Quick Answer

- You are required to submit your tax information in Google AdSense, in order to reduce this tax deduction (if your country is eligible as a Tax Treaty/Rebate with the US).

- Even if you are paid by an MCN (Multi-Channel Network), you are still required to submit your Tax Info, to the AdSense account linked to your Channel.

- Because according to law Google will assume you as a US citizen by default, and you need to pay double tax (to the US and your own country as well).

Google recently announced new guidelines on March 9, 2021, for all those Youtube creators, bloggers who are located outside the US. The said announcement stated that if you are a monetizing creator located outside the US then later in 2021, Google will start deducting tax from your US earnings. You are required to submit your tax information in Google AdSense, in order to reduce this tax deduction (if your country is eligible as a Tax Treaty/Rebate with the US).

Make sure to bookmark and share this article with your friends so they don’t miss updating their US Tax Info.

Also, Read | YouTube Channel Got Hacked? Here’s How to Get It Back

What if I don’t submit my tax info? Will the tax still be deducted?

Yes, even if you don’t submit your tax information in AdSense, the tax will still be deducted from your earnings. But it will have an impact on the overall Global earnings, and Google will deduct up to 24% from your Worldwide total earnings. Because according to law Google will assume you as a US citizen by default, and you need to pay double tax (to the US and your own country as well).

How much tax will be deducted if I submit my tax info?

The tax amount can vary between 0-30% depending on the country of your channel or blog. Google will be deducting it from your monthly US earnings only.

Why is this happening?

According to Chapter 3 of the US Internal Revenue Code, Google is required to collect tax information from all the monetizing creators who are outside the US. Also, in certain instances, to deduct taxes when these creators earn income from viewers in the US. Here Income means any revenue generated from Ads, Youtube Premium, SuperChats, Super Stickers, and Channel Memberships.

Also, Read | 5 Ways to Fix YouTube Comments Not Showing on a Video

Who is required to submit the tax info?

Every monetizing creator or blogger, whether having an Individual or Business Profile is required to submit the Tax Info. Even if you are paid by an MCN (Multi-Channel Network), you are still required to submit your Tax Info, to the AdSense account linked to your Channel.

What is the deadline to submit this tax info?

According to Google, you need to submit your Tax Infomation in Adsense latest by May 31, 2021. But they recommend doing it before May 20, 2021, to get your payment in time. If you fail to submit this Tax Info by May 31, 2021, then until Google receives your required details, they will straight away deduct 24% from your total global revenue.

Also, Read | 4 Ways To Get Rid of Spam Comments on Your YouTube Channel

How can I submit my tax information in AdSense?

Submitting your Tax Info is very easy, don’t worry as we know Tax is a very important and sensitive subject, we are here to help you. We will guide you through the process.

