Quick Answer

- Once your card is added with Tap to Pay enabled, you need to enable NFC on your phone and set Paytm as the default app for Contactless payments.

- Once on the Tap to Pay Screen, you can choose your Saved Cards, or click on Add New Card, to enter your card details.

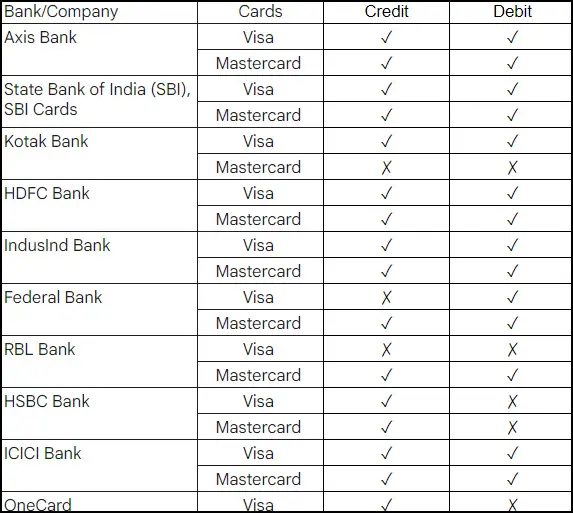

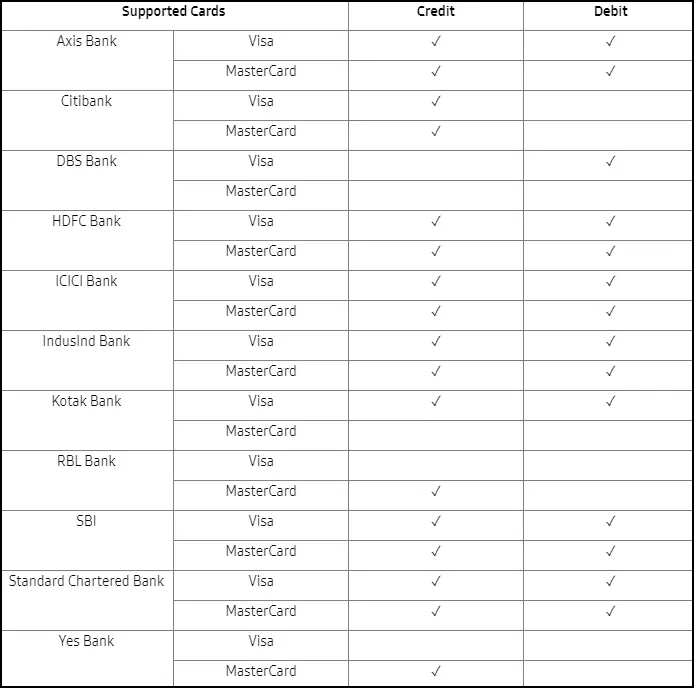

- However, if you own an NFC-enabled phone, you can also use the Tap to Pay feature, via UPI or the supported cards mentioned below, using Google Pay.

An NFC chip helps us in many ways like connecting our favorite pair of audio accessories, NFC trackers, or checking up on our health via NFC-based health sensors, making payments, and more. However, with the absence of Apple Pay in India. Today in this article we will help you enable the Tap to Pay feature on any NFC-compatible Android phone or iPhone, via Paytm, Google Pay, etc. So without any further adieu let’s get started.

How to Activate Tap to Pay?

While UPI is the most used contactless payment mechanism in India. With an increasing number of NFC-compatible phones, Tap to Pay service has started picking up lately. In this read, we have discussed three ways you can use Tap to Pay on your phone with selected cards and UPI.

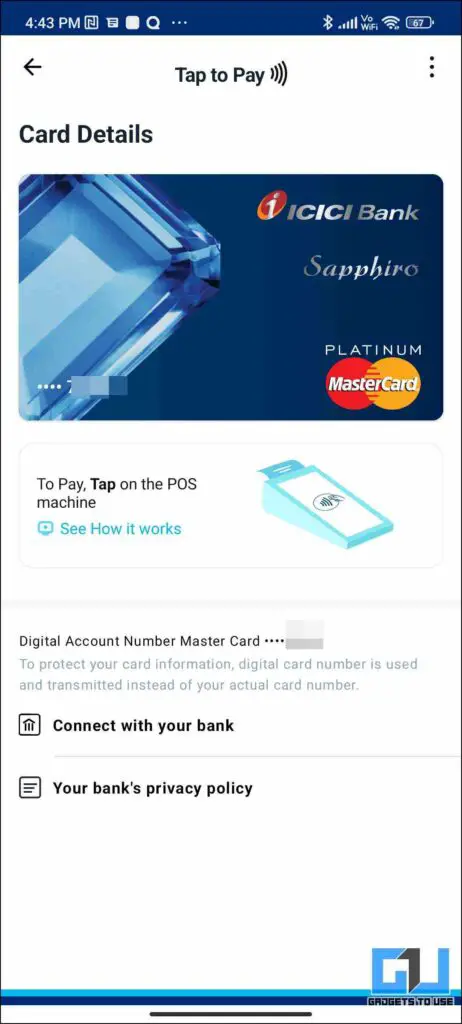

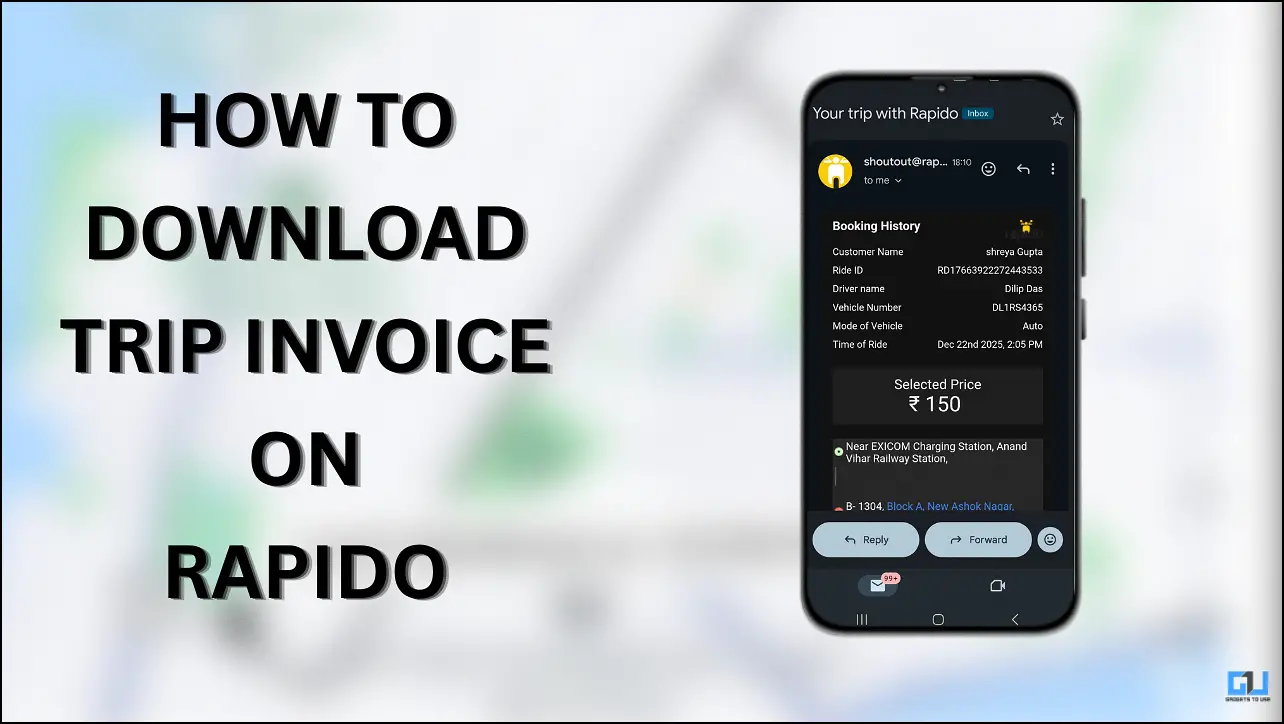

Steps to Activate Tap to Pay on Paytm

Paytm is one of the most popular payment apps, used in the country, for wallet and UPI transactions. However, very few are aware that it offers the Tap to Pay feature as well, with the supported cards mentioned below. Let’s see how you can use it on your NFC-compatible phone.

