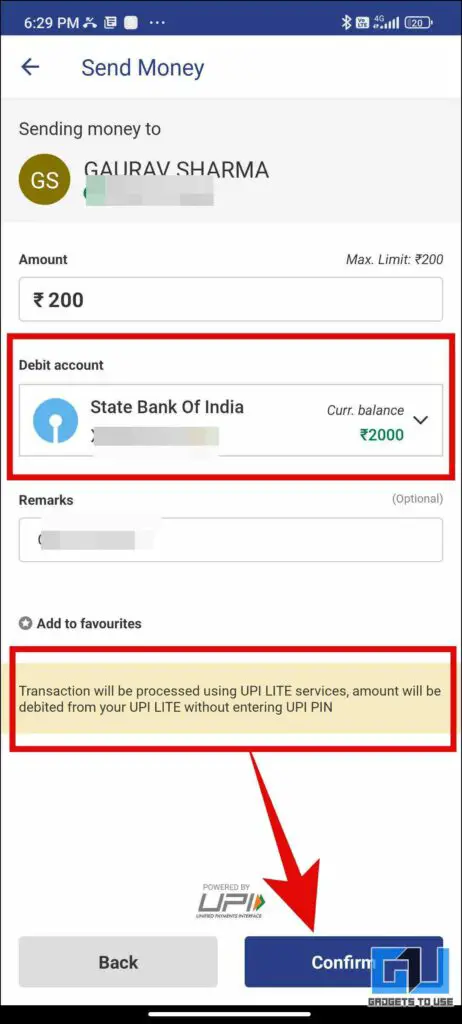

7. For transactions under INR 200, you will be asked to pay via UPI Lite. However, if you wish to pay via normal UPI, you can simply use another bank.

FAQs

Q: Why can’t I see Enable UPI Lite on the BHIM app?

A: Make sure you’re using the updated BHIM app, and your bank is in the supported list for UPI lite. The supported banks are, Canara Bank, HDFC Bank, Indian Bank, Kotak Mahindra Bank, Punjab National Bank, State Bank of India Union Bank of India, and Utkarsh Small Finance Bank.

Q: Can I use my RuPay Credit Card for UPI Lite?

A: Yes, It does support RuPay Credit cards, the support is expanding to RuPay cards of all banks.

Q: Can I top up the UPI Lite Wallet balance more than once in One day?

A: Yes, you can add INR 2000 as many times in a day to your wallet.

Q: Why can’t I Pay more than INR 200 via UPI Lite?

A: The maximum transaction amount supported is INR 200, and it won’t ask for your UPI PIN.

Wrapping Up

In this read, we discussed what is UPI Lite, its features, and how to use it on your phone. In case you have made a wrong UPI transaction, read our guide to get a refund for the wrong UPI transaction. I hope you found this useful; if you did, make sure to like and share it. Check out more tips linked below, and stay tuned for more helpful guides.

Also, Read:

- How to Use UPI Lite X to Make Offline Payments on Your Phone

- 3 Ways to Pay LIC Premium Online Via UPI Apps (Paytm, GPay, Phone Pe)

- [FAQ] UPI Payments Transaction Limit per Day and Upper Limit

- How to Pay via Paytm Wallet on Amazon and Flipkart?

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse YouTube Channel.