Quick Answer

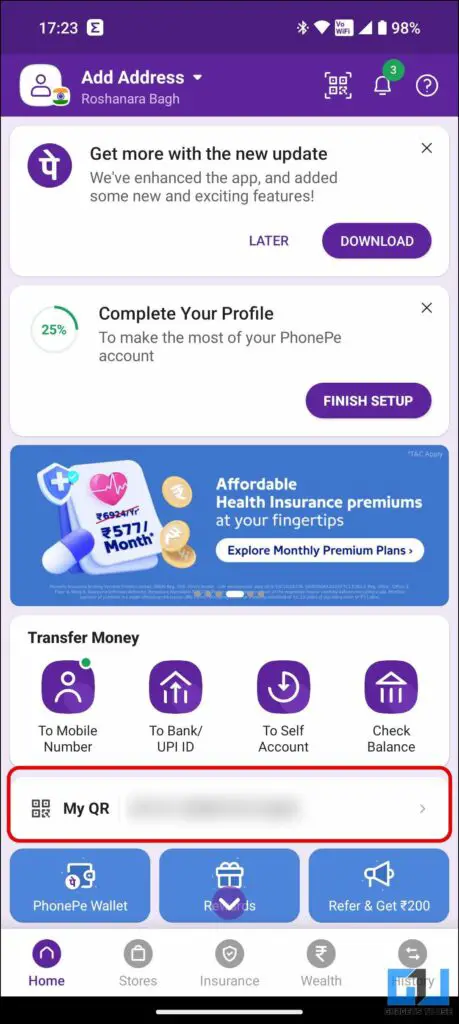

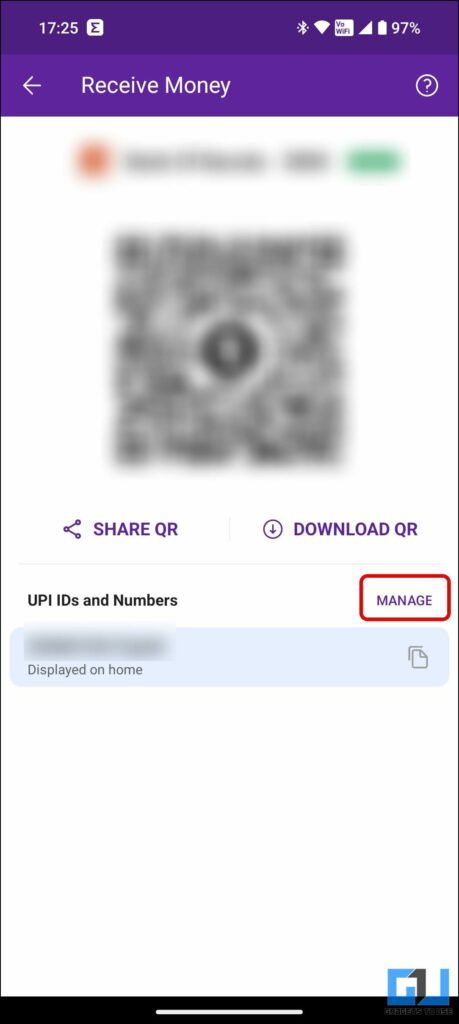

- Alternatively, you can tap your UPI ID next to My QR on the home screen and then go to Manage to activate any of your disabled UPI IDs.

- Now that we have learned how to reactivate any disabled UPI ID on TPAPs, let’s learn how to reactivate a disabled UPI ID on dedicated PSP banks.

- The NPCI circular, dated 7 November 2023, mentions TRAI’s guidelines, allowing for the reallocation of a mobile number to a new user after a cooling period from deactivation.

If you rely on UPI transactions for your daily nifty payment, then here’s news you must know about. According to a circular by NPCI (National Payments Corporation of India), inactive UPI IDs and UPI numbers will be deactivated by 31st December 2023. The circular has notified all the Payment Service Providers (PSPs) and Third-Party Application Providers (TPAPs) to deactivate all inactive UPI IDs for one year. Let’s learn how to reactivate a disabled UPI ID.

How to Reactivate an Inactive UPI ID?

The NPCI circular, dated 7 November 2023, mentions TRAI’s guidelines, allowing for the reallocation of a mobile number to a new user after a cooling period from deactivation. The circular is issued to prevent inadvertent UPI transfers to the wrong recipient due to changed mobile number ownership.

As noticed by NPCI, the users can change to a new mobile number without disassociating their previous mobile number from the banking system. The circular will result in disabled inward credit transactions on inactive UPI IDs and UPI numbers for one year or more. If any of your UPI IDs or numbers cannot receive payments, they might have been disabled because of the circular. Let’s have a look at how to reactivate them.

Method 1 – Reactivate UPI IDs

As mentioned above, the circular covers both TPAPs and PSPs. First, let’s look at how to reactivate UPI ID on TPAPs like Google Pay, Paytm, PhonePe, BHIM, etc.

