Quick Answer

- Since the country has close to 300 million UPI users alongside 85 million people who have one or more credit cards, “credit card on UPI” is an excellent move from NPCI to enable a seamless payment experience alongside the benefits of credit card rewards.

- To start making UPI payments using your credit card, you need a Rupay credit card from your bank, which must be linked to either of the UPI apps that support it, as shown below.

- If you already hold a credit card (Visa, Mastercard, or any other), you can ask your bank to port it to the Rupay network.

The National Payments Corporation of India (NPCI) recently allowed the linking of Rupay credit cards to the Unified Payment Interface (UPI). This means you no longer need a POS machine to pay via your credit card in a shop or petrol pump. Instead, you can scan the QR code and pay with a credit card via your UPI app. Here’s how to make UPI payments using credit cards through PhonePe, Google Pay, Paytm, CRED, BHIM, and PayZapp. We’ll also discuss how credit card UPI works, related charges, and what to do if it’s not working.

How to Make UPI Payments Using Credit Cards in India?

UPI has become the most preferred mode of payment in India, accounting for over 75% of all retail digital transactions in 2022. From street vendors to shopping malls, over 500 million merchants have started accepting UPI in the country.

Since the country has close to 300 million UPI users alongside 85 million people who have one or more credit cards, “credit card on UPI” is an excellent move from NPCI to enable a seamless payment experience alongside the benefits of credit card rewards.

To start making UPI payments using your credit card, you need a Rupay credit card from your bank, which must be linked to either of the UPI apps that support it, as shown below.

Step 1- Get a RuPay Credit Card from Your Bank

The first step involves getting a Rupay credit card. Almost all major banks in the country have started issuing Rupay credit cards, specifically with a UPI-oriented reward structure. You can apply for a fresh credit card online or by visiting the bank.

If you already hold a credit card (Visa, Mastercard, or any other), you can ask your bank to port it to the Rupay network. This way, you’ll have a Rupay credit card without applying from scratch. In the later part of the article, we will mention some of the best Rupay credit cards you can get for UPI payments.

Step 2- Link Your RuPay Credit Card to UPI App

Once you have a Rupay credit card, it’s time to link it to your UPI app. Currently, all popular UPI apps, including PhonePe, Google Pay, Paytm, CRED, BHIM, and PayZapp, support linking credit cards for UPI. Here’s how you can use each of them.

