Quick Answer

- Online banking has eased out money transfers, with the introduction of UPI it can reach out to the masses, as we can easily scan a simple QR code, or transfer it to a phone number linked to a UPI, with the added benefit to withdraw money from ATM via UPI.

- Tap on Raise a Concern to fill in details online, or you can tap on Call bank to convey it over the phone via the toll-free number.

- If you have made a UPI transaction to the wrong person via the BHIM UPI app, then you follow these steps to report the same.

Online banking has eased out money transfers, with the introduction of UPI it can reach out to the masses, as we can easily scan a simple QR code, or transfer it to a phone number linked to a UPI, with the added benefit to withdraw money from ATM via UPI. Unfortunately, it’s also quite common to make a transaction to the wrong account. And therefore, we will guide you to get a refund in case wrong UPI, or bank transfer, and take legal steps if needed.

How to Get a Refund for Wrong UPI Transaction

If you have made a UPI payment to the wrong account, then you can report it from the instant alert on your phone via text. In case you have not received the text, you can report the transaction via the UPI app as well. We have covered the steps to report a transaction across all major UPI apps like Paytm, BHIM, Google Pay, and PhonePe.

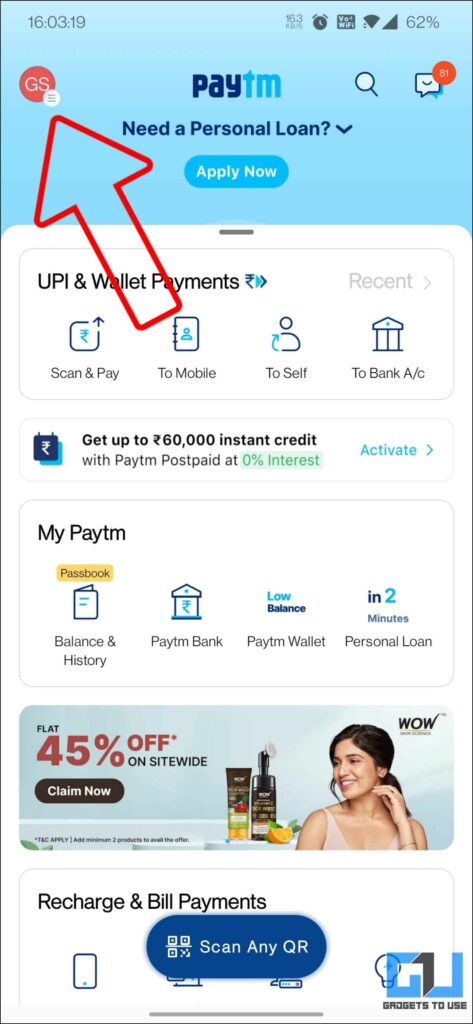

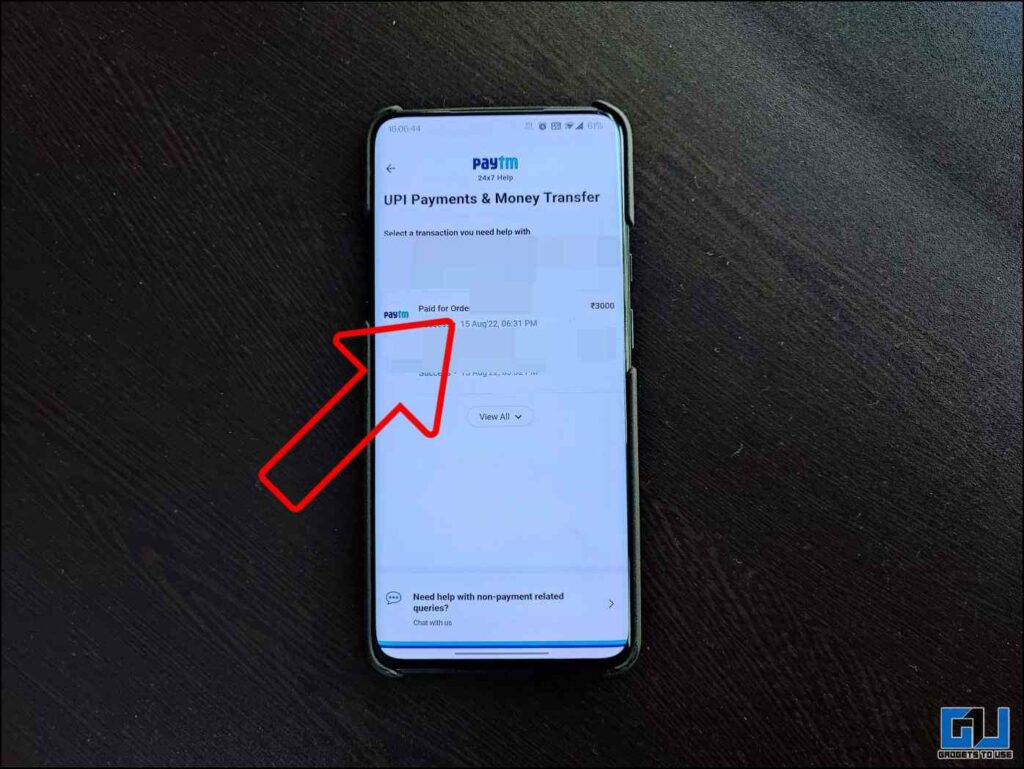

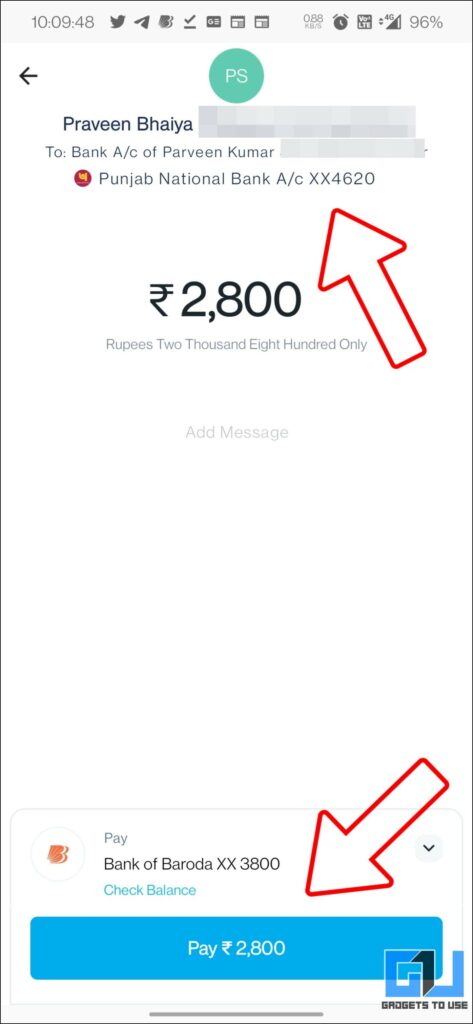

Steps to Report and Get Refund Via Paytm UPI

If you have sent funds to the wrong person via Paytm, you should reach out to the person directly and ask him to return your funds. In case you are not able to reach the person, you can contact the receiver’s bank to get his details for direct coordination. And if you are unable to talk to the receiver, contact Paytm through their 24×7 Help section as shown below.