Google Pay

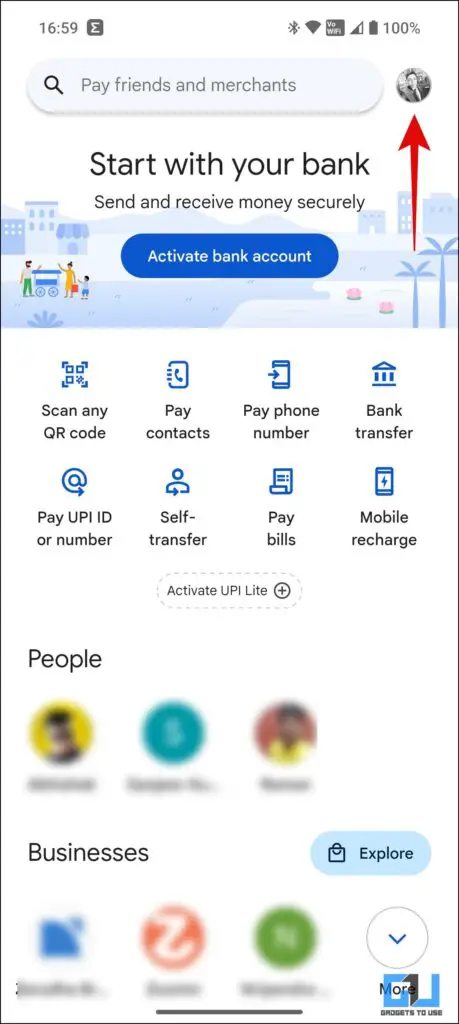

1. Launch the GPay app on your smartphone.

2. Tap your profile icon at the top right to access your Google Pay profile settings.

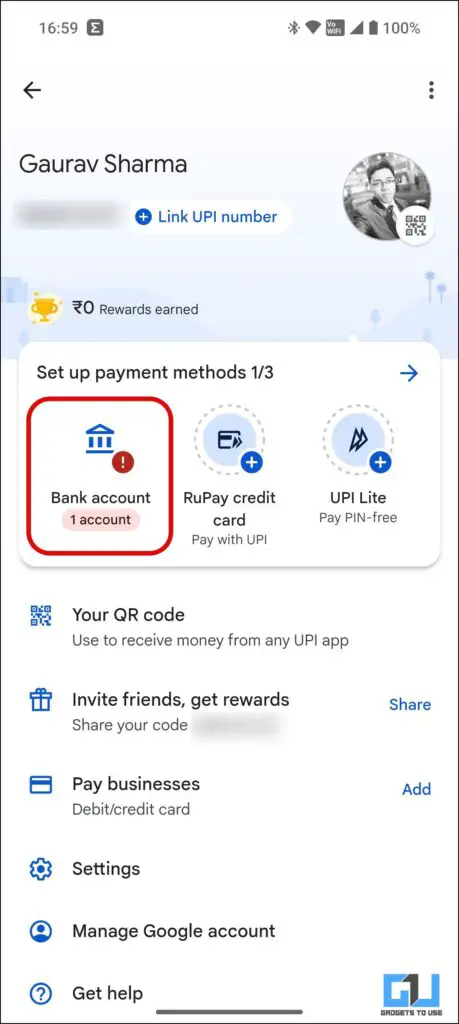

3. Tap on Bank Account (with an exclamation mark).

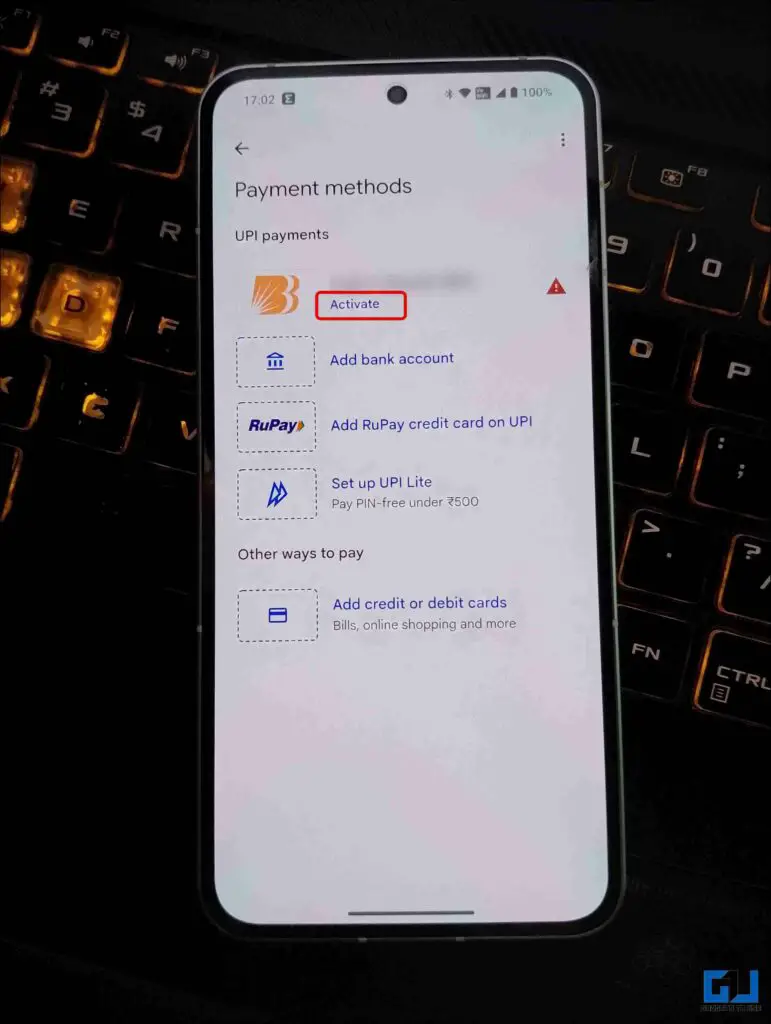

4. To reactivate your UPI, tap the Activate button under the UPI payment method linked to your bank account.

