Quick Answer

- If you are unsure why a random charge appears on your credit card statement or what the charge is for the “What’s That Charge” portal, it will help you determine whether it is a genuine charge or something fishy.

- If the charge is not located in these lists, use the search bar at the top right and type the name of the unknown charge from your card statement.

- If you cannot find out why your credit card was charged, even after cross-checking with the bills, the below mentioned methods will help you track down the charge details in your card statement.

Not recognizing an unknown transaction or random charge in your credit card statement can be unsettling and concerning if there are multiple traces. It can end up paying for what you have not even transacted for. Therefore, we will discuss identifying random charges or transactions on your credit card bill in this read.

Why Does My Credit Card Have Random Charges?

Before proceeding, let’s learn some common reasons for unknown or random charges. If your credit card statement has an unknown charge, it could be due to:

- Stolen Card – Someone might have access to your card and use it without your permission.

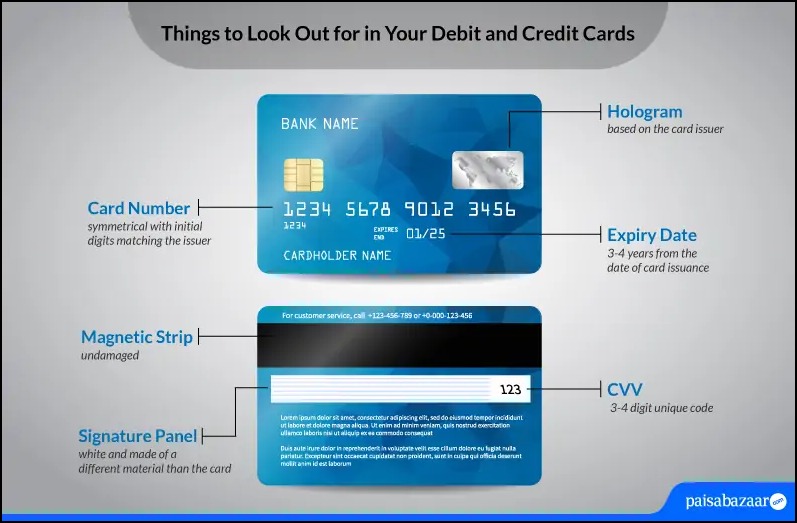

- Compromised Card Details – A hacker or mischievous person might have replicated your card.

- Clerical error or Technical Glitch – A technical error or glitch in the banking system might also lead to random charges.

- Transactions you forgot about – You might have forgotten about a transaction you made via your card. It’s better to cross-check the bills, subscriptions, etc.

How to Find Details About Random Credit Card Charges

If you cannot find out why your credit card was charged, even after cross-checking with the bills, the below mentioned methods will help you track down the charge details in your card statement.