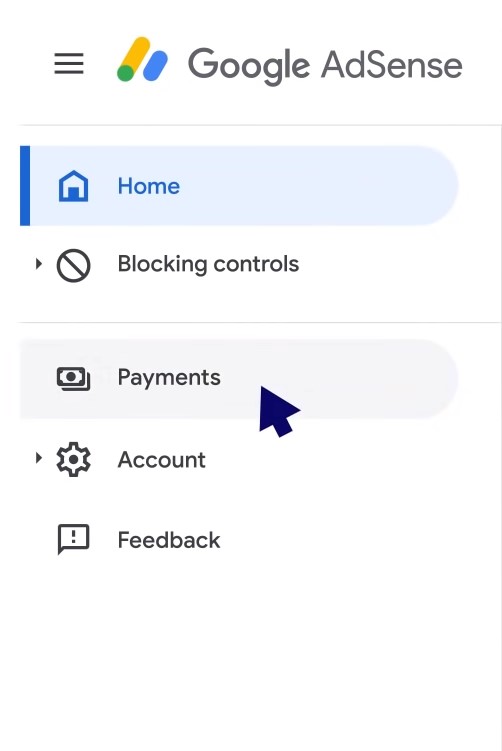

- Login to your AdSense Account

- Go to Payments from the category bar on the left

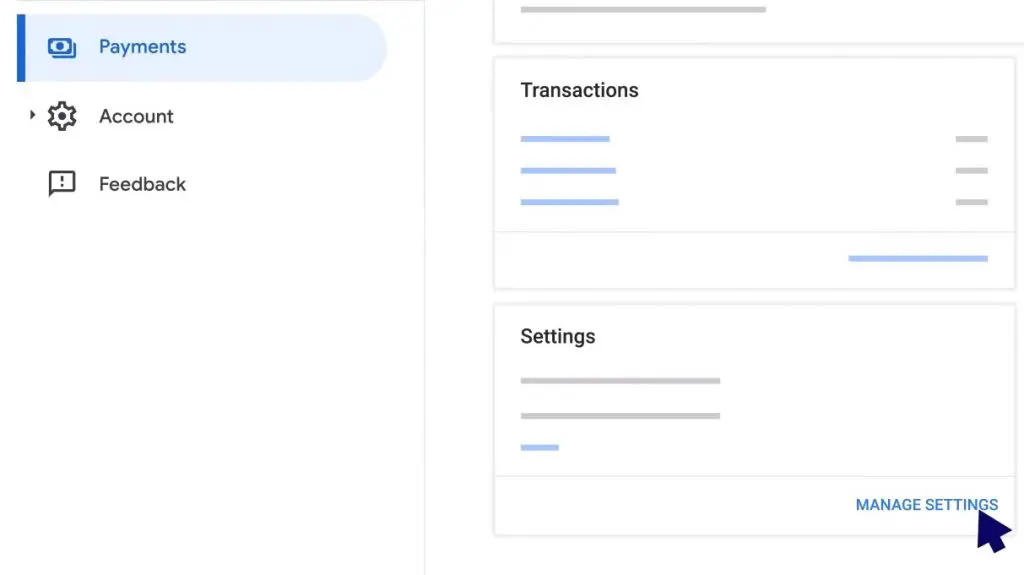

- Click on Manage Settings

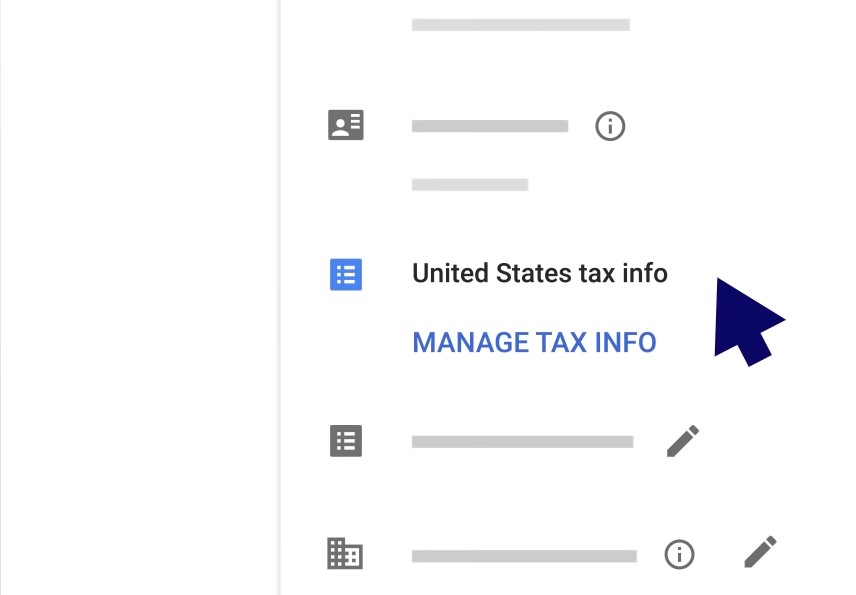

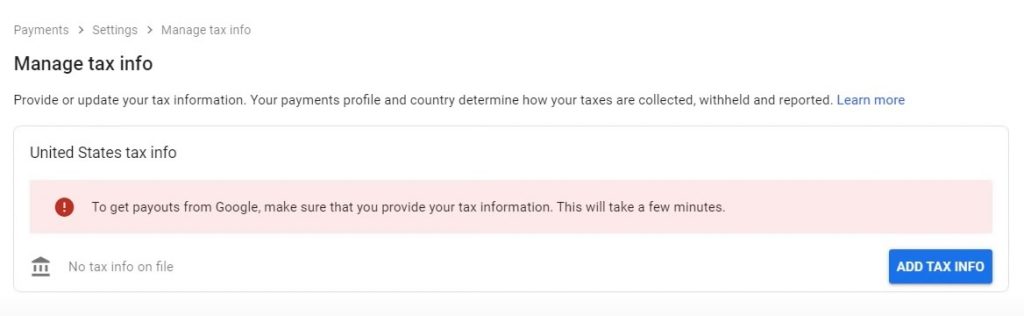

- Go to Manage Tax Info, under United States Tax Info

- Click On Add Tax Info (You need to re-enter your AdSense ID and Password)