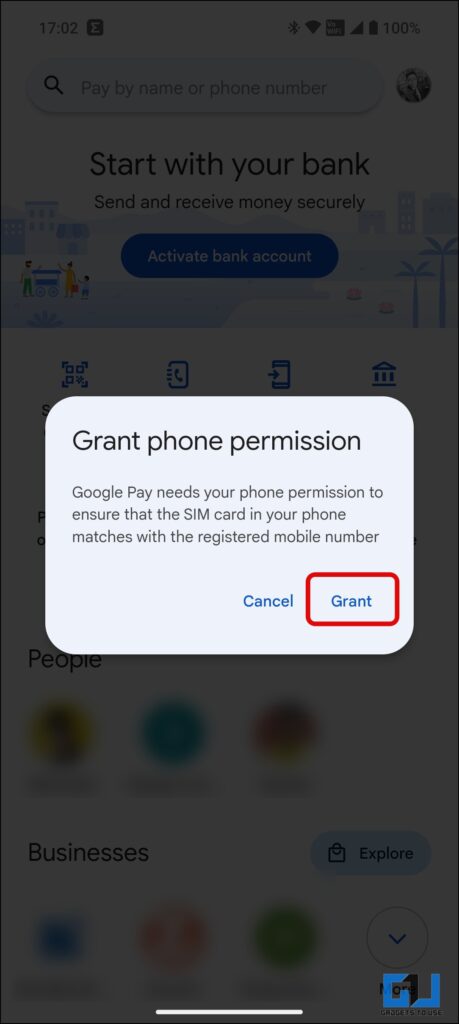

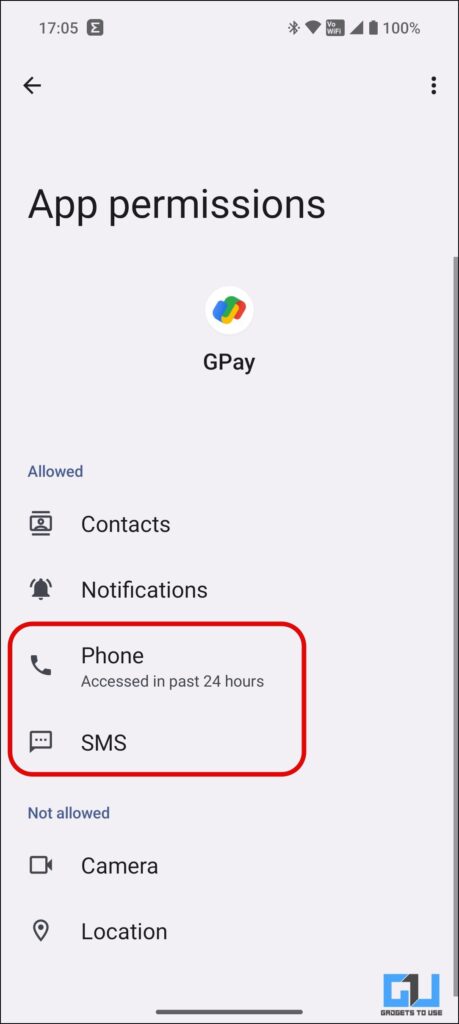

5. Grant the phone and SMS permission to verify your SIM card linked to your bank account.

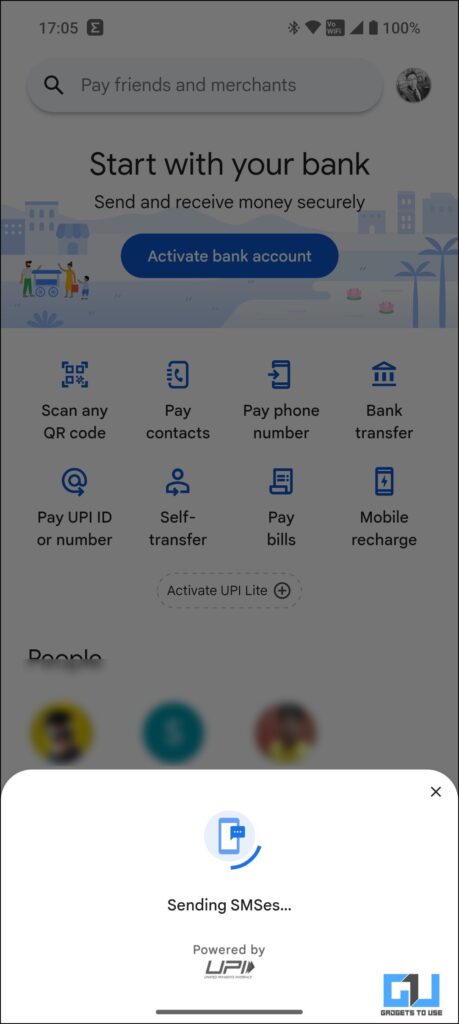

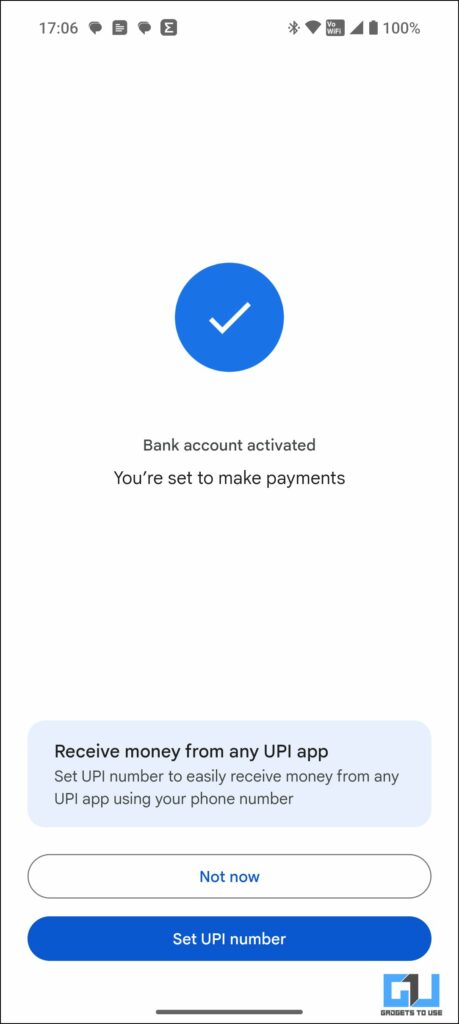

Google Pay will send an SMS to your linked bank accounts and reactivate your disabled UPI ID.