1. Tap on the profile picture menu from the top left.

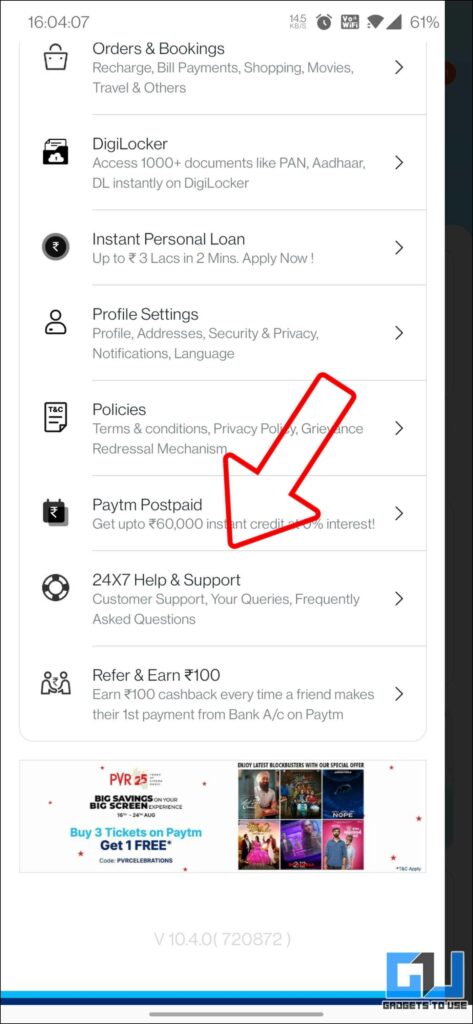

2. Scroll down, and tap on 24×7 Help and Support.

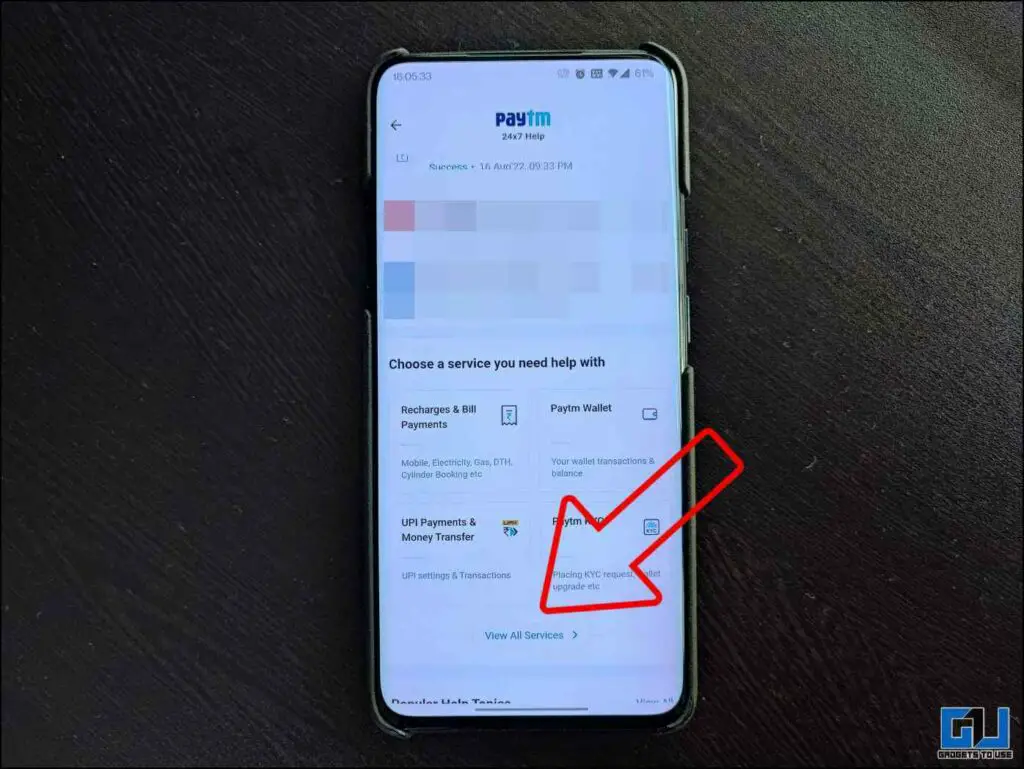

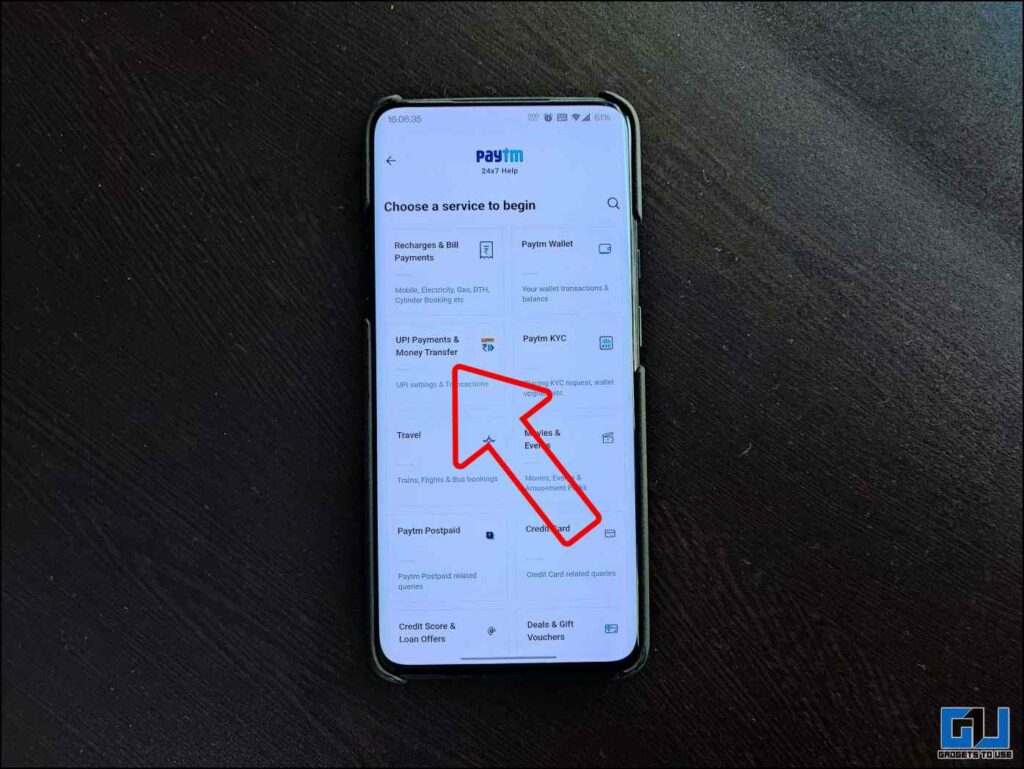

3. Now, again scroll down and click on View All Services. Go to UPI Payment & Money Transfer.

4. Here, select the wrong transaction you want to report a complaint for.

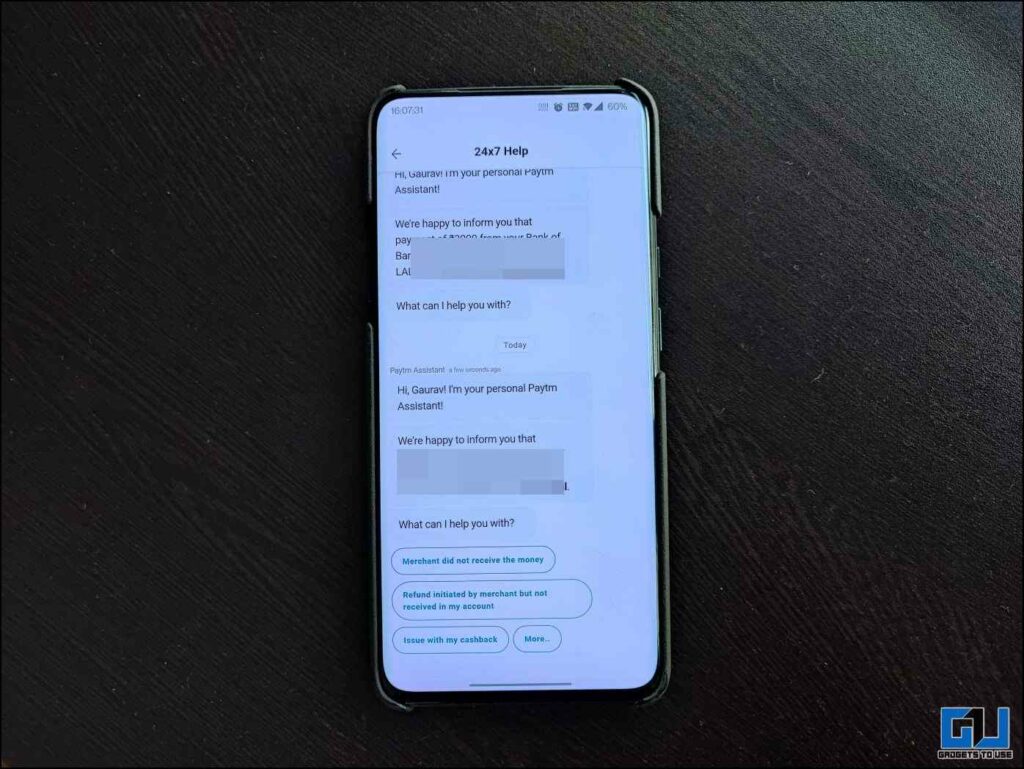

5. Now, you can start a chat with the Paytm Assistant, to lodge a complaint and initiate the refund process.