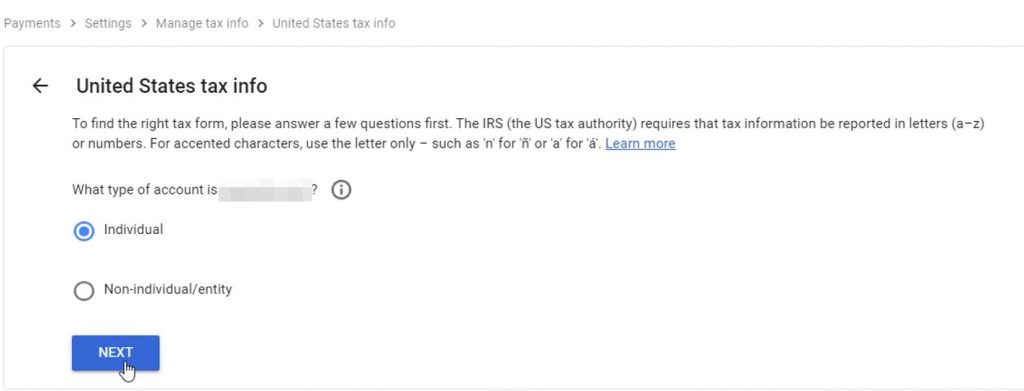

- You need to choose your account type between Individual (majority of the users) and Non-Individual/Entity (Business Profile). Click Next.

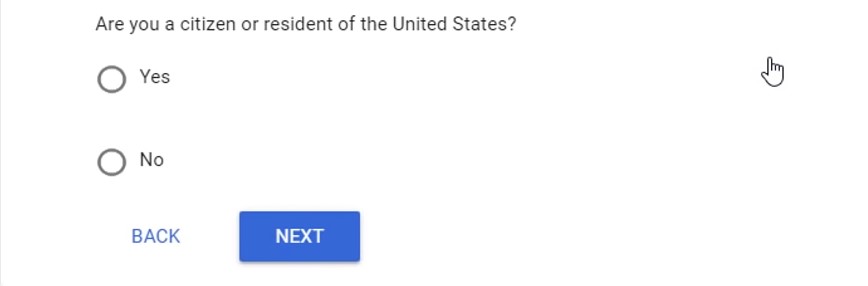

- Mention whether you are a Citizen or a Resident of the US, choose accordingly. Click Next.

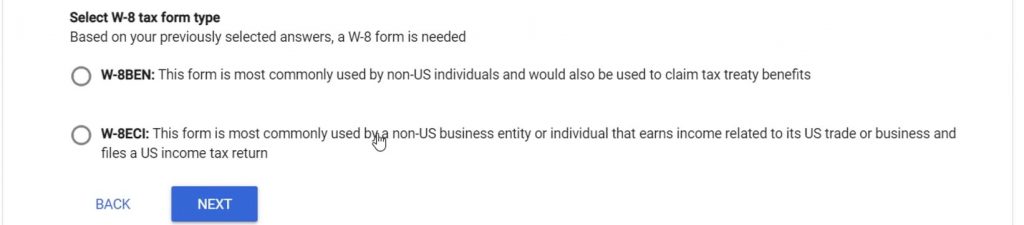

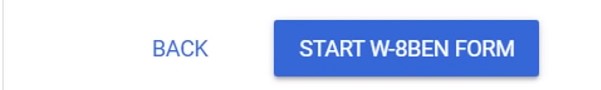

- Now you’ll see two different forms

- Choose the form accordingly and click on Start Form.

