To make money withdrawal from ATMs more secure and digital, NCR Corporation, a firm that makes ATMs, has announced a cardless cash withdrawal system in India. This announcement comes after the Reserve Bank of India (RBI) proposed making Interoperable Cardless Cash Withdrawal (ICCW) facilities available in ATMs. So from now on, you will be able to withdraw money from an ATM without a card using UPI apps like GPay.

Currently, cardless cash withdrawal is offered by a few banks like SBI at their own ATMs for their customers only.

Also, read | How to Make Offline UPI Payments (without Internet) on Your Phone

What is interoperable cardless cash withdrawal?

Using the new interoperable cardless cash withdrawal facility, customers won’t need debit or credit cards to withdraw cash from ATMs. There is no clarity on how exactly this process will work. There are reports and speculations that all ATMs will soon start showing an option to withdraw money using UPI.

Which banks have a cardless cash withdrawal facility?

Currently, cardless cash withdrawal is available only to a few banks, including State Bank of India (SBI), HDFC, ICICI, and Punjab National Bank (PNB). The first bank to enable this feature is SBI which, however, uses its own app YONO instead of any UPI app.

How to withdraw money using UPI apps?

With the help of this new technology, users will be able to withdraw money using any UPI-based app like BHIM, Paytm, GPay, etc., and they won’t need a physical card. Here’s how this process will work:

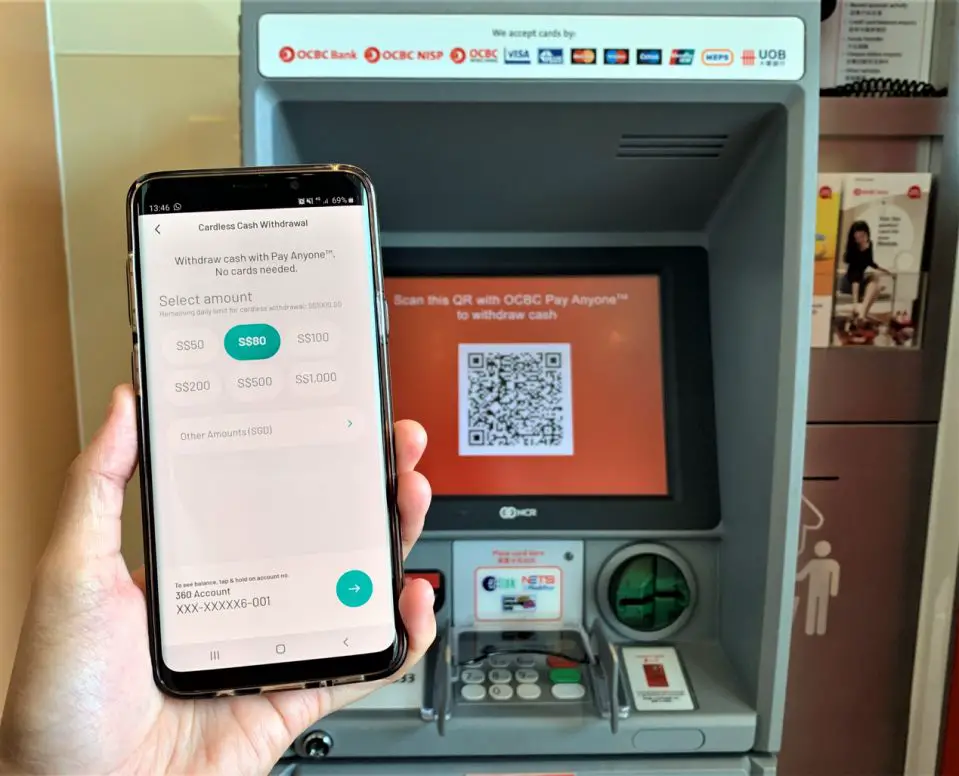

1. Go to the ATM that supports the cardless withdrawal facility.

2. Tap on the Cardless Withdrawl option and then click on UPI.

3. A QR will appear on the ATM screen. Scan the QR code via any UPI app on your phone.

4. Now, enter the amount you want to withdraw.

5. Then, authorize the transaction on the UPI app and enter your UPI PIN.

Once the transaction is approved, the cash will be withdrawn from the machine.

Some Important Points

i) Initially, you can withdraw any amount under Rs 5,000 under this new technology. However, this is likely to be increased later.

ii) QR codes are dynamic, so they’ll change with each transaction and cannot be copied.

iii) You’ll have to scan a new QR code whenever you want to withdraw cash.

When will this facility be available for all?

The NCR Corporation and the NPCI are currently working on how to implement this facility across all the ATMs in the country. They are also in talks with public and private sector banks, and a formal announcement about the same might come in the next couple of months.

So these are the two ways to withdraw money from an ATM without a card. Soon you will be able to use this facility on all bank ATMs in India.

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.