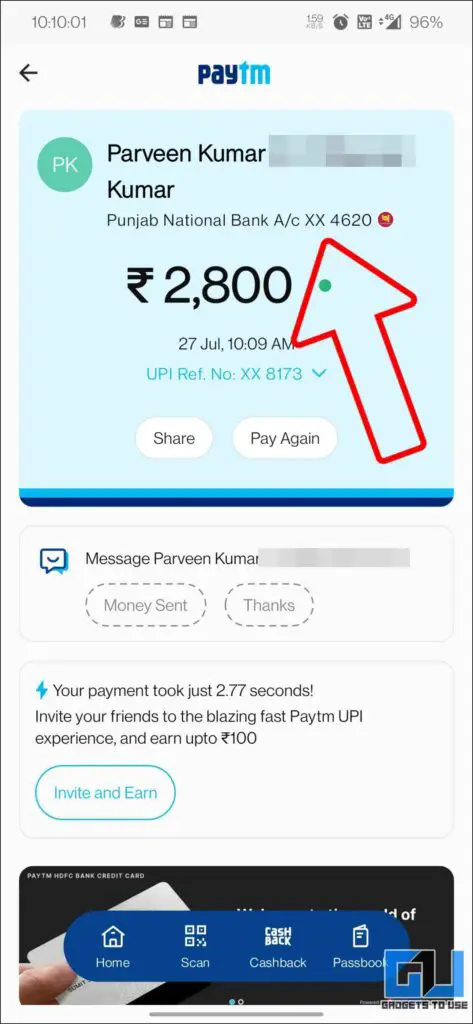

The Paytm team will help you as follows:

- Payment made to Wrong Paytm Wallet, Payment Bank – If the receiver has an account with Paytm, i.e., either Paytm wallet or Paytm Payments Bank account, the Paytm team would try to contact the receiver and on obtaining consent, shall reverse the amount back to you.

- Receiver does not have a Paytm account- If the receiver does not have an account with Paytm, the team would approach the receiver’s bank and they shall coordinate with him. If the receiver gives consent, funds are transferred back to your account immediately.