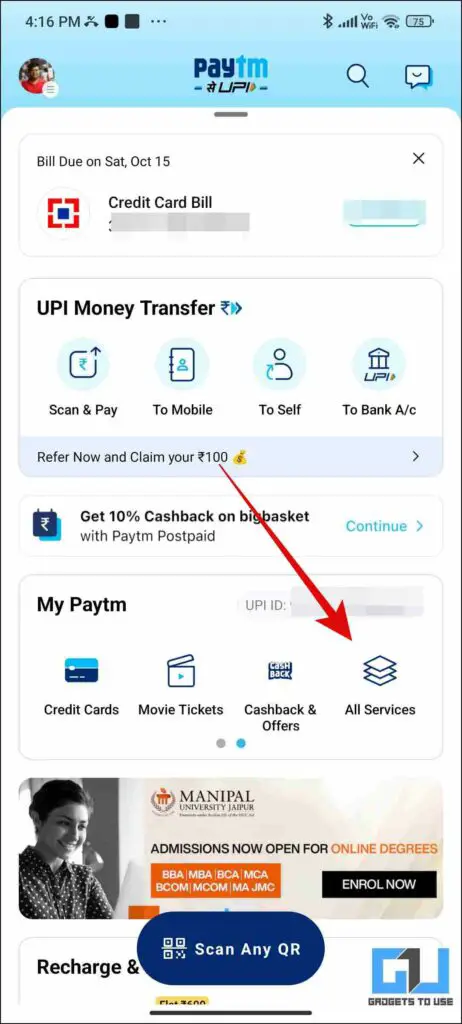

1. Launch the Paytm App (Android, iOS) on your phone.

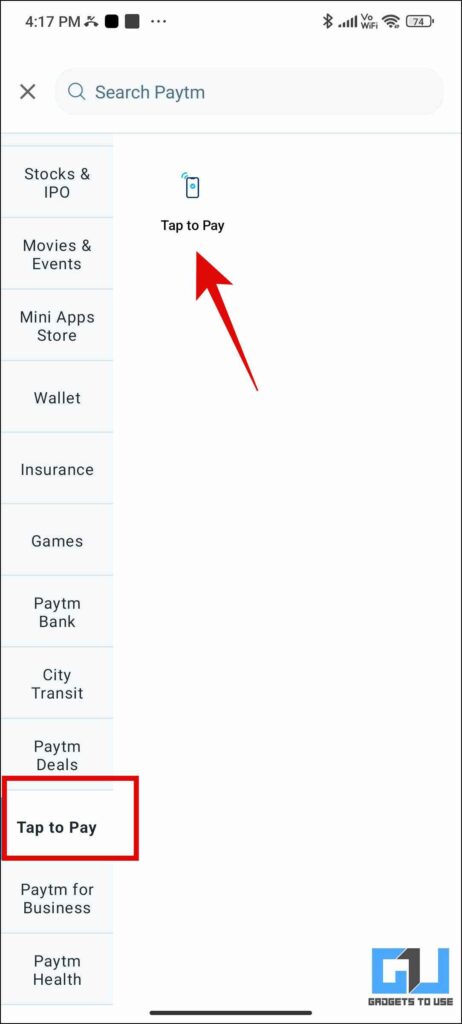

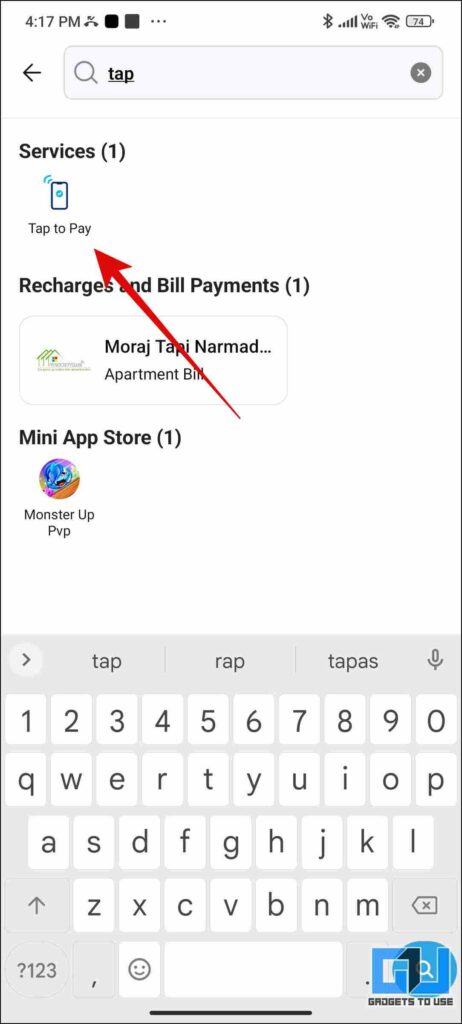

2. Either navigate to the Tap to Pay from the Services tab or simply search Tap to Pay.

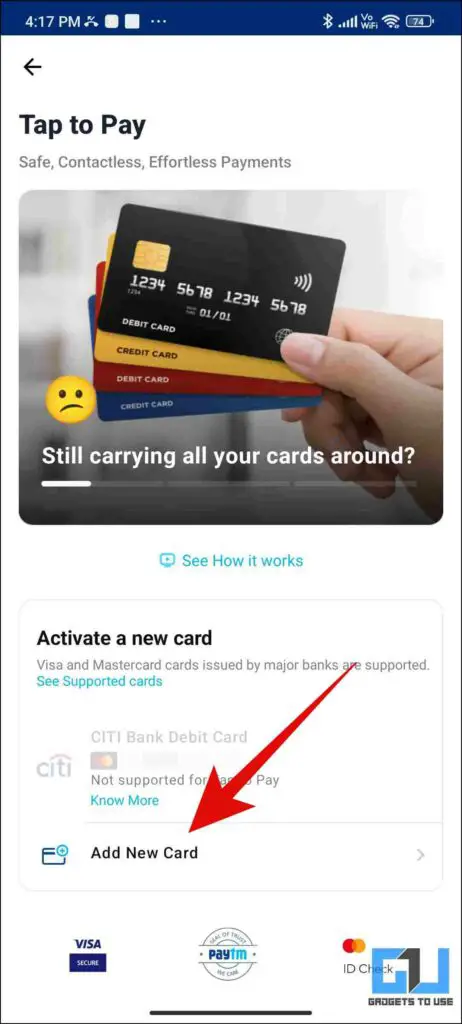

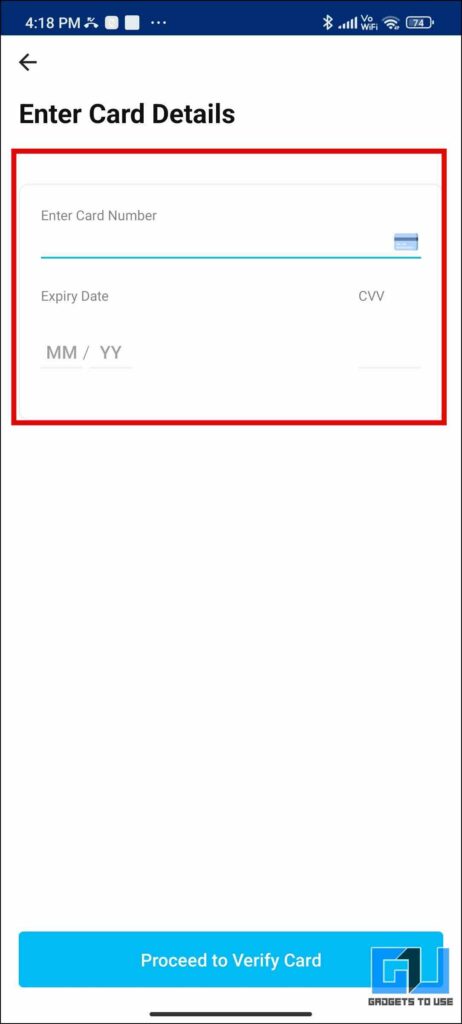

3. Once on the Tap to Pay Screen, you can choose your Saved Cards, or click on Add New Card, to enter your card details. Now, tap on Proceed to Verify Card.