Link Rupay Credit Card for UPI in PhonePe app

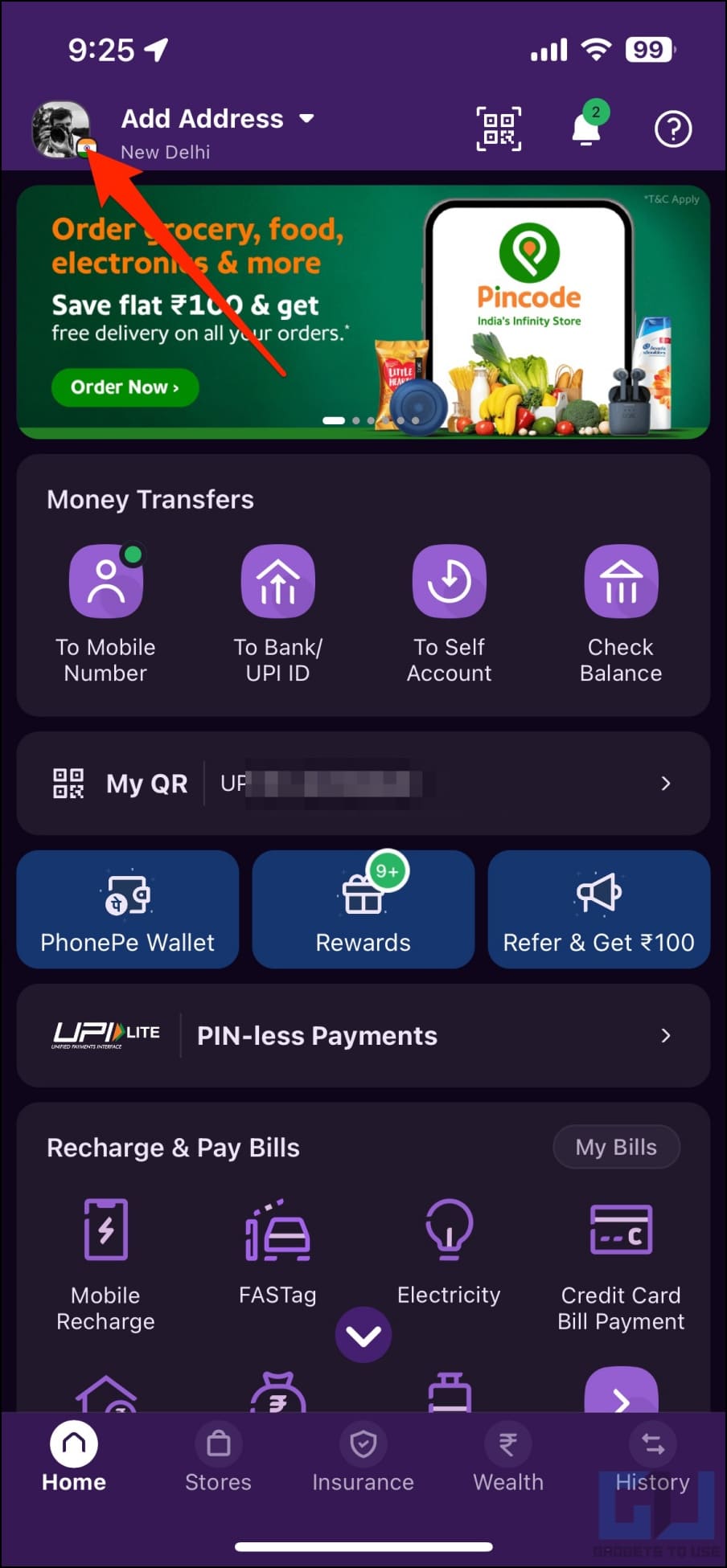

1. Open the PhonePe app on your Android or iPhone.

2. Tap your profile icon on the top left corner.

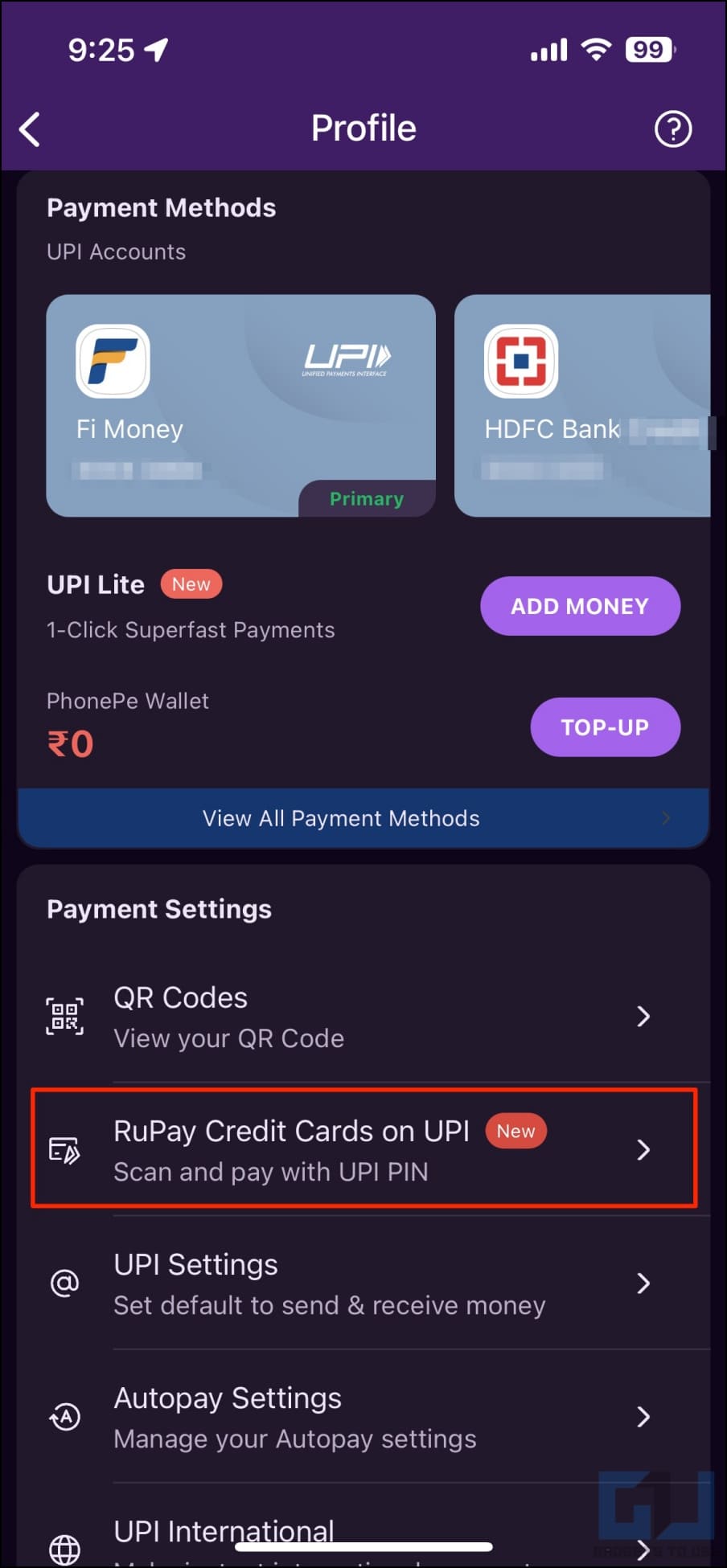

3. On the next screen, click on Link Rupay Credit Cards on UPI.

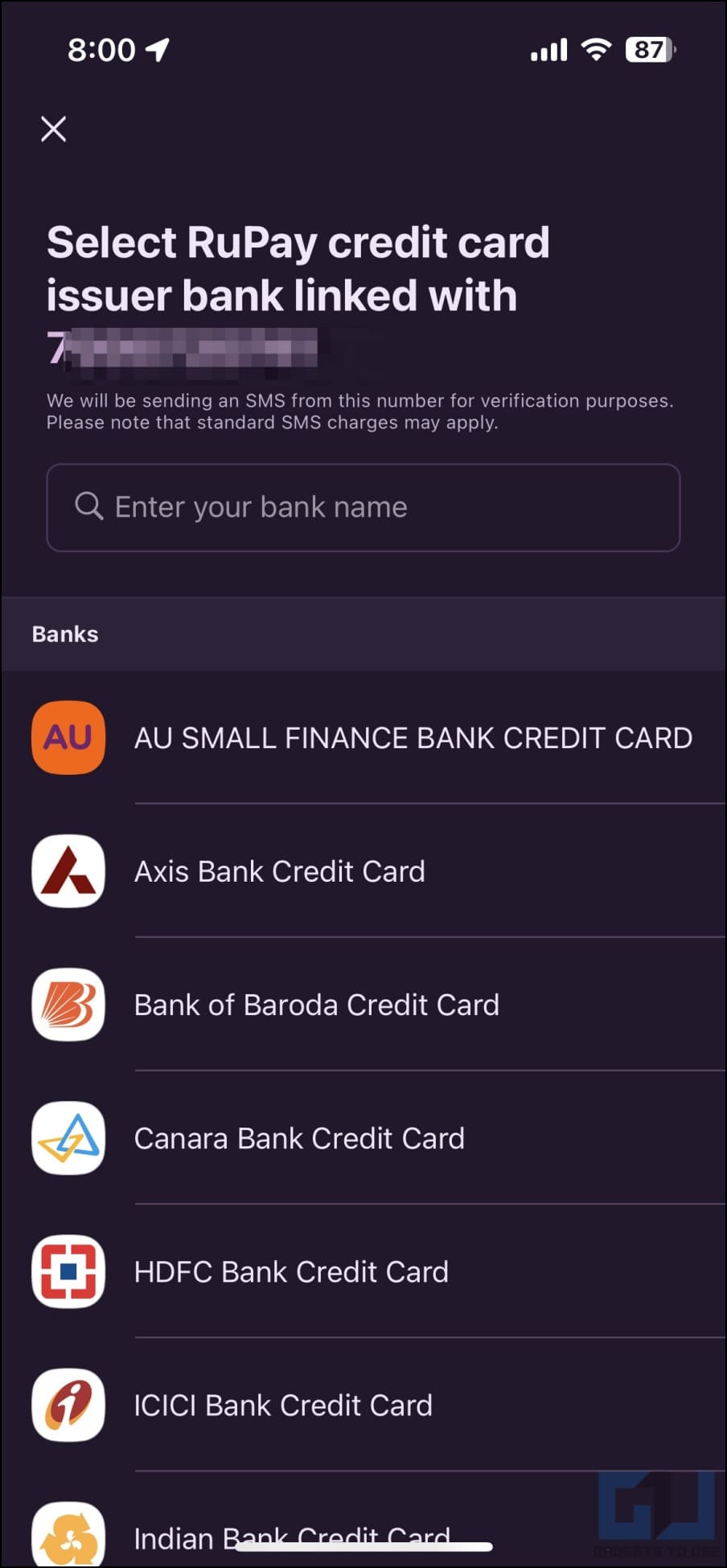

4. Search and select the bank you have a Rupay credit card with.

5. Enter the last six digits of your credit card and tap Set UPI PIN.

6. Verify the OTP sent to your registered number.

7. Enter the new 4-digit or 6-digit UPI PIN. Re-enter the PIN to confirm.

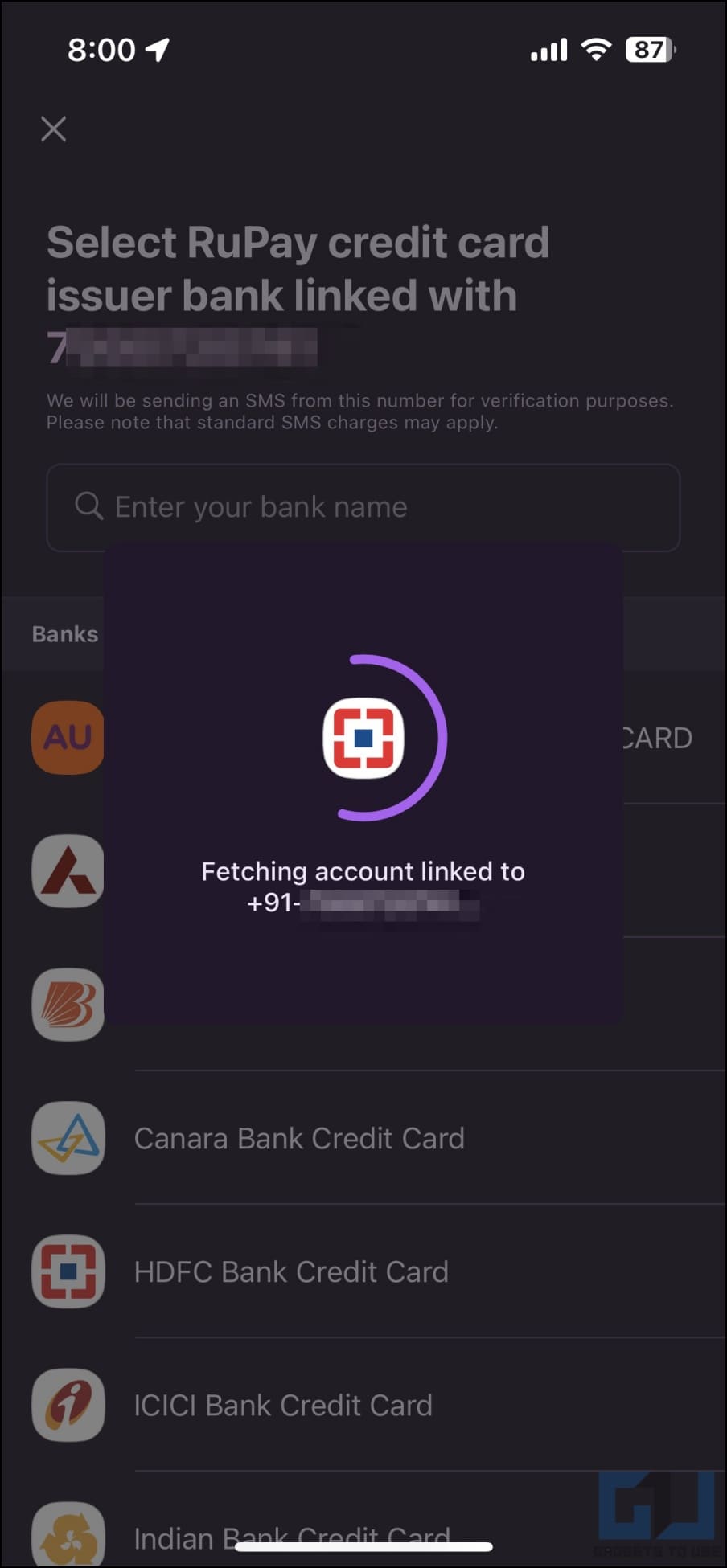

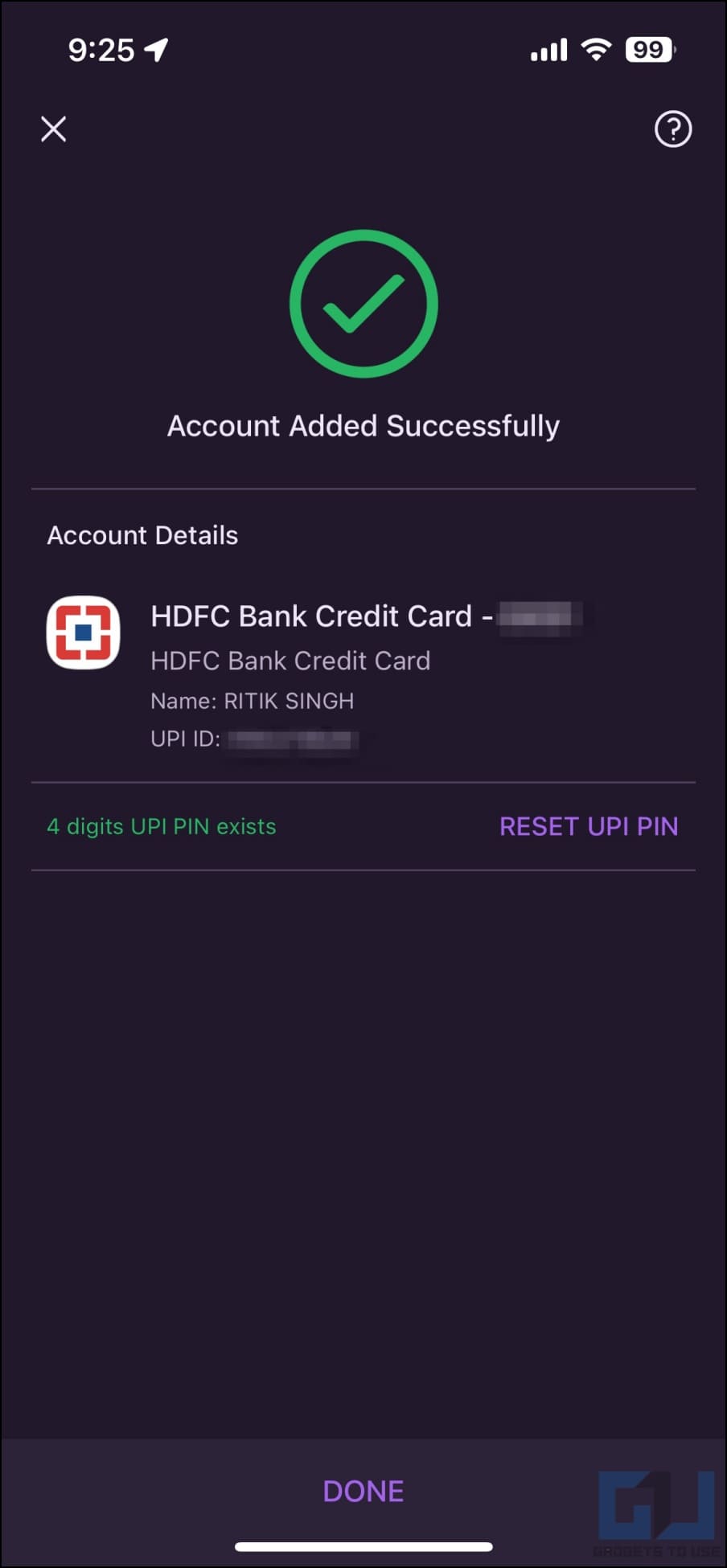

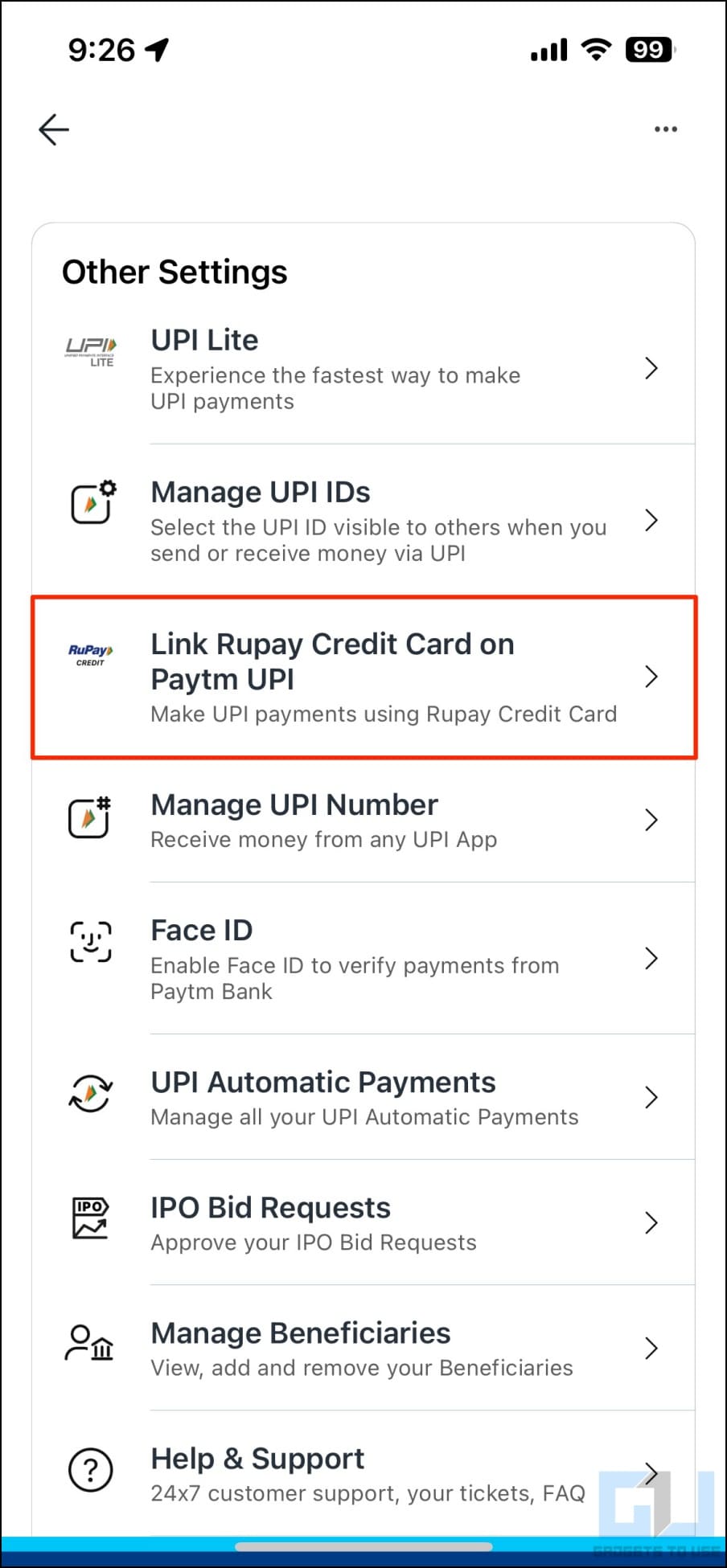