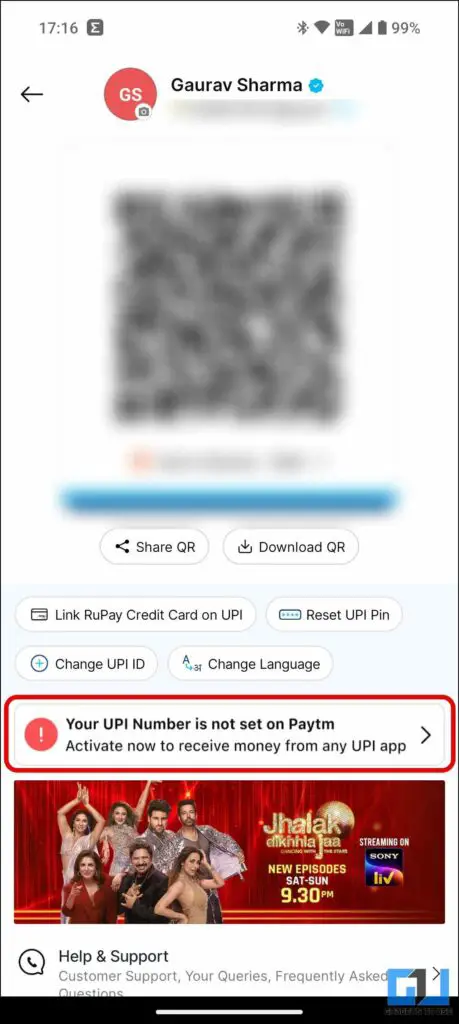

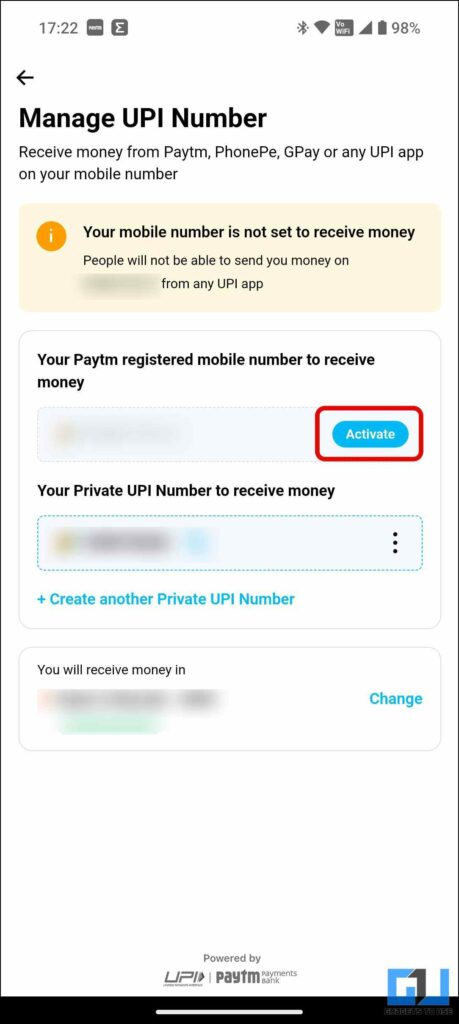

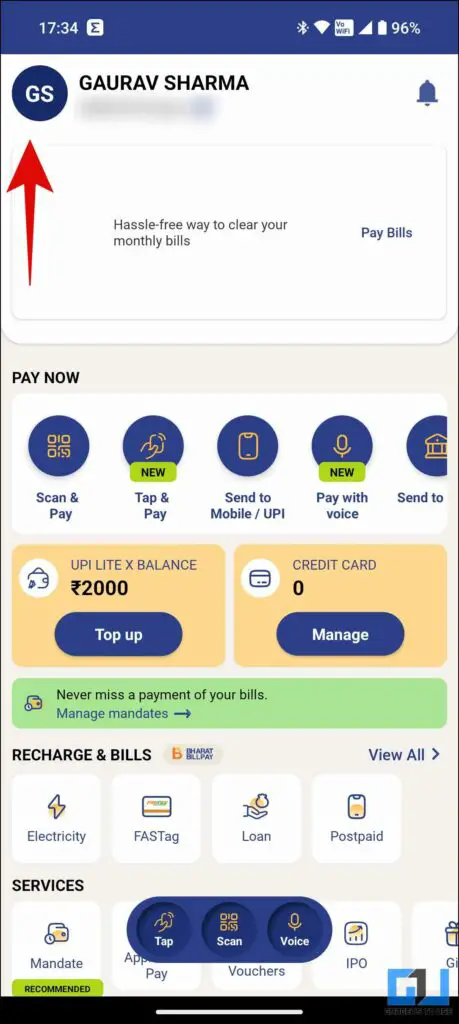

Paytm

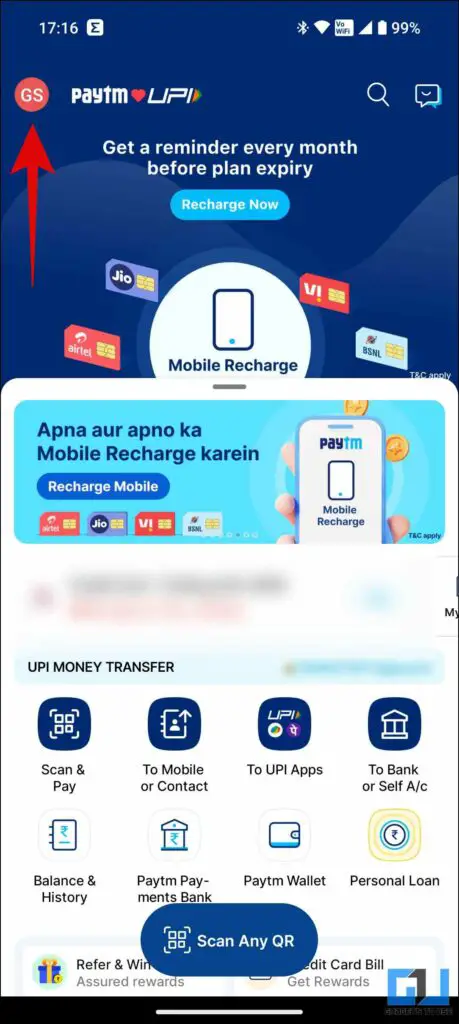

1. Launch the Paytm App on your smartphone, and tap your Name initials or the profile picture from the top left.

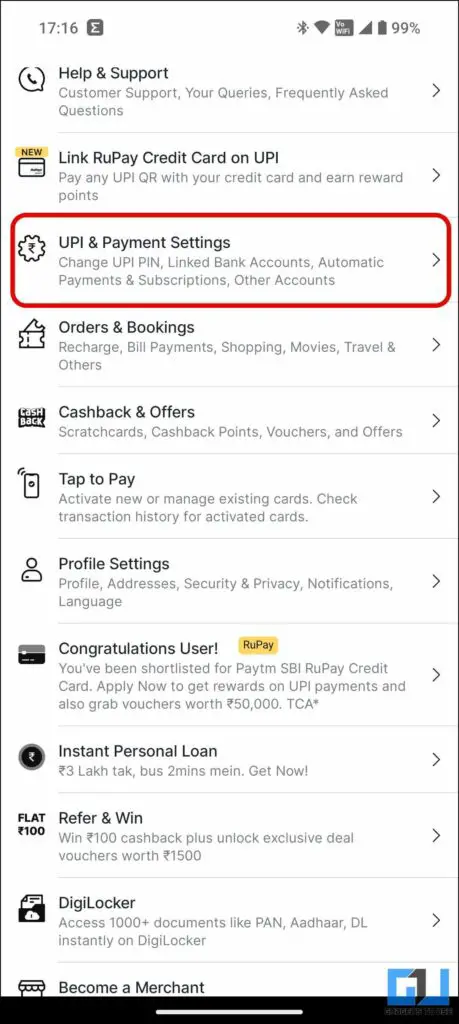