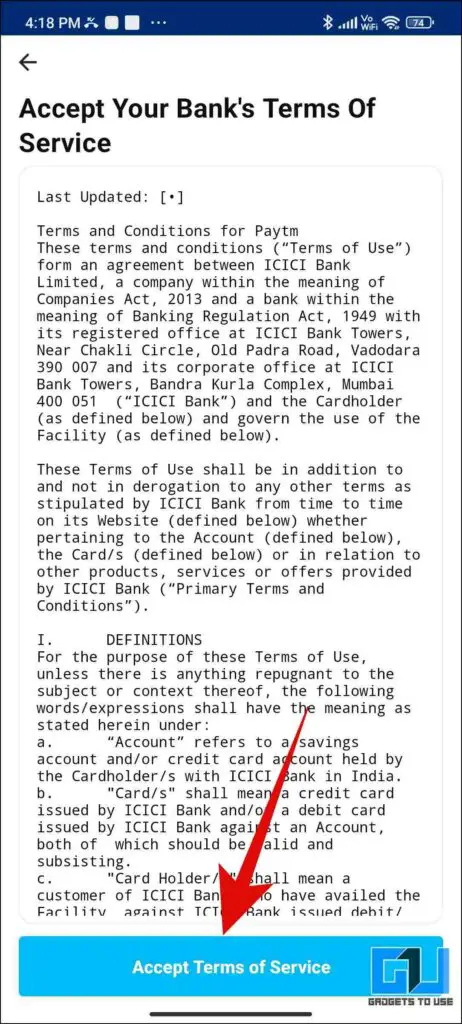

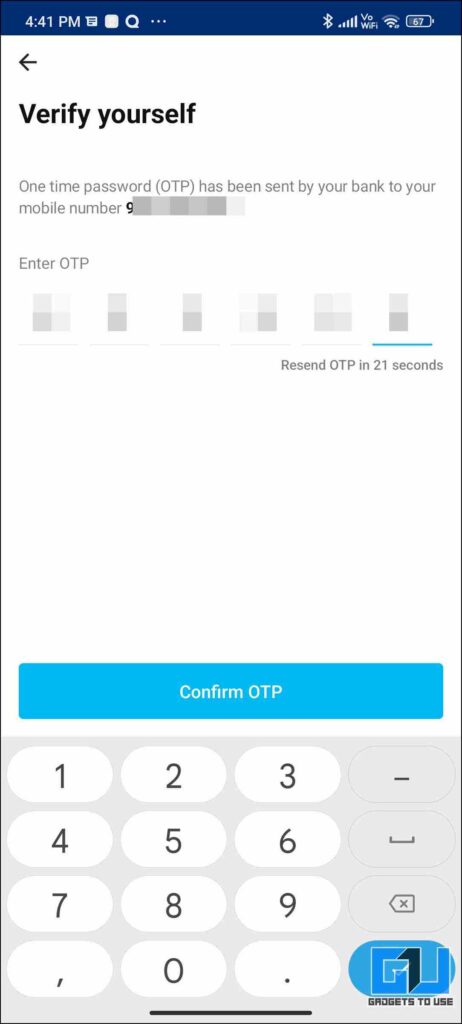

4. On the next screen, read and tap “Accept the Terms of Service”, and confirm your Identity via OTP.

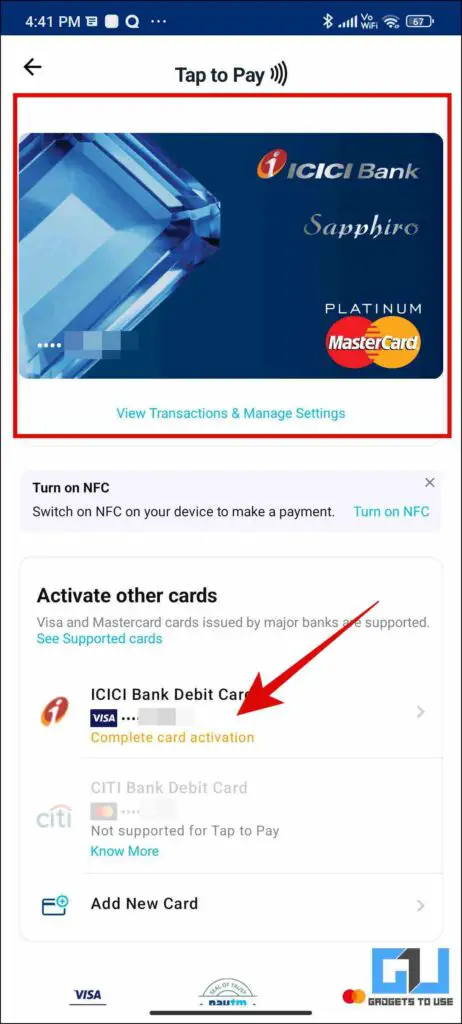

5. Now, your card will be added to the Paytm app. However, you need to enable the tap-to-pay functionality if you haven’t activated it already on your card. It can be done via the Customer Care helpline number, net banking, or the official banking app.

6. Once your card is added with Tap to Pay enabled, you need to enable NFC on your phone and set Paytm as the default app for Contactless payments.

Note: For Transactions above INR 5000, you need to enter your PIN on the PoS machine.

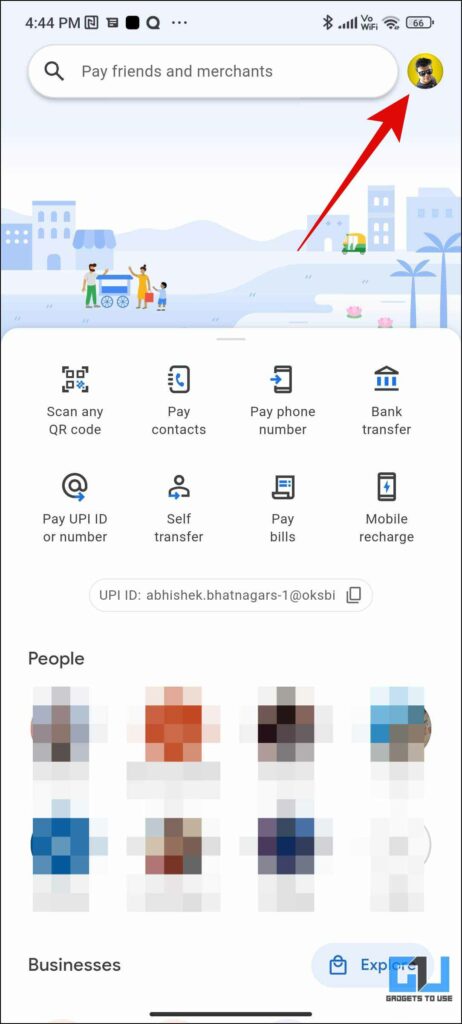

Steps to Activate Tap to Pay on Google Pay

Google Pay, is another popular UPI app used in India. However, if you own an NFC-enabled phone, you can also use the Tap to Pay feature, via UPI or the supported cards mentioned below, using Google Pay. Here’s how you can use it:

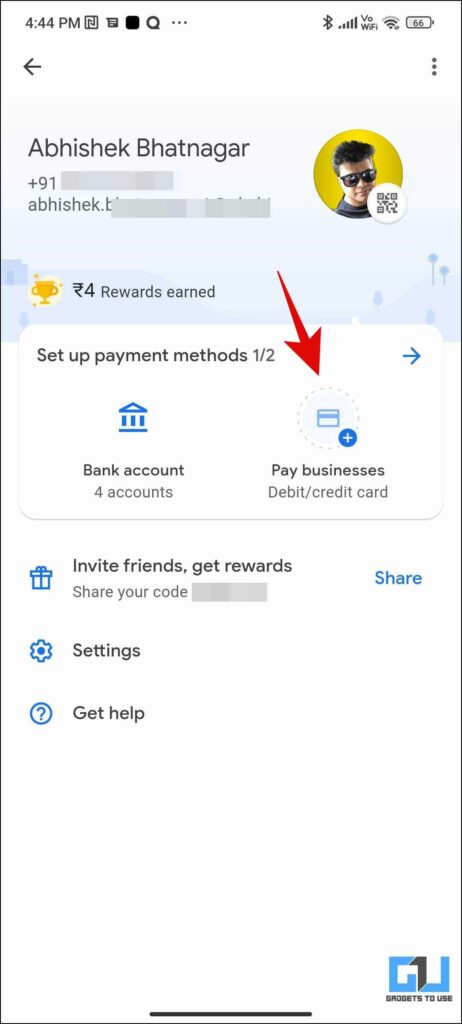

1. Launch the Google Pay App (Android, iOS) on your phone, and tap on your Profile Picture from the top right.

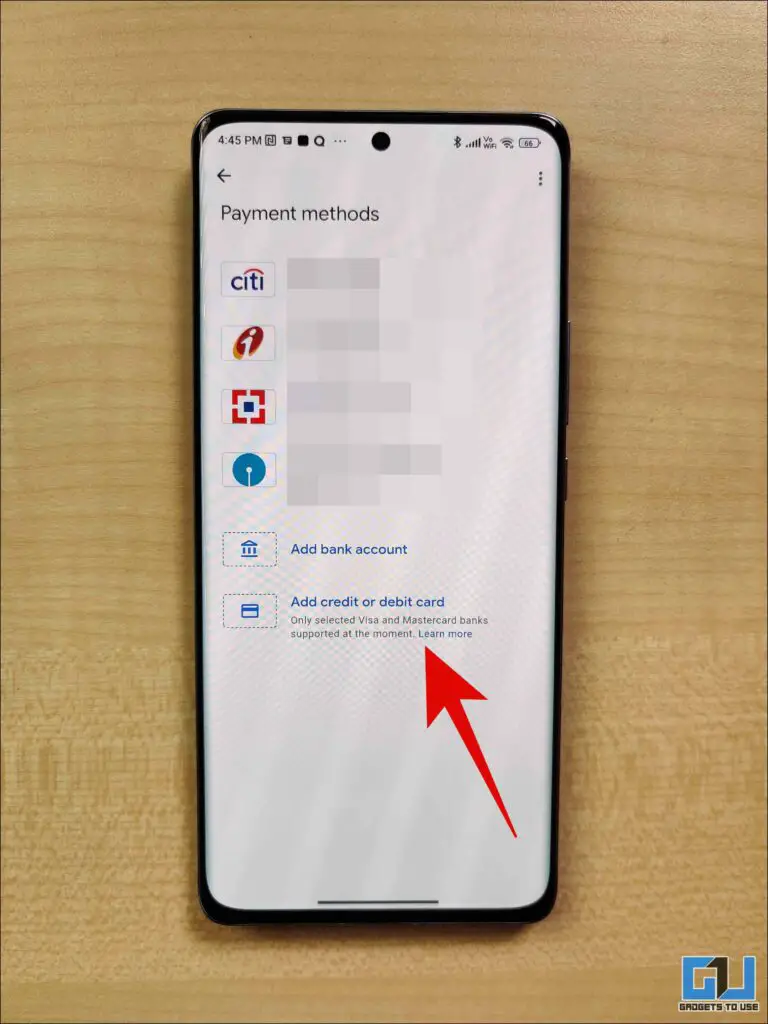

2. Here, you need to tap on Pay Business. If you haven’t saved any card previously, you will receive a prompt, tap on Proceed to continue.

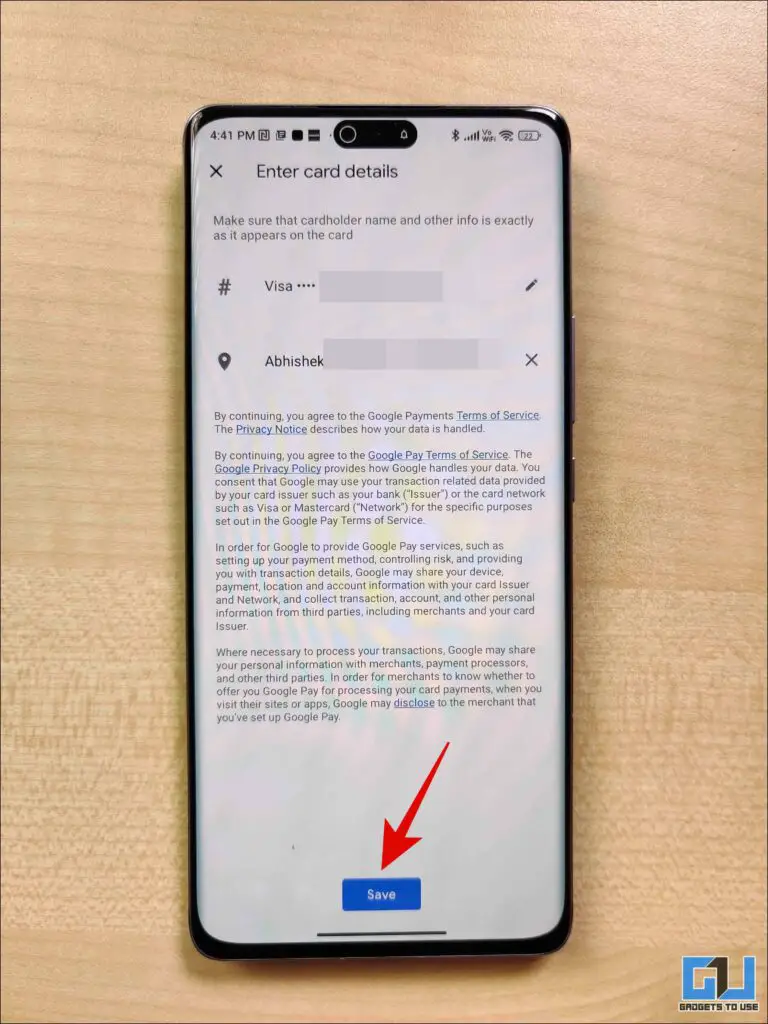

3. On the next screen you can either choose to add a card with a simple scan, or add it manually.

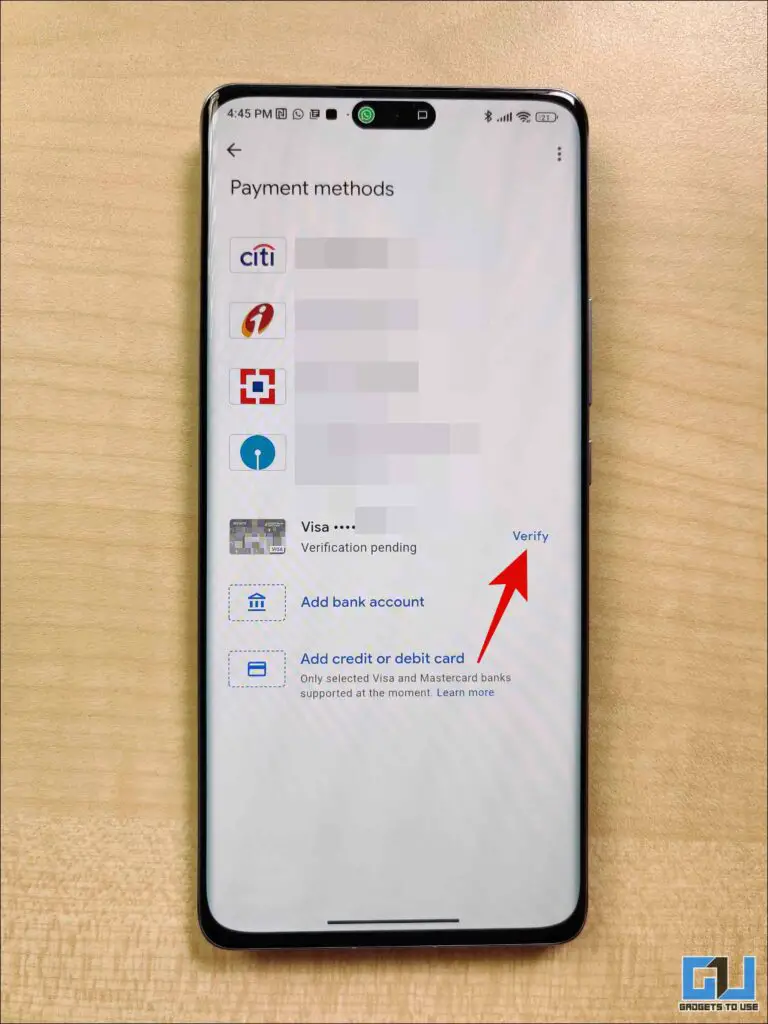

4. Once the card details appear, tap on Save to link it with your Google Pay account. It will appear in your saved card list.