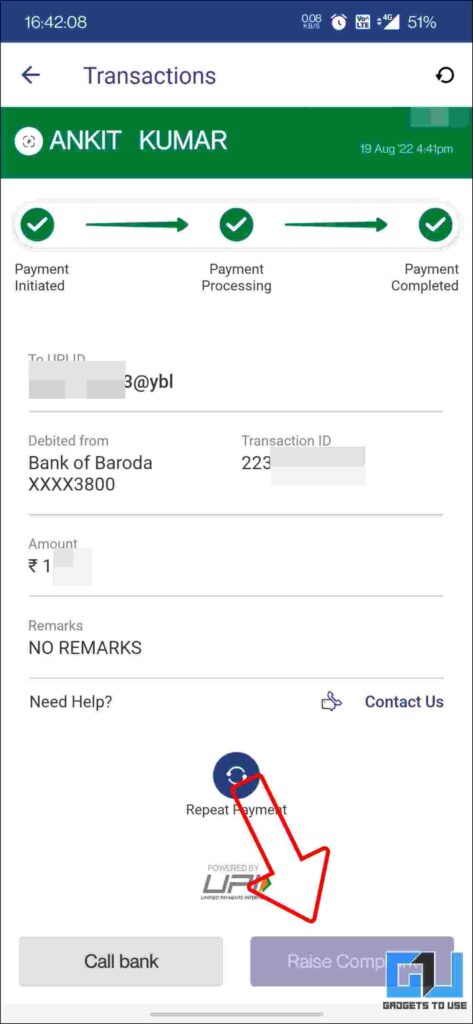

Steps to Report and Get Refund Via BHIM UPI

If you have made a UPI transaction to the wrong person via the BHIM UPI app, then you follow these steps to report the same:

1. Tap on Hamburger Menu (three lines) from the top right.

2. Go to Raise Complaint.

3. Select the transaction you want to report a complaint for.

4. Tap on Raise a Concern to fill in details online, or you can tap on Call bank to convey it over the phone via the toll-free number.