Link Rupay Credit Card for UPI on Paytm app

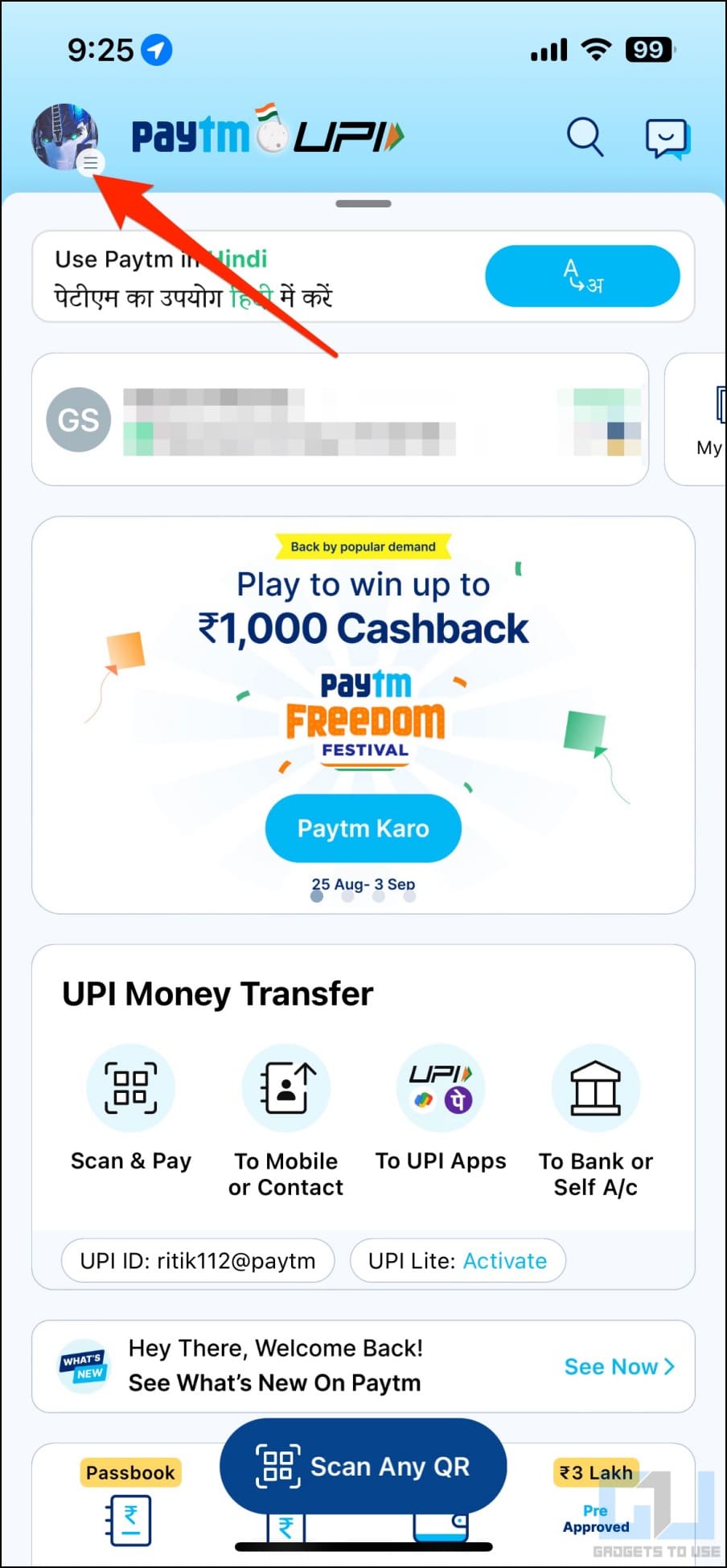

1. Open the Paytm app on your Android or iPhone.

2. Tap your profile picture in the top left corner.

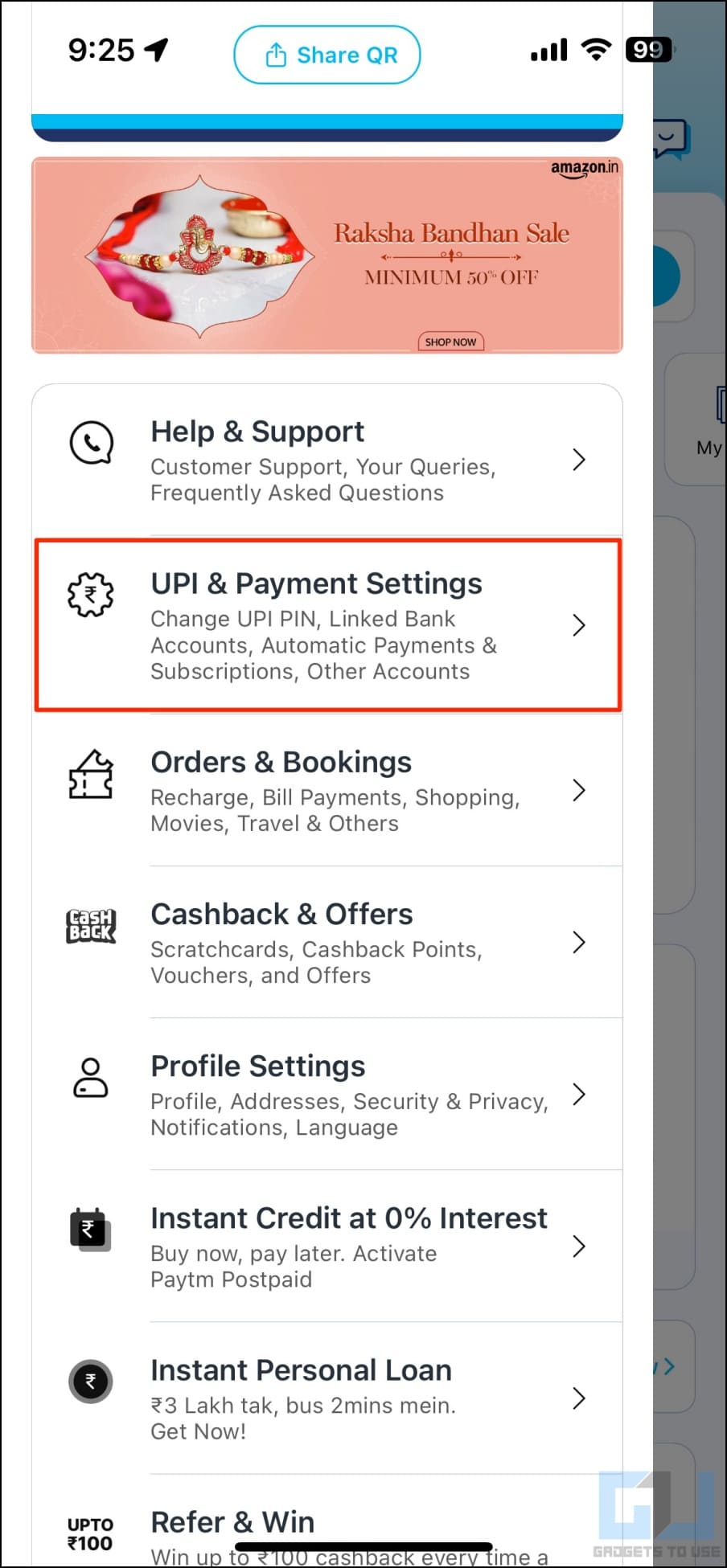

3. Scroll down and click on UPI & Payment Settings.

4. On the next screen, scroll down and tap Link Rupay Credit Card on Paytm UPI.

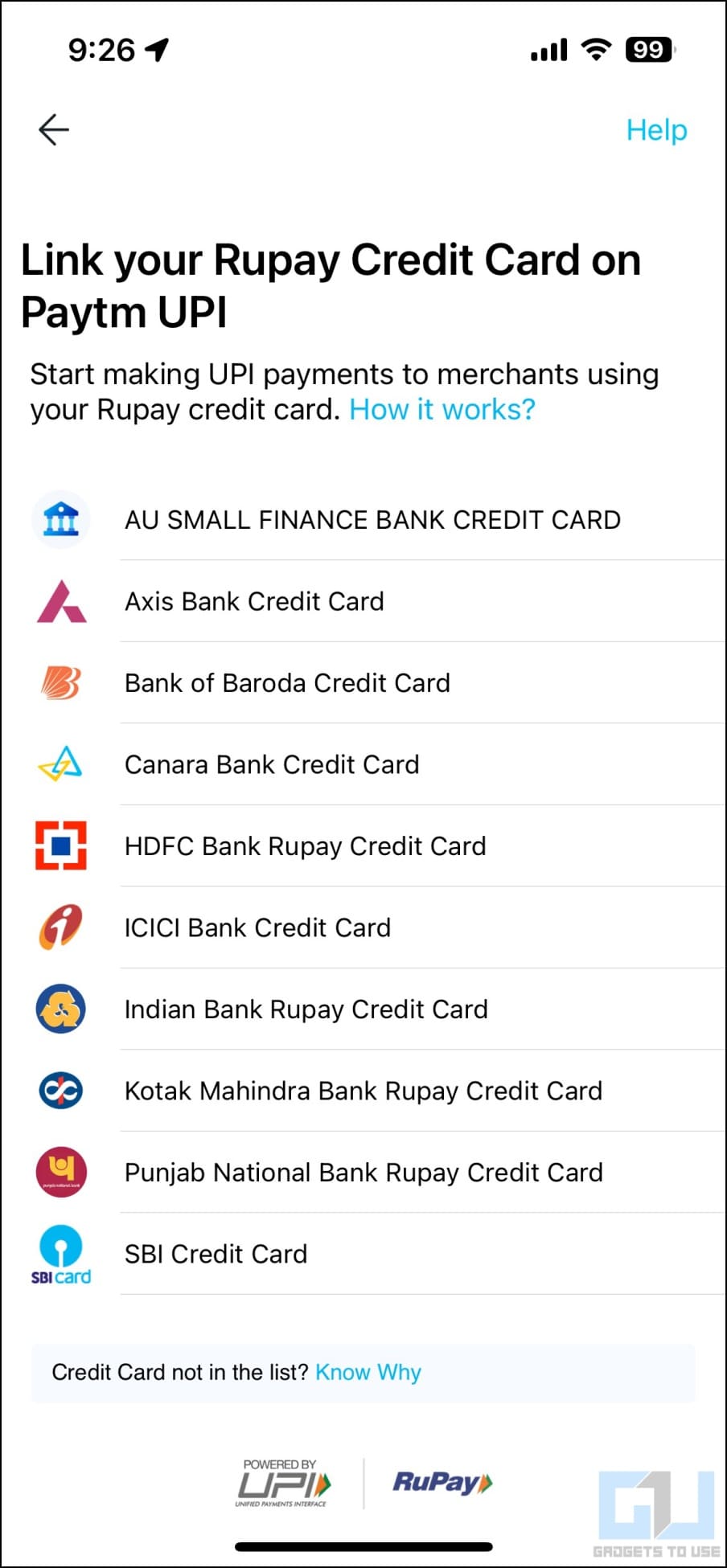

5. Tap Link Card with UPI and select your credit card issuing bank account.

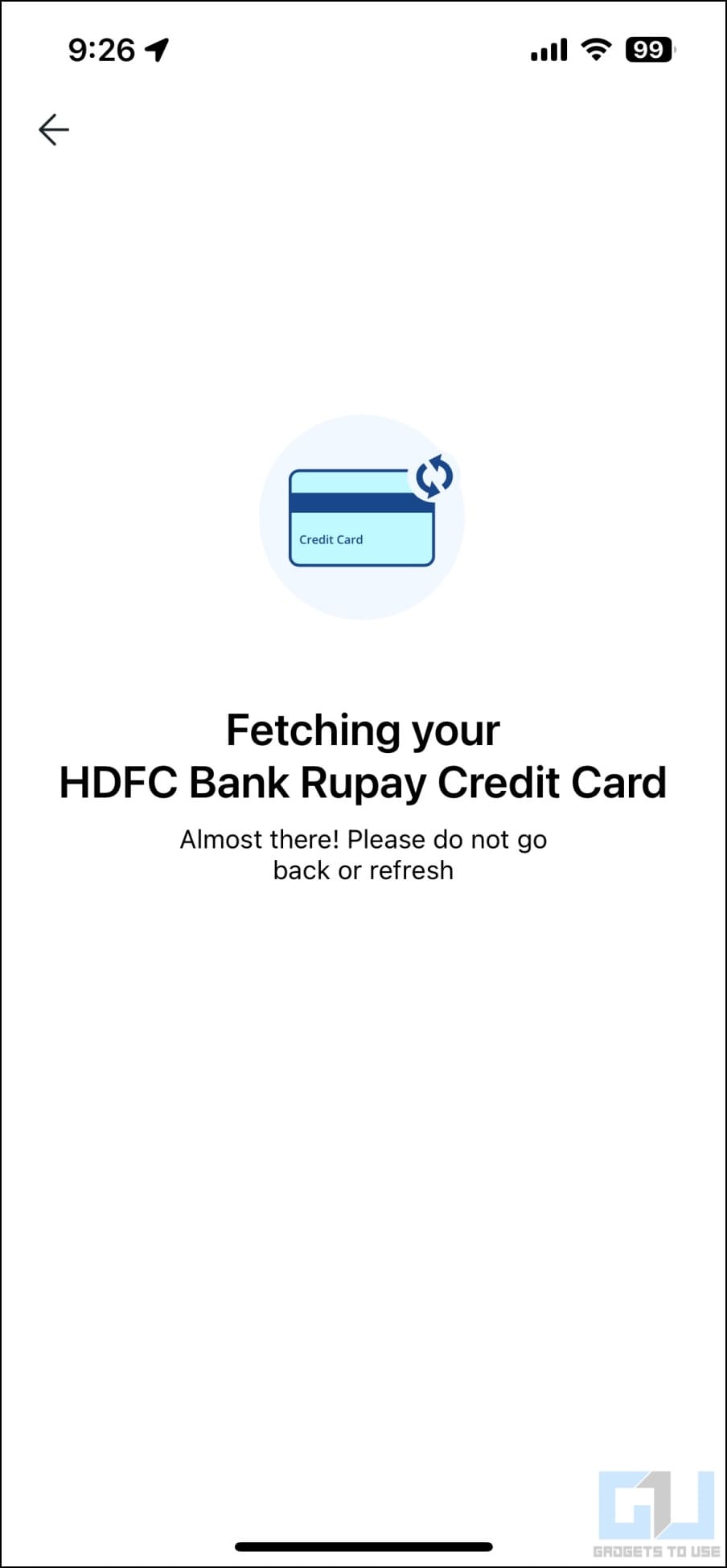

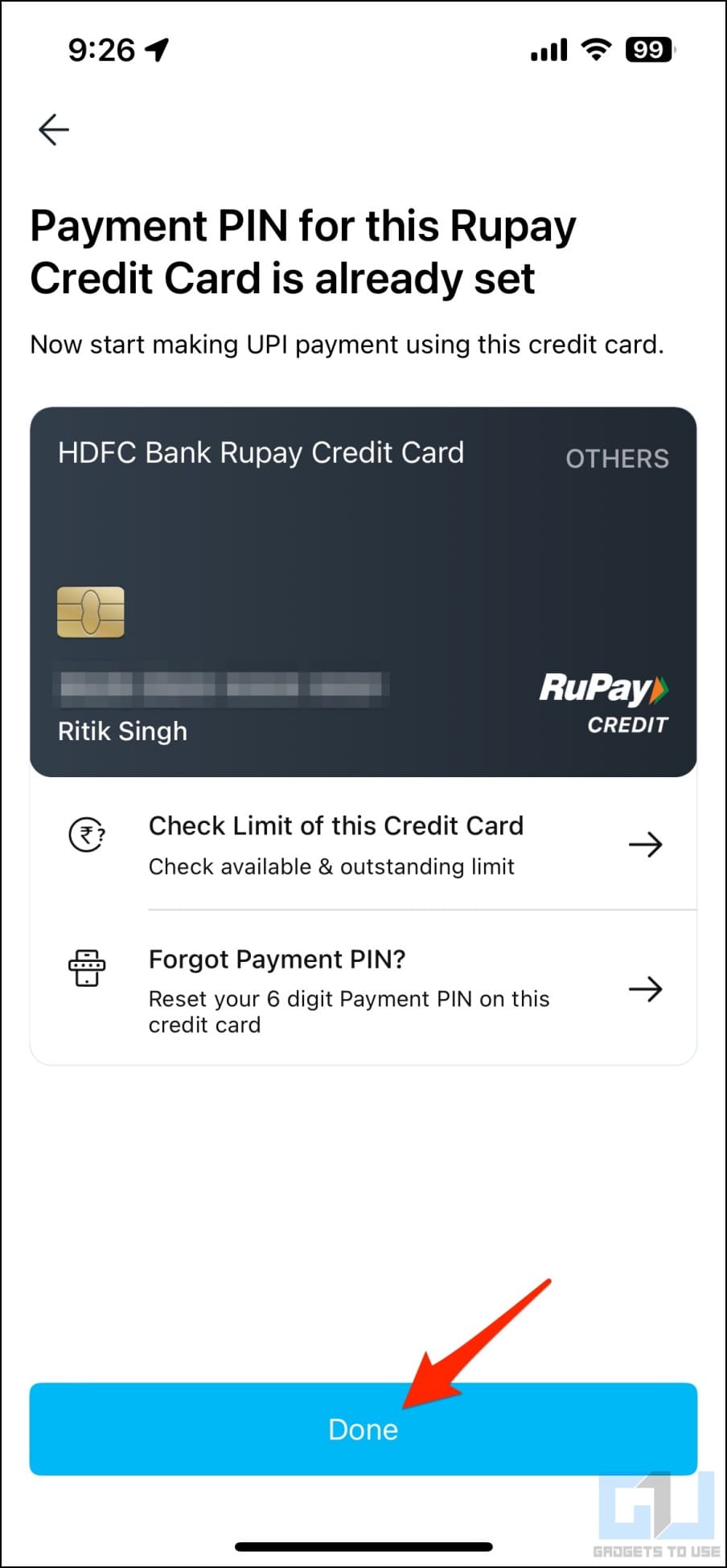

6. Your card should appear automatically. If you have not set a UPI PIN yet, follow the on-screen instructions to enter your credit card details and verify with OTP.

