Quick Answer

- A hedge is a one-of-a-kind investment made with the primary objective of eliminating the risk of high fluctuations in the price of an asset.

- Even though inflation is a constructive trait of a healthy economy, it is a big challenge for the people in the country.

- So, put together, a hedge against inflation is an asset that handles or witnesses a rise in value over a period while safeguarding against unfavorable price volatility.

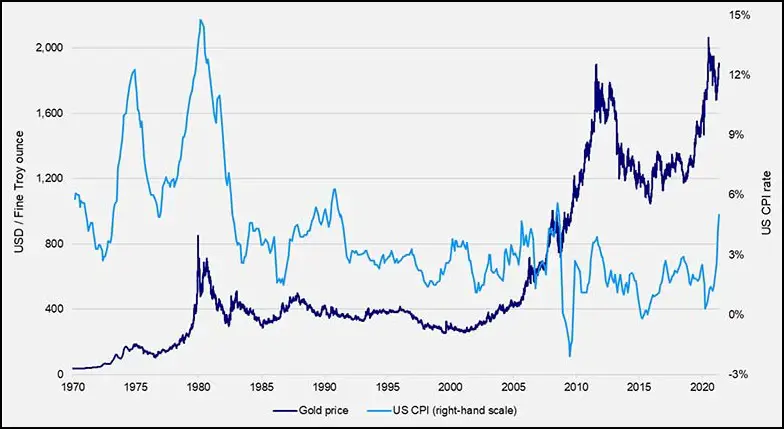

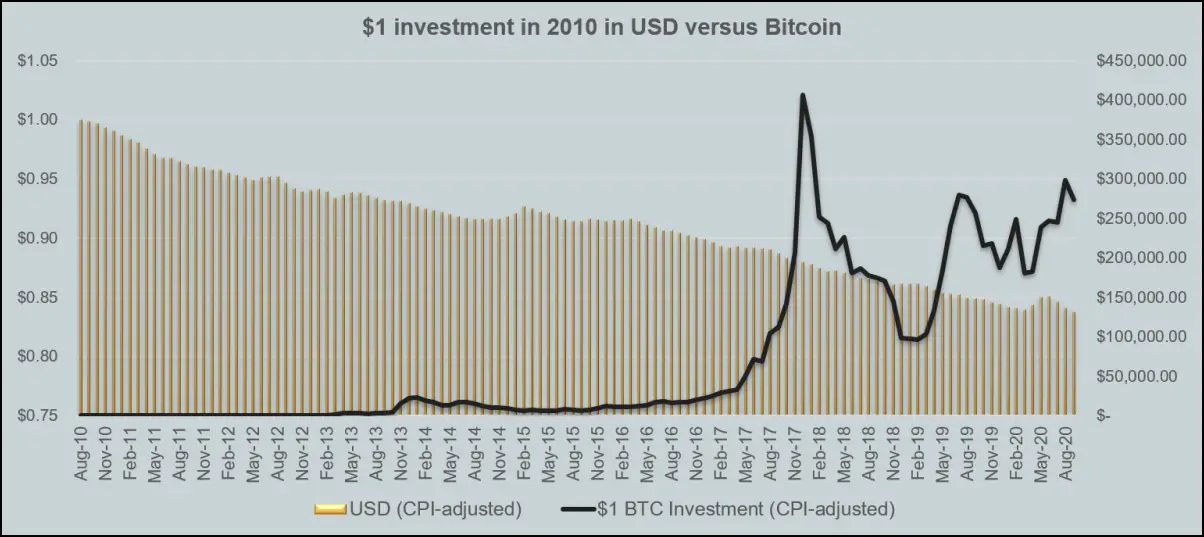

The United States Bureau of Labor highlights that the inflation rate has surged up to 7.5% in the last year until January 2022- the highest rate ever recorded in the last 40 years. Traditionally, gold and real estate have been the preferred to hedge assets against inflation. But Gold is to arrive in 2022 at a loss of 5% overall. So cryptocurrencies, especially Bitcoin, are modern-day investments that seem to work well as a hedging asset against inflation. Here’s how and why Bitcoin makes up for a perfect hedge asset in the current era.

What is Inflation?