Also, Read | 2 Ways to Change YouTube Channel Name Without Changing Google Account Name

Fill W-8BEN Form in Google AdSense

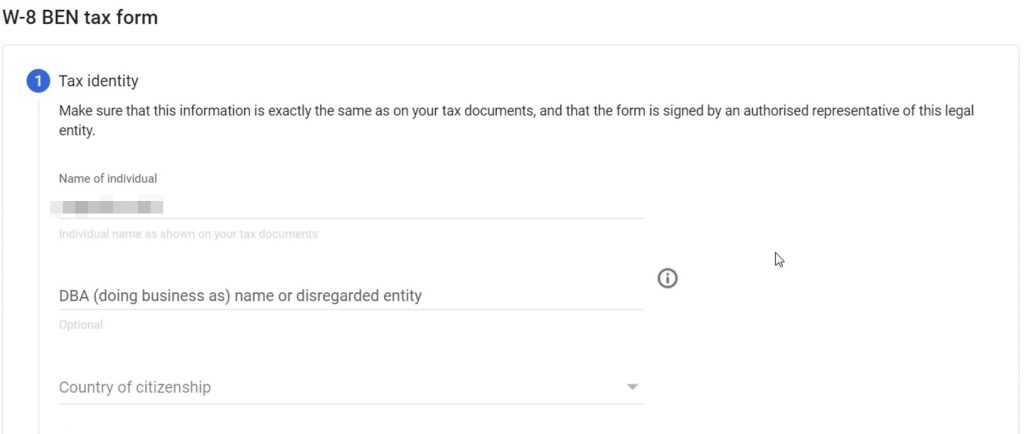

- You need to enter your Tax Identity.

- Fill in your Legal Name

- If you are also running a Business Channel or Blog with a different name from the owner’s name (for example your name).

- Then fill in the DBA Name or disregarded entity name. [Individuals running a channel with a different name need not fill this]

- Select the country in which you are a citizen, from the drop-down menu.

Also, Read | How to Automatically Set YouTube Video Quality To the Best or Data Saver

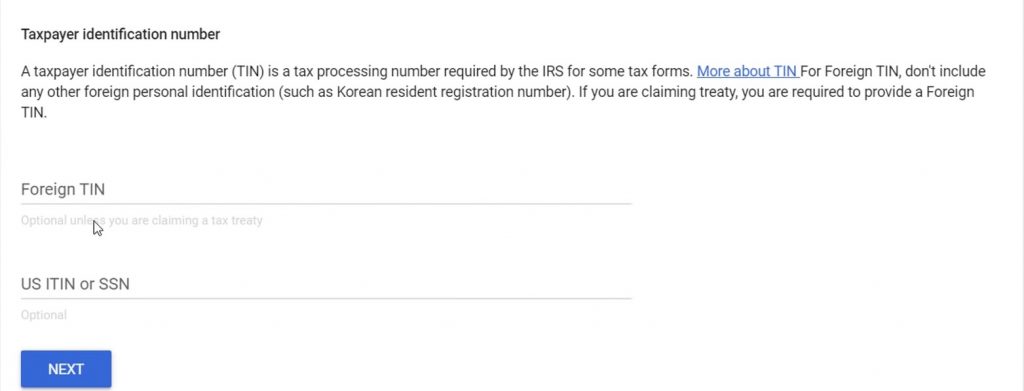

- After filling in your Tax Identity, next is your Taxpayer Identification Number (TIN), it may be called something else in your country. In the case of India, it is your Permanent Account Number (PAN).

