Quick Answer

- Those who haven’t yet linked their Aadhaar with their PAN card will not be able to use their PAN card and will also be liable to a fine after the deadline is over.

- One of the easy ways to link Aadhaar and PAN Card is the income tax website, in a simple two-step process.

- In such a case, you must change the name in either your Aadhaar or in the PAN database.

Linking your Aadhaar with a PAN card has been made mandatory by the Government of India, as per CBDT Circular No.7/2022 dated 30.03.2022. Those who haven’t yet linked their Aadhaar with their PAN card will not be able to use their PAN card and will also be liable to a fine after the deadline is over. The government has extended the deadline for Aadhaar linking with a PAN card many times before; now, it is June 30, 2023. So if you have not done this now, you can check these easy ways to link your PAN with your Aadhaar card.

Pre-Requisites to Link Aadhaar and PAN Card

In order to link your Aadhaar Card and PAN card, you must have the following:

- Valid PAN

- Aadhaar number

- Valid mobile number

Exceptions to Link Aadhaar and PAN Card

As per Notification number 37/2017 from the Department of Revenue Notification, dated 11th May 2017. If any of the following applies to you, then you don’t need to link your Aadhaar card and PAN Card:

- NRIs

- Not a citizen of India

- Age > 80 years as of the date

- State of residence is ASSAM, MEGHALAYA, or JAMMU & KASHMIR

Also, a PAN holder whose PAN was allotted after 01 July 2017 need not link it with Aadhaar, as it was already linked during the application stage.

How to Link PAN card with Aadhaar card

The IT department has made it easy for taxpayers to link their PAN cards with their Aadhaar. You can do this with a simple online process or by sending an SMS via your registered number. Here’s how you can link your Aadhaar card with your PAN card.

Online via Income Tax Website

One of the easy ways to link Aadhaar and PAN Card is the income tax website, in a simple two-step process. Keep your Aadhaar Number and PAN handy, and proceed with the following steps:

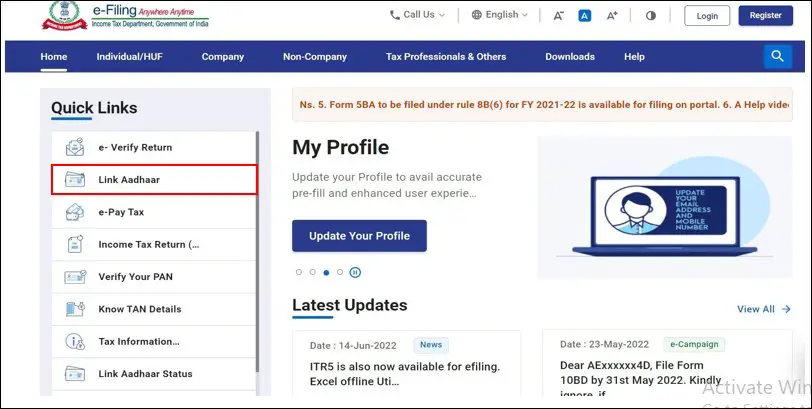

1. Visit the official website of the Income Tax portal, and click on the ‘Link Aadhaar‘ option from the left pane.

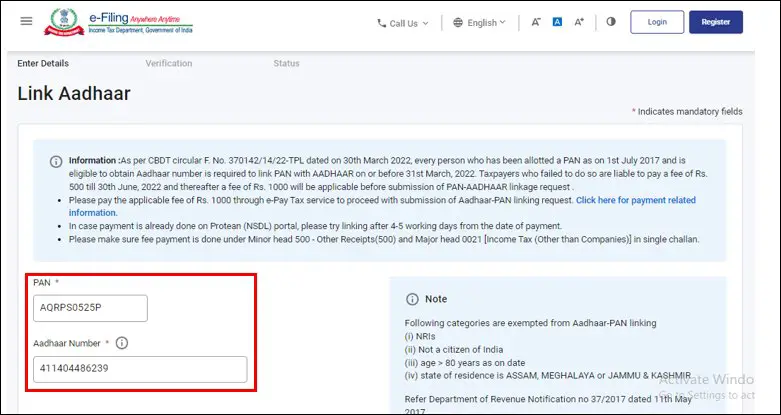

2. On the next page, enter details like your PAN number and Aadhaar number, and click on Validate.

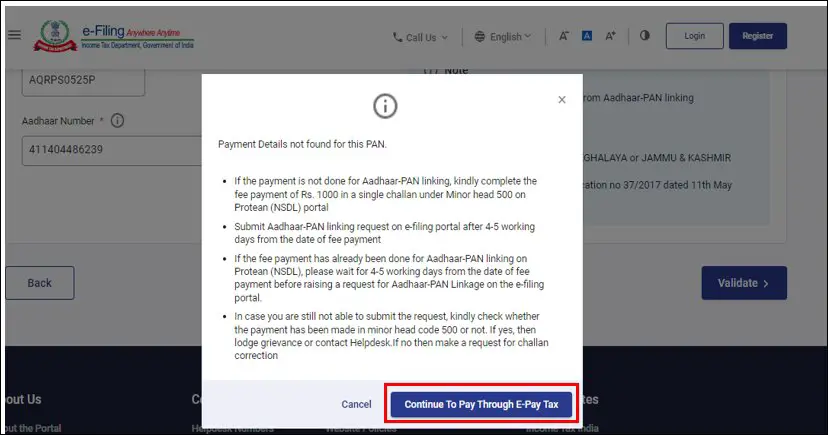