2. Scroll down the menu and go to UPI & Payment Settings.

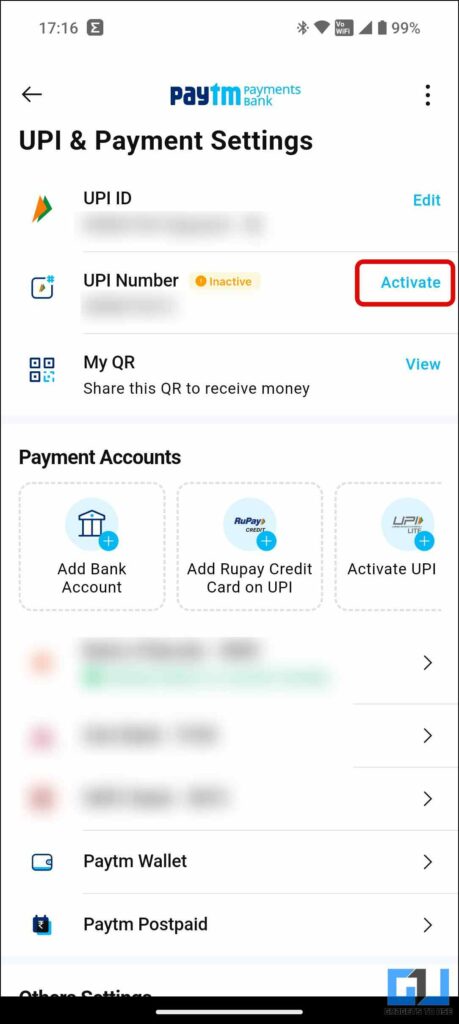

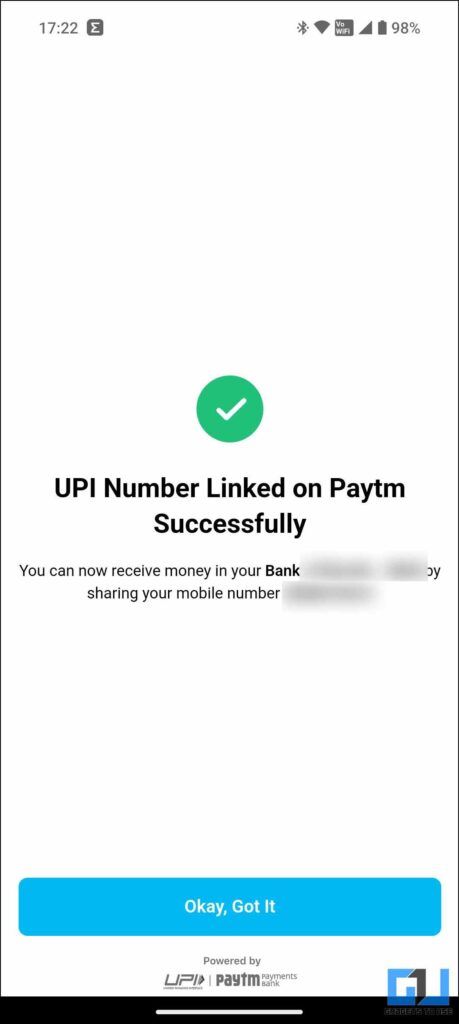

3. If you see an inactive UPI ID or number, tap Activate adjacent to it.

Alternatively, you can tap the inactive UPI warning after tapping your name initials or the profile picture from the top left.

