Quick Answer

- According to the standard market metrics, the score representing Greed is when a crypto asset is overbought, and the score representing Fear is when the asset is oversold.

- The average price fluctuation of the crypto asset from the last 30 days and 90 days is compared to decide the craze in the market.

- Therefore, if there is a demand to buy/sell the asset within this 24/7 market, the Crypto Fear and Greed Index aids in improving the decision-making process.

Investment has become a part of life for people of all ages. It is glad to see that people have a better knowledge of investment when compared to previous years. Despite having solid investment plans, do you agree that everything you planned can be demolished in just a few seconds by the crypto market’s greed or panic? That’s the crypto market for you! The prices of crypto assets tend to fluctuate very high, even on the same day. So this blog will deeply discuss the Crypto Fear and Greed Index to give you a good understanding of the market.

What is the Crypto Fear and Greed Index?

The Crypto Fear and Greed Index is an amalgamation of market emotions and basic metrics. Similar to every other index in the stock market, the Fear and Greed Index is one of the primary indexes to look for before laying your hands on cryptocurrencies.

This index indicates that excessive fear will lead to a decline in the prices of crypto assets, while excessive greed will have the opposite effect. To be precise, it is used to evaluate the behavior of investors in the crypto realm.

Whenever investors receive some crucial world news, there arise only two possibilities: FOMO (Fear of Missing Out) Buying or Panic Selling. Therefore, if there is a demand to buy/sell the asset within this 24/7 market, the Crypto Fear and Greed Index aids in improving the decision-making process.

How Does the Crypto Fear and Greed Index Work?

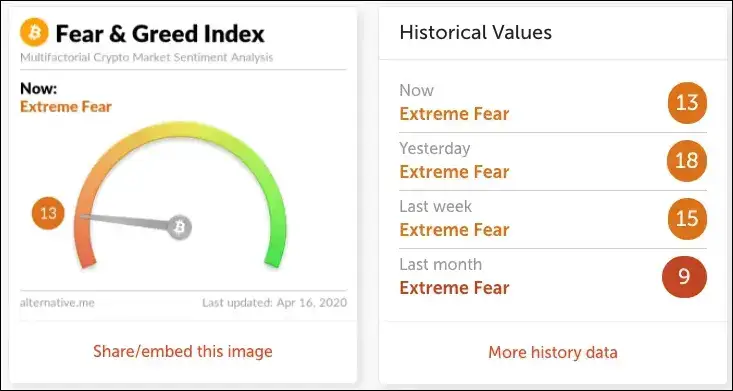

This index calculates the emotion or sentiment value of the market by representing a score that ranges between 0 and 100. The first part of the lower end of the band denotes Fear (0-49), while the latter part of the higher end of the band denotes Greed (50-100).

The index band can be subdivided into four categories: 0-24: Extreme Fear (Orange), 25-49: Fear (Amber/Yellow), 50-74: Greed (Light Green), and 75-100 Extreme Greed (Green).

According to the standard market metrics, the score representing Greed is when a crypto asset is overbought, and the score representing Fear is when the asset is oversold.

Factors Influencing the Crypto Fear and Greed Index

The following are the factors that decide the Crypto Fear and Greed Index.

Fluctuation or Uncertainty (25%): The average price fluctuation of the crypto asset from the last 30 days and 90 days is compared to decide the craze in the market.

Market Volume (25%): The present volume and market momentum (the comparison of 30/90 day average value) are measured to give a value. Usually, when investors are on the positive side, we see good buy volumes and the market will act over greed, which will be a bullish run.

Social media: Social media like Twitter are constantly followed to know the public’s interest in various crypto assets. The hashtags are monitored to know their interest in buying or selling. Positive and high interaction will lead to a greedy market.

Surveys (15%): Online Polls will be conducted to know the market emotions of people worldwide. This gives the overall picture of the crypto investor’s mindset about the market.

Dominance (10%): The dominance of the crypto assets is related to the market cap share of the whole crypto market. The increase in the dominance of any crypto asset would result in a bullish market.

Trends (10%): The Google Trends Data and search volumes are monitored continuously. For instance, if the search volume is high for “Bitcoin Price Manipulation” or related queries, it will clearly show fear in the market.

FAQs Related to the Crypto Fear and Greed Index

Q. Is there any website that tells you the Crypto Fear and Greed Index?

There are various websites that clearly show this index. It assists them in making the right decisions to buy/sell crypto assets. Among them, Alternative.me is a reputed website that bestows all the statistics and lists a plethora of software and their alternatives to figure out the performance of cryptocurrencies.

Q. What is the need to measure Fear and Greed?

Unlike the traditional stock market, the crypto market is highly volatile. People become greedy when the market rises, which leads to FOMO. At the same time, they tend to sell their assets as soon as they see the red candles in the graph. So, the Crypto Fear and Greed Index helps individuals manage their own sentiment overreactions.

Q. What are the two predominant market assumptions?

Extreme Fear is the state where investors worry about the market, which is directly a buying opportunity for newcomers.

Too Greedy is the state where investors are selling their assets due to price corrections in the market.

Wrapping Up

Therefore, the Crypto Fear and Greed Index is an amazing index to help investors. It provides them a hint before they buy/sell crypto assets. It is to track investors’ sentiments in the market. But other tools or indexes are available to predict the buying and selling of assets. Do your own research to learn more about the index and start dipping your toes in the crypto sphere. Happy Trading!

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.