5. The tap-to-pay functionality needs to be enabled if you haven’t activated it already on your card. It can be done via the Customer Care helpline number, net banking, or the official banking app.

6. Lastly, you need to enable NFC on your phone and set Google Pay as the default app for Contactless payments.

That’s it! Now, now you can simply tap on an NFC-powered PoS terminal to make the payment. For larger purchases, you need to unlock your phone, in order to pay.

Steps to Activate Tap to Pay on Samsung Pay

While, Samsung’s own Tap to Pay via Samsung Pay, has been there for many years, we hardly find people using it. Lack of information might be one reason for it. However, if your Samsung phone has a NFC chip, here’s how you can use Tap to pay on it, with the supported cards mentioned below:

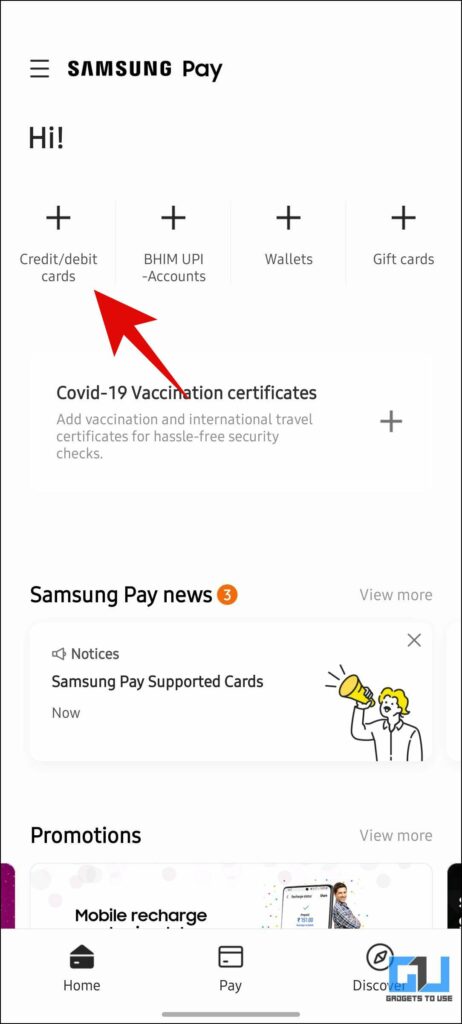

1. Launch the Samsung Pay App on your phone, and tap the + icon to add a Credit/Debit Card.