Generally, inflation is a term to indicate the increasing prices of goods and services. Ultimately, it leads to a decrease in the purchasing power of the native currency. For example, consider the price of a product was $1 a few years ago. The price of the same product might have inflated to $3 now, which signals a drop in purchasing power.

And guess what? Consumer Price Index (CPI) is a phenomenal metric to measure inflation. It focuses on the weighted average cost of various goods and services. This metric influences interest rates, wages, state benefits, tax allowances, pensions, maintenance, contracts, and other payments.

What is Hedge Against Inflation?

A hedge is a one-of-a-kind investment made with the primary objective of eliminating the risk of high fluctuations in the price of an asset. Specifically, it is a strategy to limit risks in financial assets, most commonly similar to our insurance policy.

So, put together, a hedge against inflation is an asset that handles or witnesses a rise in value over a period while safeguarding against unfavorable price volatility.

Even though inflation is a constructive trait of a healthy economy, it is a big challenge for the people in the country. Wonder why? This is because people’s hard-earned cash value will lose its purchasing power.

So people try to invest their money in an assorted range of assets, including stocks, bonds, real estate, cryptocurrency, precious metals like gold, etc. They do this because these assets have the potential to either maintain the same value or increase their value over time.

Why is Bitcoin a Good Inflation Hedge?

Any guesses on what makes Bitcoin a great hedge against inflation? Scarcity, accessibility, and durability are the three imperatives parameters that make Bitcoin a successful hedging asset.

The total supply of Bitcoins is 21 million, and it is not possible to mint more than this count. The stats show that by the end of 2021, almost 18.77 BTC are already in circulation, which means 83% of the total supply is already minted within 12 years of the period.

Usually, the government prints fiat currencies according to their requirements, and they will not have any restrictions on the total supply. Therefore, printing more notes will increase purchasing power, which results in inflation. It is true that inflation happens when the supply of currency is rapidly increasing than the actual output of goods/services. Thus, limited supply is a positive for Bitcoin.

Also, the annual rate of minting of crypto assets decreases by 50% on average every four years. If we consider this, Bitcoin’s annual production rate will be just half that of precious metals like gold and may even decrease more. This significantly makes Bitcoin the scarcest asset than metal and, at the same time, drives real value.

Additionally, Bitcoin has the merit of being a decentralized ecosystem. Having many nodes operating worldwide makes it highly impossible for fraudsters to hack the network. In short, it neither has any leader to influence nor a committee to bribe. Indeed the power of decentralization!

FAQs Around Bitcoin as Hedge Against Inflation

Q. Why is Bitcoin the first choice to hedge against inflation? What about other crypto assets?

Well, Bitcoin has the pride of being the first invented crypto-asset globally. We have witnessed its growth, right from its inception in 2009 to till date. From just having the value of some cents to today’s $41300 is something extraordinary, and not every crypto asset has the potential to achieve this massive feat.

Therefore, investing in Bitcoin is the ideal way to hedge against inflation. And for obvious reasons, one cannot presume the same for the other crypto assets in the market.

Q. Can you give an example to understand how hedging against inflation works?

Let us consider you have invested in an asset whose value increases by 4% yearly. If the inflation rate is 5%, the real return of that particular asset is actually -1%. So, it is necessary to rightly choose the assets that will have their value more than the inflation rate.

The assets must either be tied to the inflation rate to maintain stability or should be more than it to provide a decent profit. This is how you prevent the degradation of your money’s purchasing power.

Q. What do investors use common assets to hedge against inflation?

The conventional investments to hedge against inflation include precious metals like Gold, Real Estate, Stocks, Treasury Inflation-Protected Securities (TIPS), Floating-Rate Bonds, Commodities, etc. Bitcoins beat these traditional assets with their limited supply, decentralized ecosystem, and ability to be an easily transferable store of value.

Wrapping Up

The experts say that Bitcoin works exceedingly well against inflation and has proved itself a phenomenal asset by beating other assets, including gold, real estate, stocks, etc., by a huge margin. They firmly believe that the odds are pretty good for storing value in Bitcoin than the aforementioned assets. This is because the price of Bitcoin skyrocketed to unbelievable figures in the last 9-10 years and will still create whole new records. Thus, scarcity and the powerful concept of decentralization elevate Bitcoin as a hedging asset against inflation.

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.