Quick Answer

- In Lending, You supply crypto to a crypto exchange platform for a fixed period on a fixed interest rate.

- Staking refers to locking away your coins for a certain period in a crypto exchange to earn interest-based rewards on it.

- Exchanges like Binance, CoinDCX, and BlockFi support Lending and Borrowing and offer a varied percentage of interest from 5% to 13% that you can earn on your crypto.

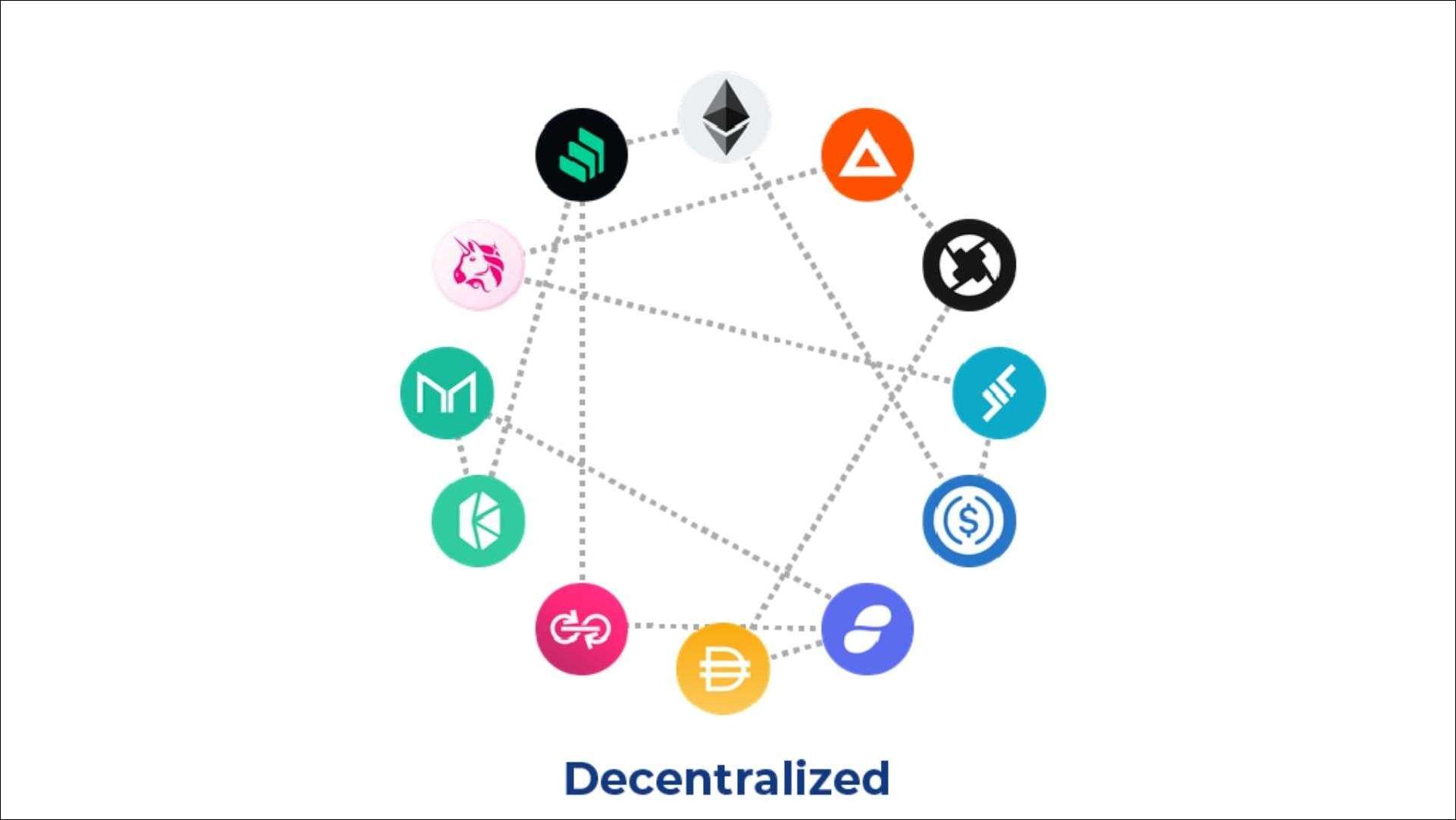

Other than trading, there are other methods to earn from cryptocurrencies. Thanks to the growth and development in the field of DeFi. It consists of several different apps and services that provide different financial services but are not owned by a central authority like Banks. DeFi also allows crypto investors to earn a passive income on their crypto. We will discuss all 3 ways you can earn passive income from cryptocurrency and which one is best suited for you.

Disclaimer: This article is intended for educational purposes only. Information is provided according to reliable sources and industry trends. The value and position of cryptocurrency in the market are susceptible to change. Please do your research and background check before investing.

Ways to Earn Passive Income from Crypto

There are 3 methods to earn a passive income from cryptocurrency other than trading or holding them. All 3 of them require prior knowledge and you should do your research before investing. We will be taking a look at Staking, Lending, and Yield Farming. How they work, things to know about them, and what are the risks involved in them.