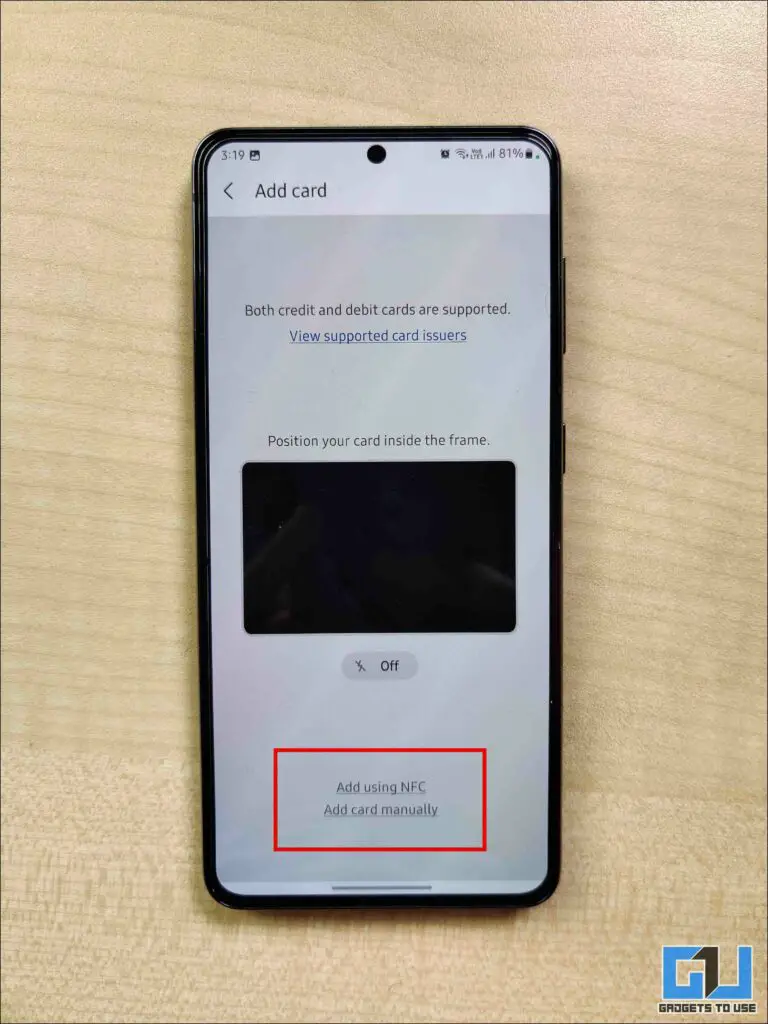

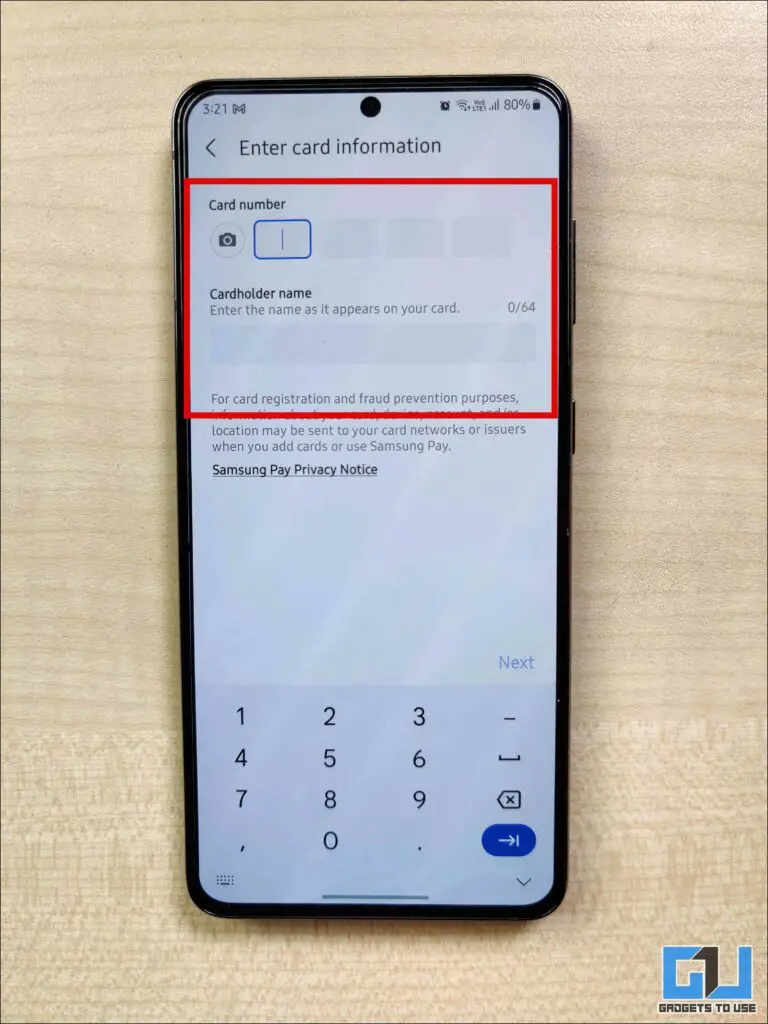

2. On the next screen you can either choose to add a card with a simple scan, or add it manually.

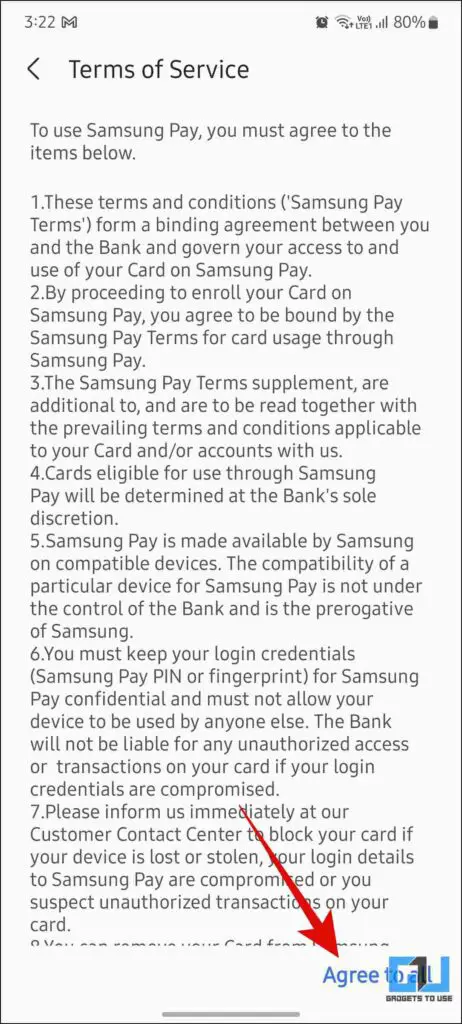

3. Accept the Terms of Service, after this, your card will be linked to your Samsung Pay.

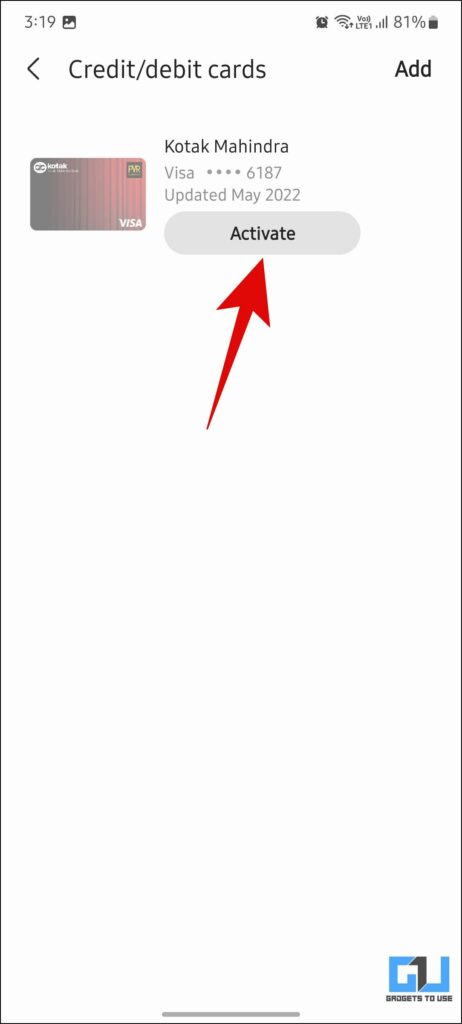

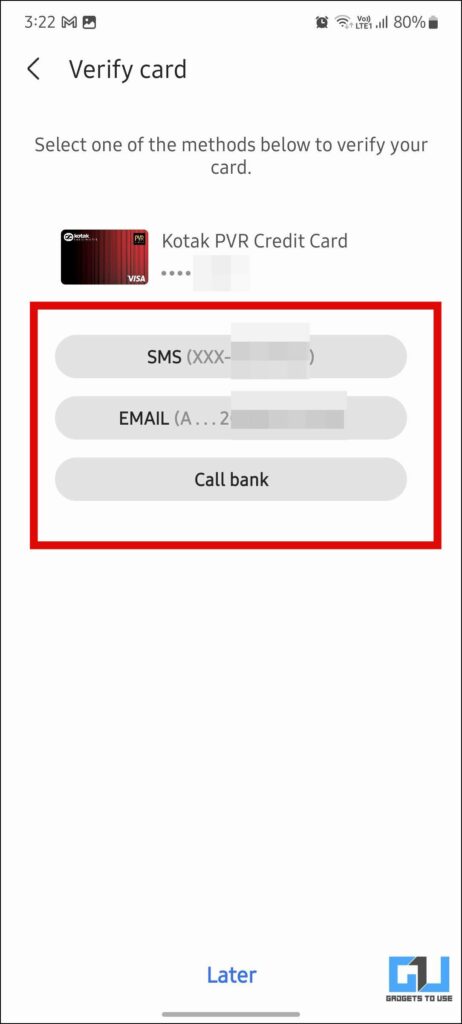

4. Now, tap on Activate under the card, and choose a method to verify your card either via SMS, email or call.

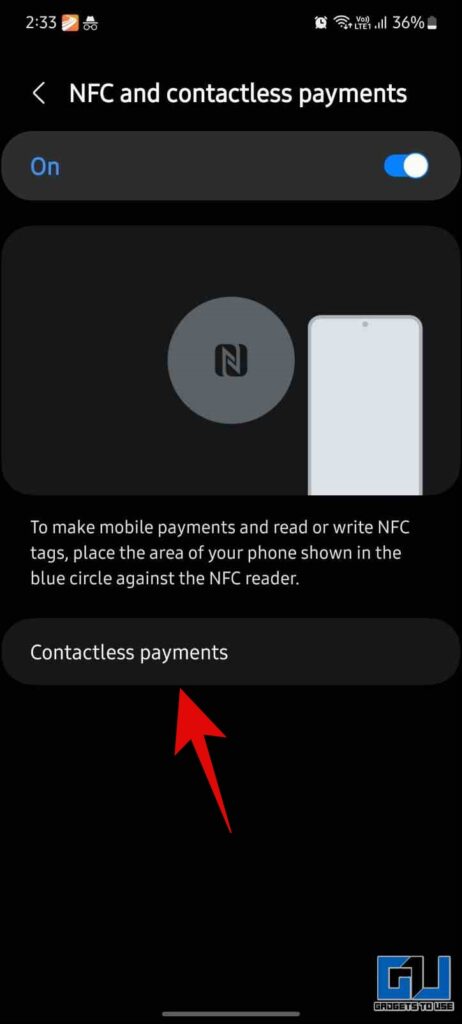

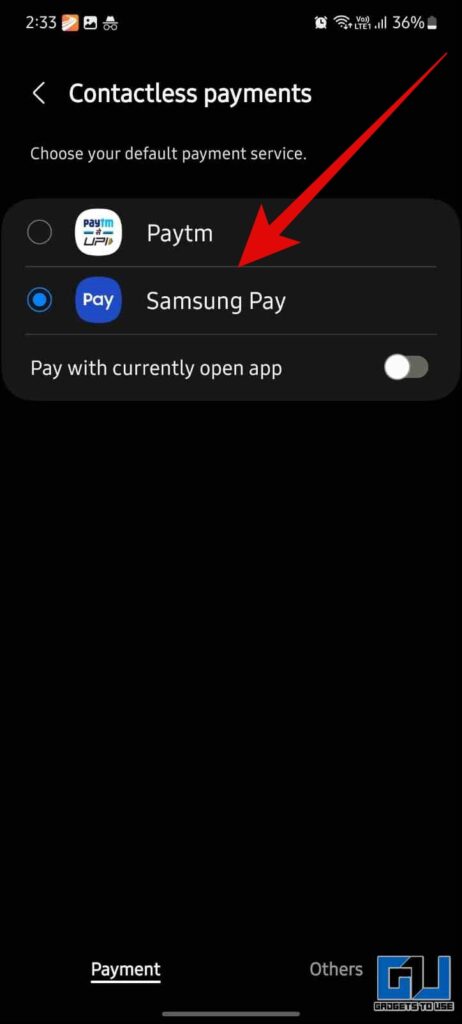

5. Lastly, you need to enable NFC on your phone and set Samsung Pay as the default app for Contactless payments.

6. Now, you need to switch to the Pay tab from the bottom navigation bar. To make the payment, launch the app, use your fingerprint, Iris Scan, or Samsung Pay PIN to authenticate tap to pay, and tap your phone to the NFC-enabled PoS terminal.