3. Next, click the Continue to Pay Through e-Pay Tax button.

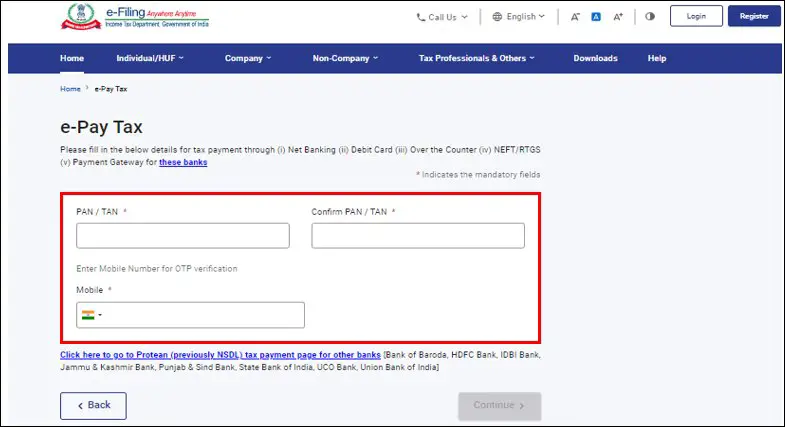

4. Enter your PAN, Confirm your PAN, and your Mobile number to receive OTP.

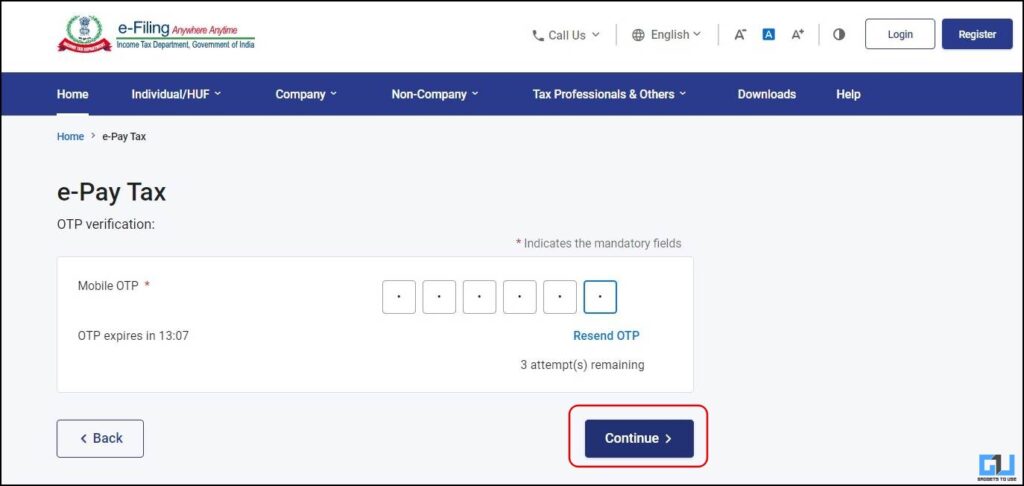

5. Enter the OTP for verification, and click Continue.

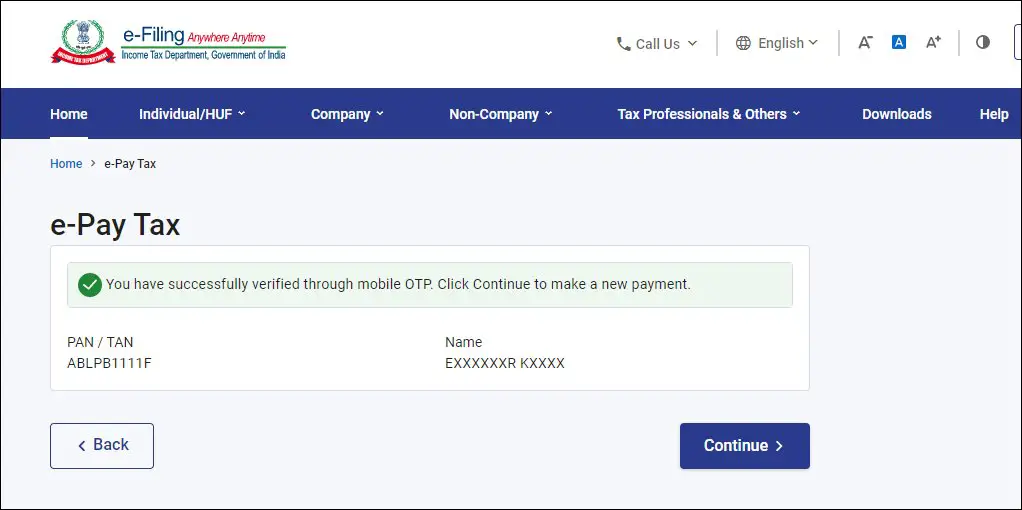

6. you will be redirected to the e-Pay Tax page; click Continue to proceed.