1. Staking

Staking refers to locking away your coins for a certain period in a crypto exchange to earn interest-based rewards on it. Think of it like a fixed deposit where you lock away your funds for a set time period and earn interest on them. The exchange uses your coins to validate transactions on the blockchain. In return, the exchange receives a reward which it distributes appropriately among investors.

Staking is not supported by every type of cryptos like Bitcoin or Ethereum. Coins like Tezos, Polygon, Theta, Ethereum 2.0 (Not released as of now but you can still stake it), and Cardano support staking. Binance exchange allows staking.

Staking Pool

In Staking Pool, a group of people collects and invests crypto for staking. The interest earned is then divided among the members of the group for their investment. Here, rewards can be very high but these staking pools are not reliable like exchanges. They can be rug-pull scams and you can lose all your crypto.

Things to know about Staking

- You can stake a small number of your funds

- Limited crypto support staking

- Exchanges will charge a small fee for staking

- Not all exchanges support staking

Risks in Staking

Staking is a minimal risk method as you will earn in the crypto’s units, not in its value. . Any risk involved is mainly due to bugs in the smart contract.

2. Lending

In Lending, You supply crypto to a crypto exchange platform for a fixed period on a fixed interest rate. This crypto is lent to the borrowers who have to pay interest on its borrowed amount. You are rewarded in other tokens that represent your initial deposit + interest in current market value. You can choose to sell these tokens, HODL them or swap them for another cryptocurrency.

Exchanges like Binance, CoinDCX, and BlockFi support Lending and Borrowing and offer a varied percentage of interest from 5% to 13% that you can earn on your crypto.

DeFi vs CeFi Lending

DeFi uses Smart contracts or Automated Market Makers (AMM) to facilitate lending on decentralized platforms. Protocols like Compound and AAVE create a market for specific cryptos like Ethereum, DAI, ChainLink, or Wrapped Bitcoin to be lent and borrowed. It removes any middleman in the process and allows lenders and Borrowers to interact directly.

CeFi or Centralized Finance includes centralized exchanges like Binance, CoinDCX, and BlockFi which take custody of your crypto to be borrowed by Market Makers, Hedge Funds, and other users of their exchange. These exchanges accept lending in various coins even Bitcoin for liquidity purposes and they have an easy-to-use interface that does not require a learning curve. They are trustable options if you are new to lending.

Related article | What Are Decentralised Crypto Exchanges? Know Pros and Cons Here

Things to Know About Lending

- You can choose a fixed period and interest based on deposit

- Rewarded with a native token of exchange

- Not all cryptocurrencies are supported

- With CeFi, you can use crypto in your exchange

Risks in Lending

There is minimal risk involved in lending but do make sure to look up which exchange can give you the best interest for your crypto. The main risk involved is with lending to a scam or rug pull exchange or smart contract bugs which a rare.

Also, read: 5 Best Metaverse Coins to Invest in India (2022)

3. Yield Farming

Yield farming, also called Token farming is a new concept. It prioritizes maximizing your returns on investment using various methods like Liquidity Pool, Lending, Staking, and leveraged lending. We have already discussed Staking and lending so we will talk about the other two.

Liquidity Pool

In a liquidity pool, you along with a mass group of people can lend 2 funds in equal value to exchange. This makes you a liquidity provider. The exchange uses the funds in the pool to pay transaction fees and to maintain the price even after a big order. In return, the exchange distributes the fees it has collected from several transactions to the liquidity providers respectively.

Automated Market Maker and smart contracts are used for Liquidity pools. Exchanges like Uniswap charge 0.3% fees. This multiplied by a huge number of transactions over the day can result in huge returns. Uniswap and PancakeSwap are 2 of the most well-known exchanges for this.

Leveraged Lending

We will understand it with an example. You lend 1000 Rupees worth of BAT (Basic Attention Token) which has a high-interest rate on lending. Then you borrow DAI using your lent BAT as security or collateral. Since you can only borrow 50-60% of your security, you get DAI worth 600 Rupees. You then go on an exchange and use this DAI to buy more BAT and you again lend that BAT for interest. And follow the same process till you cannot do it further.

This is called Leveraged lending and it has very high-risk for a high reward. One has to be active daily and veteran in the crypto market to pull it off. Usually only recommended for crypto veterans.

Things to know about Yield Farming

- There is a high risk

- It is not recommended for new crypto investors

- Actively checking the crypto market

- Have to plan out how and where to invest

Risks in Yield Farming

Yield farming, especially leveraged lending and liquidity pool involves a lot of risks. The volatile nature of crypto can drastically affect leveraged lending whereas scam and rug pull in the liquidity pool can lead to losing all your crypto.

Also, read | Crypto Regulation Bill 2021 in India: 5 Points You Should Know

Wrapping Up

These were the best ways to earn passive income from cryptocurrency. All these concepts have a potential risk involved with them so we emphasize that you take proper precautions before investing your crypto. These can earn you more gains than just holding crypto. We hope we helped you understand the 3 best ways you can earn a passive income from cryptocurrency.

You can also follow us for instant tech news at Google News or for tips and tricks, smartphones & gadgets reviews, join GadgetsToUse Telegram Group, or for the latest review videos subscribe GadgetsToUse Youtube Channel.