7. Finally, set a 4-digit or 6-digit PIN to make UPI payments with your credit card.

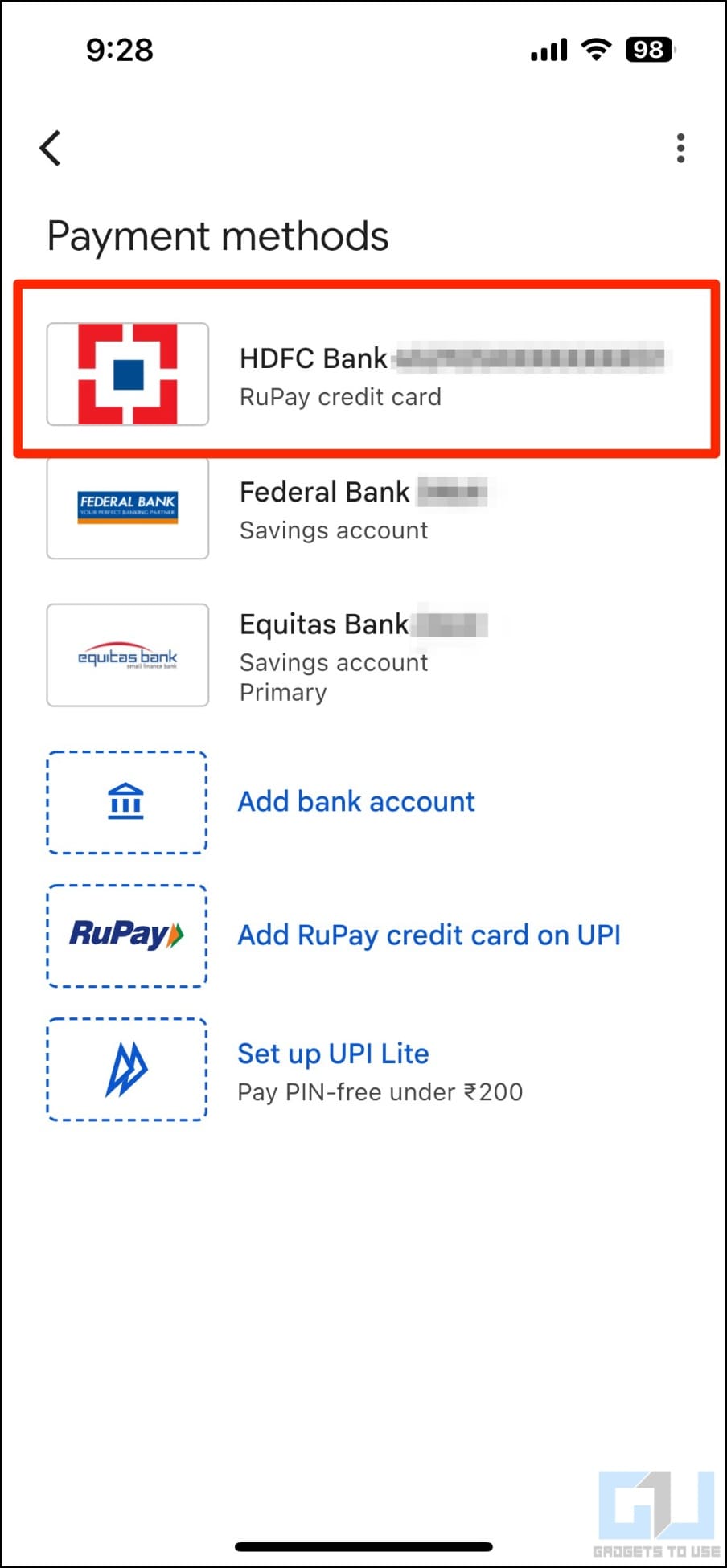

Link Rupay Credit Card for UPI on Google Pay app

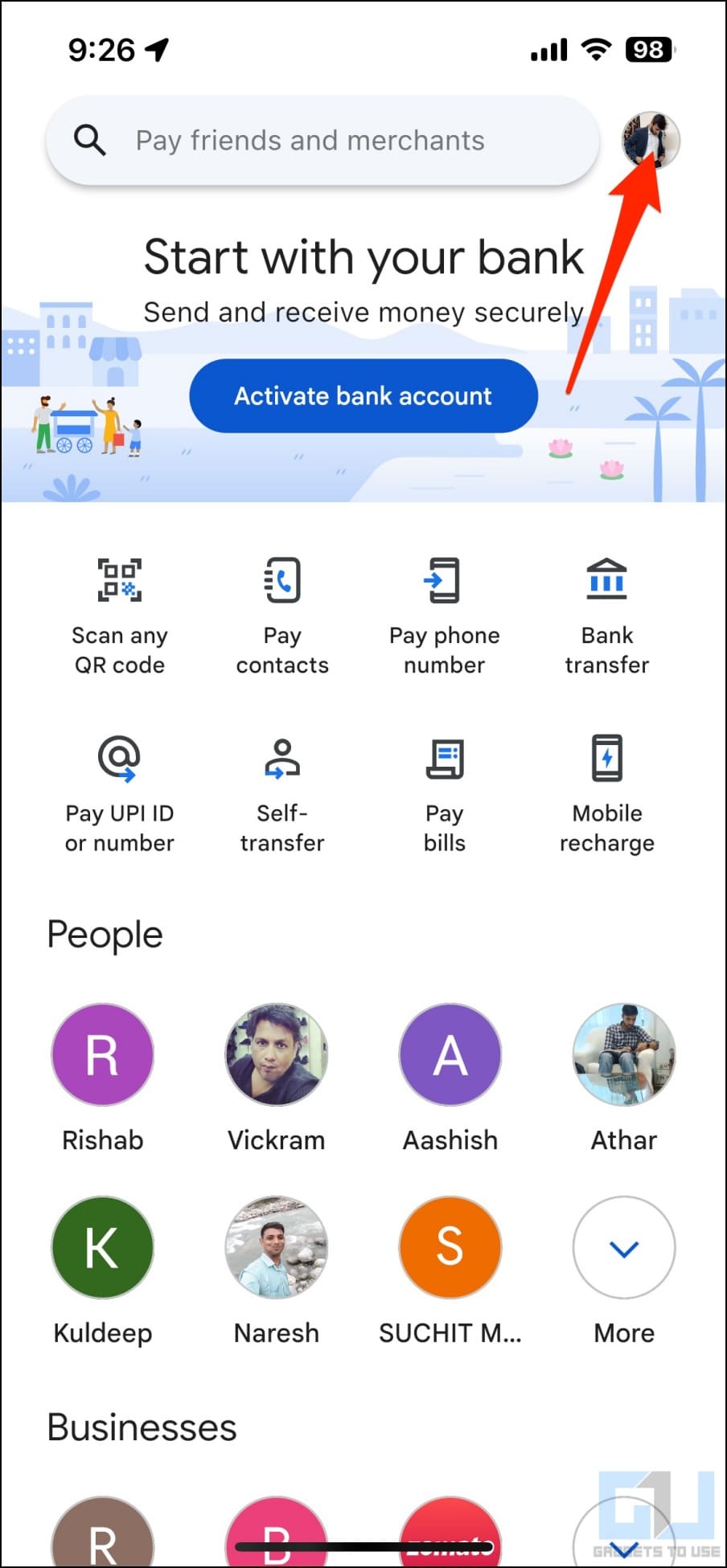

1. Open the Google Pay app on your Android or iPhone.

2. Tap your profile picture in the top right corner.

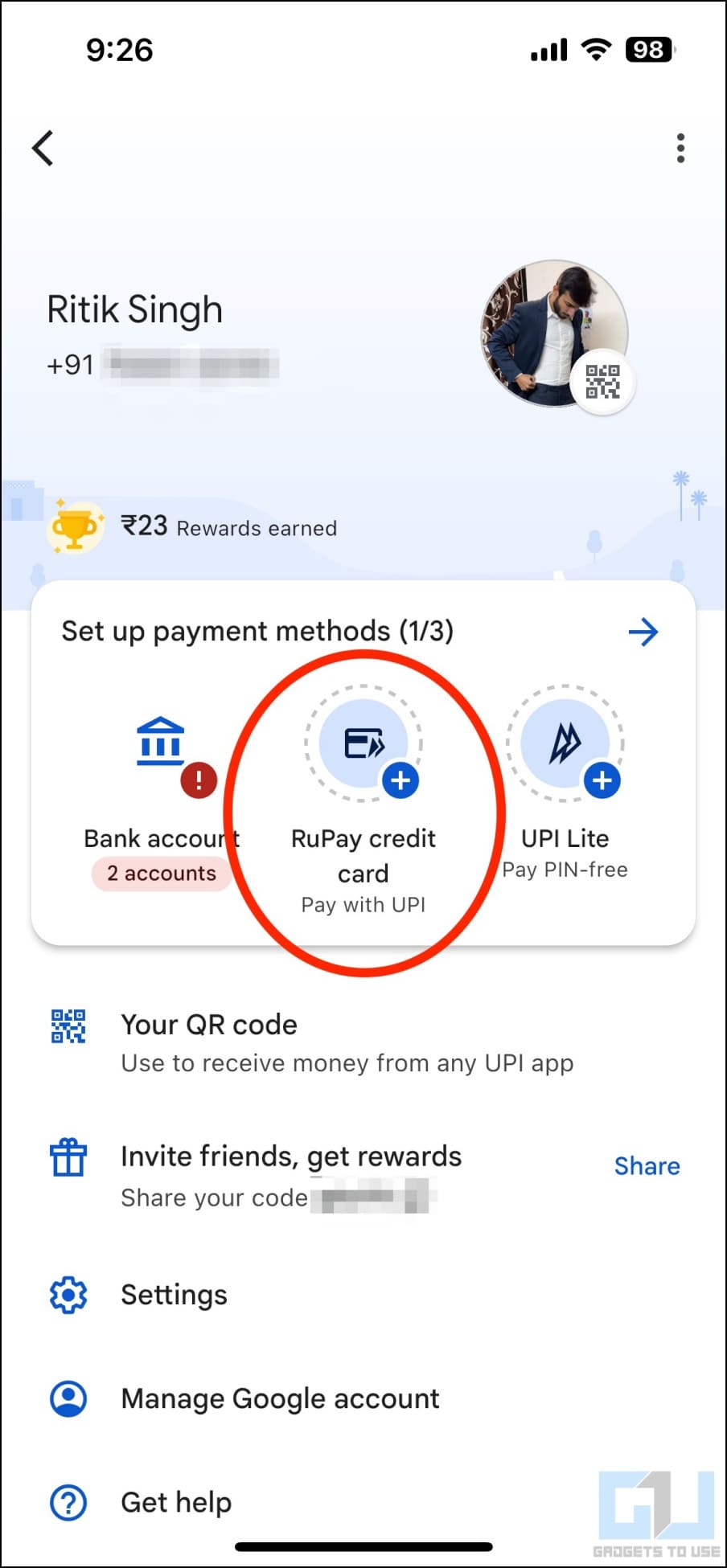

3. Under Setup payment methods, select Add Rupay Credit Card.

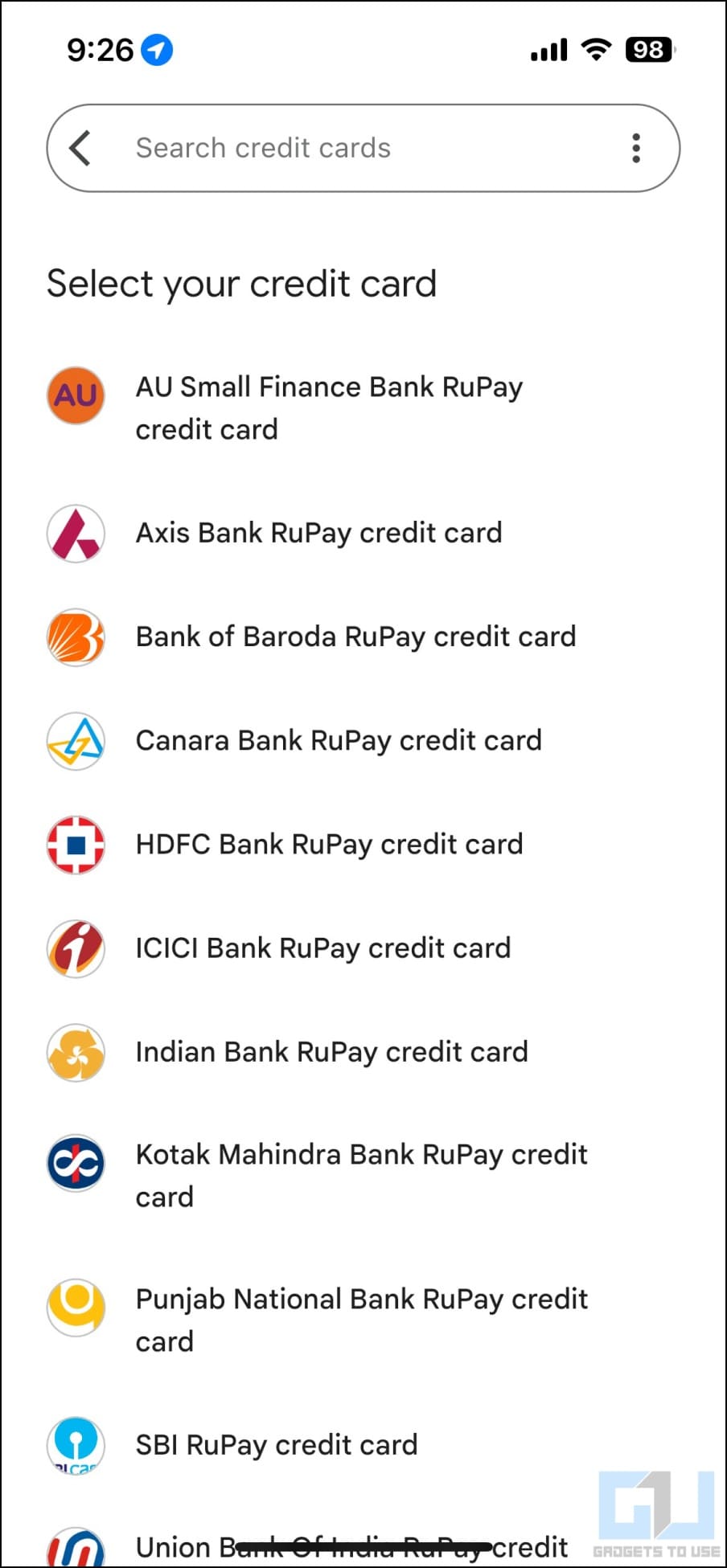

4. Choose the bank that issued your Rupay credit card.

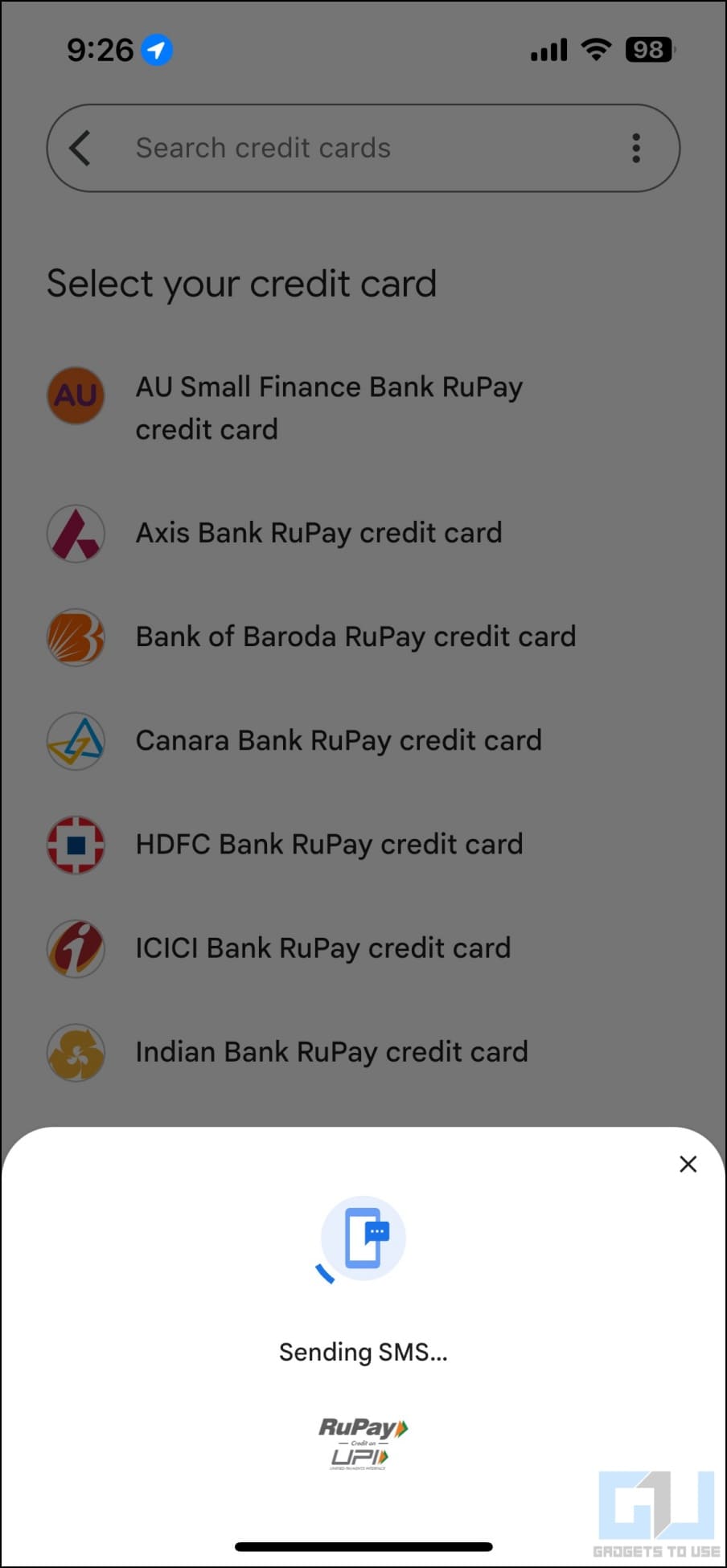

5. If prompted, set a UPI PIN by entering the last six digits and expiry date of your credit card and verifying the OTP sent by the bank.