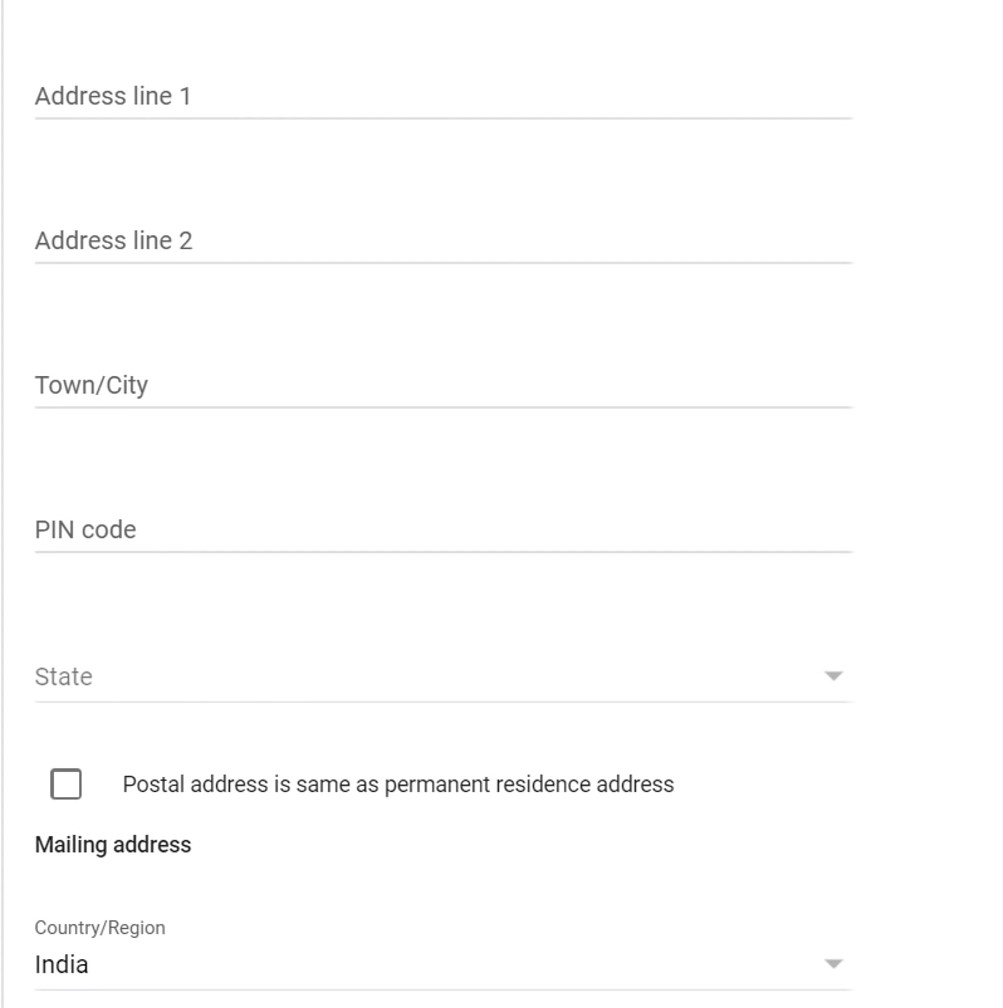

- The next step is to fill in your Address details. You need to enter the address linked to your AdSense Account. Also, you need to fill in your Postal Address, if it is the same as Permanent Resident Address (filled in just now), then simply click the checkbox. Click Next.

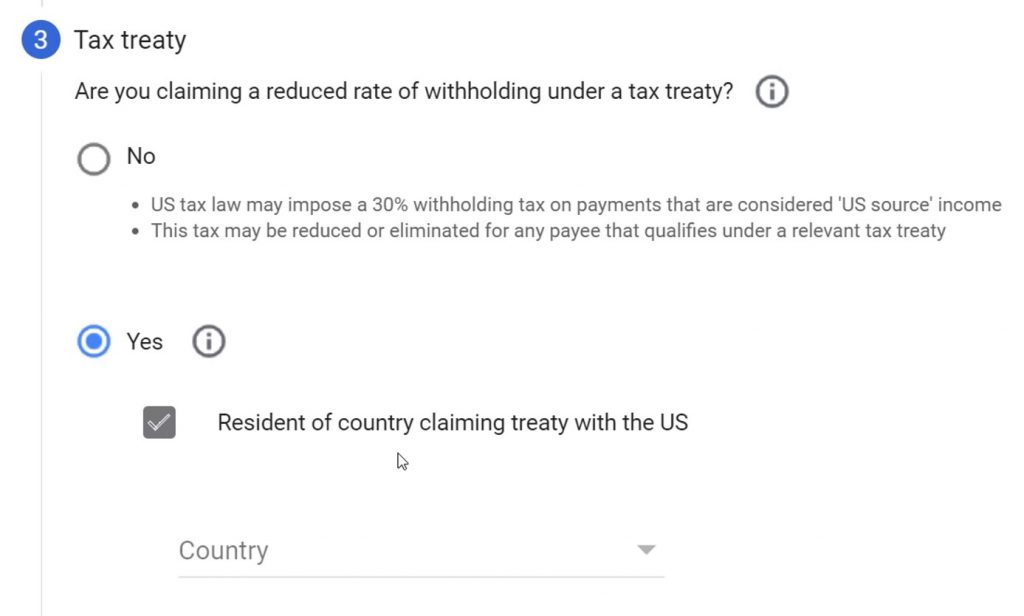

- Now comes the main step, to submit your Tax Treaty/Rebate details:

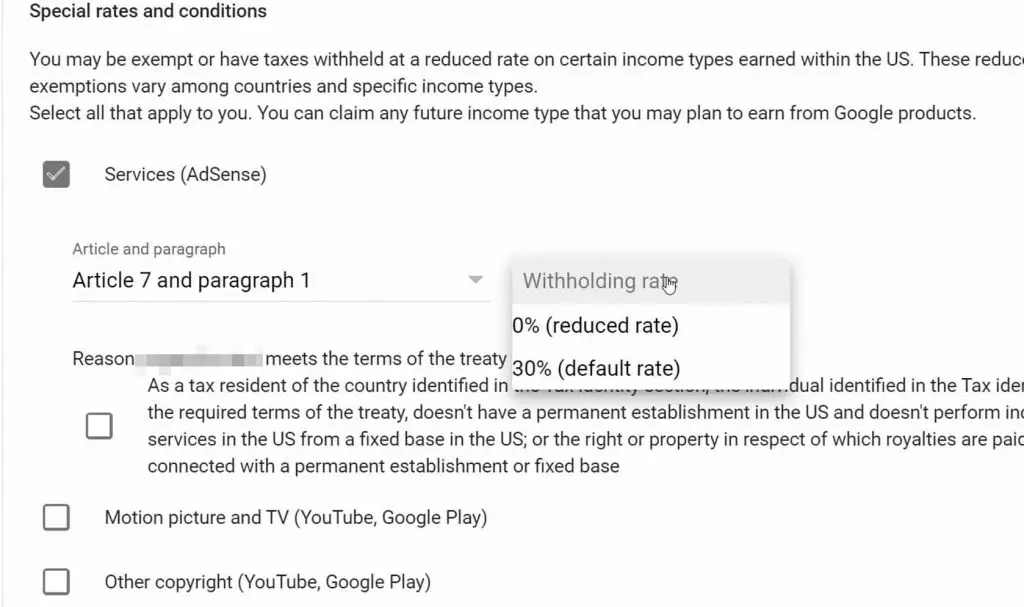

- Moving to the Special Rates (it may be different depending on your country). Select the checkbox which applies to you, and you generate income out of it.

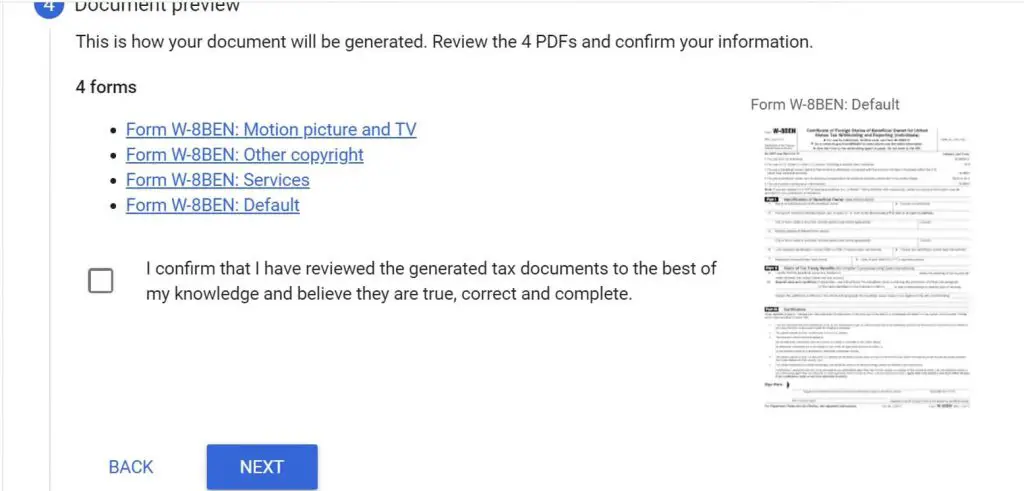

- After submitting all your info, Google AdSense will generate a form with all your details filled in for each income mode opted for in the last step.