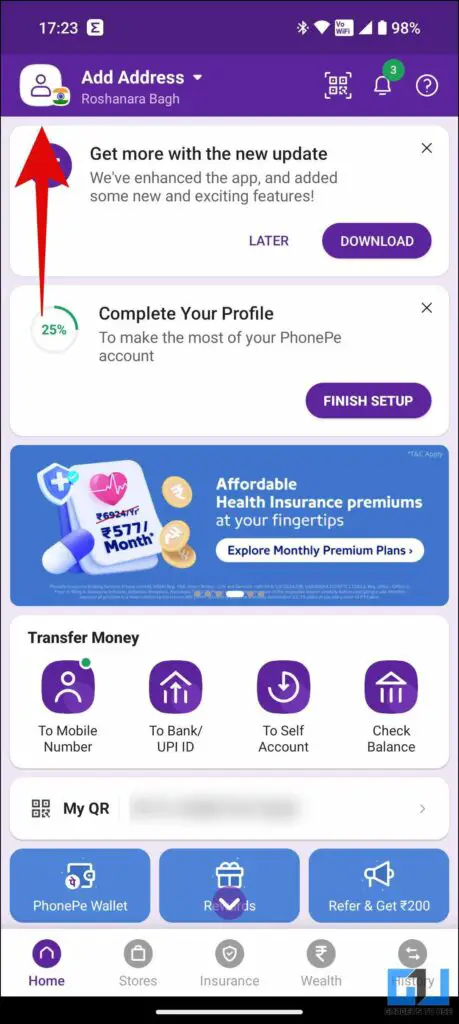

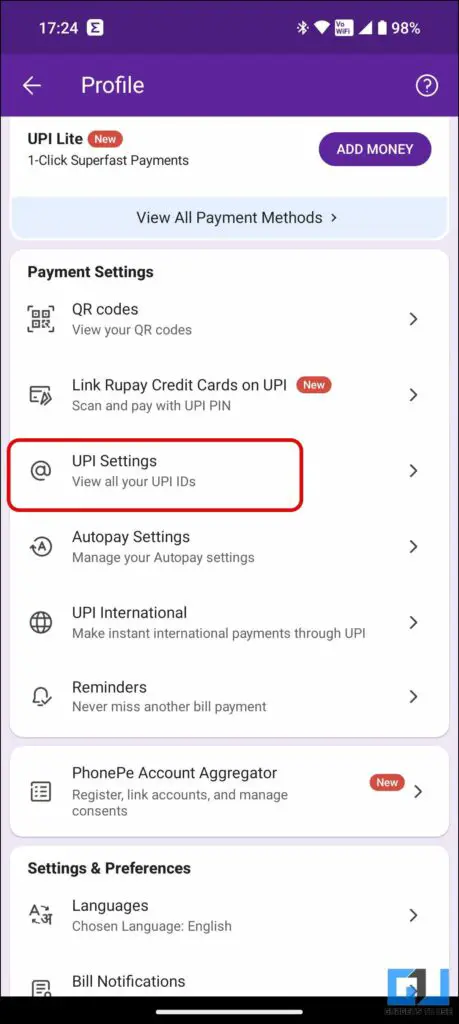

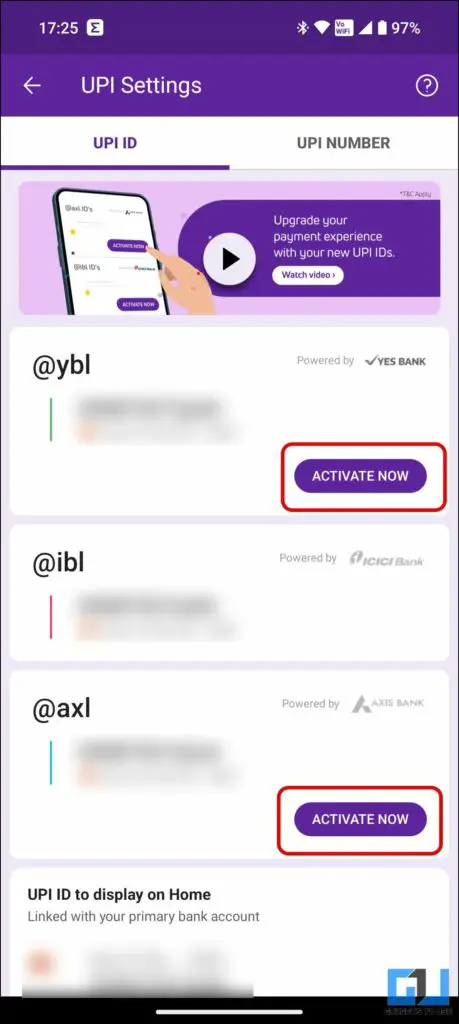

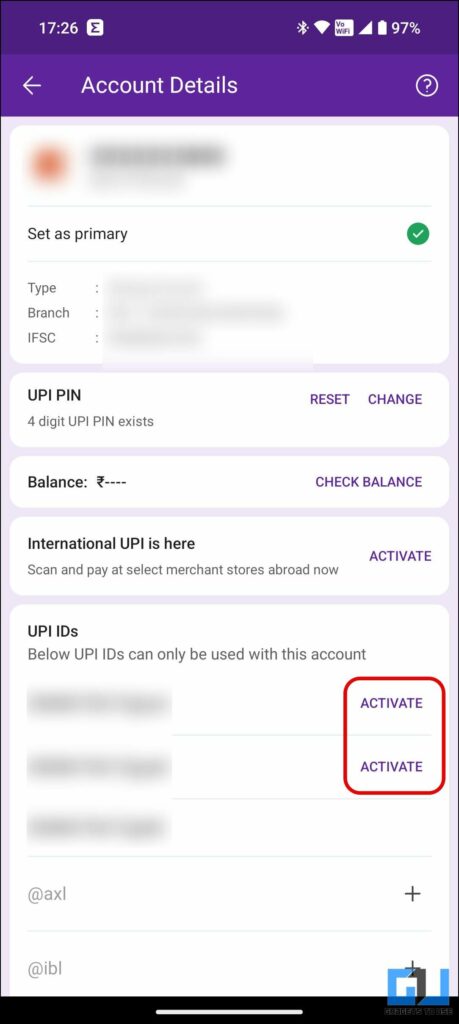

PhonePe

1. Launch the PhonePe app on your smartphone and tap your profile icon at the top left.

2. Scroll down and tap on UPI Settings.

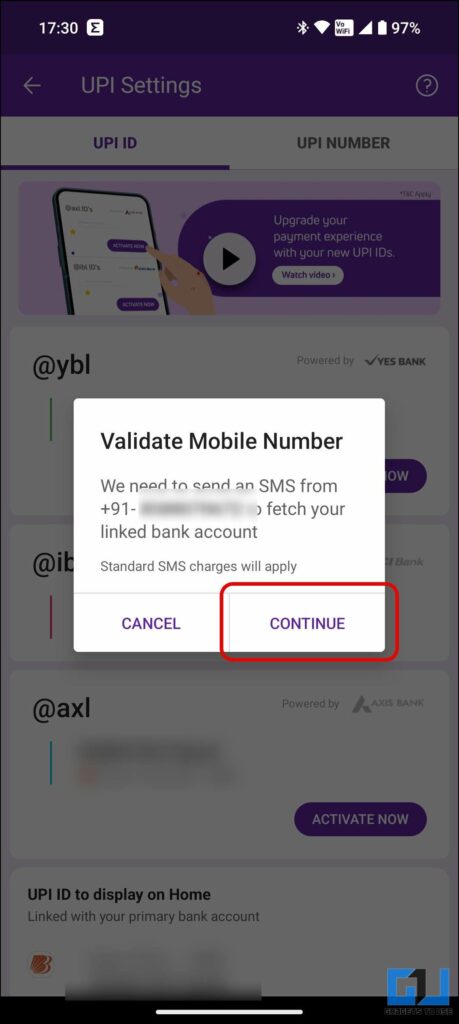

3. Here, tap the Activate button next to a disabled UPI ID you want to reactivate.

PhonePe will send an SMS to your linked bank accounts and reactivate your disabled UPI ID.

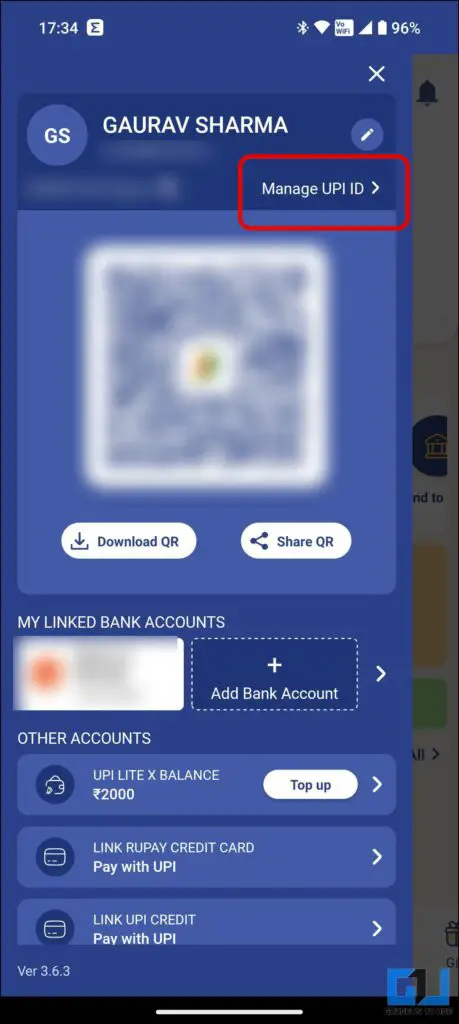

Alternatively, you can tap your UPI ID next to My QR on the home screen and then go to Manage to activate any of your disabled UPI IDs.