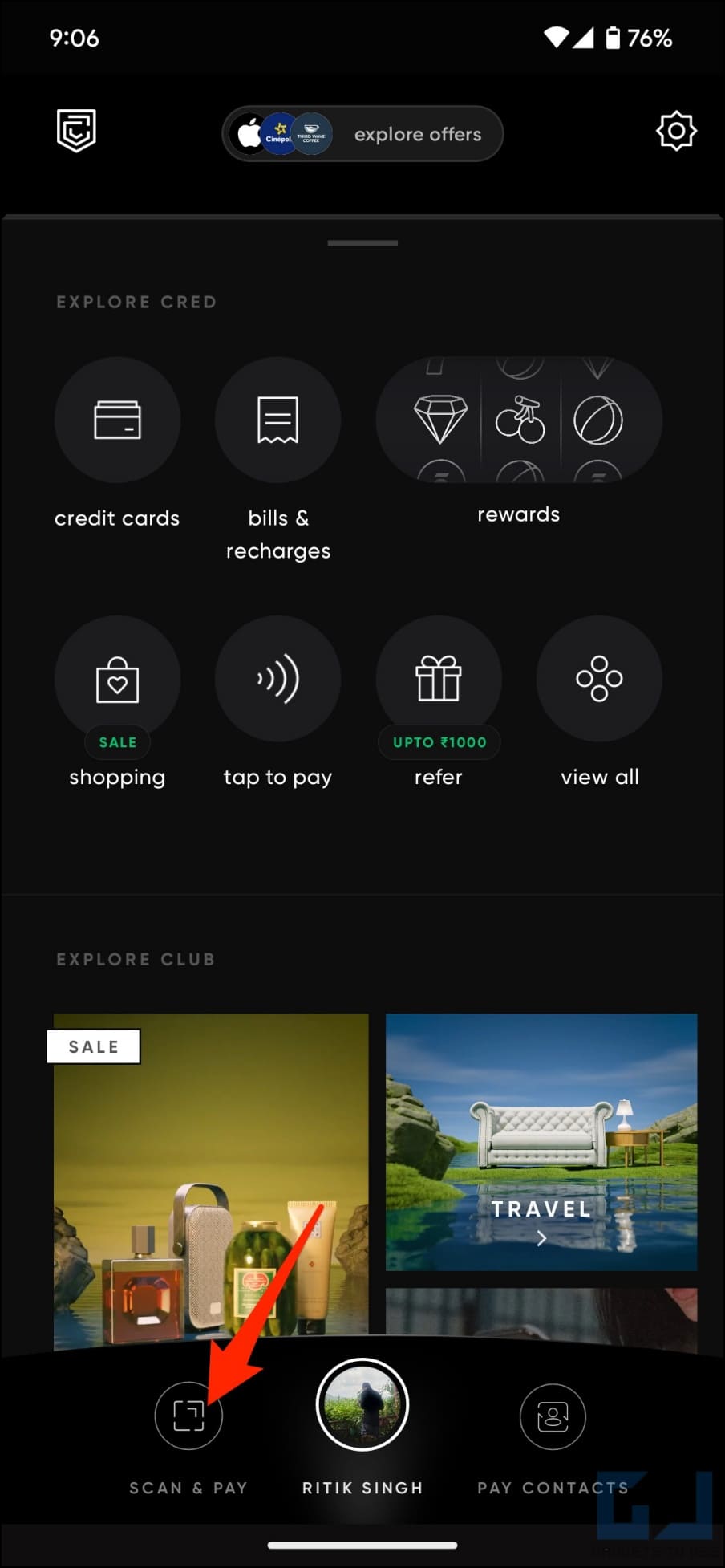

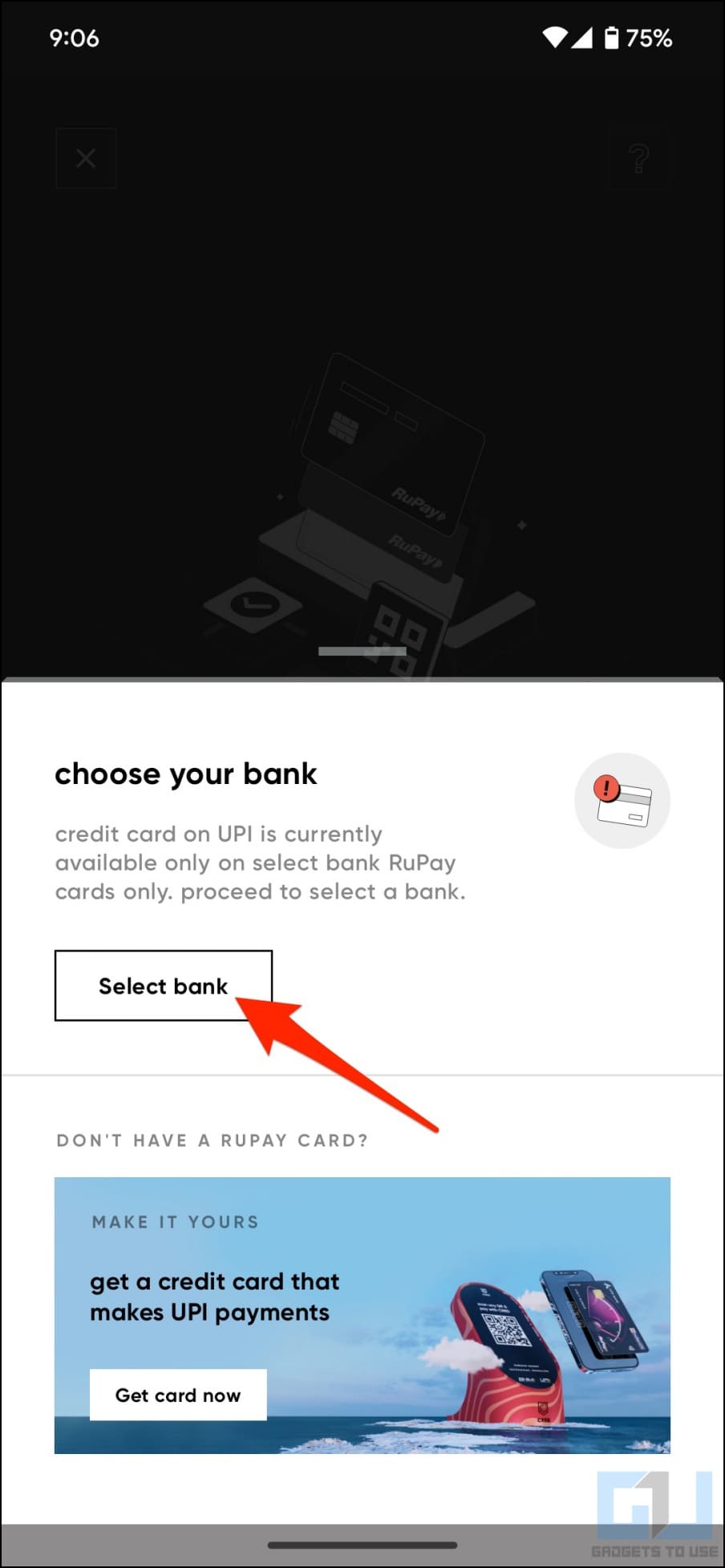

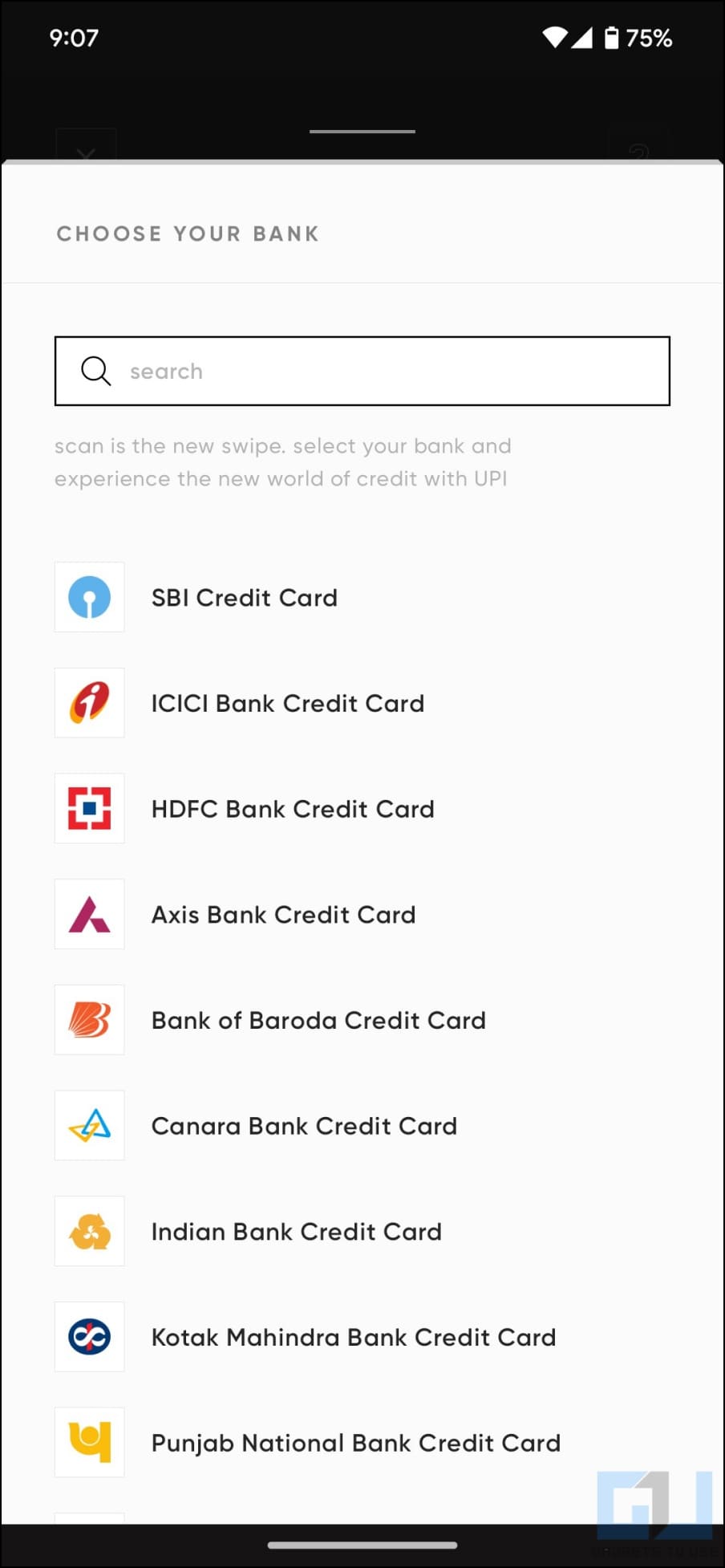

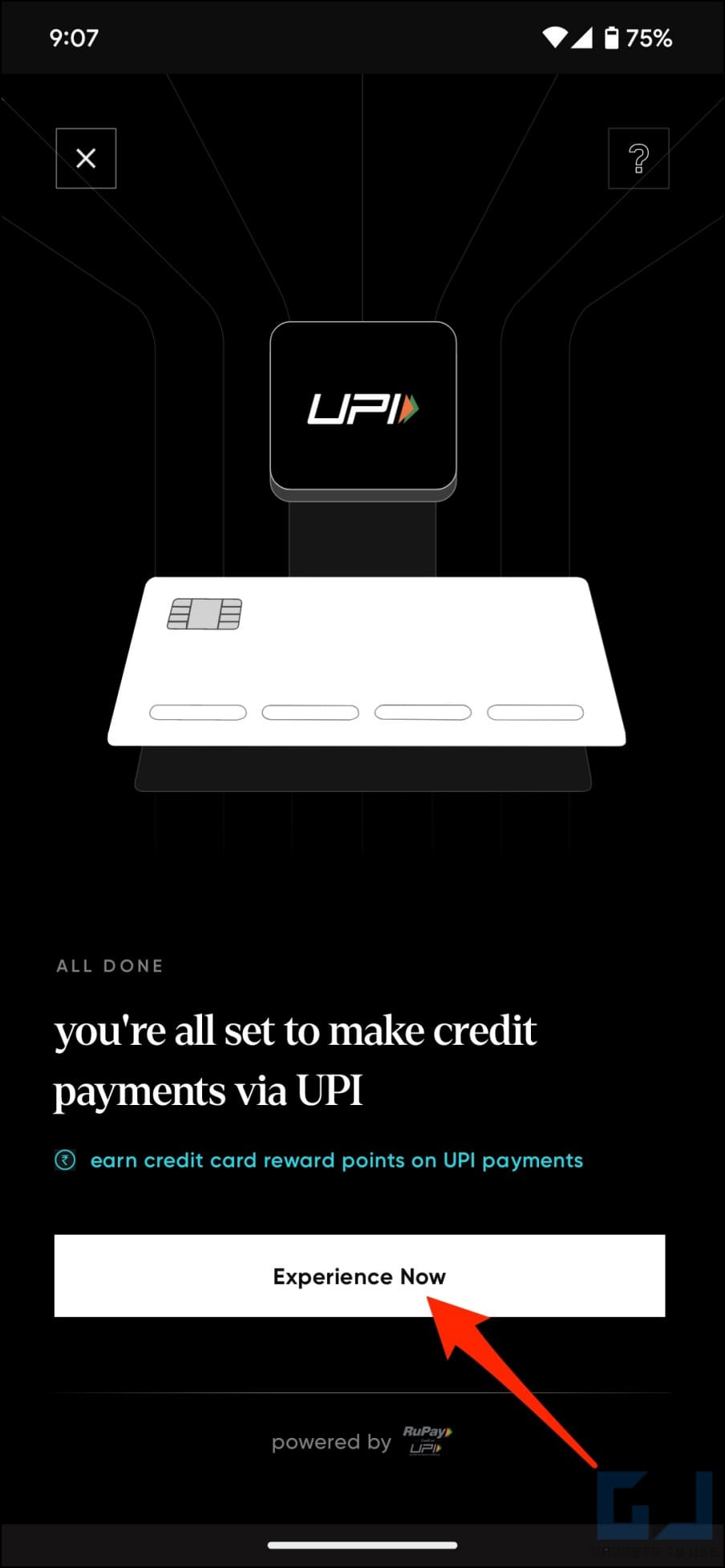

Link Rupay Credit Card for UPI on CRED App

1. Open the CRED app on your Android or iPhone.

2. Tap the Scan & Pay button in the bottom toolbar.

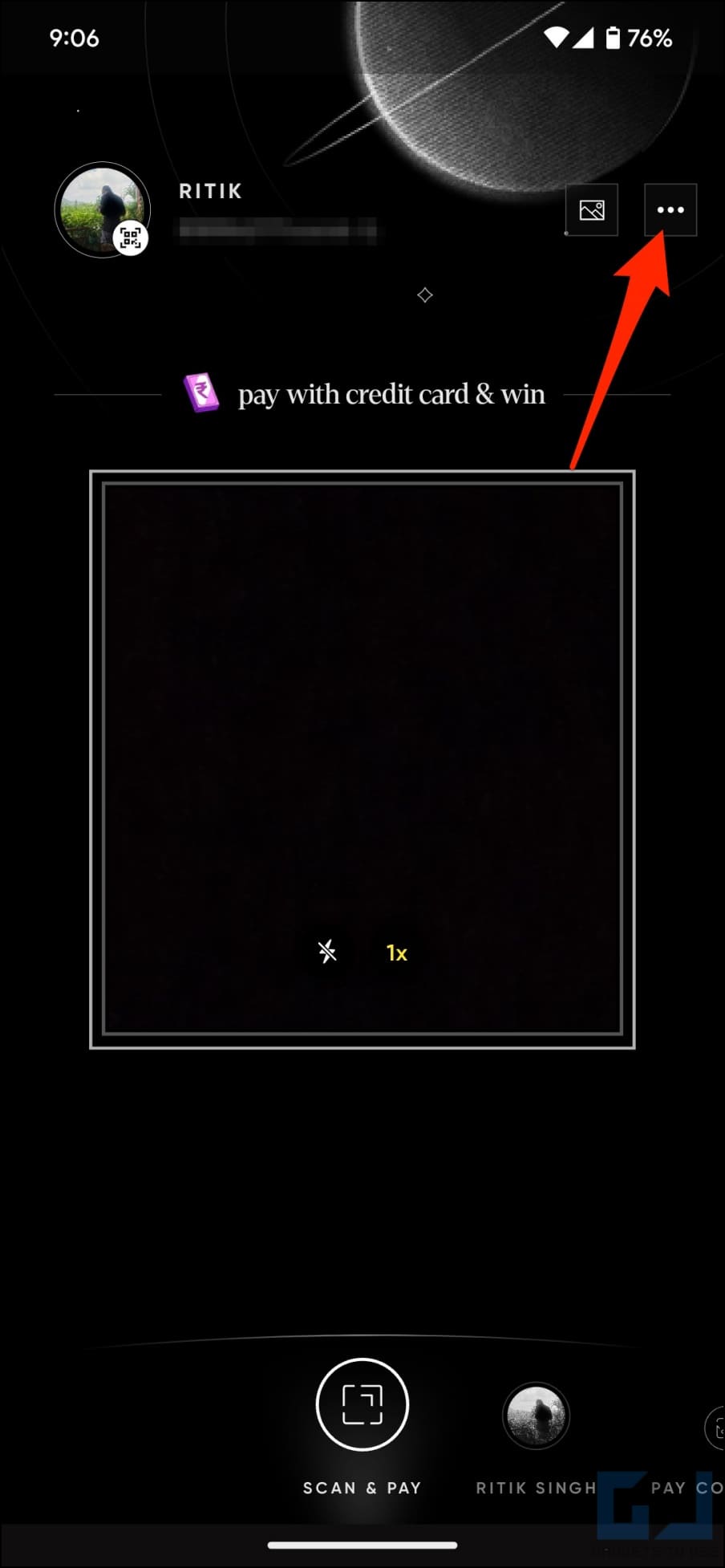

3. Once on the scanner screen, tap the three dots in the top right corner.

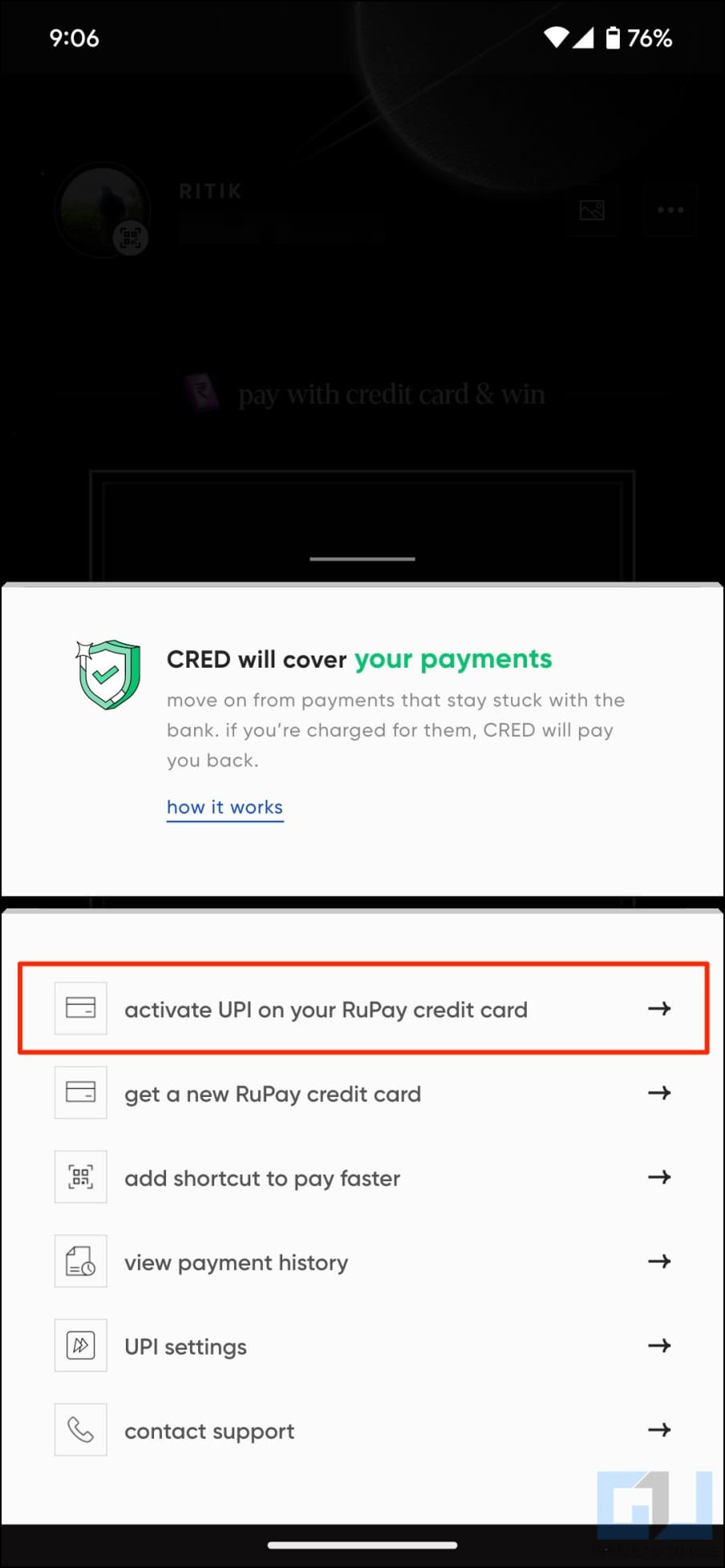

4. Here, select activate UPI on your RuPay Credit Card.

5. Hit the Let’s Go button.

6. Verify your card by entering its last six digits, expiry date, and the OTP sent by the bank.

7. Set a four or six-digit UPI PIN to start making payments from your credit card.

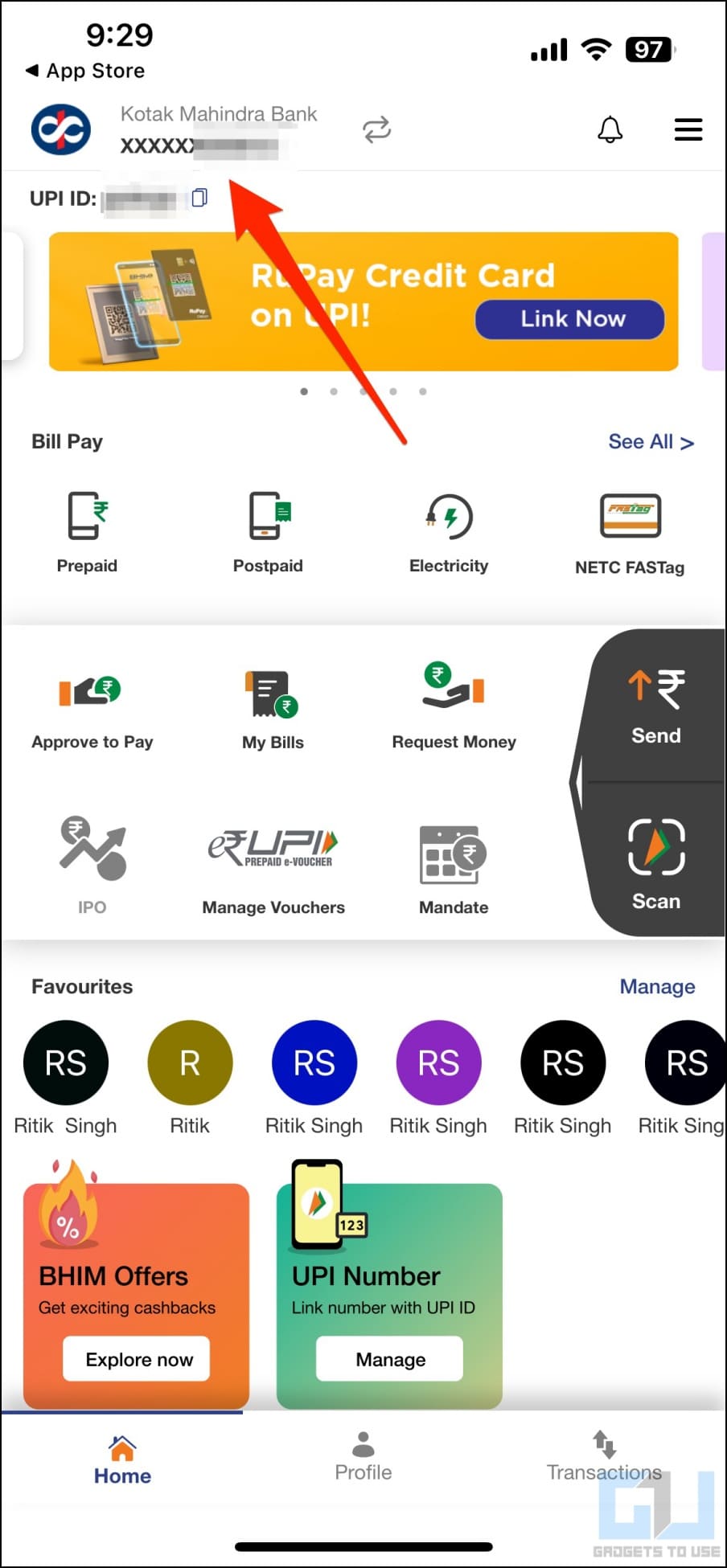

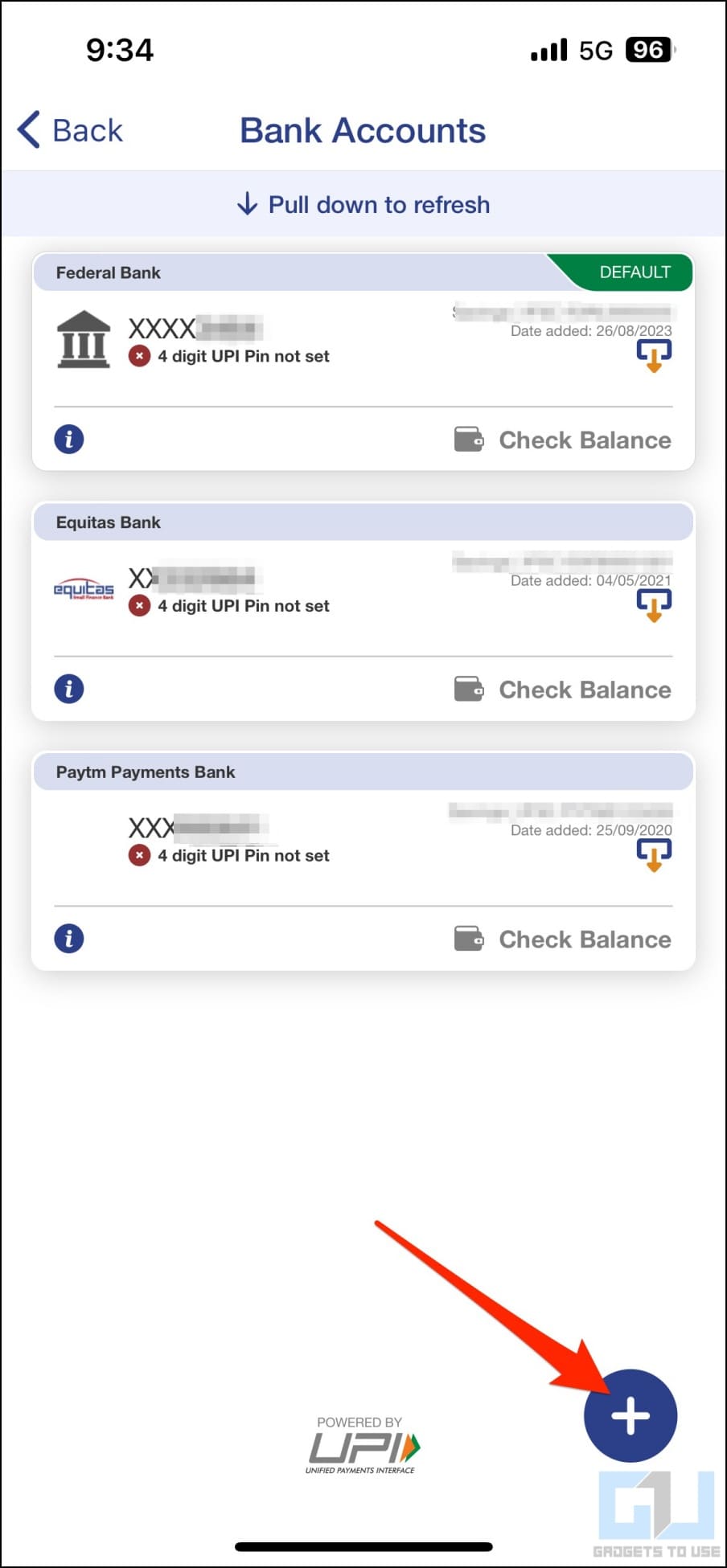

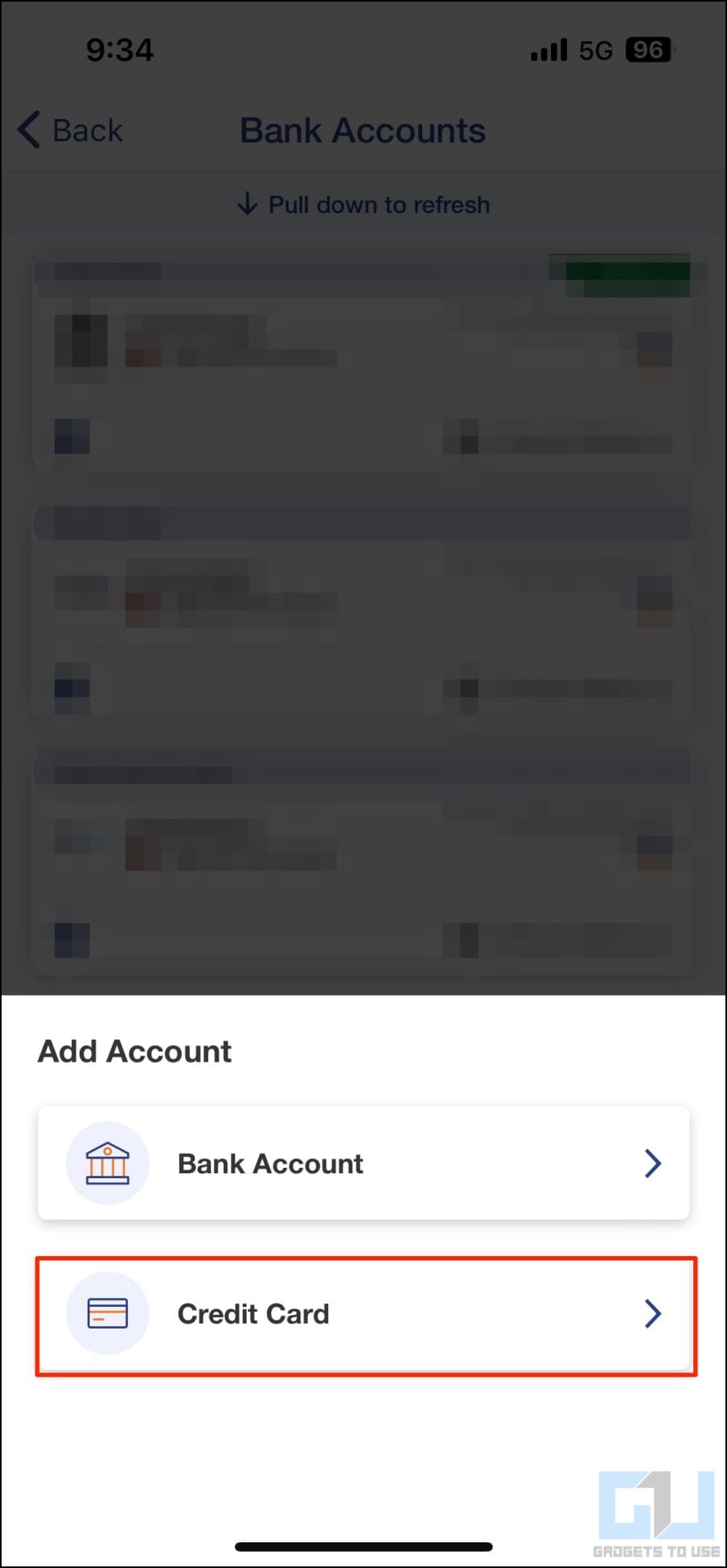

Link Rupay Credit Card for UPI on BHIM App

1. Open the BHIM UPI app on your phone.

2. Tap on bank accounts in the top left corner. It will show all your accounts linked in the app.

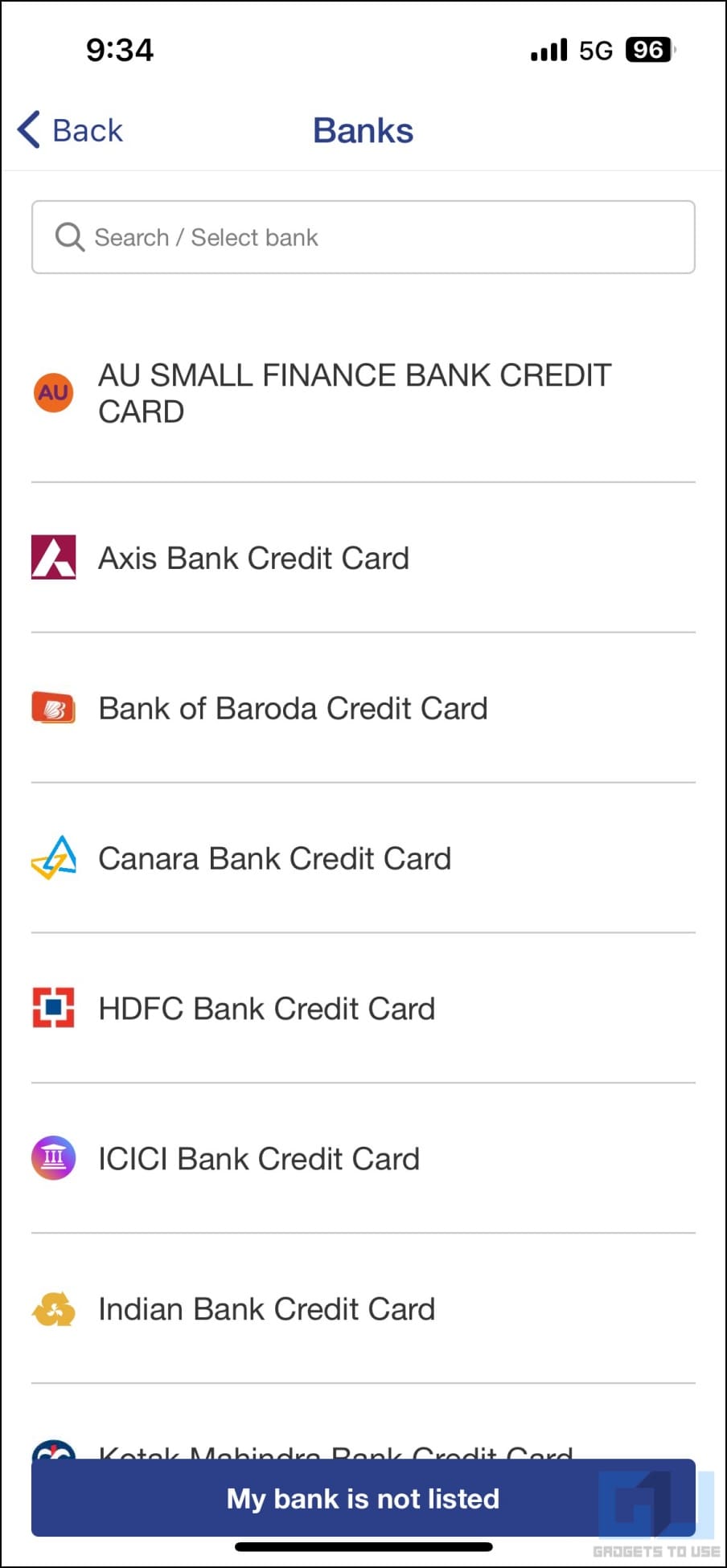

3. Click the + button on the bottom right of the screen. Select Credit Card.

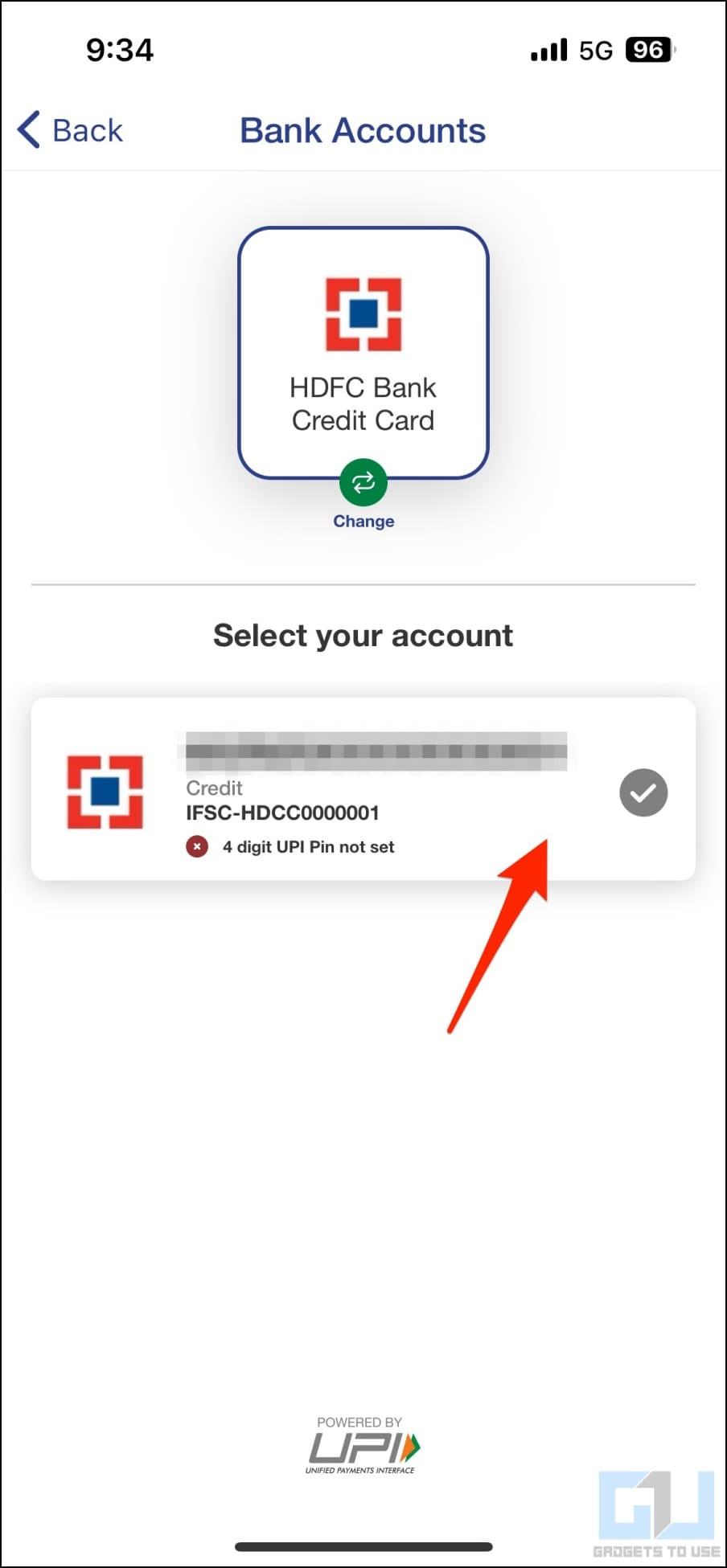

4. Select the issuer bank. Tap your credit card once it’s fetched automatically, and tap Yes to confirm.

5. Next, tap Set UPI Pin and verify using credit card details and OTP.

6. Choose the PIN of your choice. You’re now ready to make merchant payments with your Rupay credit card.

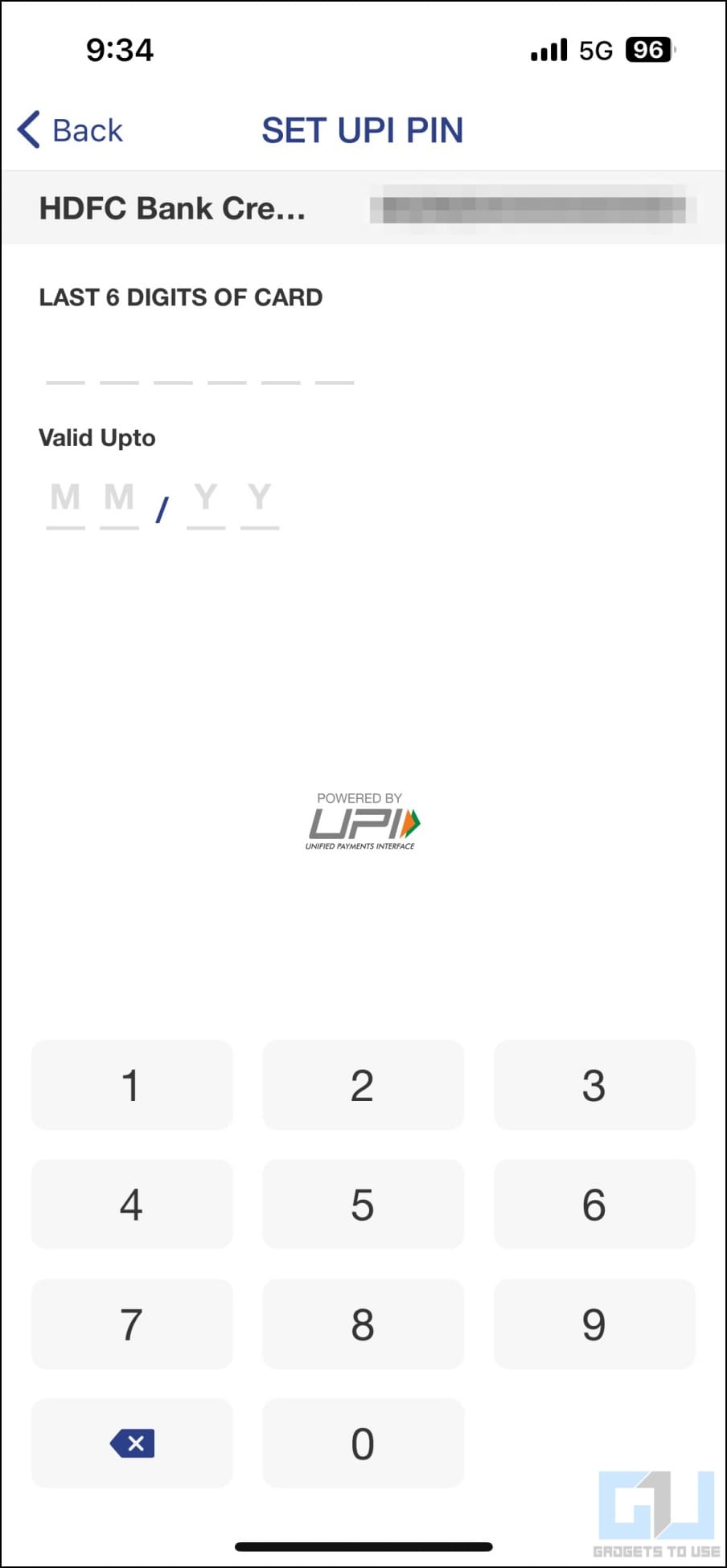

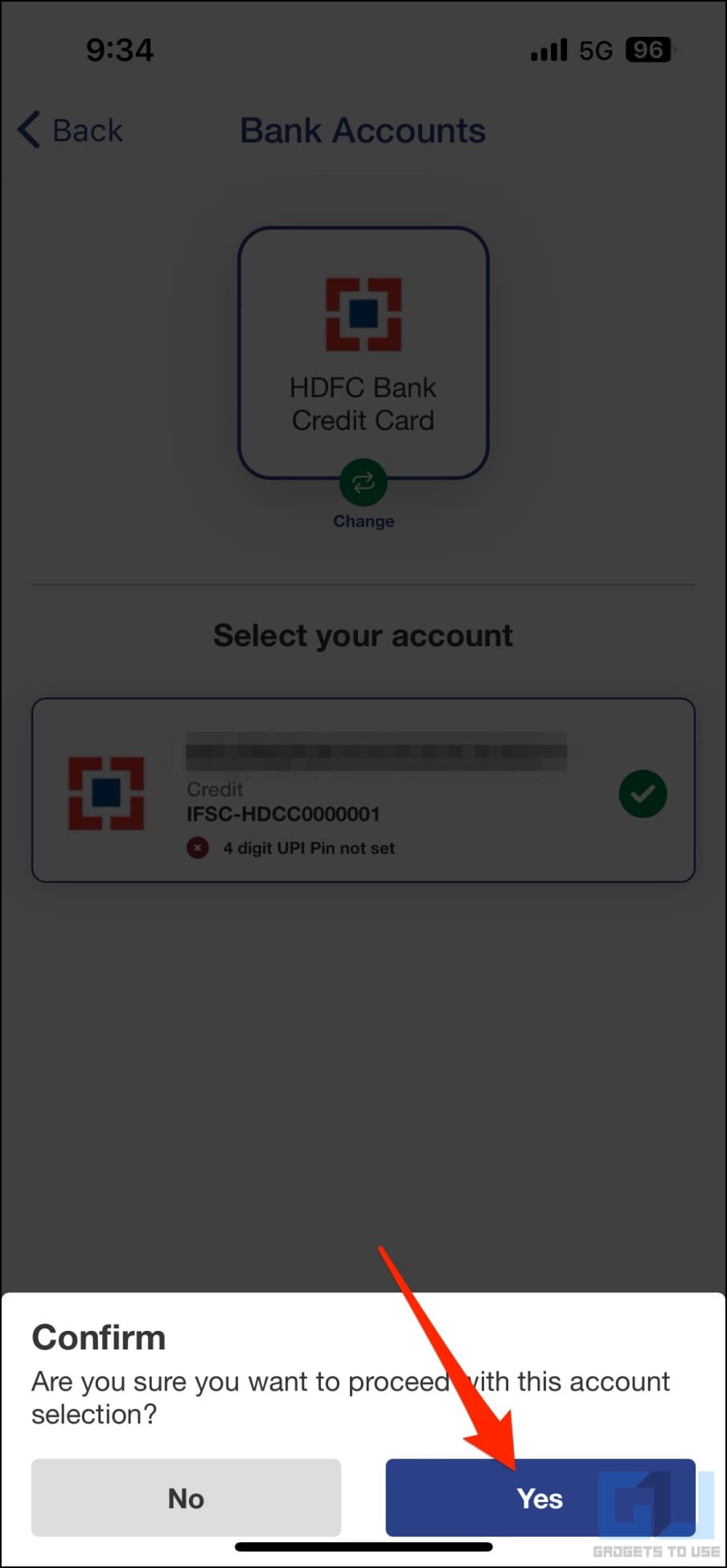

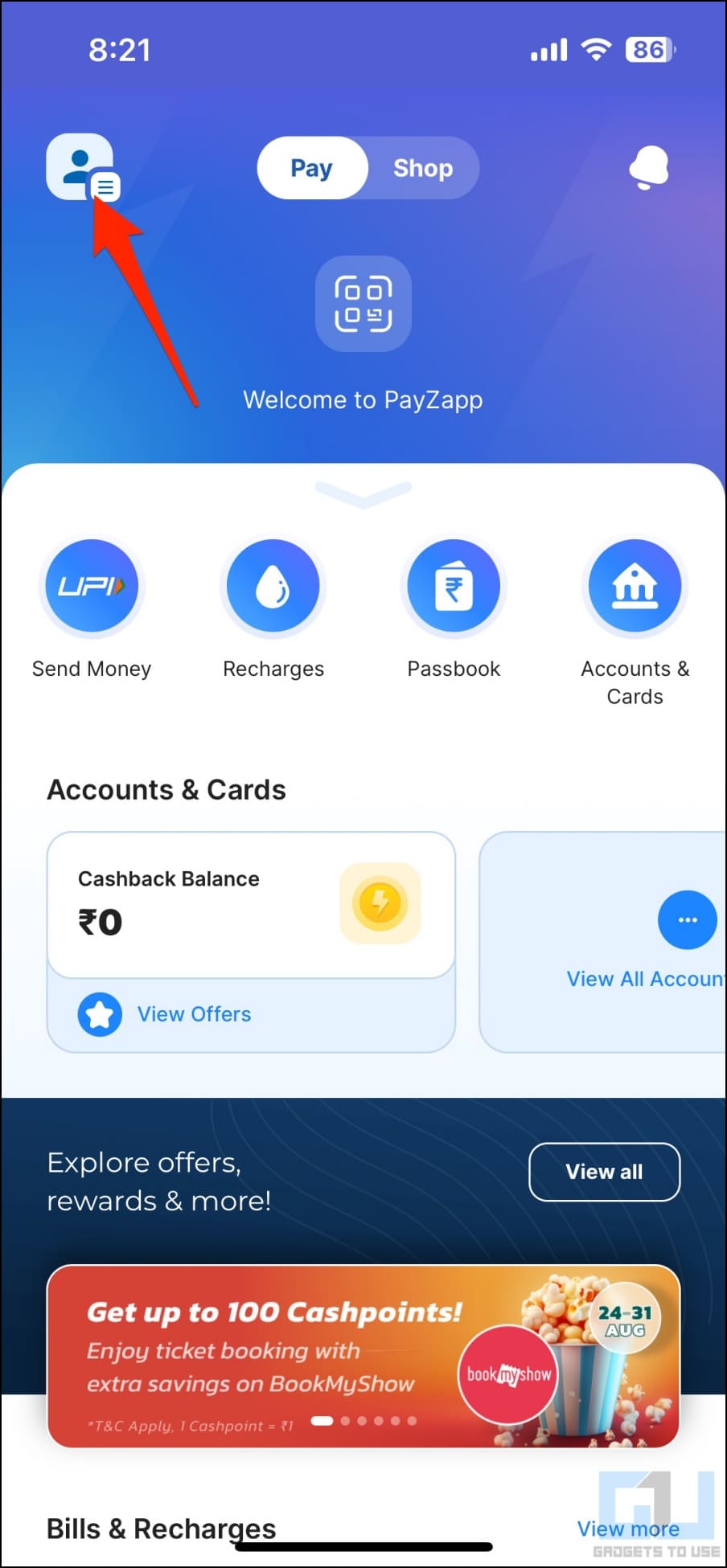

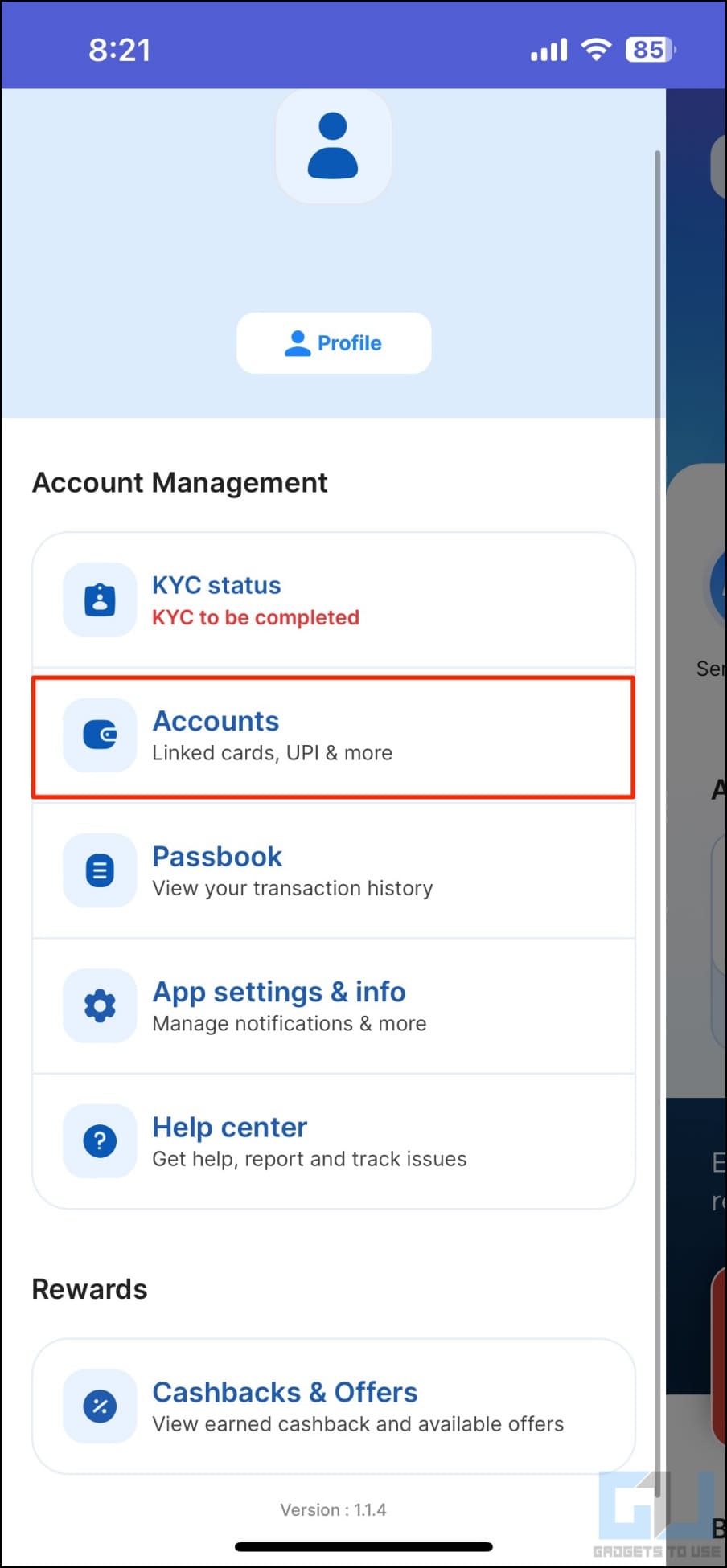

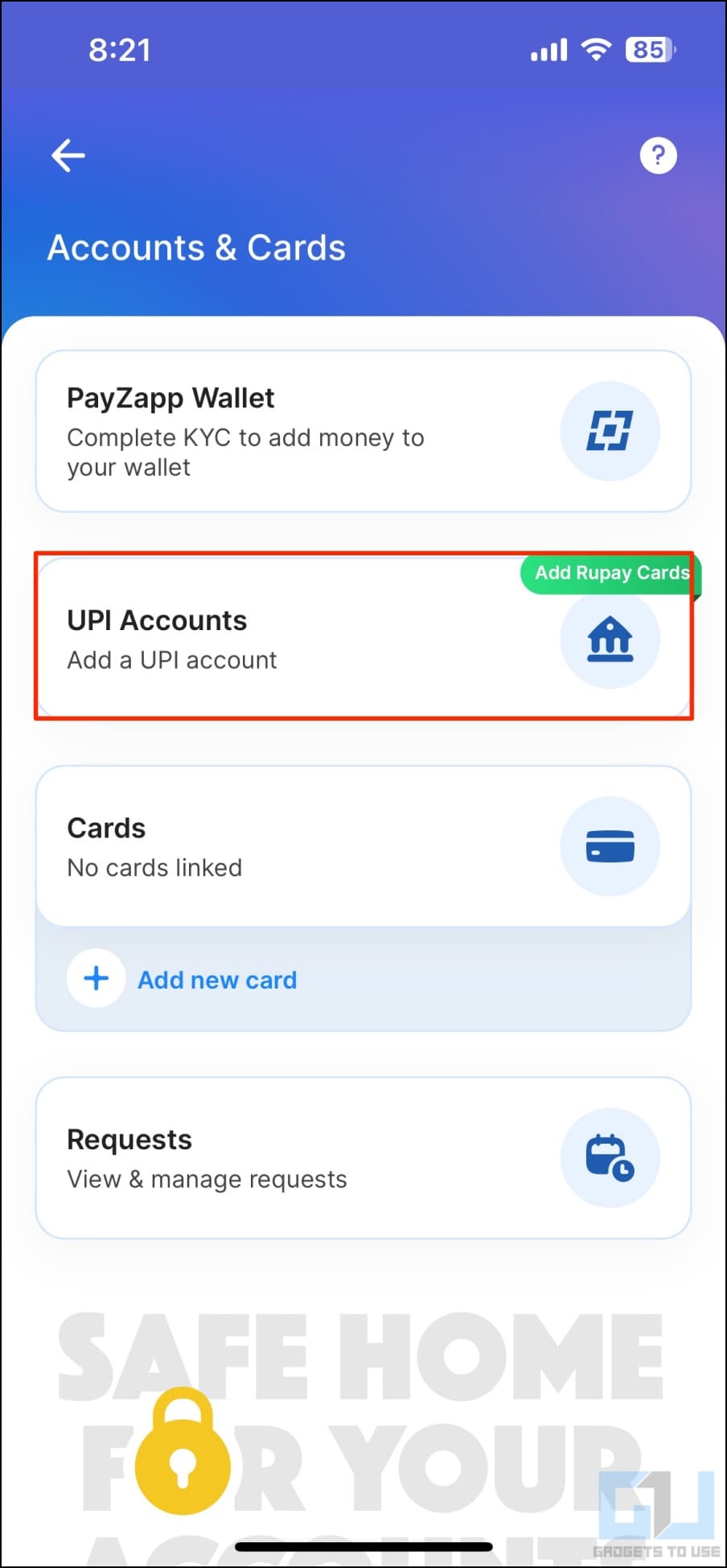

Link Rupay Credit Card in HDFC PayZapp app

1. Open the PayZapp app on your Android or iPhone.

2. Tap the profile icon on the top left and select Accounts & Cards.

3. Click on UPI Accounts- Add a UPI account.

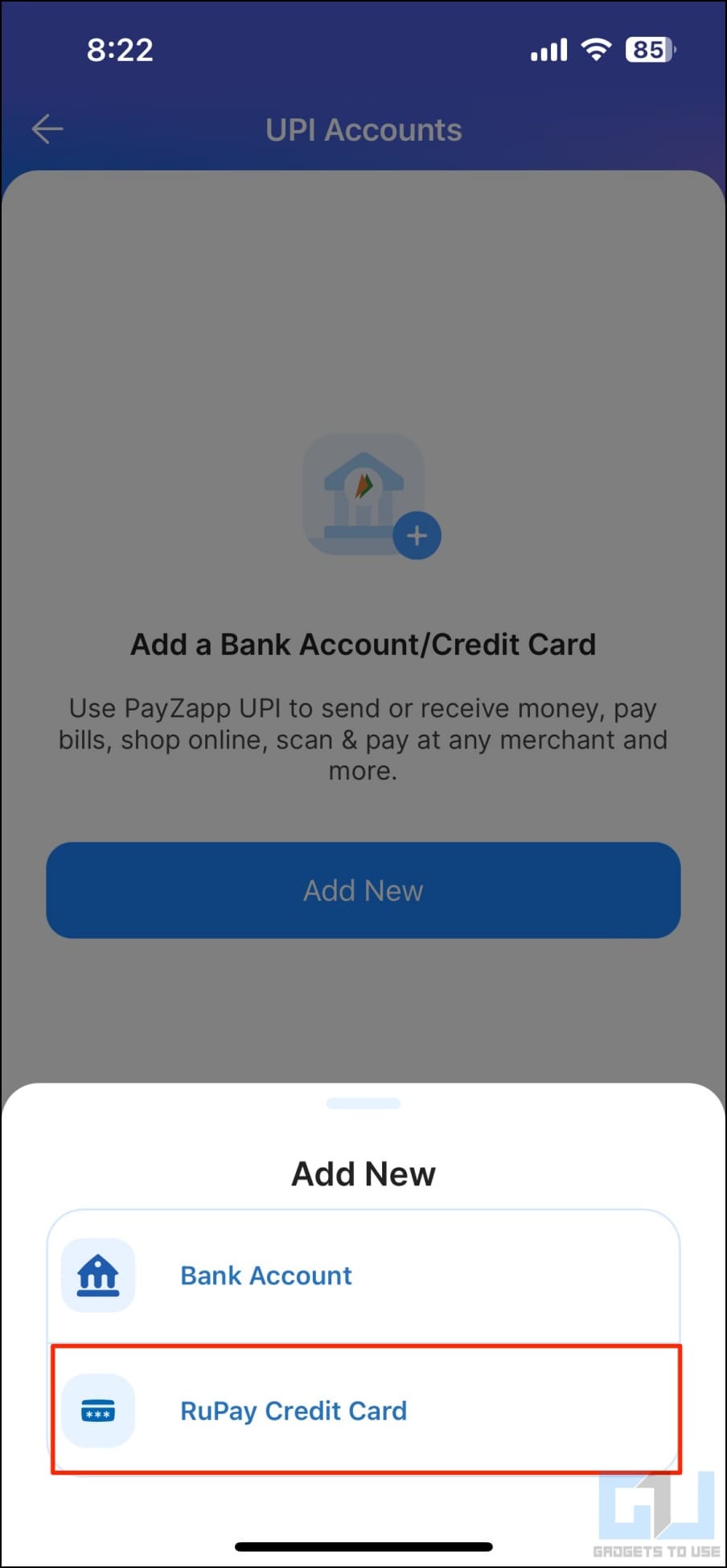

4. Tap Add New and select RuPay Credit Card.

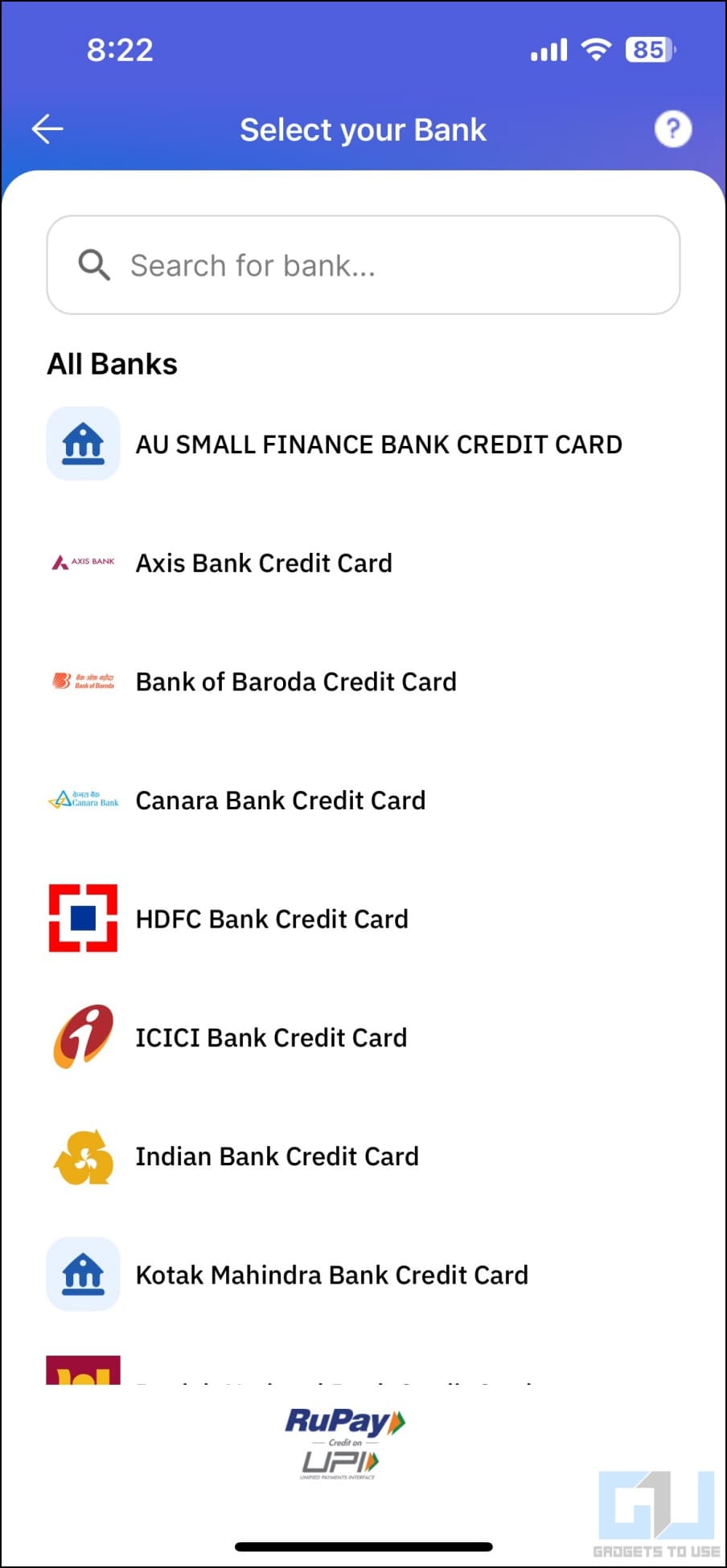

5. Search and select your card issuing bank.

6. Once the card is fetched, tap Proceed.

6. If prompted, set a UPI PIN after verifying with card details and OTP sent by the bank.