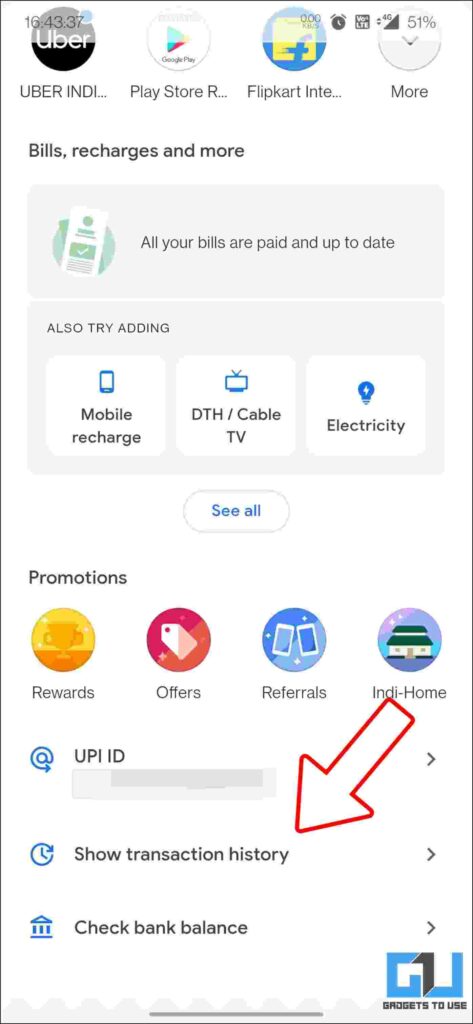

Steps to Report and Get Refund Via Google Pay UPI

With Google Pay used globally, it is the preferred mode for most people to transact with friends and family. If you have made a UPI transaction to the wrong person via the Google Pay app, then it can be reported by following these steps:

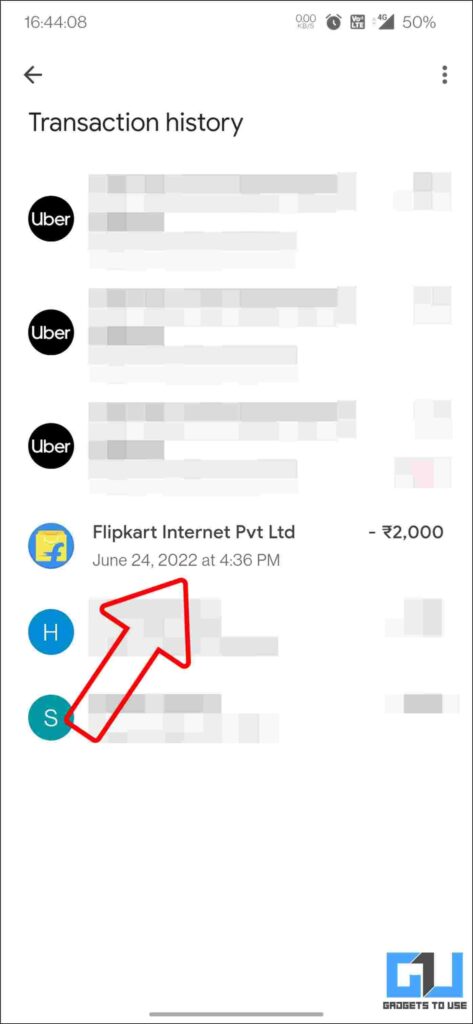

1. Launch Google Pay on your Phone.

2. Scroll down and click on Show all transaction history, and select the transaction you want to report a complaint for.

3. Now, tap on the Having issues button located at the bottom. (It will show up after two days from the transaction date).