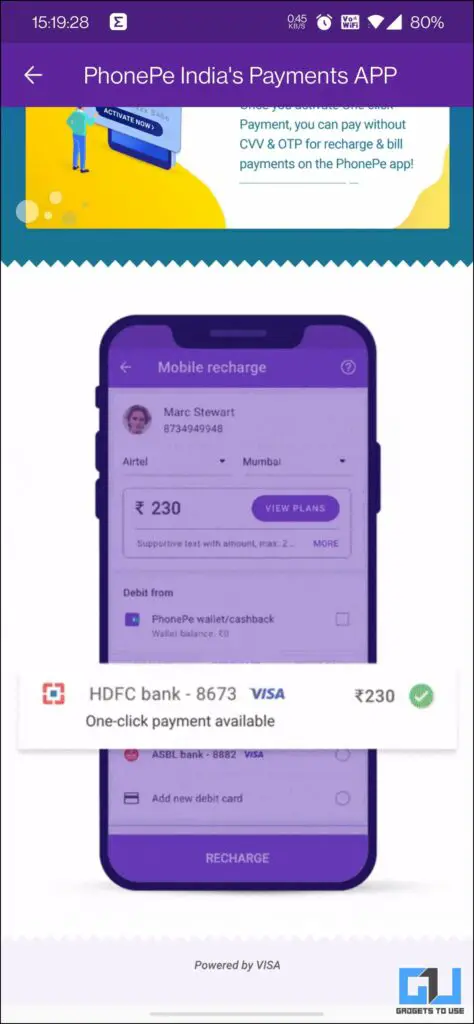

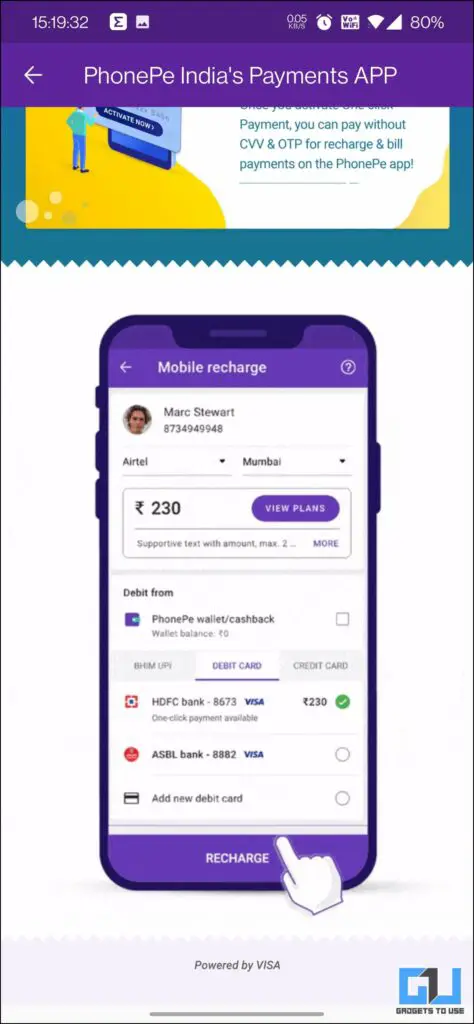

Bonus: Activate One-Click Payment on PhonePe

If you don’t own an NFC-compatible phone, you can still enjoy the comfort of easy one-click payments via PhonePe. While PhonePe doesn’t offer the Tap to Pay feature, it does allow its users to make payments in One-Click via compatible cards, to avoid entering CVV or OTP every time. Here’s how to use it.