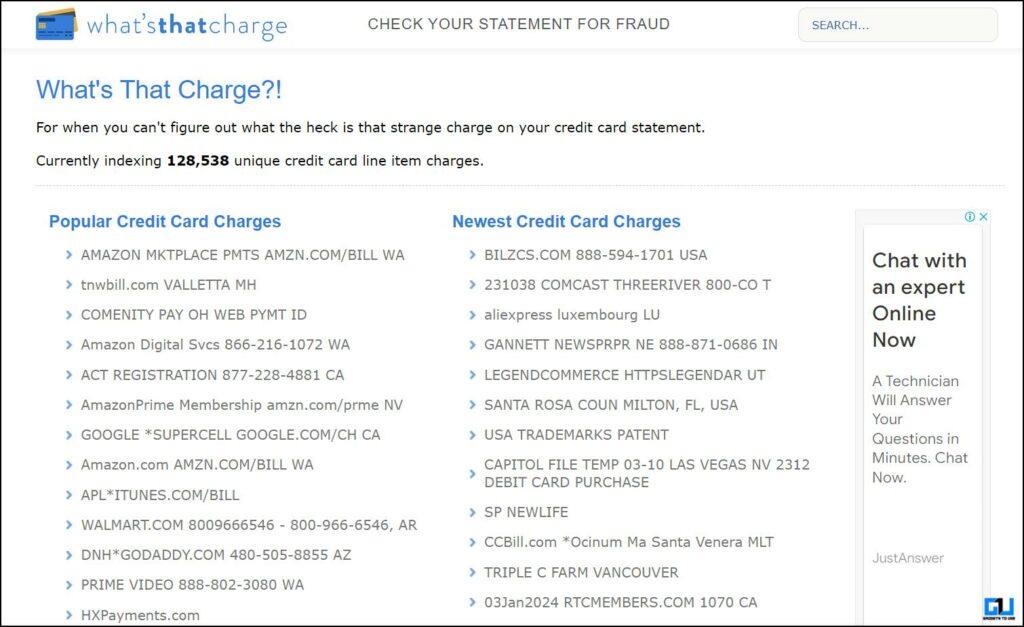

Method 1 – Use What’s That Charge

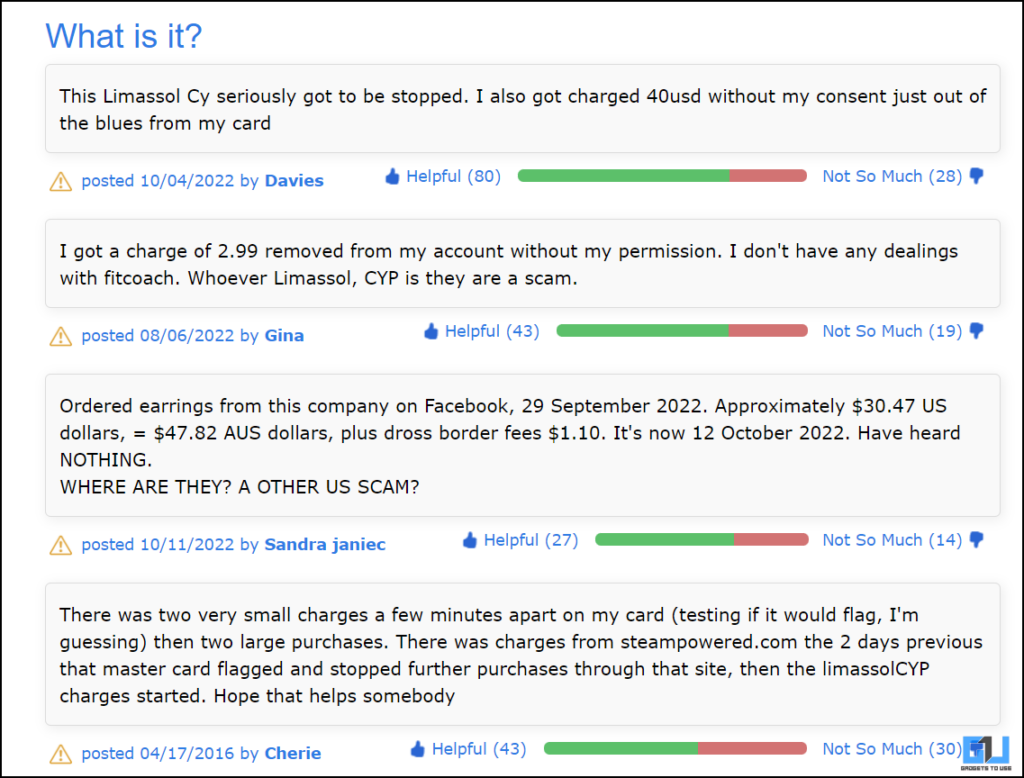

If you are unsure why a random charge appears on your credit card statement or what the charge is for the “What’s That Charge” portal, it will help you determine whether it is a genuine charge or something fishy. This portal mentions all the details about a genuine charge, and in case of a spam transaction, you can report it and see reports from others on the platform.

1. Visit the What’s That Charge website on a browser.

2. Under the “Popular Credit Card Charges” or “Newest Credit Card Charges” list, click the charge appearing in your card statement.

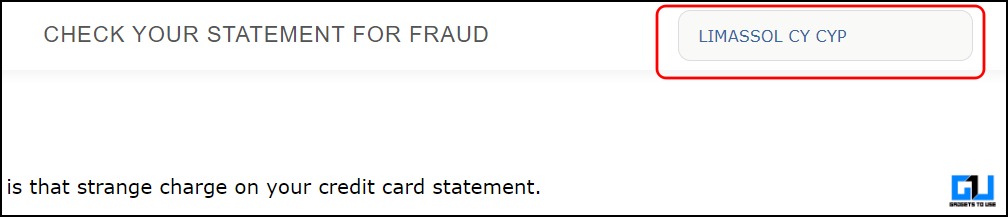

3. If the charge is not located in these lists, use the search bar at the top right and type the name of the unknown charge from your card statement.