Step 3- Pay at a Shop or Merchant via Credit Card on UPI

Once you have linked your Rupay credit card to the UPI app, you can scan and pay as usual. Note that you can pay via credit card on UPI only at merchants. This includes grocery stores, clothing outlets, fuel pumps, electronic stores, cabs, hotels, restaurants, pharmacies, online stores, and more.

1. Open PhonePe, Google Pay, Paytm, or any other app and tap the Scan & Pay option.

2. Scan the QR code at a shop, restaurant, or other merchant, enter the amount, and proceed to pay.

3. Select your Rupay credit card when asked to choose the account you want to pay from.

4. Finally, enter your 4 or 6-digit UPI PIN to pay via your credit card.

Credit Card Not Working For UPI Payments?

If your credit card is not working for UPI payments, make sure of the following points:

- Only Rupay credit cards support UPI for now. You cannot use cards on Visa, Mastercard, Discover, or American Express networks for UPI payments. You can see the network logo on the credit card itself.

- Credit cards won’t work when transferring money to individuals. You cannot transfer money from your Rupay credit card on UPI to your friends, family, or relatives with an individual UPI account. It will work only for merchants.

- Credit card on UPI won’t work for small merchants. You cannot use your credit card to make UPI payments to small merchants with an expected inward transaction of Rs. 50,000 or less. These are categorized as P2PM merchants by NPCI and may include street vendors, street hawkers, chaiwalas, and vegetable sellers.

- Your Rupay credit card-linked UPI handle cannot transfer money to other credit card-UPI handles. This means you cannot send money to someone else’s (or any of your other credit cards) using your credit card on UPI.

- Specific merchant category codes (MCC) have been restricted for payments over credit cards on the UPI platform. You cannot use your credit card to make UPI payments on categories like IPO, mutual funds, credit card bill payments, loan repayments, B2B collections, etc.

Benefits of Using Rupay CC on UPI

Making UPI payments via Rupay credit cards has certain advantages over traditional bank payments:

- Interest-Free Money: Paying via credit card on UPI gives you interest-free money till the next due date. This means you’re paying the bank’s money without worrying about cash in your account for everyday expenses. But you must repay the amount before the due date as failure to do so may result in a heavy fee and penalty. You shall also be cautious about overspending.

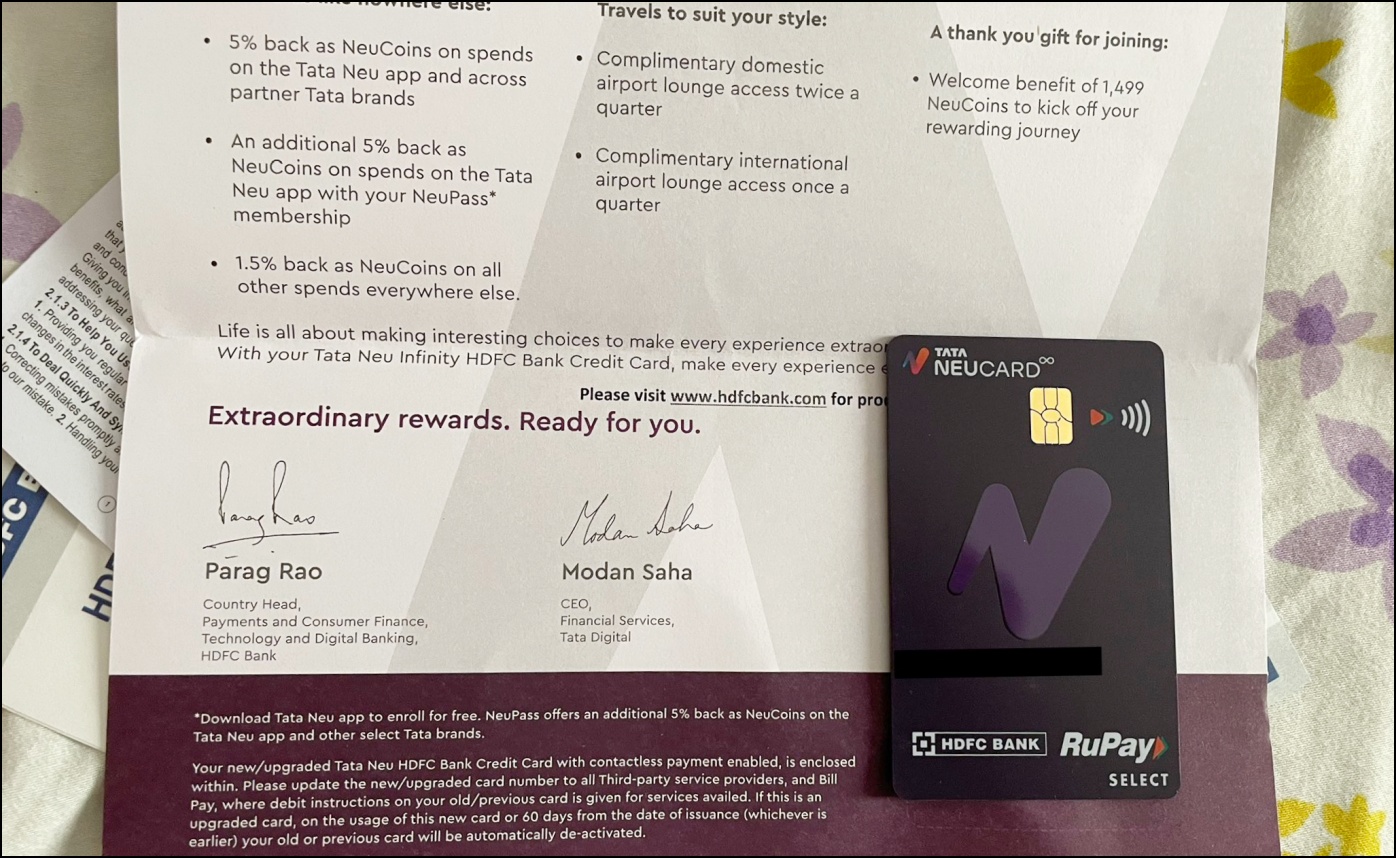

- Rewards and Cashback: Many Rupay credit cards offer rewards for making UPI payments. For example, the HDFC Tata Neu Infinity credit card gives you 1.5% Neucoins. Similarly, the Tata Neu Plus credit card gives you a 1% value back as Neucoins when paying via UPI.

- Reach your milestone faster: You can quickly fulfill spending milestones or targets on your credit card by making payments on UPI. Certain credit cards offer vouchers while others give annual fee reversal on meeting target spending criteria. For example, Kotak League Platinum Rupay credit card provides free 4 PVR tickets on spending Rs. 1,25,000 every six months.

Best RuPay Credit Cards for UPI Payments in India

There aren’t too many Rupay credit card options available right now. But as the feature is gaining popularity, banks are gradually releasing new cards designed explicitly keeping UPI in mind. Here are some of the best Rupay credit cards you can use for UPI in India:

- HDFC TataNeu Infinity Rupay Credit Card

- HDFC TataNeu Rupay Rupay Credit Card

- HDFC Freedom Rupay Credit Card

- HDFC MoneyBack+ Rupay Credit Card

- ICICI Coral Rupay Credit Card

- Kotak League Platinum Rupay Credit Card

- IDFC HPCL FIRST Power/ Power+ Credit Card

- Axis Bank KWIK Credit Card

- Axis Bank IndianOil Rupay Credit Card

- SBI IRCTC Rupay Credit Card

- PNB Rupay Platinum/ Select Credit Card

- Bank of Baroda Easy RuPay Credit Card

- Federal Bank Signet Rupay Credit Card

You can check the complete range of Rupay Credit cards here.

FAQs

Q. Why Does Credit Card Option Not Appear When Paying via UPI?

If your Rupay credit card does not show up after scanning a UPI QR code, it is likely that:

- The scanned QR code is an individual account and not a registered merchant.