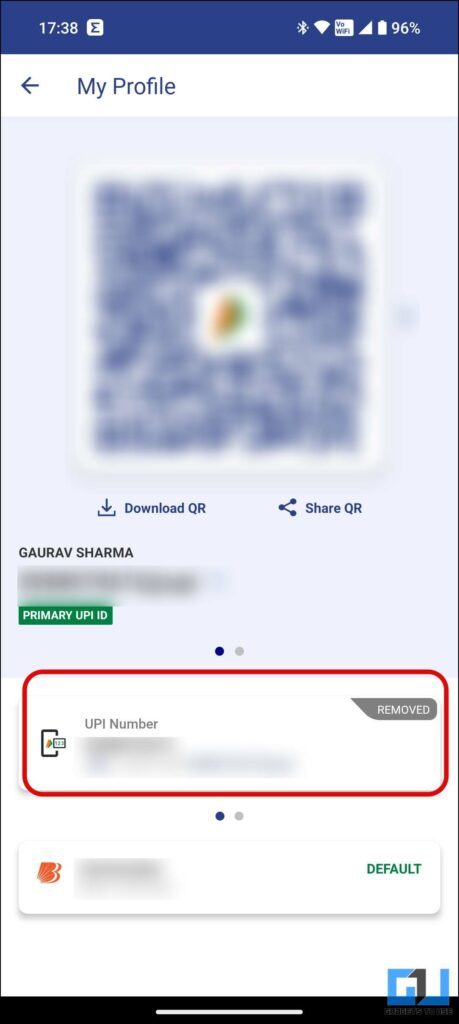

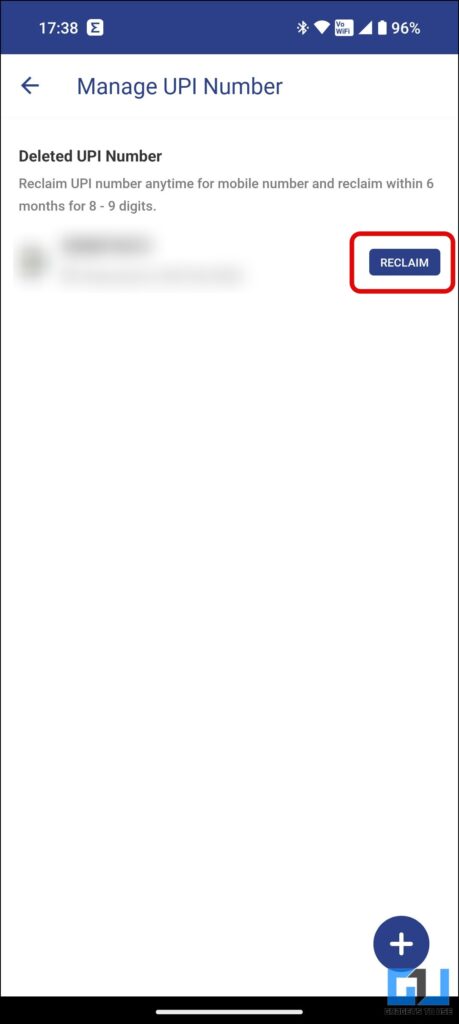

BHIM

1. Launch the BHIM app on your smartphone, and tap your name’s initials or profile picture at the top left.

2. Tap on Manage UPI ID under your name to access all previously linked UPI IDs to BHIM.

3. Here, tap the UPI ID marked as removed or deactivated.

4. Press the Reclaim or Reactivate button and follow the on-screen process.

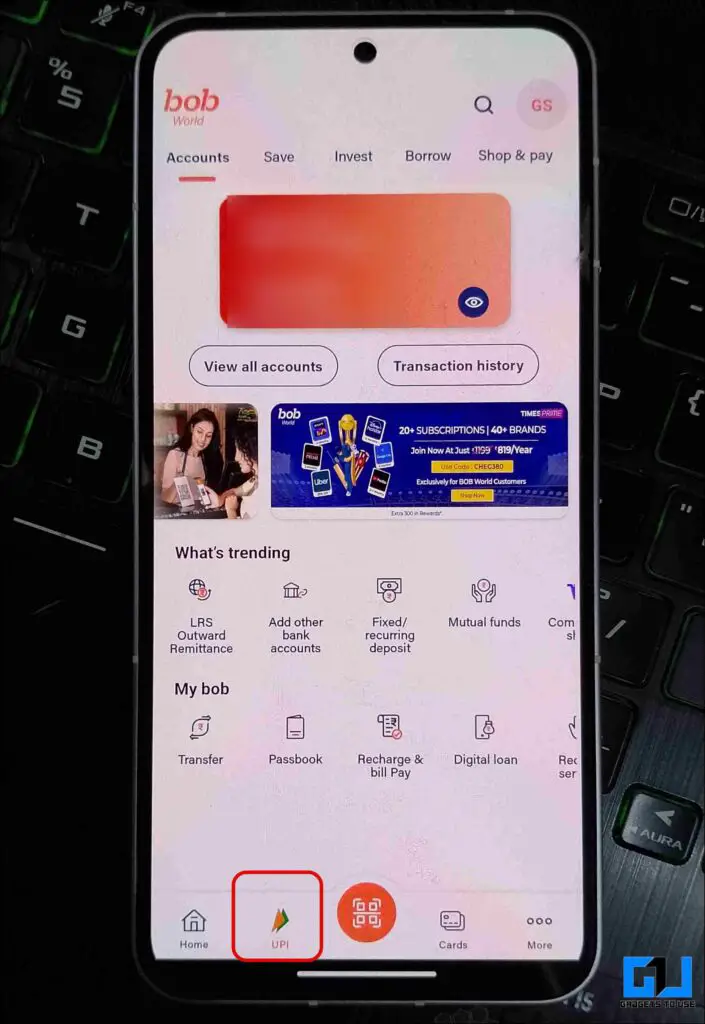

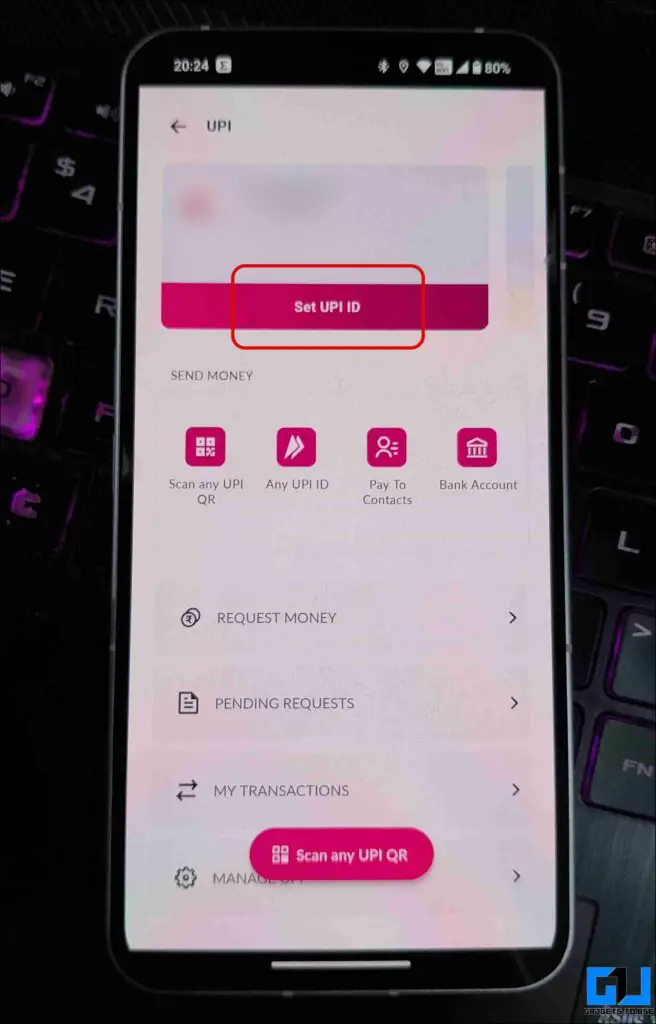

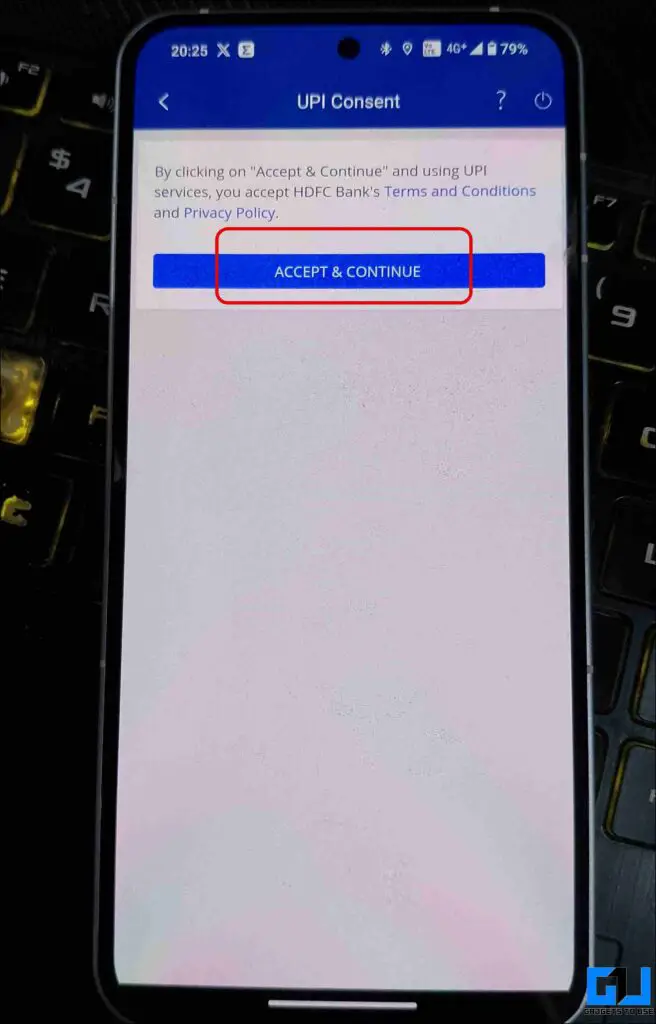

Method 2 – Reactivate UPI IDs from your Banking App

Now that we have learned how to reactivate any disabled UPI ID on TPAPs, let’s learn how to reactivate a disabled UPI ID on dedicated PSP banks.

1. Launch your banking app and log in by entering your login or mPIN.

2. Look for the UPI payment settings.

3. Follow the on-screen process to reactivate your UPI ID.

FAQs

Q. Why Am I Not Able to Receive Payment via My UPI ID?

You might have accidentally disabled your UPI ID or UPI number. Also, as per the circular from NPCI, any UPI ID that has been inactive for a year will be automatically disabled starting December 2023. Check your UPI app to reactivate your ID. Refer to the above-mentioned method to learn how to reactivate your UPI ID.

Q. Why Are Inactive UPI IDs Being Disabled?