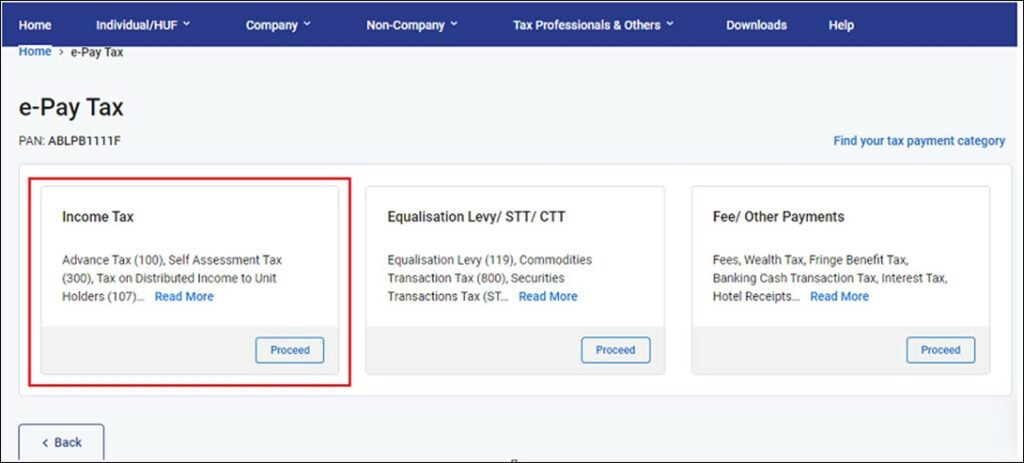

7. On the next page, click on the Income Tax Tile.

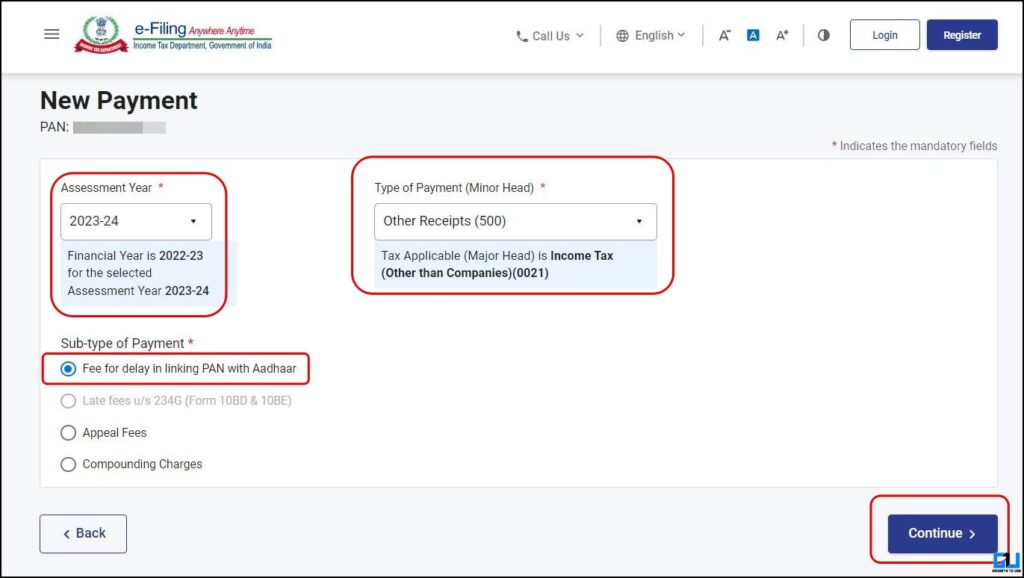

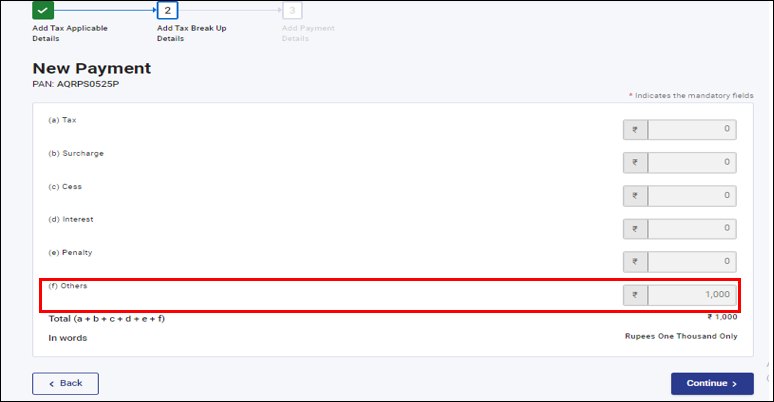

8. Select the AY (2023-24), change the Type of Payment to Other Receipts (500), and select Sub-type of Payment to Fee for the delay in linking PAN with Aadhaar. Click Continue to proceed.

9. On the next screen, you will see the amount pre-filled, check your details and click on Continue to proceed.

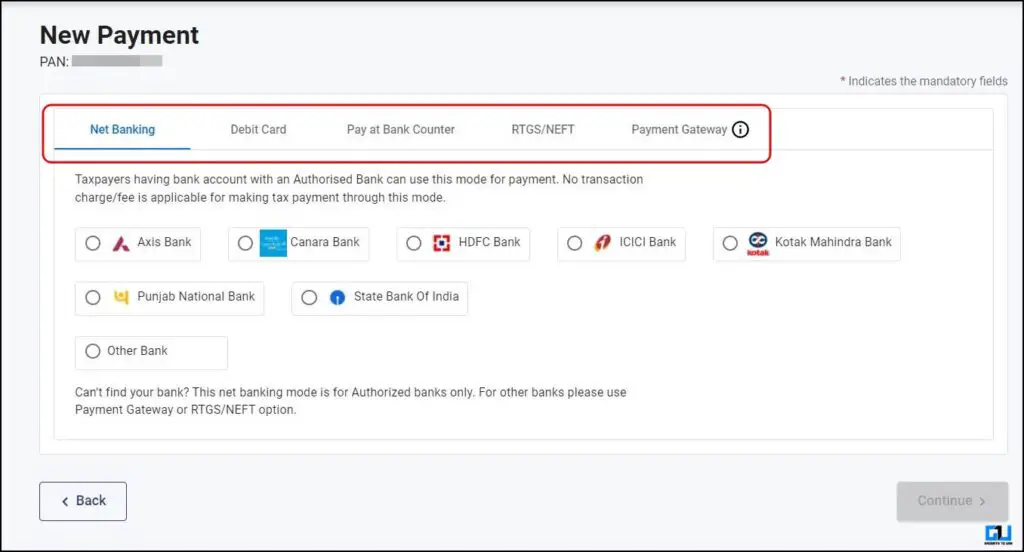

10. Lastly, select a mode of Payment, and make the payment.

If the Aadhaar name is completely different from the name on PAN, then the linking will not be done from here, and it will fail. In such a case, you must change the name in either your Aadhaar or in the PAN database.