Steps to Report and Get Refund Via PhonePe UPI

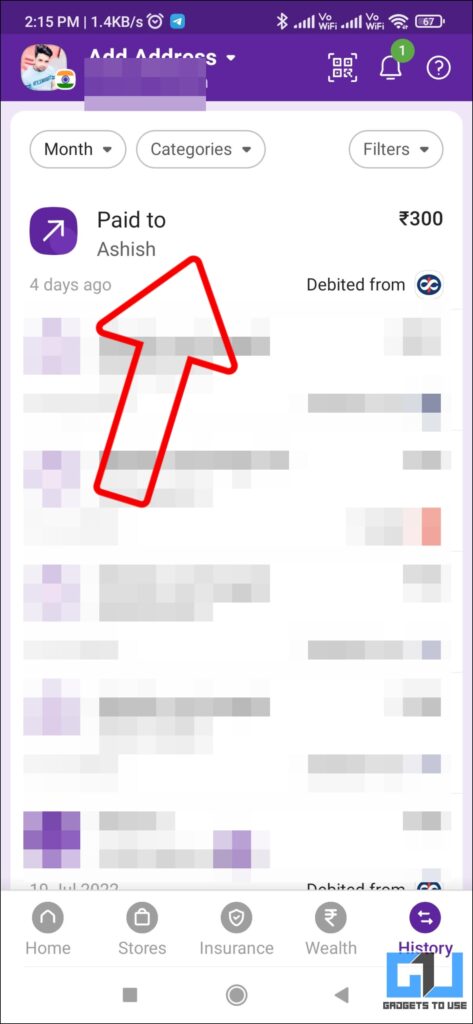

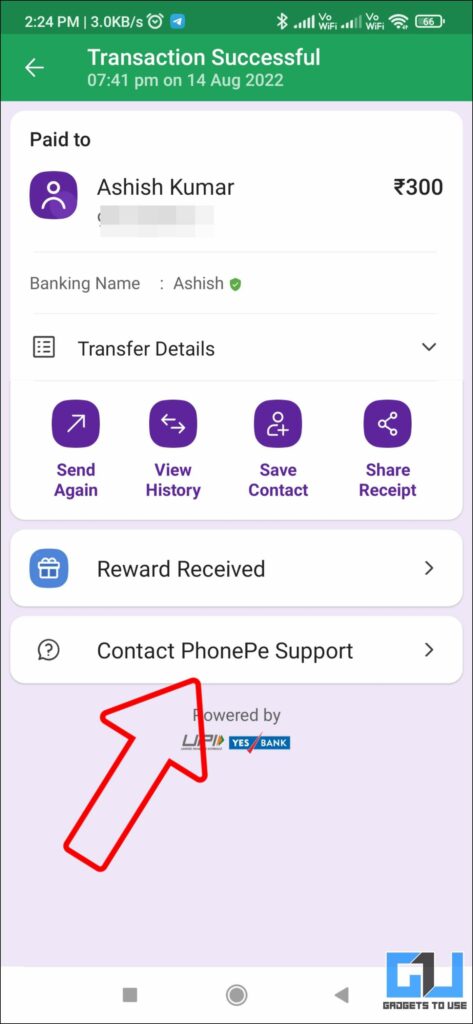

In case you have made a UPI transaction to the wrong person via the PhonePe app, then it can be reported by following these steps:

1. Launch the PhonePe app on your phone.

2. Tap on the History button from the bottom bar.

3. Select the transaction you want to report a complaint for.

4. Now, click on Contact PhonePe support to start a chat with the PhonePe help support to lodge a complaint and initiate the refund process.

How to Get Back money in case of Wrong Money Transfer Via Bank?

In case you have made a fund transfer to the wrong account, directly via your bank account and want to get back the money, as follows:

When Account Details Entered “Does not Exist”

If the details like MMID, mobile number, or account number, you have made the transfer to do not exist at all, then your money will automatically be transferred into your account. In case the account number exists, you will have to take immediate action, by contacting your bank manager.

When Account Number Entered Exists

If the account number you have made the transfer to belongs to someone, who is not the legal recipient of the amount, then you need to follow these steps:

1. Immediately inform your bank about the transaction within 3 days from the transaction date, with the following details, to prove that you transferred the fund to the wrong. In some cases, you might even need to visit your branch.

- Transaction date and time,

- Your account number and

- Account number of the recipient

- Take Screenshots as a proof

2. If the amount has been credited to an unintended beneficiary’s account who has the name same as your intended beneficiary, you will have to provide proof to support that the transfer made was wrong.

3. To document the process and regular status updates, write a detailed mail about the matter to the bank.

4. Since the bank acts as an intermediary or a facilitator, it can provide you details like the branch name and contact number of the wrong recipient.

5. In the case of:

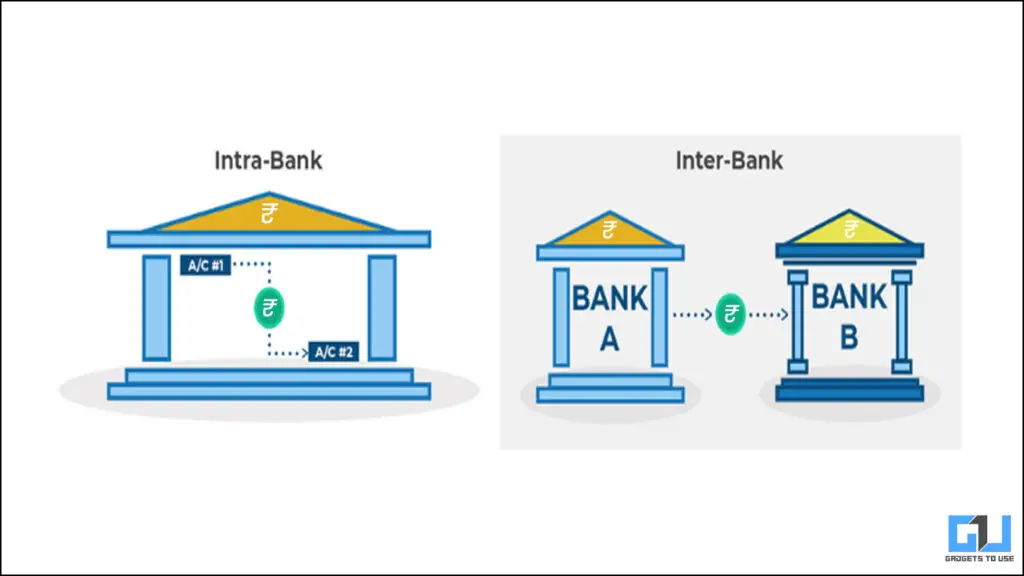

- Intra-bank transfer, i.e., within the same bank, your bank may approach the recipient on your behalf, and request for a reversal of the transaction.

- In case of transfer to another branch or bank, you have to personally visit the branch to meet the bank manager to resolve the matter. The recipient’s branch will request the other party for a reversal of the transaction.

6. Once the beneficiary agrees, the transaction will be reversed back within 7 working days.

If Beneficiary Refuses to Refund the Amount of Wrong UPI or Bank Transaction

It is not possible to reverse the transfer without the permission of the wrong beneficiary, and nearly impossible to retrieve the funds. In such a case you will need to take the legal step as follows:

File Legal Complaint in Case of Wrong UPI Transaction

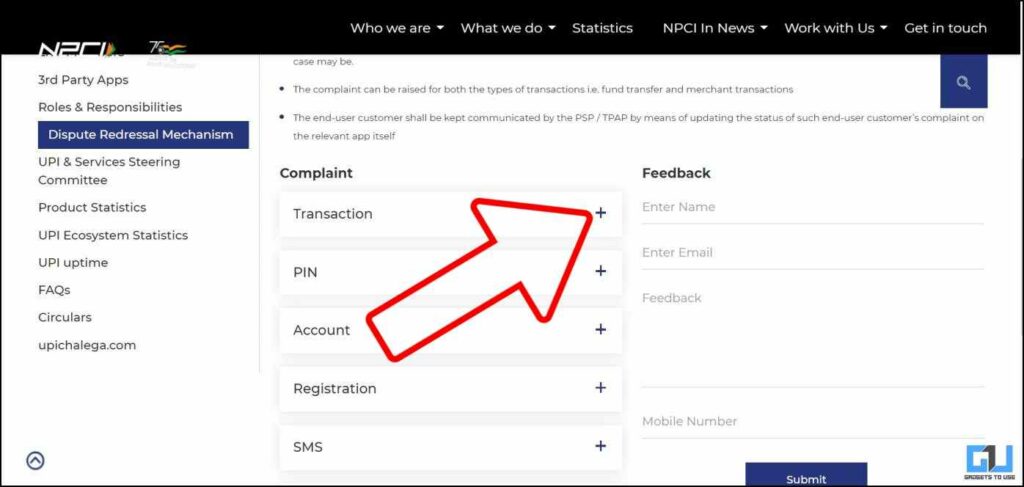

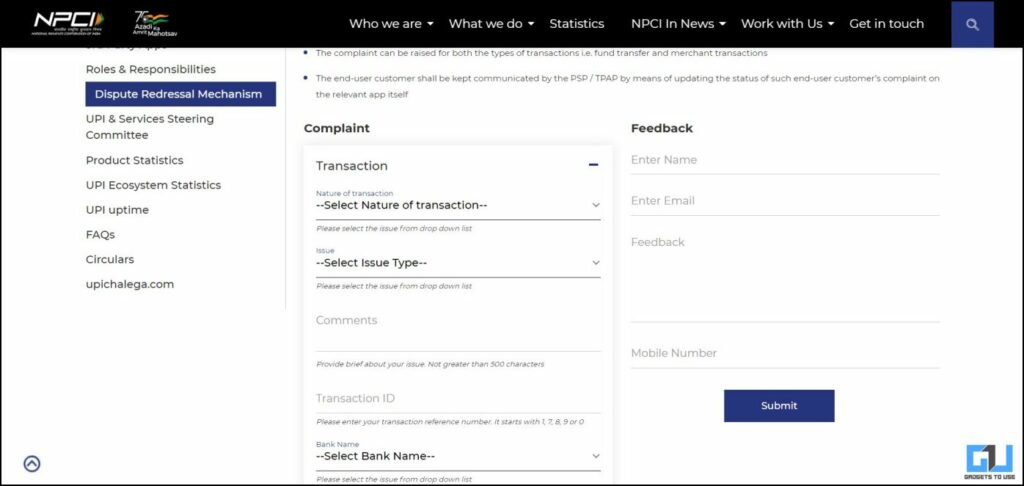

In case of a UPI transaction where the wrong recipient of the amount refuses to reverse the transaction or any other case, you can file a complaint, on the NCPI website. Here’s how:

1. Visit the NCPI website on your phone’s or computer’s browser.

2. Under the Dispute Redressal mechanism, scroll down and expand the Transaction tab.

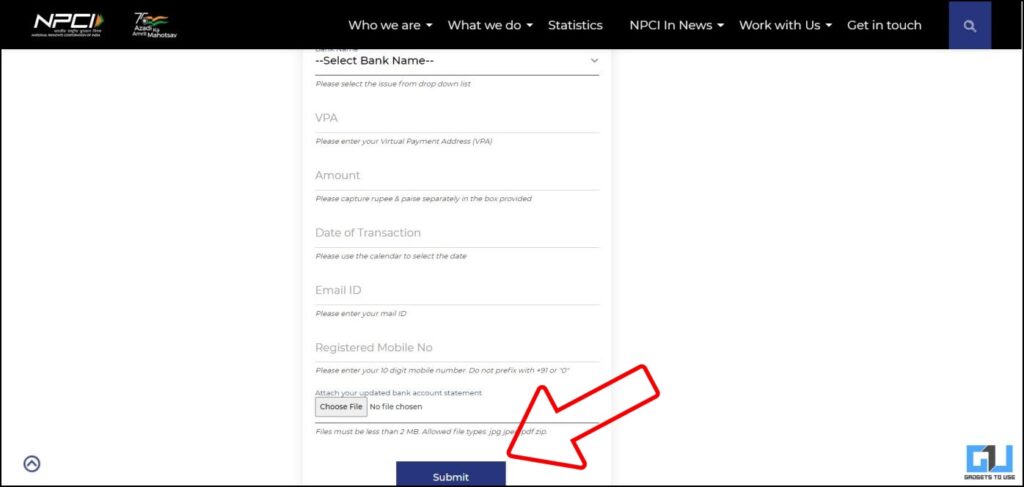

3. Enter details like the Nature of transaction, issue, transaction ID, Bank, Amount, date of transaction, email ID, and mobile number.

4. Attach your bank account statement and click on Submit.

File Legal Complaint Against Bank

As per the RBI (Reserve Bank of India) notification dated October 14, 2010, any bank is generally expected to match the name and account number information of the beneficiary before affording credit to the account. However, in the case of India with many different ways in which beneficiary names can be written, it becomes extremely challenging to perfectly match the name field, which leads to longer transaction time.