As observed by NPCI, users who discontinue their SIM cards often do not de-link their number from their Bank accounts. This can lead to inadvertent transfers to the wrong recipient. That’s why NPCI has instructed PSPs and TPAPs to identify and disable inactive UPI IDs for inward credit transactions.

Q. Why Is the UPI Transaction Taking Longer to Process?

The transaction speed depends on the internet connectivity and band server speed. Also, from December 2023, the UPI apps must perform a Requester Validation Check (ReqValAd) before initiating a ‘Pay to Contact’ or ‘Pay to Number’ transaction. This will show the customer name fetched from the bank instead of the contact name saved on the device. If the internet or server speed is slow, this process will take longer, and so does the transaction.

Wrapping Up

We discussed reactivating a disabled UPI ID or UPI number on TPAPs and PSPs. It is to be noted that only inactive UPI IDs will be disabled for receiving payments. If you haven’t used your UPI ID for a long time, you can still make payment via it by entering your UPI PIN as usual. Stay tuned to GadgetsToUse for more such reads, and check the ones linked below.

You might be interested in the following:

- How to Use UPI Lite X to Make Offline Payments on Your Phone

- 6 Ways to Pay via UPI Using Credit Cards in India

- [FAQ] The Real Truth About 1.1% UPI and Wallet Charges

- What Is a Private UPI Number? How to Create It on Paytm?

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join the GadgetsToUse Telegram Group, or subscribe to the GadgetsToUse Youtube Channel for the latest review videos.