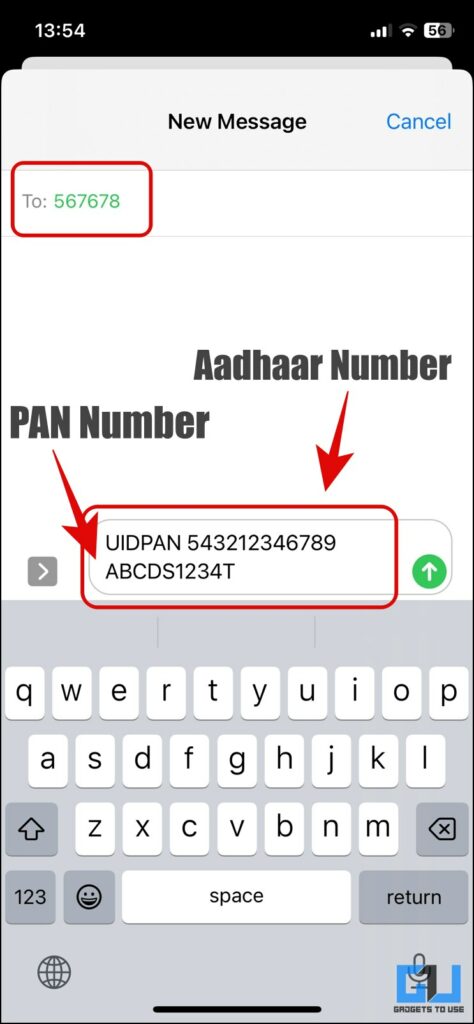

Link Aadhaar with PAN through SMS

The Income Tax Department has also facilitated taxpayers to link their Aadhaar with their PAN using an SMS-based facility. You can link your Aadhaar and PAN card by sending an SMS to 567678 or 56161. Send an SMS to any of these numbers from your registered mobile number in the following format:

UIDPAN <SPACE> <Aadhaar Card Number> <Space> <PAN Number> and send it to 567678 or 56161.

Example: UIDPAN 543212346789 ABCDS1234T

Linking Aadhaar with PAN is also available after logging in to the Income Tax website. For this, you must first register at the Income Tax e-filing website if you are not already registered.

Visit Your Bank to Link Your Pan and Aadhaar Card

Lastly, you can also visit your bank branch to avoid paying any fee for linking your Aadhaar and PAN card. Ask them to link your Aadhaar Card with your PAN card, and they will do it without any charges.

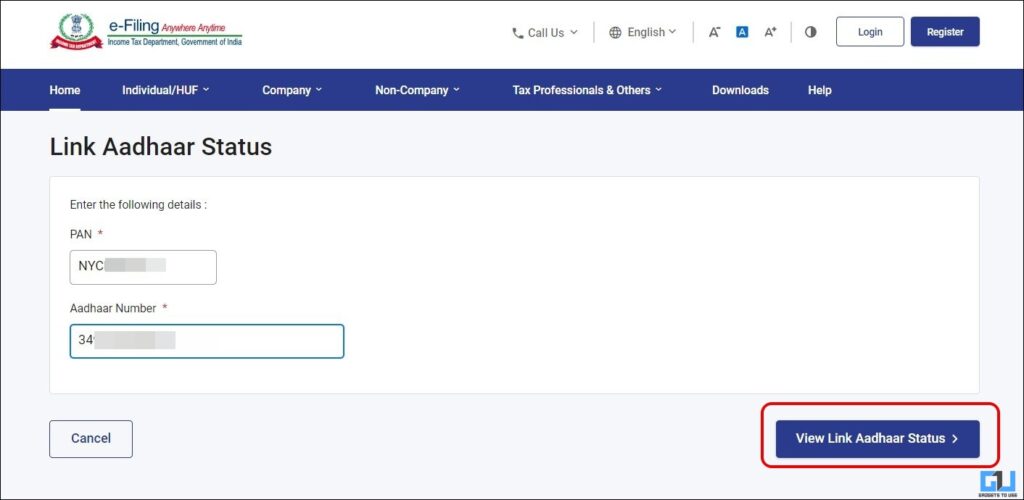

How to Check if PAN and Aadhaar Are Linked?