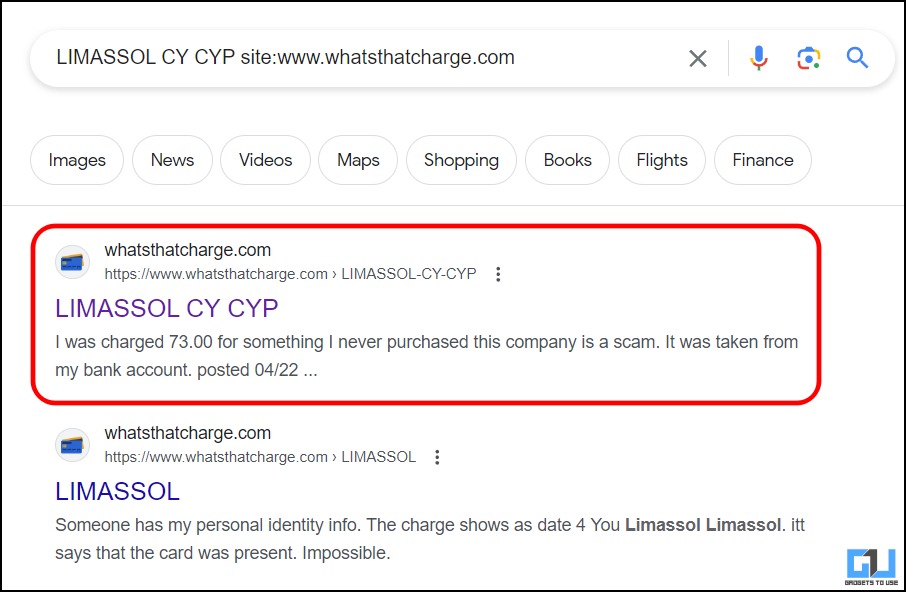

This will fetch the Google search for the exact page on the What’s That Charge website.

Click the search result to see its details.

Method 2 – Contact Customer Care

If the “What’s That Charge” did not help you determine why your card was charged, contact your bank or the card issuer company. Call the customer care number on the back of your credit card and enquire about the charge. The representative will help you investigate the charge.

What Should You Do in Case of Unknown Credit Card Charge

In case of an unknown or random charge on your credit card, you should take the following actions immediately:

- Re-check the card statement and look closely for the date, amount, merchant name, etc.

- Ask if someone in your family has used your credit card.

- Check for the subscription renewals or trials you have signed up for.

- Online search about the charge on What’s That’s Charge, or contact the card issuer.

- Contact the card issuer and ask them to freeze your immediately and place a request for a new card.

Reporting such unknown transactions or charges on your card immediately to the bank or card issuer helps limit your liability and prevent such transactions from occurring in the future.

As per RBI, you can give a missed call on 14440 to report the unauthorized transaction and take the acknowledgment number of the report. The bank has to resolve your complaint within 90 days from the date of receipt. If the fraudulent transactions continue even after informing the bank, your bank will have to reimburse those amounts.

Wrapping Up

This is how you can track down unknown transactions or charges on your credit card. Never share your card details with anyone, including PIN, CVV, and the transaction OTP, and change the password every few weeks to prevent suspicious transactions. Do not use any public network or computer to make transactions, and inform the bank immediately in case of any such transaction. Stay tuned to GadgetsToUse for more such reads, and check the ones linked below.

You might be interested in the following:

- 3 Ways to Check Railway Lounge Access on Your Credit Card

- 4 Ways to Check Lounge Access at the Airport on Your Debit/ Credit Card

- How to Find Out Apps Charging Money On Your Credit Card (Android, iOS)?

- 6 Ways to Pay via UPI Using Credit Cards in India

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join the GadgetsToUse Telegram Group, or subscribe to the GadgetsToUse YouTube Channel for the latest review videos.