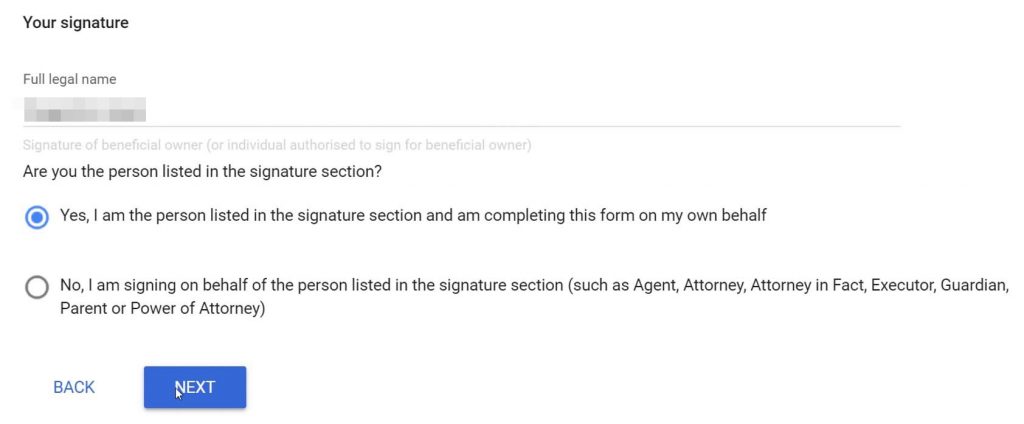

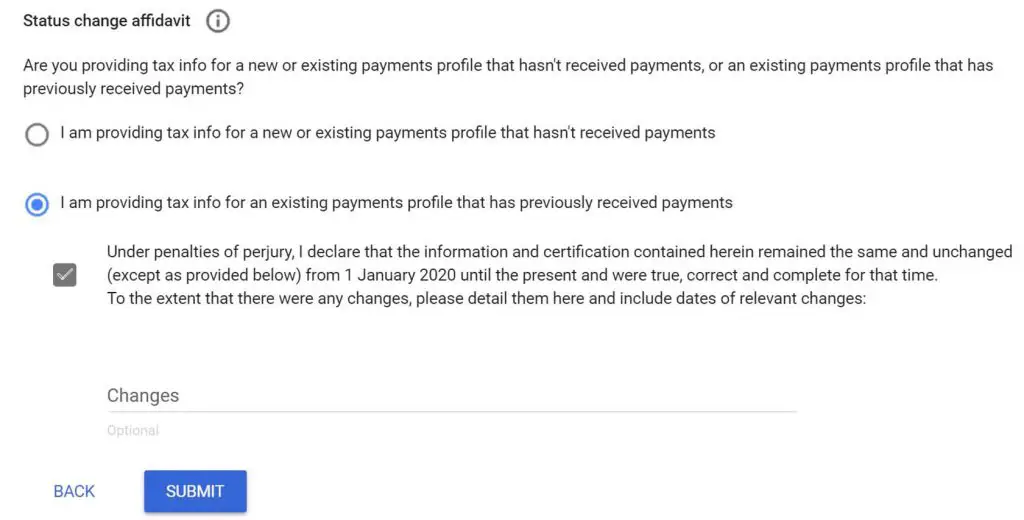

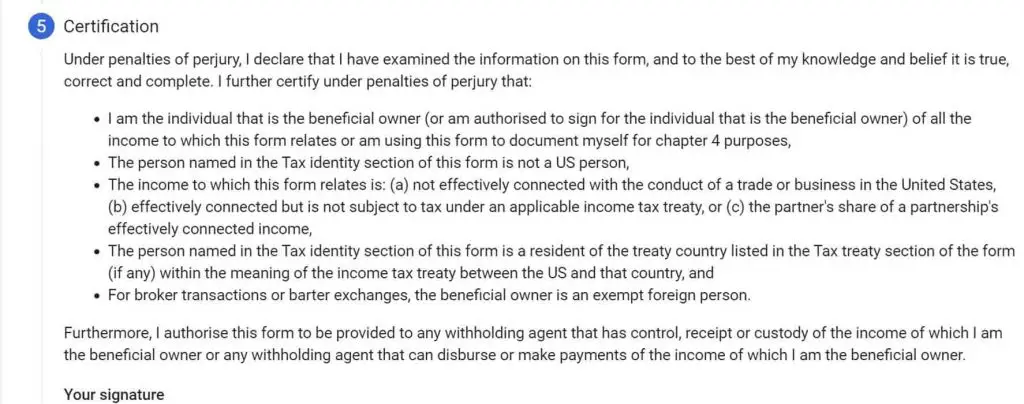

- Next is the certification and disclosure step, do read all the points mentioned in the form, and enter your Full Legal Name. Next, you need to disclose whether:

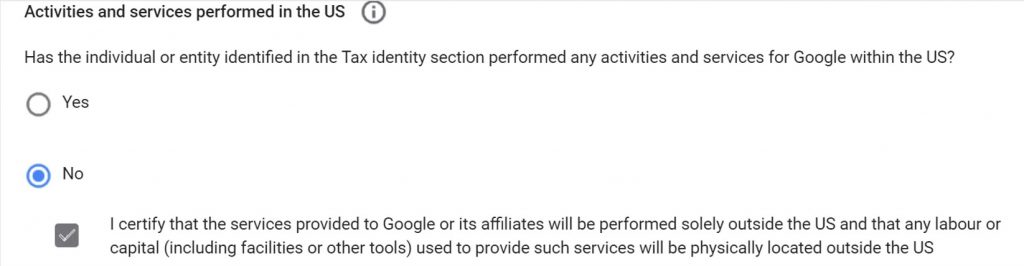

- Activities and Services performed in the US, this is to disclose whether you

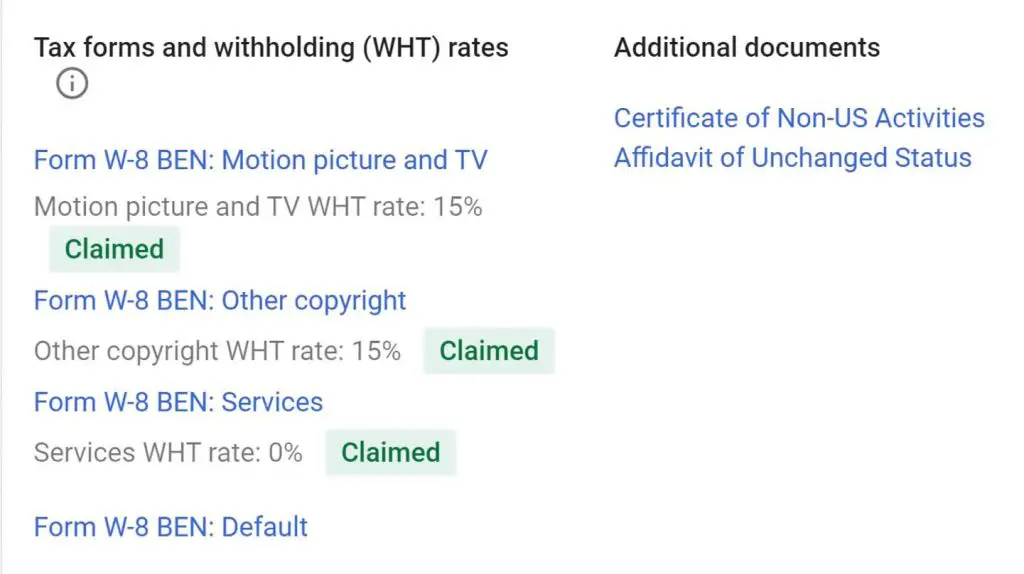

That’s it. You have submitted all the requires Tax Info, and now you will see this screen stating Approved and the Claimed next to the selected modes of incomes and corresponding rate to it.

Now that you have filled in your US Tax details properly, any income generated by US viewership will subject to deductions mentioned in the last screen. It will automatically deduct and you need not do anything else for this.

Also, Read | Download YouTube Videos on Your JioPhone

I hope with our help, you would be able to submit your tax information in Google AdSense properly. If you face any issues then you can reach out to us or Google and keep on creating awesome content you’ve joined the platform for.

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group or for the latest review videos subscribe GadgetsToUse Youtube Channel.