If you are unsure that your Aadhaar and PAN card is linked, you can check the status online and offline. Keep your PAN and Aadhaar cards handy to enter details.

Here’s how you can check the status:

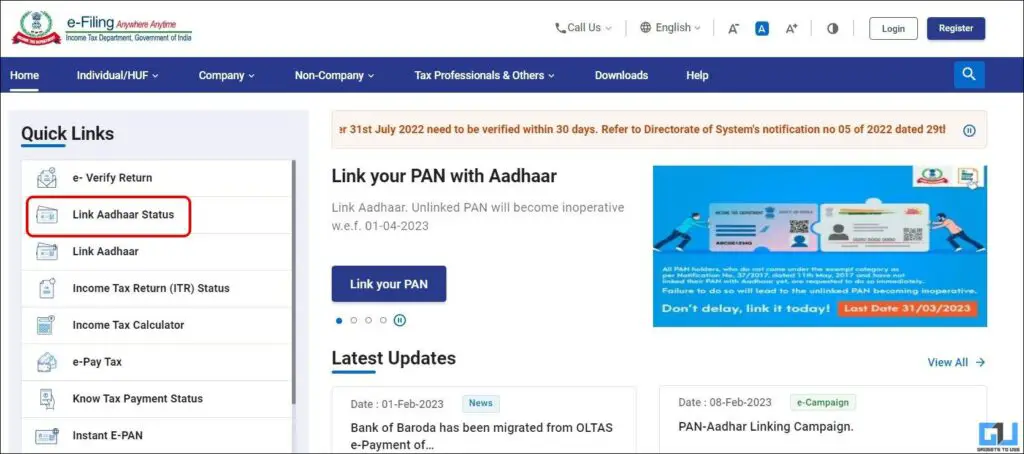

1. Again, visit the income tax e-filing portal and Navigate to Aadhaar status from the left pane.

2. Enter your PAN card and Aadhaar details in the provided boxes.

3. Click on the ‘View Link Aadhaar Status’ option below.

A new page will open up and display the status of your Aadhaar and PAN linking.

FAQs

Q. How Can I Check if My PAN Card and Aadhaar Card Are Linked or Not?

You can check the status of your PAN card and Aadhaar linking via the Income Tax Portal. We have shared the detailed steps to do so in the article above.

Q. How Can I Link My PAN Card With My Aadhaar Card Online?

You need to visit the income tax portal to link your Aadhaar Card with your Permanent Account Number card for a nominal fee of INR 1,000.

Q. How Can I Link My Aadhar Card With a PAN Card for Free?

To link your Aadhaar Card with your Permanent Account Number Card for Free, you should visit your Bank branch and ask them to do it for you.

Q. Can I Link My Aadhar With My PAN Without Login?

Yes, using the income tax portal, you can link your Aadhaar card, and PAN card, without logging in to your account. Follow the detailed steps mentioned above to do so.

Q. I Have Paid to Link My Aadhaar With My PAN Card. But the Status Shows ‘PAN Not Linked With Aadhaar’. How to Fix It?

Once you have paid the Rs. 1000 to link your Aadhaar and Permanent Account Number card, it can take 4-5 days to reflect the updated status. If the status is not updated after 4-5 days, you should either raise a grievance or contact the help desk.

Wrapping Up

This read discussed the three easy ways to link your Aadhaar card with your PAN card. If you fail to not link it by 31st March 2023, you may be liable to pay INR 1,000 penalty, and your PAN Card will become inoperative. Check out other useful tips below, and stay tuned to GadgetsToUse for more such reads.

You might be interested in the following:

- 2 Easy Ways To Change, and Update Mobile Number On Aadhaar Card

- How to Check if Someone Is Using Your Aadhaar Card Without Permission

- 4 Easy Ways to Link Your Voter ID Card with Aadhaar Card

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.