So the responsibility to provide correct inputs in the payment instructions, particularly the beneficiary account number information, rests with the payment payer (remitter/originator). While the beneficiary’s name shall be compulsorily mentioned, the reliance will be only on the account number for the purpose of affording credit.

And if the credit has been afforded to a wrong account, banks need to establish a robust, transparent, and quick grievance redressal mechanism to reverse such credits and set right the mistake and/or return the transaction to the originating bank.

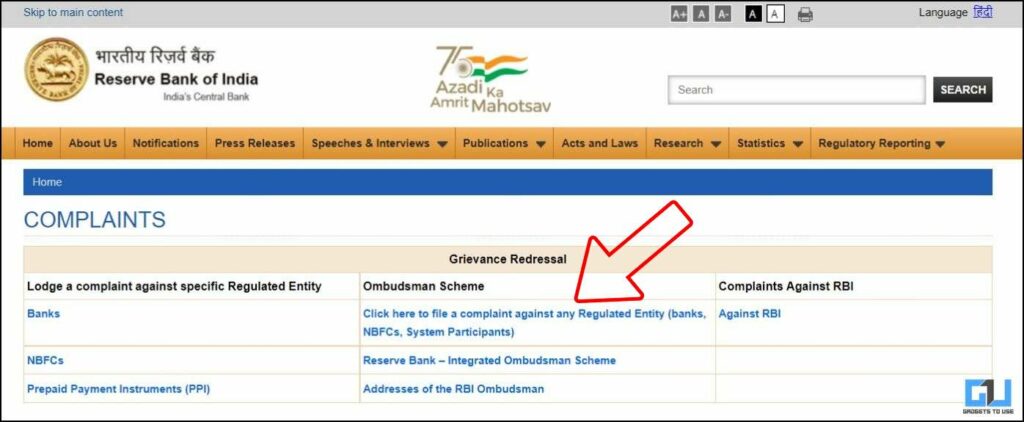

However, if the bank commits a mistake, and non-receipt of reply within 30 days, or whole or partial rejection of complaint by the bank, you can file a complaint against it on RBI’s website as follows:

1. Visit the RBI website on a browser to register a complaint.

2. Choose “Click here to file a complaint against any Regulated Entity.”

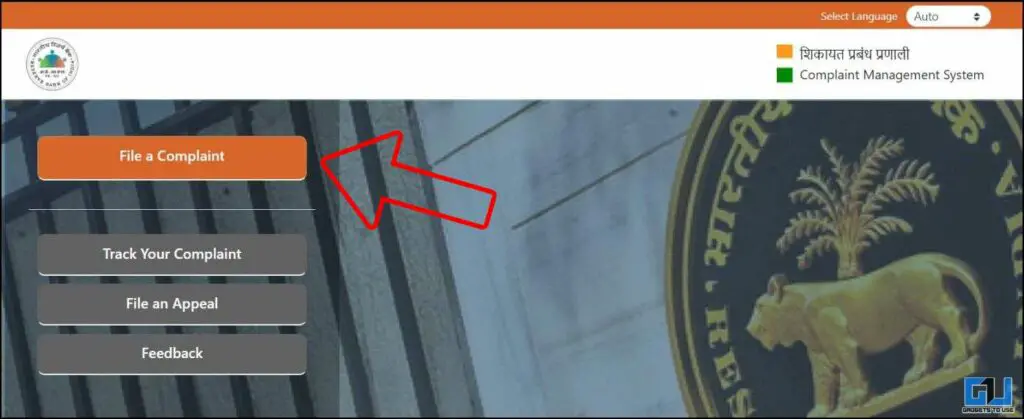

3. Click on File a Complaint and fill in details.

File A Complaint in Consumer Court

If you still don’t get a resolution for the issue of your money transfer to a wrong account via UPI or bank transaction, then you can file a consumer complaint via the online portal. Check out our guide to filing a complaint in the consumer court of India.

Things to Take Care of While making a UPI Transaction

You should take care of the following things while transferring any sum of money through UPI or via Bank:

1. Try to pay via contact number in case of UPI.

2. Always cross-check the verified details like Name, UPI ID, Bank Name, and Account number

3. Always do a test payment for new transactions.

Online Transaction Safety Tips

- Avoid calls or emails from fraudsters. Don’t engage with an unknown person.

- Keep Net Banking, and UPI PIN and passwords secret.

- Change banking app/ net banking, mobile phone, and email account passwords periodically.

- Disable UPI in case of any suspicious UPI transactions.

- Don’t share bank details over the phone.

- Do Not use Public Computers and Public Wi-Fi for online banking.

- Do not click on links embedded in emails or text messages.

- Report lost cards immediately.

Wrapping Up: Get Refund For Wrong UPI or Bank Transaction

In this article, we have covered all the methods you can get a refund in case of a wrong UPI and bank transaction. We recommend you take extra care while making any UPI or Bank fund transfer to anyone, to avoid any such circumstances in the future. I hope you found this useful, if you did, make sure to like and share it, to spread awareness. Check out other useful articles linked below and stay tuned for more such tech tips and tricks.

You might be interested in:

- 4 Easy Ways to File a Complaint Against Airlines In India

- How to File Complaint to RBI Ombudsman for Bank Not Refunding Money

- 3 Ways to Get Refund If You Get Fake Product From Amazon or Flipkart

- [Working ] 3 Ways To Get Refund from Google Play Store for Fraud Transactions

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse YouTube Channel.