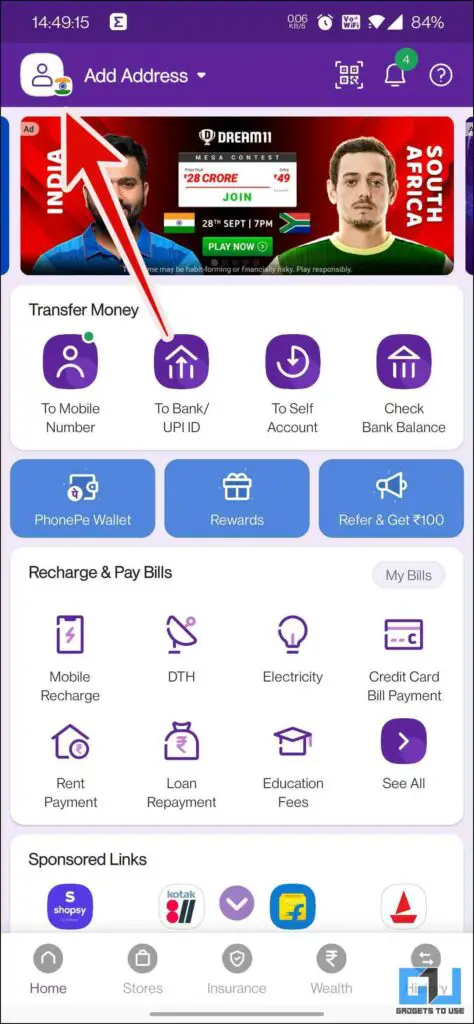

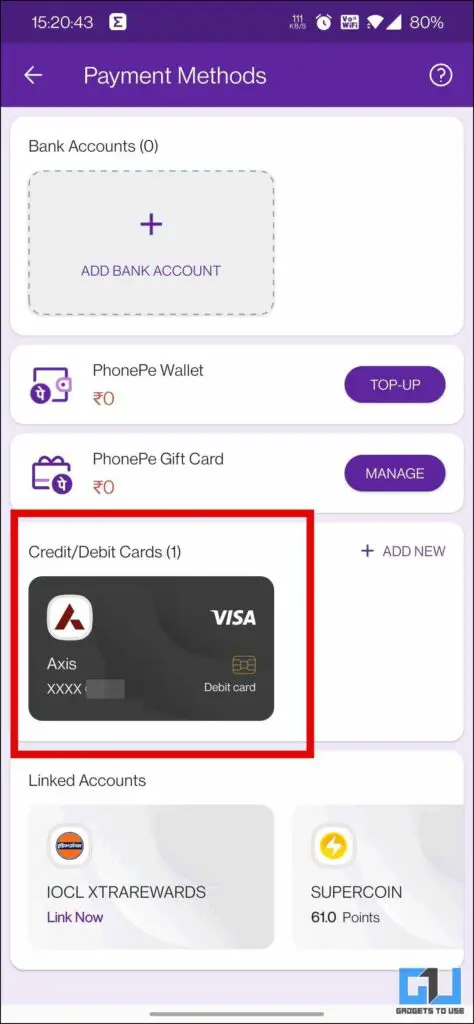

1. Launch the PhonePe App (Android, iOS) on your phone, and tap on your Profile Picture from the top left.

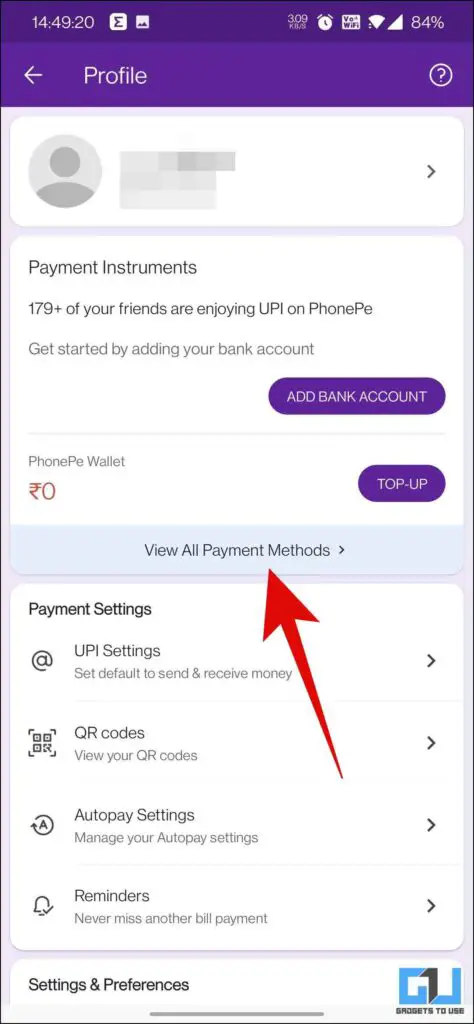

2. Under your profile, tap on View All Payment Methods.

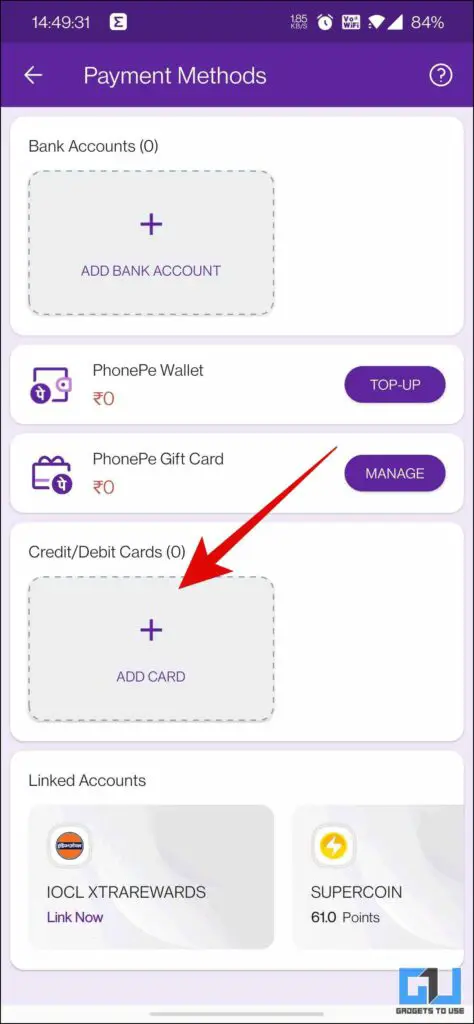

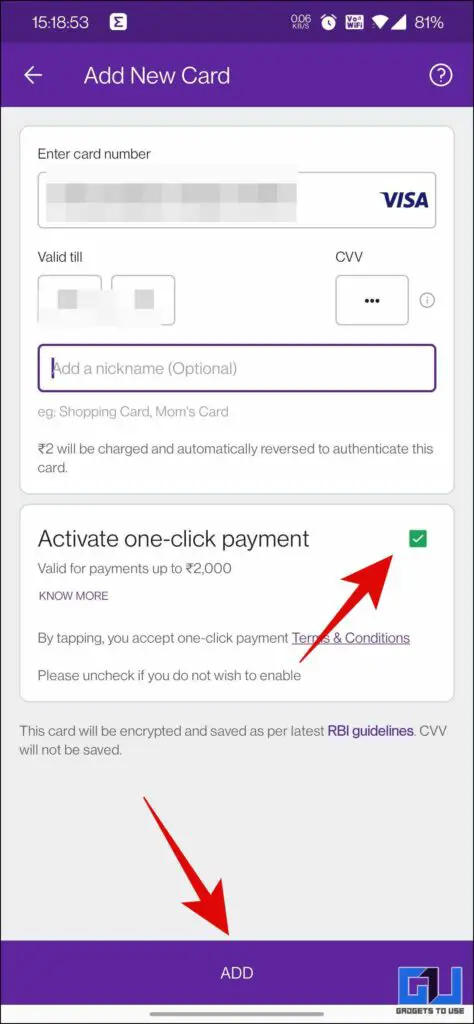

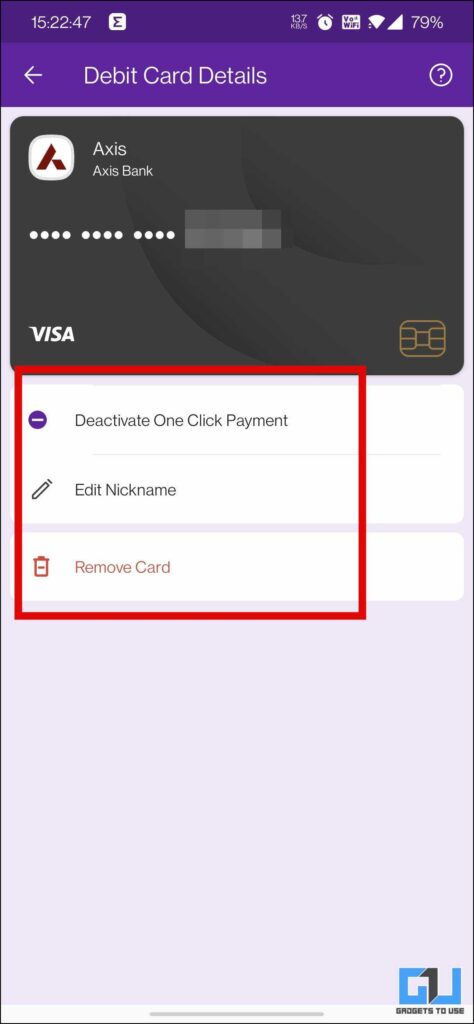

3. On the next screen, tap on Add Card and enter your card details. After this, you need to tap on Activate one-click Payment.

4. Now, you need to verify the card via OTP.

5. Once your card is added to your PhonePe, with One Click Payment Activated. Every time you do a recharge or bill payment under INR 2000, via the said card, your payment won’t require CVV or OTP.

Note: Even though PhonePe supports all Domestic Debit/Credit cards, using Visa, Maestro, Diners, American Express, and RuPay network, my RuPay card was not accepted. If you face the same error, try adding another card.

FAQs

Q: If I change my phone, do I need to add the Cards all over again?

A: Yes, if you change your phone the cards need to be added again. Since Card tokens are device specific and you would need to re-tokenize your cards on your new phone.

Q: Will my Card information erase if I format/reset my phone?

A: Yes, a format or reset will remove all payment Cards registered on your phone.

Q: I want to sell my phone, and my cards saved in it. What should I do?

A: Before passing on, recycling, or selling your phone you should delete all your saved cards, log out of all the payment apps and uninstall them. A format or reset will also remove all your saved cards.

Wrapping Up

In this read, we discussed how you can enable and use Tap to pay in apps like Paytm, Google Pay, Samsung Pay, etc. using an NFC-enabled phone in India. The newly introduced UPI Lite also allows you to pay without entering UPI PIN for some specified transactions, check out our detailed guide to know more about UPI Lite. I hope you found this useful; if you did make sure to like and share it. Check out other useful tips linked below, and stay tuned for more such tips.

You might be interested in:

- 2 Ways to Make Alexa Pay Your Bills Using Voice With Amazon Pay

- How to Create and Find UPI Payment QR Code in Paytm, Google Pay, PhonePe, BHIM

- 5 Reasons Why You Should Not Use Buy Now Pay Later

- Paytm Spoof: Useful Tips to Save Yourself From Fake Paytm App

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse YouTube Channel.