- Or it’s a P2PM merchant with net monthly inward transactions of Rs. 50,000 or less.

Q. Do I Have to Pay Any Fee When Using Credit Card on UPI?

There is no charge to customers when making UPI payments via credit card. If the transaction is more than Rs. 2000, the merchant you are paying will bear an interchange fee of up to 1.1% to cover the cost of accepting and processing the transaction. Again, no cost shall be passed on to the customer.

Q. Which Credit Cards Support UPI Payments in India?

Rupay credit cards issued by banks that have enabled linking to UPI can be used for making UPI payments in India. This includes HDFC Bank, Kotak Mahindra Bank, Punjab National Bank, Bank of Baroda, Union Bank of India, YES Bank, ICICI Bank, Bank of Baroda, Federal Bank, Canara Bank, IDFC First Bank, and Indian Bank.

Q. How to Check if Your Credit Card Supports UPI Payments?

To begin with, check the credit card network logo on your credit card. It should say Rupay and not Visa, Mastercard, or any other. Once you know it’s a Rupay credit card, try linking it to your UPI app registered with the same number as on the credit card.

Q. How to Check Your Card’s Remaining Limit in the UPI App?

Checking the remaining credit card limit is similar to how you currently check your bank balance on UPI. In PhonePe, tap Check Balance, select your credit card, and enter the UPI PIN. Similarly, Paytm users can go to Balance & History to check their remaining credit limit.

Wrapping Up

This is how you can pay via UPI using credit cards in India. I hope the above guide helped you link your Rupay credit card to UPI apps like Paytm, PhonePe, Google Pay, and more. Using the “credit card on UPI” platform will not only help you declutter your bank statements but also earn rewards for your daily transactions. Stay tuned for more such tips, tricks, and how-tos.

You might be interested in:

- 5 Best Credit Card Bill Payment Apps in India (With Cashback Offers)

- [FAQ] The Real Truth About 1.1% UPI and Wallet Charges

- How to Setup and Use UPI Lite on PhonePe

- 3 Ways to Send More Than 2000 to a UPI QR Code Image

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.